The sustainability of a REIT dividend/distribution payments is a key consideration for most investors looking at generating a passive income source from the ownership of such assets.

We highlighted the dividend growth profile of our S-REITs in an article last week, entitled: Which S-REITs have the best record of dividend growth.

This article is sort of a follow-up, one which we highlight the management fees profile of the REIT which will have a direct impact on the available income for distribution to unitholders.

Are you overpaying your S-REIT manager?

The question begets if you, as a REIT unitholder, are actually overpaying your REIT manager? Which S-REITs have a high “FEE to Income available for distribution” ratio, a potential “red flag” that the REIT manager is being over-compensated, resulting in a decline in distributable income for unitholders?

For the purpose of this article, the emphasis will be on the “externally-managed” REIT Manager and not on the Property Manager.

The differences as per Reitas definition:

REIT Manager: S-REITs’ assets are externally managed by a REIT manager. The REIT manager is responsible for managing the S-REIT, setting and executing the strategic direction of the REIT in accordance with the S-REIT’s stated investment strategy.

This includes the acquisition and divestment of the underlying properties. In exchange for its services, the REIT manager charges a management fee that includes a base fee and a performance fee. It may also charge additional fees such as acquisition and divestment fees.

Property Manager: A property manager is typically appointed by the REIT manager to manage the underlying real estate properties of the S-REIT. It oversees renting out the property to achieve the best tenancy mix and rental income, running marketing events or promotional programs and upkeep the property in general. In exchange, the Property Manager is paid a property management fee out of the assets of the S-REIT.

Expenses for the Property Manager is recorded before the Net Property Income (NPI) line. This information might or might not be separately disclosed by the REITs.

Expenses for the REIT Manager is recorded after the Net Property Income line and will include two key components: 1) Base and 2) Performance fee. Let’s elaborate slightly.

Base fee

The base fee is usually calculated as between 0.25% to 0.5% of the property value. This is likely the common metric adopted by most REITs. A second method is to price the base fee as a % to distributable income. This percentage is usually approx. 10% of distributable income. The second method, though fairer in my opinion (as we will later discover that this % is higher in almost all the REITs), is less common and I noticed that it is generally being adopted by the smaller REITs such as IREIT Global, Keppel Pacific Oak, EC World, etc.

Calculating the base fee as a % of the property value (method 1) could result in a conflict of interests between unitholders and management. That’s because if management is paid based on the size of a REIT’s assets, then it has an incentive to grow the REIT as large as possible to maximize its payment.

This can result in a REIT chasing after “growth at any price”, buying properties when the dynamics might not be favorable. Ultimately, this will translate to a higher share count base (as the REITs will likely adopt partial equity raising) but a potentially lower NAV.

A good REIT Manager is those that can make good acquisitions that are truly “accretive” to unitholders and being very selective in their selection process to ensure that management’s interest is aligned with unitholders. They are also not afraid to divest assets at the right time (although divestments are generally packaged with a back-to-back acquisition) and at the right price to “realize” or “monetize” the property to the benefit of unitholders.

Performance fee

This is a variable component that might or might not be paid, depending on if the REIT is able to achieve a certain degree of growth.

I believe that heartlandboy in this article has previously done a good summary of the current market practice, where performance fee is calculated as a % based on growth in 1) Gross Revenue, 2) Net Property Income (NPI), 3) DPU and 4) Property value (assuming DPU growth of 2.5% YoY).

Point 1 and 2 call into question of potential conflict of interest as we previously highlighted while Point 3 and 4 are more aligned with unitholders’ interest.

The Straits Times, back in 2015, have also pointed out this issue in this article, highlighting that MAS would like the REIT manager’s performance fee to be linked to parameters such as the net asset value per unit (an accretive acquisition will raise the NAV over time) or the DPU paid out to investors.

Acquisition and Divestment fees

There are 2 other fees, mainly acquisition and divestment fees which range between 0.5%-1% of a property transaction. I will not be elaborating on this as they are not recurring and tend to be one-off.

Before we get into disclosing the “BEST-PAID” S-REIT Managers (let’s not term it explicitly as overpaid but you get the gist), I will like to highlight another component. That REIT managers’ fees are typically paid with a combination of cash and units.

Receiving payments in Units and cash

What is the implication of this? By receiving their payments in units, that will “artificially” boost the income available for distribution.

Let’s use a simple example. If a REIT manager is entitled to $1 million in fees. Instead of receiving it in cash, which will reduce distributable income to unitholders by $1m, they opt to receive in units. There will be minor dilution as more shares of the REIT are being created and given to the REIT manager as payments and when the REIT announced the next round of dividend payment, there will be slightly more dividends to be paid due to the higher share count level.

However, this higher dividend amount is relatively minor compared to the $1m cash cost. If the counter is priced at $1/share, the REIT manager will receive 1m shares as fees. If this REIT has a 6% dividend yield, that will mean a dividend of $0.06/share or a total dividend payment of $60k vs. S$1m upfront.

That is how a REIT potentially conserve cash and boost its distributable income to unitholders. This is perfectly LEGAL. Just note that such a move will be dilutive. The bottom-line P&L figure remains the same although cash is boosted, alongside an increase in share count. The majority of S-REITs have a combination of receiving partial payment in units and cash.

With that lets finally move on to the meat of this article.

The BEST PAID S-REIT managers

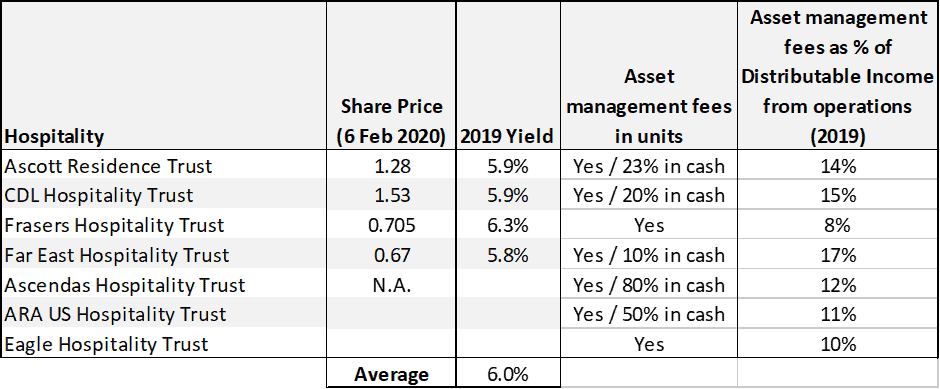

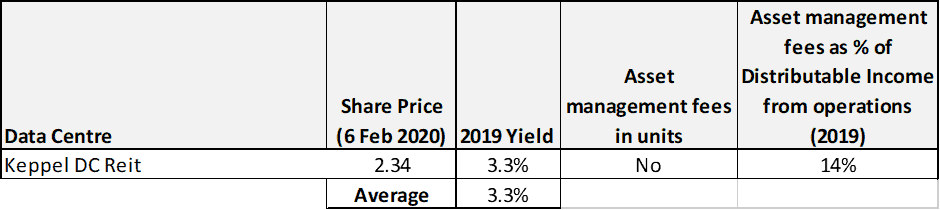

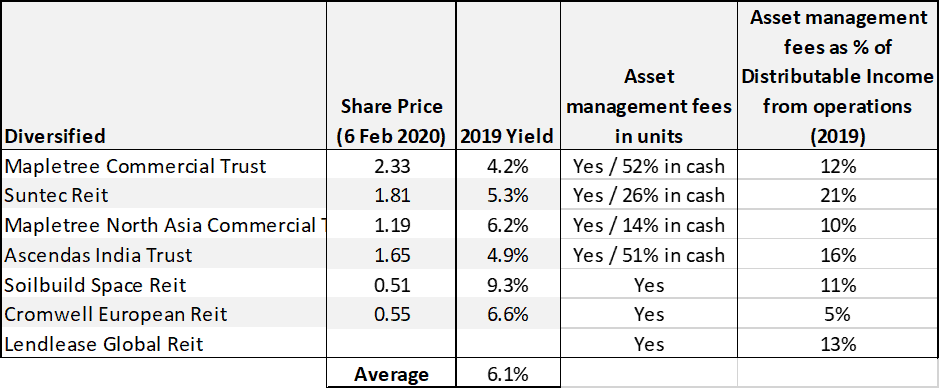

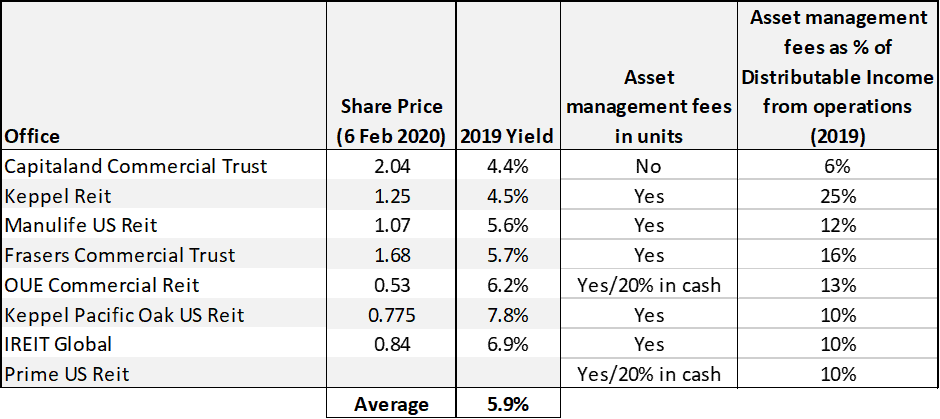

Again, let’s break down the analysis by the REIT industry. There will be one column which details if the fees are paid in units or cash or a mixture (if so, the breakdown)

The second column will show the total REIT Managers’ fee (base + performance) as a % of distributable income from operations. I use the distributable income from operations as the denominator as there are some REITs that have significant income that is paid out of the capital as their operations clearly ain’t sufficient to support the stated income payment.

Most of the REITs tend to have a ratio that falls between 10-15%. Those above 15% can potentially be classified as “best-paid” in our definition.

The analysis is, however, done on a snap-shot basis. A more accurate depiction will be one that looks at the historical trend. Nonetheless, this is a good starting point.

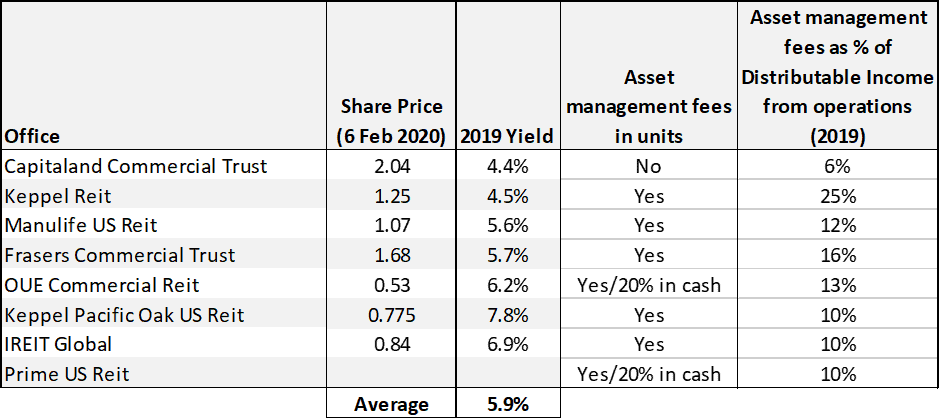

Office REITs

Looking at the last column, Capitaland Commercial Trust has the lowest % in this industry and clearly the best-in-class. Not only do they have a “decent” dividend growth track record (more volatile in the last few years as I have previously detailed), their 2019 fees are the lowest (with the exception of Cromwell) when we benchmark against their distributable income.

Two REITs stand out as “best paid”, one is Keppel REIT at 25% and the second is Frasers Commercial Trust at 16%. Both also paid out fees fully in units.

We tend to “dislike” those with a ratio of more than 15% and paid fully in units, which means a higher risk of dilution with no potential income buffer. A REIT like Capitaland Commercial Trust that pays out management fees in cash can have the luxury to convert to units when the operating climate gets tougher which will ensure a certain level of DPU stability.

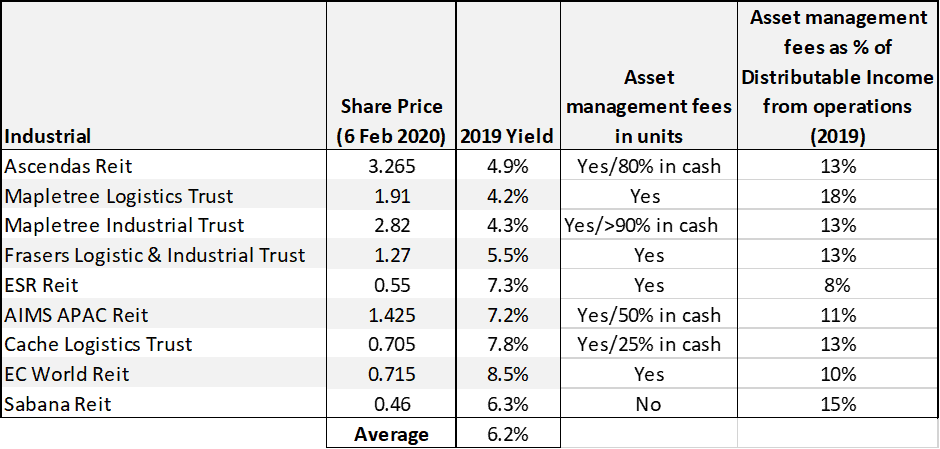

Industrial REITs

Ascendas REIT and Mapletree Industrial REIT have a combination of units plus cash but skew heavily towards cash payment, which means that they can still afford to increase their distributable DPU when core operations get more challenging, like what we are seeing today.

Mapletree Logistics is our winner in this industry at 18% with full unit payment. Sabana REIT is next at 15% but REIT managers receive their fees in cash (no confidence in the long-term REIT’s prospect?)

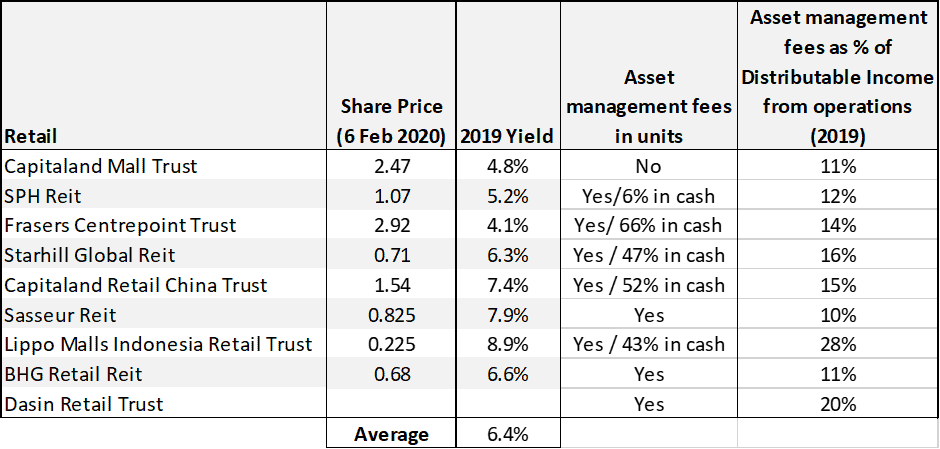

Retail REITs

The key outlier is undoubtedly Lippo Malls Indonesia Retail Trust where their ratio stands at a hefty 28%. This is a REIT that has a significant amount of distributable income paid out of its capital which clearly ain’t sustainable over the long run.

Starhill Global and Dasin Retail both have a high ratio as well at 16% and 20% respectively.

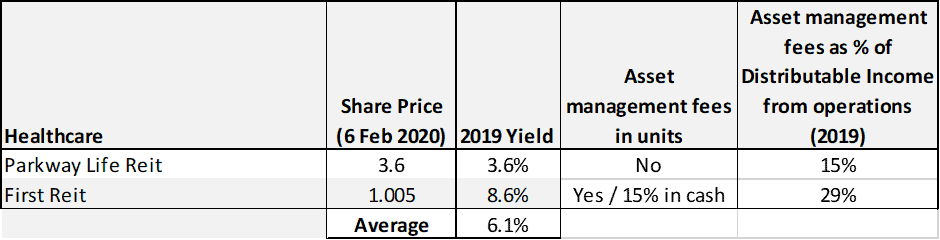

Healthcare REITs

First REIT’s REIT managers likely take the crown as being the “best-paid” within the entire S-REIT universe, with a ratio standing at 29%.

Parkway Life REIT stands at our border benchmark but we note that fees are paid fully in cash. We tend to notice that those REITs which pay fees fully in cash are those that are more stable with a better dividend growth track record (with the exception of Sabana).

Hospitality REITs

Far East Hospitality is on the high side with its ratio standing at 17% while Frasers Hospitality is the best in class for this industry.

Data Center REITs

The only REIT in this industry, Keppel DC REIT fees are fully in cash with an acceptable 14% ratio. Payment fully in cash provides a certain level of buffer that the REIT can maintain its DPU growth ahead.

In fact, we previously highlighted that Keppel DC REIT has among the most stable forward-looking DPU growth prospect due to the industry rosy outlook as well as how their leases were being structured.

Diversified REITs

Suntec REIT takes the top accolade for this industry with a ratio standing at a significant 21% while Cromwell European REIT is the cheapest across the entire S-REIT sector (time for a raise perhaps? If so, will that have a substantial negative impact on distributable income?)

Conclusion

Having a base fee that is fixed (at 10%) to distributable income (assuming not inflated by income coming out from capital) is the IDEAL scenario for unitholders.

However, I personally don’t mind paying a reasonable management fee to the REIT Manager if they are doing a good job. What is reasonable? 10-15% perhaps.

More critically, have they demonstrated a good track record of growing DPU for unitholders? Acquisition-driven growth in AUM will increase the asset base (and enhance benefit REIT managers) but if they are not accretive in nature, then the NAV/unit and DPU will not grow and will potentially be eroded, hence being detrimental to unitholders.

One should not only look at a REIT in terms of their yield attractiveness but also evaluate their past acquisition track record to ensure that dividend growth is sustainable or growth is 0% at worst.

Don’t incentivize a REIT manager by “overpaying” them, particularly when it is not accompanied by a strong track record of DPU growth.

The IDEAL scenario for me will be one where fees might be of a higher principal amount (which implies AUM or NAV growth) over the years but as a % to distributable income, that ratio is declining which implies skilled management that generates accretive growth, both through organic and inorganic means.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

13 thoughts on “Are you overpaying your REIT manager? Which S-REITs have the “highest” management fees?”

Hi, I am surprise that you analyze REIT management fee similar to how I do. The only difference is I do it the other way round, inverse your formula. I check how much dividend received for every dollar of management fee paid. I previously post in my blog: https://reit-tirement.blogspot.com/2019/03/uncommon-financial-metrics-of-reits.html

I also notice that capital distribution may not represent that REITs paid out distribution from capital. Normally distributable income from oversea properties is returned to shareholder in term of capital distribution, a classification for Singapore Tax purpose. There are cases where REITs distribute from real capital, this will happen when they dispose interest in their investment properties. And in a lot of case, they don’t announce this as “capital distribution”

Hey Vince, thanks for stopping by.

Yes, I might have missed out on the fact that overseas contributions might be distributed from capital. I took a look at LMIR historically DPU payment trend and distribution from capital typically consists of about 1/3 of its DPU payment.

Thanks for the heads up.

I previous do check on this “capital” matter on LMIR before, so I have do a re-check. Those “capital” distribution are not from capital (cash or cash equivalent) actually. Those are investment properties depreciation, and trapped due to Indonesia accounting principal. So they put in place for a structure to get those “properties depreciation” cash out.

LMIR Trust manager did not explain this in their financial statement or annual report. I only happened to read once in its 2018 4Q result. They explained it because of the realised currency loss for this practice. You could refer page for Note (a) for more detail explanation:

http://lmir.listedcompany.com/newsroom/20190222_184538_NULL_EDG71N49JIACDAZ2.1.pdf

I have to say I do not fully understand the concept either. I see that you are from finance industry, perhaps you could read up and explain in a simple layman term to me ?

Sounds complicated but i think you have got the gist of it. Not sure if this is the standard across all Indo-based REITs.

I believe the structure is such that they are similar to how US REITs dividend payouts are computed, which might not add back depreciation and hence, although US REITs are mandated to payout 90% of taxable income, this is usually calculated using net profit instead of funds from operations.

Whereas for our REIT standard, we add back depreciation for distributable income. This explains why US REITs yield are so much lower.

What LMIR is trying to do is probably to be competitive vs. SG REITs because if they are not allowed to distribute from cash flow, then their yield will be extremely low…. so they have this complicated structure which involves another layer of FX risks from the RPS structure which I believe sits on LMIRT as an asset. Since this asset is denominated in IDR, the significant depreciation of the IDR against SGD results in substantial FX losses.

I just look at First REIT, it also has those redeemable preference share portion, so it should be norm for REIT with Indonesia properties. As I understand, REIT could only distribute from their “distributable income” in which they could not simply distribute from their capital, unless they dispose their properties/joint venture/associates. The best part I found is, they could distribute the whole selling amount instead of only profit.

I found the following REITs distribute from their capital (data within 5 years), which from property disposal:

– Ascott – 4Q 2017, 4Q 2018, 4Q 2019

– CLT – 2Q 2015 to 3Q 2017 (exclude 2Q 2016 to 3Q 2016), 2Q 2018

– CCT – 3Q 2017 to 4Q 2017

– CRCT – 4Q 2017 to 1Q 2019

– CDLHT – 1Q 2018 to 4Q 2019

– ESR – After merger, 4Q 2018 to 4Q2019

– FCOT – 1Q 2016 to 4Q 2019

– FLT – 3Q 2018, 3Q 2019

– KREIT – 4Q 2018 to 4Q 2019, 3Q 2015 to 3Q 2016

– MLT – 1Q 2015 to 4Q 2019 (exclude 2Q & 3Q 2015)

– Plife – 1Q 2017 to 4Q 2017, 1Q 2015 to 4Q 2015

– Sabana – 1Q 2019

– Suntec – 2Q 2015 to 4Q2019

The longest record are MLT and Suntec. FCOT merger with FLT come just in time as FCOT capital amount from disposal almost finish distributed. Pai Seh, seems like hogging your comment section.

Hey Vince, No problem man. thanks for sharing.

Yes does seem like quite a number of reits sooth their dpu through capital distribution from property disposed of. A good way to ensure growth continuity.

Happy to share, I am also learning still. I have added your blog in my blog link. Do you mind to o the same for me?

If you are willing to create a dedicate page for SREIT article, then I am happy to add that in my SREITs Sites page.

I could do the same for your SGX REIT DATA too, but I see the link is “https://newacademyoffinance.com/sgx-reit-data-2019/”.

Do you intend to change it ? or remain in the future REIT Data update ?

Hi, may I know where did you get your data from?

The data source? ThAnk you

Hi james,

I referred to each individual reits annual report and financial statements

Hi,

Am I right to say that you manually calculated the management fees as per reported in the financial report/statement?;

yup.

Appriciable article, We at Property Hunters shifted this service to a level much higher than the broker concept. you can see more details like this article Good location