Table of Contents

Saving money: Wise or folly?

From young, we were taught the virtues of being thrifty and to “save for a rainy day” by our parents. Our parents were taught to do the same thing by their parents and they truly believe that is the type of “financial discipline” that is required to get us through life.

Alas, how many have truly achieved financial freedom by solely being thrifty. Not that it is impossible but only a handful of hardcore savers have managed to “save themselves to financial freedom”.

Instead, one has to move away from the mindset that “saving is good” to avoid financial ruin. Now, I am not talking about the YOLO (You Only Live Once) mindset that millennials ascribe to these days. There is actually a much simpler way to think about your money that will set you up financially and allow you to achieve financial freedom if you embark on this journey early.

Here we go.

It is not purely about how much you make

You can make a lot of money and yet still lose the bulk of it if you don’t understand how money works. We have got so many examples of celebrities who lost all of their wealth at one point in their career.

Michael Jackson was reportedly at least $400m in debt when he died unexpectedly in 2009. Mike Tyson, the former heavyweight champion, made a lot of money but was still declared bankrupt. The list goes on.

If lady luck shines on you and lets you win the lottery, she can easily take back that luck if you are undeserving of it. According to the National Endowment for Financial Education, 70% of lottery winners end up broke and a third go on to declare bankruptcy. Runaway spending, toxic investments, and poor accounting are often cited as key reasons to turn riches back into rags.

You can make a lot of money. Yes, that is one part of the equation to achieving financial freedom. But if you do not know how to “conserve” the wealth that you have earned, that wealth is not going to last you.

Most people believe that the best methodology to conserve your wealth is to be frugal and save. That might not end up well for you.

Additional Reading: Net Worth by Age. How Much do you need to Retire Well

It is also not purely about how much you save

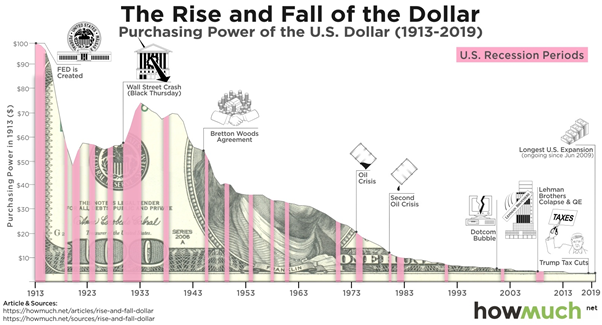

The image below from Visual Capitalist describes why saving will destroy you financially. Imagine you have got a $100 note back in 1913 and decided to save that under the comfort of your mattress. More than 100 years later, assuming that your banknote has not been chewed up by the “bed bug”, it will be worth just $3.87 in 2019 terms.

What is happening is this phenomenon called inflation, something which is quietly eroding the value of your money in the background and the key reason why it could lead you to financial ruin if you save.

Additional Reading: Inflation. Don’t ignore this silent retirement killer

You see, keeping your money tuck in the comfort of your saving account does not generate you sufficient interest to keep up with the eroding effects of inflation. Every minute you save money is another minute inflation is eating away at your hard-earned money.

Why work so hard to have your money be devalued and work against you? It just does not make any financial sense?

Making your money work for you, not against you

You can make money work for you and not against you, thus preventing being financially ruined by the act of saving money if you change your approach from:

- It is not about how much money you make

- It is not about how much money you save

Into this approach:

- It is ALL ABOUT how much money you INVEST.

Investing your money is simply letting money work for you, one that helps you to overcome the negative impact of inflation and much more.

Additional Reading: Invest or Save? 5 Compelling Reasons why you should invest instead of save

The money you make needs to be invested. The problem is that most people do not know how to get started when it comes to investing or they engage in speculation that often ends in tears (think punting stocks like GME, AMC, etc).

The first step is often the hardest. To overcome the inertia to get started on something that seems like a “black box” is tough. It requires the right “force”. But once the process is in motion with the right amount of “automation”, everything will fall in place nicely.

How to get started on investing

We all need a “safety net” and very often that is in the form of emergency savings. I understand that, and I concur that it is critical to have a certain amount of emergency savings built up before one ventures into investing.

Typically, your emergency savings should cover 6-9 months of your monthly expenses. The rest should then be invested.

When it comes to investing, you have a few options which some of you might already have an inkling about. Stocks, bonds, real estate, ETFs, mutual funds, commodities, digital currencies, etc are some of the most popular options out there right now.

These are financial assets that you can invest your money in so that inflation does not destroy the value of your money and kill everything that you have work so hard for.

I have written a beginner primer on Stocks vs. bonds. Vs. ETFs vs. Mutual Funds which might be a good starting point for someone who wishes to learn more about the basic investing instruments.

The next step is to determine how much money you wish to allocate to the different financial assets. This step is important and is termed asset allocation in the financial world.

Asset allocation is the art of diversifying your investments into different asset classes so that they help balance out the risk. The solution to this problem is different for everybody. How much you invest in each asset class depends on your financial situation and your age.

If you are laden with credit card debt, you might wish to pay them off first, accumulate 6-9 months of emergency savings before embarking on your investing journey. If you have $100k of excess cash lying around, you can afford to be more aggressive.

Additional Reading: 5 astoundingly easy steps to saving your first $100k

Today if you are a 25-year-old millennial who have plenty of time before you retire, you might also wish to be a tad more aggressive and invest more into stocks (since this asset class has the highest annual return vs. other asset classes when invested over the long-term)

The way to save yourself financially (by now you should know the answer is not to save) is to learn about where you can allocate your money into the different asset classes.

Passive approach through Robo Advisors

For those who wish to avoid the hassle of selecting their investing asset class or unsure how to go about doing that, one can engage in a “passive” approach through a Robo-advisor.

All you have to do is to fill up a questionnaire that will determine if you are a 1. Conservative, 2. Balanced or 3. Aggressive investor and you will be allocated the “right” amount of financial assets that fit your risk profile.

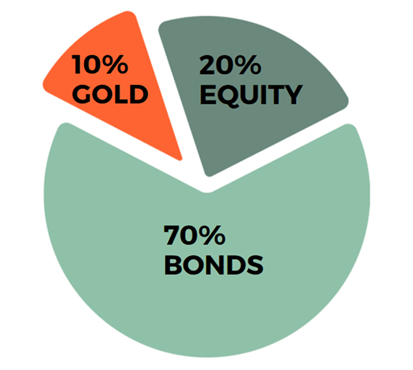

For example, if you are seen as a conservative investor, then you might be advised to structure your investment portfolio based on the below asset allocation:

Equity: 20%

Bonds: 70%

Commodity: 10%

On the other hand, if you are seen more as a risk-taker, then your ideal asset allocation might be as such:

Equity: 60%

Bonds: 20%

Commodity: 20%

Note that the asset allocation (with the Robo advisors) can always be altered as your risk profile changes along the way.

Alternatively, you can engage a DIY (Do-it-yourself) approach and allocate your money accordingly. This can be done with ease through the purchase of ETFs or Exchange-Traded-Funds which are traded just like a stock but provides one with ample diversification through a single stock purchase.

Additional Reading: Best ETFs in Singapore to structure your passive portfolio

Engaging a disciplined/automated approach

Getting started in investing is the first and most important step towards avoiding financial ruin. Ensuring a disciplined approach to invest consistently (and automatically) is the next most important step.

When it comes to investing, it is not so much about getting the right timing to invest but more about consistency. Have a disciplined to invest consistently every month. This is what I termed as “pay-yourself-first”.

Every month, when you receive your paycheck, contribute a portion of your income towards your long-term financial stability and well-being. This can be done through a dollar-cost averaging approach.

What is the season right now?

This involves a little bit of market timing and might NOT be the necessary approach for someone new to investing.

A new investor or a wannabe investor’s key goal is to overcome the inertia of getting started and to engage a disciplined approach to “automate’ his/her investing process as highlighted in the previous segment.

For someone more advanced in the “investing game”, he/she might wish to consider the current economic cycle in which we are in and allocate the appropriate capital into the different asset classes.

For example, inflation fears are currently hitting the headlines almost daily. Whether that proves to be transitory or structural, it pays to look at inflation-resistant assets (such as commodities) in uncertain times, one where money printing is rampant.

One can look at the financial markets like they are the 4 seasons: spring, summer, autumn, and winter. You don’t want to be overly aggressive during “winter” aka bear market where the market is extremely volatile. You could be totally “wiped out” before the long winter is over and we welcome spring.

If you are more advance when it comes to investing, feel free to select a season and invest accordingly. If not, stick to your asset allocation structure based on your risk profile and dollar cost average into your portfolio.

Conclusion

Saving money might be the action that actually destroys you financially, contrary to traditional thinking. This is due very much to the devaluation of fiat money as a result of widespread money printing which elevates the problem of inflation.

Likewise, making a ton of money without engaging in the right manner of “conserving” is equally pointless.

The strategy that makes the most sense when it comes to your money is to invest it so that your money is working hard for you and not against you because of inflation.

The first step and often the most difficult one is to get started on investing. This process is now simplified with the introduction of Robo-advisors which does most of the “leg-work” for you such as asset allocation and diversification.

Additional Reading: Syfe Review. Is this now the most comprehensive Robo advisor in Singapore?

The next step is to ensure a disciplined and automated approach to “pay-yourself-first” every month by investing a fixed amount into your investment portfolio (could be through a Robo advisor).

That is all you need to save yourself from the financial ruin of saving money the traditional way aka savings account which generates close to zero interest.

Invest more, stress less, and do good with your work!

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.