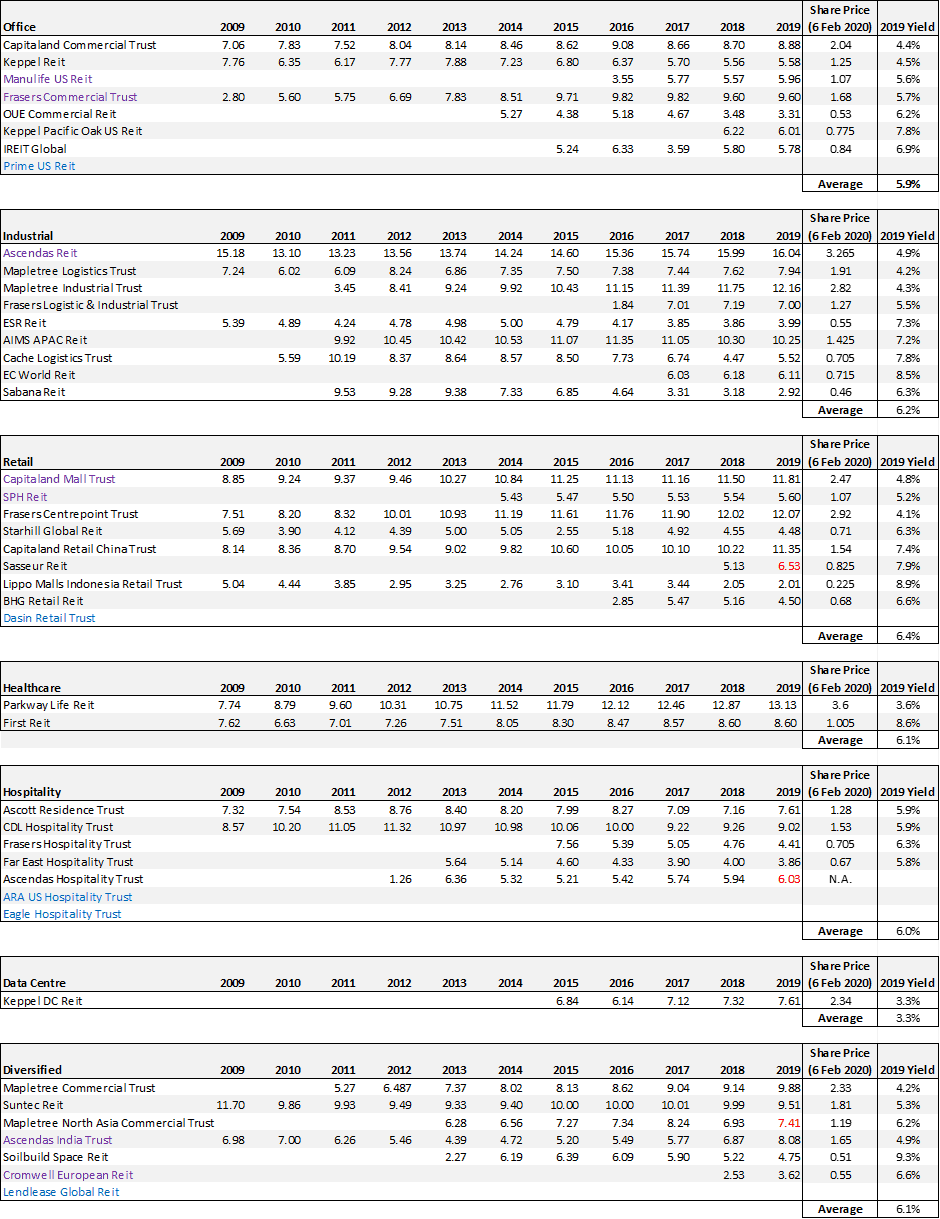

I thought it will be useful to list the dividend-paying track records of S-REITs. Consistent dividend growth is one of the key criteria that I personally used in the evaluation of dividend-paying stocks or REITs.

I wasn’t able to find any website that provides a summarized snapshot of the dividend track record of our S-REITs, hence I decided to compile a list of all the REITs (excluding business trust) in Singapore and their past 10-years dividend payment track record.

The results surprised me as I found that the consistency of dividend growth is clearly lacking, particularly with regard to smaller REITs. Only a handful of REITs have a consistent dividend growth record and not surprising, these belong to the “BLUE-CHIP” Reits.

The information below is gleaned from the individual REITs’ websites on distribution history and might or might not have been adjusted for changes in their unit base.

For some of the REITs, their 2019 dividend payments have been annualized (highlighted in red). We have also excluded some REITs which have a very limited dividend-paying track record (i.e. those recently listed, highlighted in BLUE).

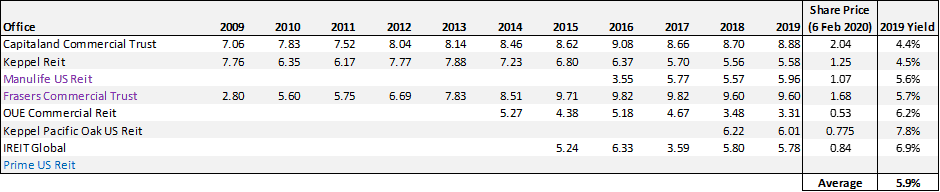

Office REITs

The office space has been a generally challenging one, with NO REITs having a strong track record of consistent growth. Two REITs that stand out to me are Manulife US Reit and Frasers Commercial Trust.

Both have a decent track record of dividend growth and are yielding close to the sector average. While Capitaland Commercial Trust does also have a decent track record ( the last few years were more volatile), its yield of 4.4% is the lowest.

While OUE Commercial, Keppel Pacific Oak and IREIT all have higher than industry average dividend yield, their dividend track-record has been either inconsistent or on a downward trend.

Despite the volatility seen in this industry, the average industry yield at 5.9% is among the lowest of all industries (with the exception of data center).

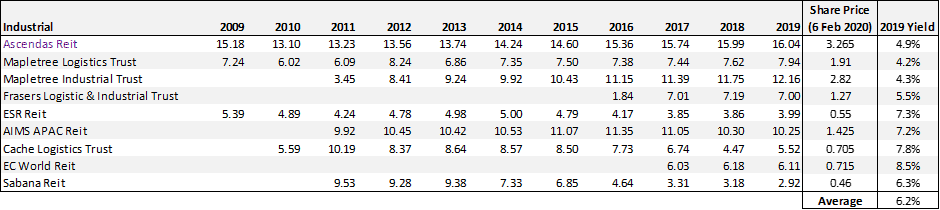

Industrial REITs

The Industrial REITs have been more consistent dividend payers, with the Big 3, Ascendas REIT, Mapletree Logistics Trust and Mapletree Industrial Trust showing the greatest consistency, with uninterrupted dividend growth over the past 10-years.

Consequently, their yields have also been the lowest. The standout to me is Ascendas REIT where its dividend growth has been consistent and uninterrupted since 2010 and still yields a decent 4.9% compared to Mapletree Log 4.2% and Mapletree Industrial 4.3%.

However, do note that Ascendas REIT dividend growth rate is also the slowest among the three.

While the rest of the smaller REITs have more attractive dividend yields, their dividend-paying track record has been unimpressive.

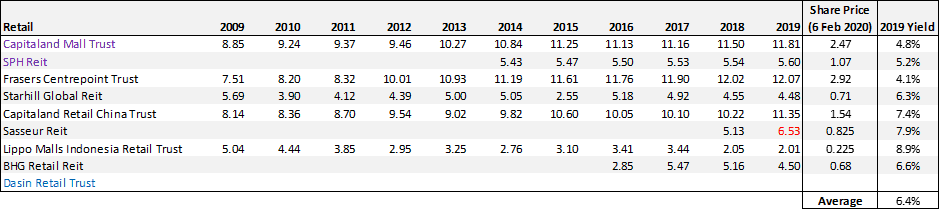

Retail REITs

Retail REITs have among the highest yield, averaging at 6.4%.

The best of the best with 10-years of uninterrupted dividend growth track record is Capitaland Mall Trust and Frasers Centrepoint Trust.

However, the yield of Frasers Centrepoint Trust is the lowest in this industry. Hence, my preferred picks are Capitaland Mall Trust yielding 4.8% and SPH REIT that also has a consistent dividend growth track record (albeit only six years of record) which yields 5.2%.

Again, the smaller REITs do have significantly higher yields but their dividend-paying track record has been extremely inconsistent. Sasseur REIT does look slightly promising but its track record has been limited to just 2-years.

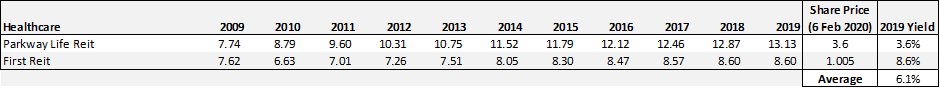

Healthcare REITs

No particular standout. The best quality REIT is undoubtedly Parkway Life REIT but at 3.6% yield, it is the second-lowest yielding REIT within the Singapore context.

First REIT is definitely looking more attractive on the yield front and its dividend payment has actually been pretty consistent. However, uncertainty over Indonesia’s master lease renewals is likely the reason for keeping the share price depressed.

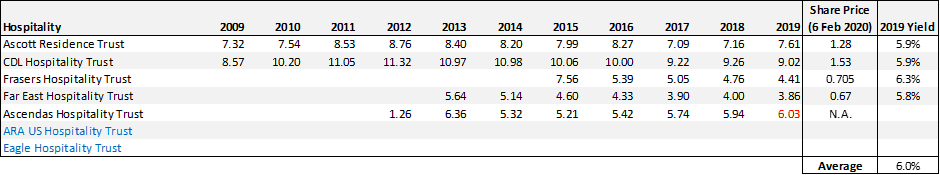

Hospitality REITs

Dividend payment has been all over the shop and there is no single entity with a consistent dividend growth track record.

The challenges seen in the hospitality industry could be what leads to the merger between Ascott Residence Trust and Ascendas Hospitality Trust which was completed on 31 Dec 2019.

For those looking to partake in this industry, the enlarged Ascott Residence Trust, currently yielding 5.9% might be the way to go.

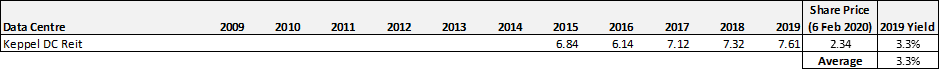

Data Center REITs

Keppel DC Reit is the only Reit in this industry and is the LOWEST yielding Reit within the S-REIT space.

Granted that its dividend growth track record is among the safest due to the long WALE of its leases with escalation clauses in place, its low yield is particularly unattractive to me.

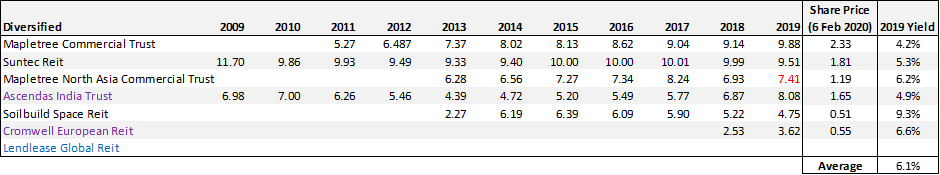

Diversified REITs

Last but not least, we have the diversified REITs, REITs with a mixture of different asset classes such as a combination of office and retail, etc.

The counter with the strongest distribution growth track record is Mapletree Commercial Trust. However, it is also the REIT with the lowest yield in this category, currently standing at only 4.2%

The two standouts to me are potentially Ascendas India Trust which yields a decent 4.9% with a strong dividend growth record since 2014 and Cromwell European Reit which yields 6.6%.

The former’s 2019 distribution growth has been particularly strong and it is worth investigating if such growth is sustainable. The latter has a short dividend payment track record and a Singaporean investor will be exposed to the EUR currency which should be taken into consideration as well.

Conclusion

The “best” REITs with the strongest dividend growth track record are usually those with the lowest yields aka “most expensive”.

Just based on dividend growth record and taking into consideration the counters’ yield, my personal favorites are 1) Manulife US REIT, 2) Frasers Commercial Trust, 3) Ascendas REIT, 4) Capitaland Mall Trust, 5) SPH REIT, 6) Ascendas India Trust and 7) Cromwell European REIT.

However, looking at a consistent dividend growth profile is just one aspect in evaluating the attractiveness of a REIT.

It is generally more of a challenge to find an S-REIT with a strong dividend growth track record compared to a US REIT due to the differences in how distributions are mandated to be paid out. This will, however, be an article for another day.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

2 thoughts on “Which S-Reits have the best record of dividend growth?”

Finally. Something in the REIT space that’s REIT-lly useful! Haha.

Good stuff thanks!