Table of Contents

Sell to Open Put Options: A smarter way to Invest?

I have previously written an article as to why value investors should also be options traders, specifically “sell to open put options” as a smart way to generate passive income.

As “complicated” as it might sound, it is actually a simple process that can usually be executed with a few clicks of the button using a brokerage platform that allows for options trading.

In this article, I will be touching on 2 key strategies when it comes to “Sell to Open Put Options”. The first is to Sell Puts to Buy Stocks at a Discount and the second is to Sell Puts to Trade.

What do you mean when you Sell to Open Put Options?

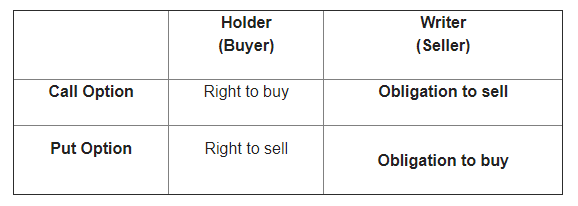

In the options world, there are 2 main types of options: Call Options and Put Options. Concurrently, you can be either a Buyer or Seller or both (in some scenarios). Let’s talk specifically about you being the Seller (or sometimes termed as Writer) in this article.

When you originate the trade as a Seller, you are Selling to Open an option contract (call or put). The table above summarizes the entitlement as a buyer or obligation as a seller of call/put contracts.

When you wish to close the contract you have SOLD earlier, you are Buying to Close an option contract.

Let’s take a look at a quick example using AAPL Put Options.

When you sell to open put option on a stock such as AAPL, you are generally taking a bullish/neutral stance on AAPL.

You as the SELLER, first and foremost, are entitled to receive a PREMIUM. This is money into your pocket from the get-go.

However, once you received this premium, you will now have an OBLIGATION. That obligation is to BUY X number of shares of AAPL at an agreed price (strike price) before a certain date (expiration date) from the BUYER of this put option contract.

This obligation is NOT a certainty. In fact, in the majority of the cases (80-90%), the buyer of this AAPL put option will NOT exercise his right to have you buy AAPL from him at the strike price.

Hence most of the time, the put option which you sold expires worthless. To close off this trade, you now Buy to Close the put option contract by paying ZERO premium (since the contract is worthless).

When you Sell to Open Put Options, you can:

- Make money in 3 out of 4 different scenarios. 1. Stock appreciates 2. Stock stays flat, 3. Stocks decline slightly. Only in the 4th scenario where the stock declines substantially will you lose money.

- Consistently generate high single-digit or double-digit annualized returns as you wait for the right market price to buy your right stock

- Use Margin of Safety or MOS to give your portfolio some downside protection. You can choose to sell to open Put option contracts at 10% below the current price of the stock. For example, if you wish to own shares of AAPL but do not wish to pay the current price ($165), you can choose to Sell to Open Put Options contracts with a strike price of $150 (approx 10% lower than the current price) with a horizon of 6-months, receiving a premium of $800.

If AAPL is below the $150 strike price on contract expiration in 6 months, you are happy to buy 100 shares of AAPL at a cost of $150. If AAPL shares trade above the $150 strike price level, your put option contract which you sold earlier becomes worthless and you now buy back to close the contract paying ZERO. Your profit is thus the full premium amount of $800 you collected from the onset.

When used correctly, this is a simple yet often under-utilized way of buying stocks “at a discount”, something which all value investors should engage in.

The key risk associated with selling to open put options for beginners is that they tend to get “greedy” and over-leverage. Note that the minimum contract size for options is 1. 1 Option contract however entails 100 shares.

Hence, by selling 1 put option contract, one is essentially potentially getting exposure to 100 shares of stock. This might not be an issue for a “low priced stock” but for a relatively “high priced stock” like AAPL, selling 1 put option contract could mean taking on the obligation to buy 100 shares of AAPL, which at the current price amounts to $16,500 in value.

When it comes to selling to open put options, I engage in 2 key strategies: 1. Sell Puts to own a stock at a discount, and 2. Sell Puts for trading purposes, with the goal of generating a consistent 15-30% return annually.

Let’s first talk about the first strategy: Sell Puts to own a stock at a discount.

Strategy #1: Sell Puts to own a Great Stock at a discount

One of the stocks that I love and have the intention to buy and hold onto it long-term is Microsoft. I will not be doing a deep-dive analysis on Microsoft but suffice it to say, this is probably a big-tech stock that is “NOT CHEAP” but will likely “NOT GO WRONG” as a long-term stock in one’s portfolio.

In fact, Microsoft is the ONLY company that has consistently maintained its position as the Top 10 largest company by market cap over the past 3-4 decades.

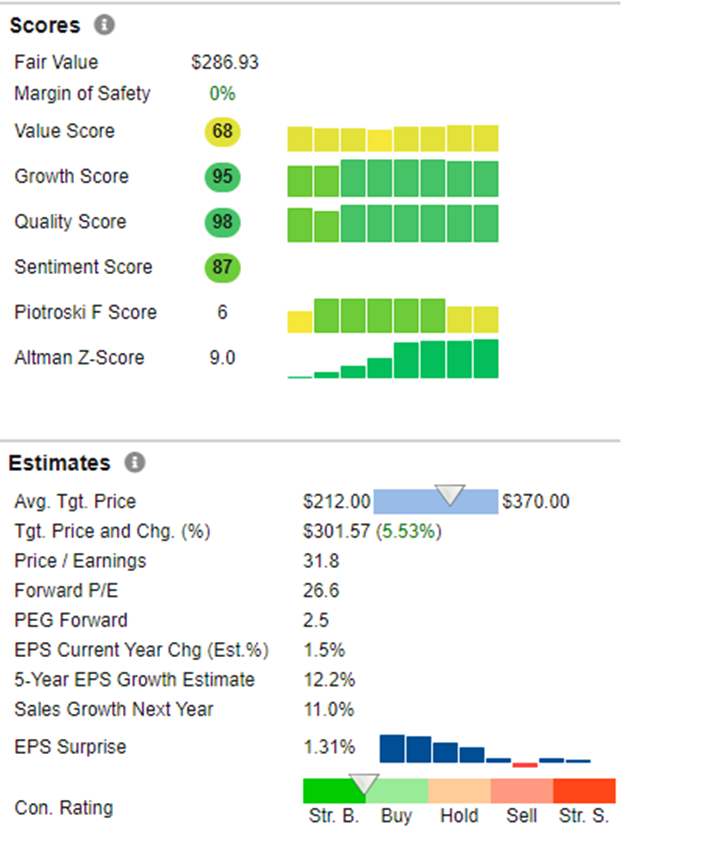

So, I have got every intention to own at least 100 shares of Microsoft but I am not willing to pay its current price of $285. The fair value of the counter, according to my favorite stock screener, Stock Rover, is $287/share. The street has an average target price of $301/share on Microsoft. There is not much “Margin of Safety” to be buying Microsoft at its current price level.

Let’s say I wish to purchase 100 shares of MSFT at a price of $260/share, which is approx. a 10% discount from its current share price level. That will give me a good margin of safety in the event that the majority of analysts out there are DEAD wrong on their fair value estimate of MSFT.

There are a couple of things I could do.

The first method is I could just sit around and wait and watch and pray for the price of MSFT to come down to $260/share (perhaps a bad quarterly result) and buy it. Or maybe it will never come down to that price in the near term and for every month that it doesn’t, my cash is sitting on the sidelines and not earning any real returns.

The second method and the smart method here is to sell to open put options on MSFT at a strike price of $260 and get paid a premium while doing so. I will, however, now have the obligation to buy at least 100 MSFT shares at $260/share (which is my original intention) since the price of MSFT drops below $260 on contract expiration.

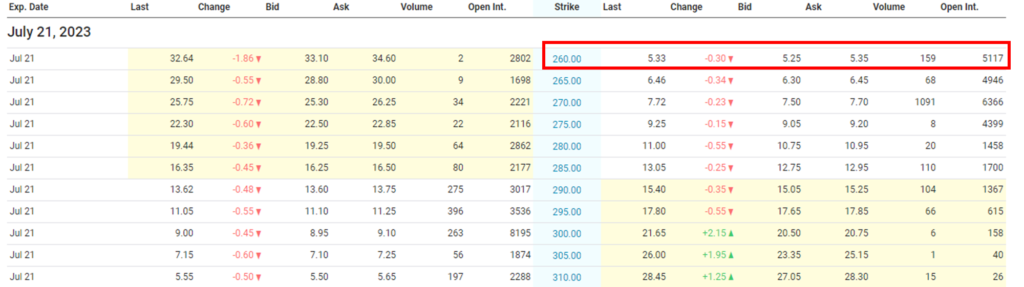

I will thus sell a Put Option on MSFT, with a strike price of $260/share, expiring in 3 months-time in July 2023.

For that trade, I will receive a premium of $530, which translates to an annualized return of (530/26,000)*4 = 8%.

If MSFT trades below $260/share on expiration in 3 months’ time, I will be happy to pay $260/share for a quality company like MSFT.

If MSFT does not trade below $260/share on expiration, I leave with $530 in my pocket. Not a bad deal as well.

Some Quick Terminology Explanations

Strike Price: This is the stock price that you would be obligated to buy the shares at if the option buyer chooses to exercise their option to assign them to you. This happens when the underlying price is below the strike price on expiration.

Last Price: This is the last traded stock price that the option has been selling for recently. This is basically how much the last option buyer pays the option seller for the option.

Change: This shows you the recent changes in the option pricing.

Bid: This is approximately what you’ll receive in option premiums per share upfront if you sell the put.

Ask: This is what an option buyer will pay the market maker to get that option from him. The difference between “bid” and “ask” is the “mark” price which is what we should always be targeting to BUY or SELL the options at.

Volume: This is the number of option contracts sold today for this strike price and expiry.

Open Interest: This is the number of existing options for this strike price and expiration. It’s the sum of all option volume leading up to today, minus any option positions that were closed prematurely

When I sell to open 1 put option contract on MSFT, I will be obligated to purchase 100 MSFT shares at the strike price, in this case, at $260/share. A conservative investor always has cash on hand to take full ownership of those stocks (if obligated to do so) when he/she sells a put option, thus, the term “cash-secured put”.

For this particular example, it’s $26,000 (cash obligation to take ownership of 100 shares of MSFT at $260/share).

If I don’t have sufficient capital, that does not mean I cannot execute the trade. In most instances, your brokerage platform will probably require just 20-30% of the $26,000 ($5k capital as margin) to execute this put-selling trade.

Do note the risk involved when you do not have sufficient capital in your brokerage account to take full ownership.

This sell-put trade now becomes a “naked” put, which is significantly riskier. In the event that the price of MSFT drops below $260/share (on the contract expiration date) and you do not have sufficient capital to take up ownership of 100 shares of MSFT, you will be forced to liquidate the shares and take the losses immediately.

Let us look at a couple of scenarios.

Scenario Analysis

Scenario 1: The stock price of MSFT is at or above $260 at contract expiration

If over the next 3 months, MSFT’s share price stays above $260/share, the Put option buyer will not have the incentive to exercise his right, which is to “force” me to purchase 100 shares of MSFT from him. He/She has absolutely no incentive to sell 100 shares of MSFT at a market price of $260/share when the price is above that level.

The put option will expire worthless and I get to realize my full premium of $530 as profit (since I paid ZERO to close the contract)

I previously calculated my annualized ROI for this trade to be 8% which is a fairly decent return to get paid without actually owning the stock outright.

Scenario 2: The stock price of MSFT is under $260 at expiration

Let’s say that in 3 months when this option is about to expire, the share price of MSFT is below $260, say at $255.

This Put Option that I sold to open earlier is now considered “In-the-money”. For the buyer of the put option, he/she now has the incentive to sell to me MSFT stock at the agreed price of $260 vs. the current market price of $255.

I will now have the obligation to purchase 100 shares of MSFT at the higher strike price of $260 vs. the lower market price of $255.

Nonetheless, my breakeven of $260 – $5.30 (earlier premium collected) = $254.70 is still slightly below that of the current market price of $255.

Key risks: 1. Price of MSFT could be significantly below the strike price of $260 (say at $220 on contract expiration) and I am still obligated to purchase at $260. My losses might be substantial. 2. If there is insufficient cash in my brokerage account (at least $26,000 to be cash-secured), I might be forced to liquidate my share holdings of MSFT immediately and realized my losses.

Strategy #2: Sell Puts on Quality + Value counters for trading purposes

The second strategy that I deploy consistently is to sell puts for trading purposes. Unlike the first strategy which is to acquire good companies at a discount with a long-term horizon in mind, I have no intention of acquiring these companies which I sell puts on in the second strategy.

The goal of the second strategy is to consistently generate 15-30% annualized returns from a “trading” perspective.

There are certain key differences between these 2 strategies.

Strategy 1: Sell puts on quality counters that are not necessarily exhibiting value characteristics but with every intention to buy these counters at the strike price at which the put option was sold. The Days to Expiration (DTE) for selling the put options might be between 3-6 months horizon.

Strategy 2: No intention to purchase these counters as long-term holdings. The key purpose is to trade these counters through put options selling. In addition to identifying quality stock counters, we will also require an element of under-valuation (stock is not over-priced). The DTE for selling the put options is typically a 1-2 month horizon.

When I execute put selling using Strategy 2, there is absolutely no “safety net” in place. If things go south, there is usually no excuse to take ownership of the physical stocks and turn a short-term trade into a long-term investment.

Instead, I will be looking to “repair” the trade using my own unique 7-Step Trade Management/Repair Technique.

Given the “higher risk nature” of Strategy 2 as there is no longer a safety net in place (to take ownership of the stock), selecting the RIGHT stock to trade on is critical.

The KEY to doing well for strategy #2 is to identify stocks with low downside risks (not stocks you love nor stocks with strong appreciation potential) and sell to open put option contracts on them to collect a steady stream of premiums on these counters every month.

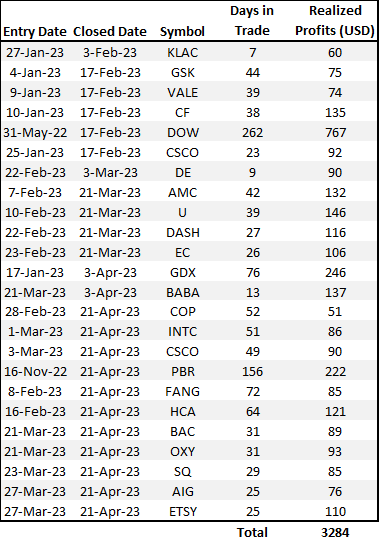

Here are some of my recent call/put selling trades which I executed, with the goal of generating a stream of consistent income every month.

Bonus Strategy: Selling ATM LEAPS Put Option

This bonus strategy can be executed as an alternative to Strategy 1.

“LEAPS” stands for long-term equity anticipation securities. These are options that have an expiration date that is more than 12 months away.

The premium paid for this type of option will be relatively high due to their relatively long contract period. In other words, these options have a high time value component.

Notice that I am selling ATM Put Options. ATM options are options that have the greatest amount of time value (when compared across the same DTE)

As a seller of options, you wish to maximize the amount of time value sold. ATM options are often the most “lucrative” options to sell. However, the key downside is that there is no “Margin of Safety”.

This bonus strategy should be executed during periods of high volatility, which translates to high options premiums and on stocks that you absolutely wish to own.

By selling ATM LEAPS Puts on stocks you wish to own during a period of high volatility, you are essentially “locking” in the high premiums for the entire contract duration. If instead, you keep selling short-term options, volatility may decrease during the rest of the year.

For example, during the March/Apr COVID-19-driven sell-down, volatility is extremely high and one can “lock in” that high volatility by selling a 1-year ATM Put option contract on a stock that you wish to own.

If instead, one chooses to sell a 2-month ATM Put option contract, he only gets to “lock in” the high premium for that 2-month horizon. Subsequently with volatility collapsing, selling puts on the same stock will likely not generate the same level of premiums thereafter.

Sell to Open Put Options FAQs

Is sell to open put options a good idea?

To be clear, the risk associated with selling put options is unlimited. However, selling put options can also be a great way to generate a consistent stream of income, when done right.

Moreover, if you already had the intention to own the underlying stock in the first place, selling put options on them with a Margin of Safety in place will allow you to purchase the stock at a better price.

What does it mean to sell to open a put?

When you sell to open a put, you are originating a put option contract as a seller/writer. You are entitled to receive a premium. However, this will also mean having an obligation to buy the underlying asset from the buyer of the put option contract at a fixed price (known as the strike price), at the buyer’s discretion.

When selling to open a put option, you’re generally expecting the stock price to move up or stay flat. On expiration, when the underlying price is above your strike price, you get to realize and profit from your premium collected at the onset.

When should you sell put options?

When you don’t expect a significant decline in the underlying counter in which you are selling a put option.

In put option selling, there are 3 out of 4 scenarios in which you can profit. The only “loss-making” scenario is when there is a drastic decline in the underlying counter.

How much money can you lose selling a put option?

There is no limit to what extent you can lose money by selling a put option. As a put seller, your losses are “maxed” out when the underlying price is ZERO.

Hence, it is critical to select stocks with limited downside risks to sell put options on, especially when one is engaging a trading angle.

Conclusion

Sell to open put option contracts is one of the most flexible and powerful tools that one should have as part of his/her investing arsenal for 1. Buying stocks at a discount, or 2. Generating a consistent stream of short-term income.

Rather than waiting to buy shares only at your entry market price (which might never happen), why not get paid during the period as you wait for your lower target entry price to be met? This strategy is ideal for value investors who always wish to acquire a counter with a good MOS.

For those who wish to generate a consistent stream of “passive” income, one can also engage in a put option selling trade on stocks with low downside risk. The big question, however, is accurately identifying these stocks consistently.

Overall, put selling is a strategy that allows one to make money 3 ways. The price goes up, the price stays flat, and the price dips slightly.

While it is not the perfect tactic for a strong bull market like what we are currently witnessing where the FOMO level is extremely high, it is a good strategy if one is satisfied with generating a “conservative” return of 15-30% consistently.

Additional Reading: 4 Option Trading Strategies for Beginners

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.