SATS announced its 3QFY20 results on 13 February after the market closes. As expected, the results weren’t pretty.

We highlighted in a short write-up of the company back in early December 2019 that the company will be negatively impacted by 3 near term headwinds:

- Margins pressure from consolidation

- Persistent cargo weakness

- Disruption in Hong Kong

True enough, all 3 headwinds contributed to a weak set of 3QFY20 results

3QFY20: revenue growth from consolidation. Margins hurt bottom-line

Revenue growth all from consolidation of 3 entities

The company managed to grow its revenue by 8.6%, largely the result of the consolidation of GTR which added S$23.5m to the top-line of its Gateway division. Without GTR, the core revenue of Gateway would have seen flat growth. This was due to weakness stemming from lower cargo volume.

Food division grew by S$58.4m YoY in this quarter, largely the result of the consolidation of Nanjing Weizhou Airline Food Corp (NWA) which contributed S$14.9m to top-line as well as Country Foods Pte Ltd (CFPL) which contributed S$42.3m. Without the consolidation of CFPL and NWA, core revenue growth for the Food division would only have amounted to a marginal +S$1.2m

Lower operating margins

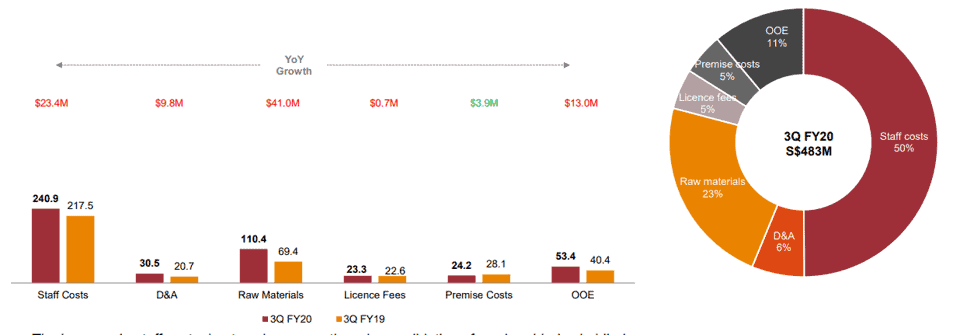

The operating profit of the Group declined from S$65.3m in 3QFY19 to S$62.9m in 3QFY20. The resultant operating margins declined was from 14.1% to 11.5%.

The weak operating margins were attributed to the consolidation effect of new entities that spot lower margins that SATS core operating entities as well as higher IT expenses and Equipment maintenance costs.

SATS also disclosed that staff costs grew from S$217.5m in 3QFY19 to S$240.9m in 3QFY20. As a percentage of revenue, staff cost was 47% of revenue in 3QFY19, improving slightly to 44% in 3QFY20, or a 3ppt improvement.

This is due to the company’s incessant effort to reduce overall labor reliance through automation efforts. A better ratio to measure the effectiveness of such a shift is if one is to account for the depreciation expense (more machinery was purchased).

In that context, the improvement would have been just down to 1ppt. Clearly, a lot more has to be done by management to further reduce manpower reliance.

Share of JV declined by 29%. Core PATMI drop 6%

This was due to the absence of one-off gains of S$5.8m generated last year. Excluding this one-off, profits would have been flat.

On a more positive note, Brahims, which has been a drag on SATS’s JV profits since Day 1 has now successfully turnaround, although we expect this entity profit contribution to be extremely marginal.

As a result of the above, core PATMI declined from S$63.1m in 3QFY19 to S$59.3m in 3QFY20, a 6% YoY decline.

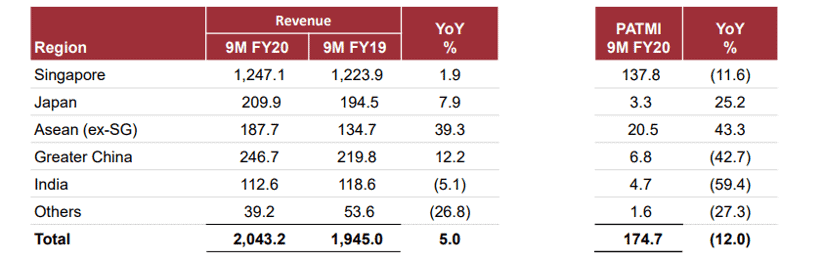

Stronger 9M performance in Japan and ASEAN

The company disclosed that for 9MFY20, Japan and ASEAN (ex-SG) saw profits increasing by 25% and 43% to S$3.3m and S$20.5m respectively. Japan’s contribution from TFK was a positive turnaround after years of losses. The Olympics to be held in Tokyo this year should be another positive catalyst for this geographical segment unless the COVID-19 epidemic derails it.

ASEAN contribution was stronger likely due to the strong performance of MacroAsia Catering in the Philippines and stable performance from PT Cardig, the latter its largest JV/associate entity in terms of revenue contribution. Brahim’s turnaround likely also contributed to better performances.

However, improvement in those geographical locations was still insufficient to offset the weakness seen in China and India, with huge declines in 9MFY20 profitability.

Outlook

The operating environment of SATS remains clouded in uncertainty, with management guiding that there might be a consequential impact on the short-term financial performance of the company, due primarily to COVID-19.

We believe that 4QFY20 earnings could witness a significant decline, potentially a 40-50% YoY drop if the COVID-19 situation continues to depress air travel demand.

That will cap a disastrous FY2020 for SATS.

Might this be an opportunity?

I don’t think the long-term air-travel demand has changed because of the epidemic issue. Once the COVID-19 has been contain, air- travel demand will likely rebound strongly, as seen back in 2003-04 post the SARS-aftermath.

Will SATS face significant credit-risk because of this issue? Unlikely, given its still decent balance sheet strength, with its debt/equity ratio at a very manageable 0.18x.

Will dividends be cut? I don’t think so given its still strong free cash flow position. However, its strong dividend growth track record might come to a halt in FY2020.

Conclusion: is this an opportunity to enter into SATS?

We have previously highlighted that the S$4.50 level is a strong support level on a technical basis. At that level, the yield is potentially at 4.4% and investors are paid to wait for SATS’s fundamentals to improve.

The COVID-19 situation, coupled with management’s dire short-term earnings outlook has increased the volatility associated with the share price of the counter.

For those already in the counter, I believe holding faith in the company is the right thing to do, with a second entry point at S$4, which is the next strong technical support level. If this virus issue continues for another month, stretching into end-March, we will likely see SATS share price dropping to that level.

SATS long term outlook remains a positive one and while this “black swan” event might have further clouded the company’s short-term earnings visibility, the global rise in air-travel over the coming two decades is an undeniable macro-phenomenon and SATS remains a low-Capex entity to benefit from that trend.

Meanwhile, hold on for the rough ride.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.