Selling your EC: MOP or Privatization?

Like all HDB regulated properties, an executive condo (EC) can only be put on the open market after you have met the five-year Minimum Occupancy Period (MOP).

So now that you’ve gotten there, what’s next?

Is it time to sell and reinvest in another property, or hold on till it hits privatization status in Year 10?

Here’s how i would approach this topic rationally:

1st, you need to be clear why you would sell right after MOP, instead of after privatisation of the EC at the 10th year mark.

Ask yourself:

1. Is it the herd instinct of following your neighbours who are cashing out that’s influencing you?

2. Are you afraid that you can no longer realise your profits in the future?

3. Or are you looking for a way to realize the gains immediately and recycle your profits into another higher potential investment property?

This is an article that I have republished from Stuartchng. I will be looking to add further analysis around the topic of whether one should be selling their ECs after MOP or after privatization (approx. 10 years after TOP).

A brief walk down memory lane

When ECs first emerged on the market in 1999 (Eastvale in Pasir Ris from $300+K!), the common consensus was that owners should wait until the development fully privatized (after the 10th year) before cashing out their profits for maximum gains.

Today however, it’s increasingly common to see owners selling soon after MOP, to realise and recycle their profits earlier into 2 or more properties.

Here are some points to consider before you make your decision.

5 Points To Consider Before Selling Your EC After MOP

1. How many units are selling in your EC?

2. What is the current supply situation of newly TOP (Temporary Occupation Permit) condominiums in your area?

3. Are there significant infrastructure growth plans in your neighbourhood?

4. Is your next property purchase likely to offer better returns?

5. Are you in an economic downturn?

1. How many units in your EC are selling at the moment?

Generally when an EC reaches MOP, many owners start looking to cash out.

Some cash out to upgrade to a bigger place as their salaries have increased since 8-9 years ago since balloting for the unit.

Some cash out and downgrade back to a HDB flat and fully pay it off with the profits they earn.

Some cash out via selling or equity loans in order to invest in multiple properties or other instruments.

Initially, it can be tougher to get a good price especially if your EC is a large development with many neighbours selling.

There are ample choices for buyers to turn to and the more urgent sellers will always offload first while the ones who can wait will subsequently see much less competition and better bargaining power.

I have witnessed this happen many times over and it can take between 6-9 months for supply to stabilise and buying demand to exceed supply.

2. What is the current/upcoming supply of newly TOP (Temporary Occupation Permit) condominiums in your area?

Watch out for newly TOP supply of condominiums in your area. Whenever there is a supply of newly TOP condominiums or upcoming ones, you may face stiff competition from them for the same buyer base.

The best situation you can find yourself in as an MOP EC owner is to be in a neighborhood of older condominiums and surrounded by a surge of MOP BTO flat owners coming on stream.

More often than not, the catchment of HDB upgraders will be looking at upgrading (and similarly realizing their profits from their BTO/DBSS) to a private home near them as their family has settled into the area.

Case in point: The Canopy EC in Yishun is highly sought after at this point of writing and owners are cashing out with significant profits as many BTO and DBSS owners in Yishun Greenwalk and Adora Green reach their MOP and upgrade to private homes.

Similarly, with BTO flats in Fernvale Link reaching their MOPs recently, Parc Botannia which TOPs end of 2020 has seen very healthy sales volume and recently sold out.

**A study on the MOP supply island wide can help you with better risk management investment decisions.

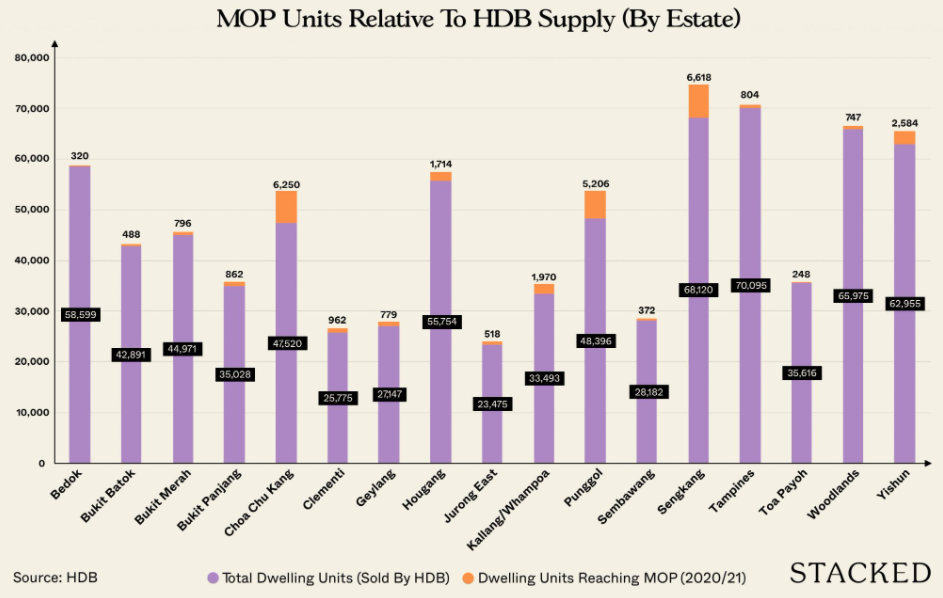

NAOF: The good folks over at Stackedhomes have collated the MOP units in 2020/21. Sengkang sees the most number of MOP units during this period followed by Choa Chu Kang and Punggol.

This might potentially suggest that demand for new/resale ECs and Condos in these areas might witness relatively strong demand in the coming years.

If you are currently residing in a relatively new EC in Sengkang for example, you might have an advantage from rising demand for your EC due to the sheer numbers of MOP of BTOs in this neighborhood. The same could be said for Choa Chu Kang and Punggol.

This is of course based on the assumption that HDB upgraders are already accustomed to living in their neighborhood and thus do not wish to move to a different town. There are of course many other different reasons in play when it comes to selecting the location of your next dwelling.

3. Are there significant growth plans coming up in your neighbourhood?

Before you decide to sell, always do your research on the upcoming plans for your neighbourhood via the URA Master Plan. You’ll want to have clarity not only on the new location you’re aspiring to buy, but your existing one as well.

Investing in where the Singapore government is is one of the safest and most time-tested methods in property investment.

Infrastructure growth and development plans in the mid to long term, such as new MRT stations, shopping malls, tech parks, townships etc can make it easier for you to sell your executive condo at a better profit and safeguard your downside risks.

Sometimes, just waiting another year or two for developments to complete can mean significantly higher returns on your investment.

Ideally, your property agent should also conduct his own research and advise you on the best time to list your property and the risks and returns you face by putting it up for sale now versus in a couple of years’ time.

4. Is your next property purchase likely to offer better returns?

Counting your profits and wanting to realise them is a natural lure for owners to sell their properties.

However, before you get too excited, it is prudent to study and weigh your next available options first.

Simply selling without an idea of where to park your war chest is a quick way to misery especially when there is still much steam left for capital growth in your current EC or your next property isn’t well researched and selected to provide you better investment returns.

Typically, executive condominium sellers cash out to invest in a private property that is either nearer to town, their in-laws, get a bigger house for the family, or a better location nearer to the MRT and transportation hubs.

It is important that you consider both the domestic and investment aspects as the right decision will greatly impact your retirement plans down the road.

5. Is it an economically favourable time to sell?

In general, you should sell in a down market only if you’re in some sort of urgent trouble (e.g. job loss) or have a lot to gain by letting go of your current property to arbitrage on another one selling at a greater discount.

Owner occupier properties such as ECs generally do not correct as much as the fundamental reason for holding it is more existential than for investment.

For example:

If the market is correcting and you are holding a property worth $1M, you might want to sell (Or draw out an equity loan at low-interest rates) in order to take advantage of larger discounts in a higher-priced property.

Generally in a downturn, the more expensive the property, the larger the price correction as investors bailout.

A correction of 10% in a $3 Million property will easily mean $300K off the price vs $100K in a $1 Million property. When a recovery comes about, you stand to gain significantly more than by holding on to the original property through the crisis.

It is during such periods where buyers dry up, that many of the best deals surface in the market (We might just be cruising into one at this point of writing with the COVID-19 cases increasing again).

Besides these, there are certain periods – such as right after new cooling measures – when the market will have a knee-jerk reaction, and sellers should adopt a “wait and see” approach.

It is almost always better to wait out the storm as property markets are cyclical and they will ultimately reward the patient ones with holding power.

To summarise, don’t think of MOP as a “magic number of years” after which you must rush to sell.

We’ve been conditioned to think this way because we’re bombarded with advertisements, flyers, and many articles online, touting the benefits of cashing in after MOP.

In reality, the right time to sell a property shouldn’t just revolve around your MOP.

The right time to sell should be based on market fundamentals, a clear and well thought through investment road map, and your family’s needs and priorities.

To put it simply: if you didn’t have an MOP that you just met, would you even be thinking of selling?

That answer is probably the one you should follow.

How profitable will your ECs be after MOP?

NAOF: I will be looking to add further analysis on ECs profitability after MOP from hereon.

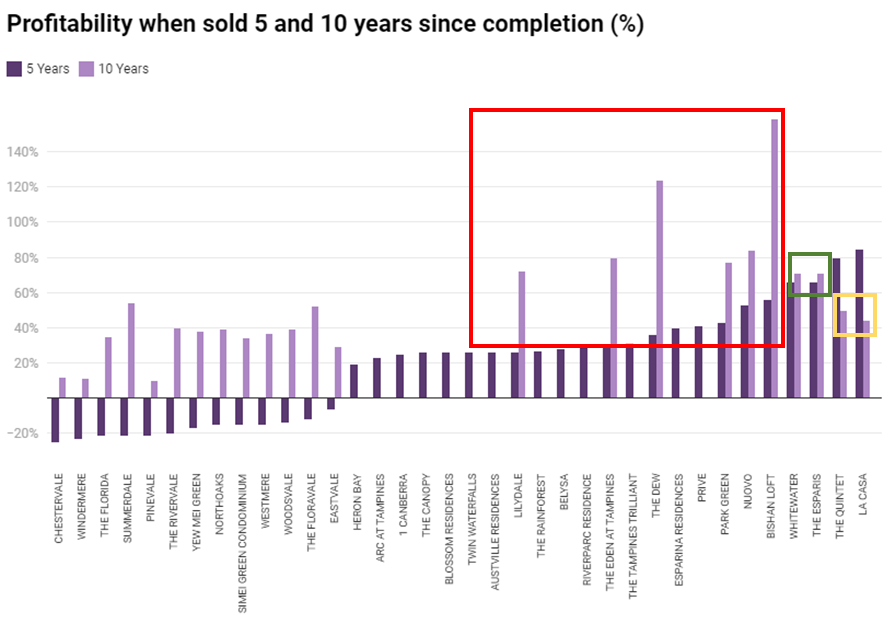

Once again, the folks over at stackedhomes have done a great job compiling the data of ECs profitability (done in June 2020) when sold after 5 years (MOP) and after 10 years (privatization).

The key takeaway made by stackedhomes is that: ECs are generally profitable if you stay for the entire 10 years horizon to privatization. This is quite obvious from the diagram above where an EC could be unprofitable on the MOP mark but become relatively profitable when they hit the 10 years mark.

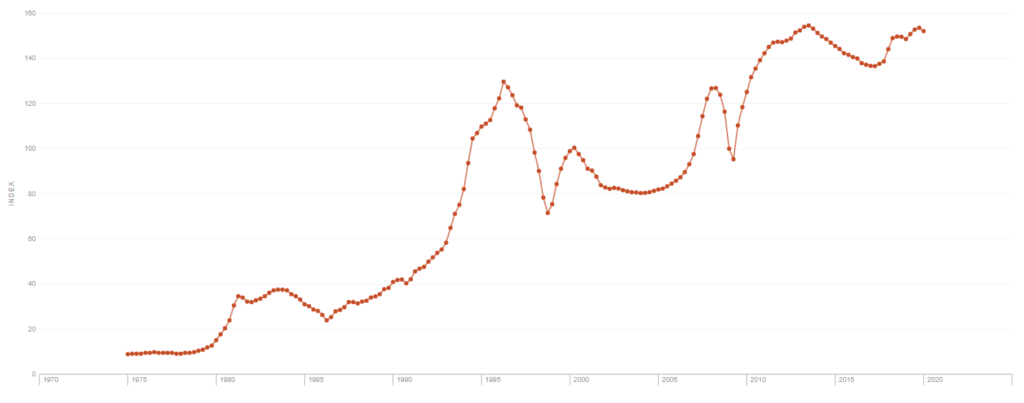

I believe that this is not purely due to the fact that these ECs have turned “private” with higher demand now from the pool of foreign residents. One would also need to consider the property cycle. If you purchase at the peak of a property cycle, such as those ECs on the left-hand corner of the chart, your likelihood of losses on MOP increases substantially.

Take for example Windermere which TOP back in 2000, the peak of the SG property market at that point in time. The property market went into a correction for the next 4-5 years, thus on its MOP mark, buyers of Windermere were looking at losses of almost 20% from their purchase price.

However, with the subsequent upcycle in the property market from 2004-2008, Windermere pares its losses and turned marginally profitable. However, the 10-year gain of approx 10% (means annualized of less than 1%) is not as explosive as many other similar developments largely due to its unfortunate timing (subsequent GFC recession).

Most ECs launched after 2000 have generally been profitable on their MOP mark

As can be seen, the MOP gains ranges from 20% (Heron Bay) to 80+% (La Casa). Again, timing plays a part as well (when it comes to the magnitude of the gain) in addition to the individual property unique characteristics.

Heron Bay was launched back in 2012, near the peak of the recent property cycle while La Casa was launched in 2005 near the bottom of the last property cycle. Consequently, their MOP gains varied quite substantially. Heron Bay recently MOP in 2020 (which has yet to witness a strong uplift in prices of late due to various cooling measures and the onset of COVID-19) while La Casa MOP of 2013 coincides with the strong recovery period post-GFC.

Will profitability be better upon privatization?

Generally, ECs have been more profitable upon privatization vs. MOP due to the longer time horizon and factoring items such inflation.

However, there are exceptions such as La Casa and The Quintet (highlighted in the green boxes above) where their 10-year selling price is much lower as compared to their MOP price. As explained above, the strong tailwind for La Casa on its 5-year mark now became a headwind in 2018 (10-year mark) with the various cooling measures taking place. Similarly, The Quintet, which was launched back in 2003, saw the peak of the SG property market on its MOP mark in 2012. Subsequently, on its 10-year anniversary in 2017 was the bottom of the mid-cycle dip.

Will privatization bring about a strong uplift in prices vs. their MOP mark, such as those ECs highlighted in red, or just marginal gains such as those highlighted in green or even worst, decline in prices such as La Casa and Quintet?

Many of the ECs which saw strong gains on their 10-year mark, such as Lilydale, The Eden at Tampines, The Dew, Nuovo, etc all benefitted from the peak in the property cycle at the 2013/14 mark. Whitewater, which only saw marginal gains on its 10-year mark vs. 5-year mark was because its privatization period coincides with the bottom of the property market in 2017.

Generally, your EC will be more profitable upon privatization if you did not purchase your property at the cycle peak when they were launched. However, a more relevant question to ask is: Should you sell your EC at the 5-year mark because the growth potential will start declining from then on?

There are many reasons why one might wish to sell his/her EC upon MOP and that might not solely be based on further price appreciation potential ahead.

Key dates for ECs vs. cycle relevance

Launched – Preferably near the cycle low so you can purchase at a good price

TOP (when building is completed) – Used to calculate MOP and privatization but property cycle have no relevance

MOP (5-year mark when buyer can sell to most residents) – Preferable in a property up-cycle

Privatization (10-year mark when buyer can sell to foreign residents) – Preferably in a property up-cycle

ECs yet to privatize

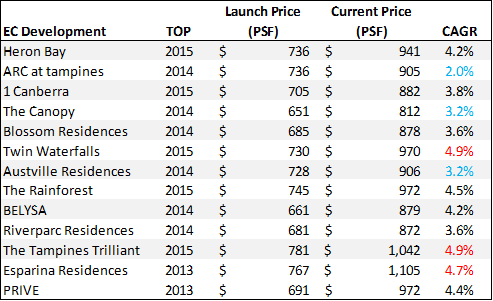

The table below shows the ECs which have yet to achieve privatization status (10-year mark), their average launch price/sqft, current average price/sqft and the compound growth in their prices since launch

These ECs all TOP from 2013-15, hence their MOP period is in 2018-2020 where the SG property market is in a recovery phase from the 2013-18 downcycle. Hence, these projects are all profitable from their launch prices although the magnitude differs, with the best selling ECs at present being Twin Waterfalls and The Tampines Trilliant.

If the property market continues its gradual upward trajectory, one should expect the selling prices of these properties to be higher vs. MOP price although the magnitude of price appreciation is unlikely to rival that of ECs such as Bishan Loft, The Dew, etc when comparing their 5-year mark prices vs. 10-year mark.

Conclusion

There is no conclusive evidence to say that it is better to sell your ECs on the MOP mark vs. holding it to privatization.

Of the 10 most recent ECs which have been privatized, 4 properties saw stronger price growth from Year 6-10 while 6 properties saw a decline in price growth (or even negative price growth)

Beyond timing the property cycle, it also comes down to the unique characteristics of the EC in question as well as the development plans of its surrounding neighborhood.

For current potential buyers of ECs, would you go for a development such as ARC at Tampines which has shown the least price appreciation since TOP and hence might be a “value” purchase with potential for stronger price appreciation till privatization or would you stick with the best performing EC in this list, The Tampines Trilliant and bet that this “growth” development will continue its fine run till privatization?

Feel free to voice your thoughts in the chat box below.

The author Stuart is a co-founder of Navis Living Group where he leads and mentors more than 1800 agents in their training, growth, and development as leaders and property wealth planners. Professionally, he is known for his interest and ability to connect with people and coaching both his agents and investors on obtaining better results in their lives and investments. Privately, he enjoys quiet time by himself, playing the guitar and acting all childish around his wife and 2 kids)

If you find the above article informative and wish to get in touch with Stuart to find out more about your property needs, do take a minute to fill up the questionnaire and we will be in touch with you shortly!

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Upgrading From HDB Flat To Condo in 2021: Buy First or Sell First?

- HPS Singapore: Why pre-paying your home loan in 2021 is a mistake with Home Protection Scheme in place

- Singapore Property: JP Morgan says a fall of 10% is likely. To buy or not to buy now?

- 12 Tips To Select A Good Unit At A New Launch Project

- The average salary in Singapore 2021: Can you afford a condo with your income?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.