Riverstone is one of the leading manufacturers of cleanroom and healthcare gloves in Malaysia. The company is expected to announce its 3Q19 results sometime around 1 November.

After many quarters of rather lackluster results, we believe this quarter has the potential to surprise positively, particularly on the back of a low comparison base last year.

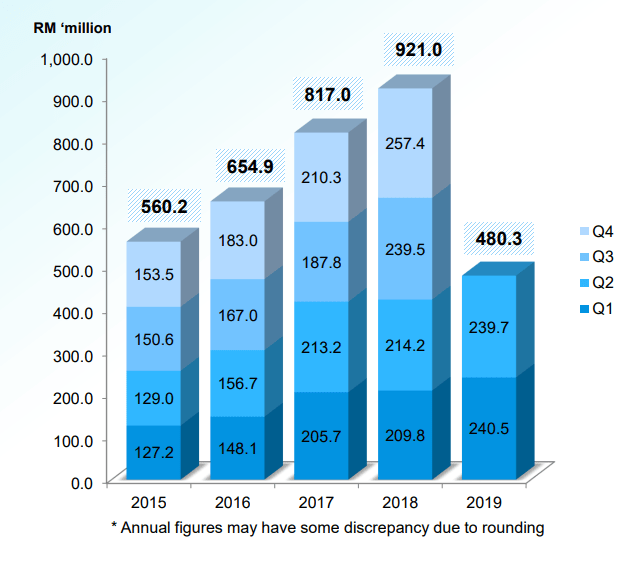

Consistent revenue growth

The company has been very consistent in growing its revenue, as evident from the chart above gleaned from its presentation pack. This is due to a consistent growth in its capacity, coupled with generally resilient demand (although pricing under pressure).

We expect a low double-digit revenue growth trend to persist over the coming quarters which will result in yet another record revenue year for Riverstone in 2019.

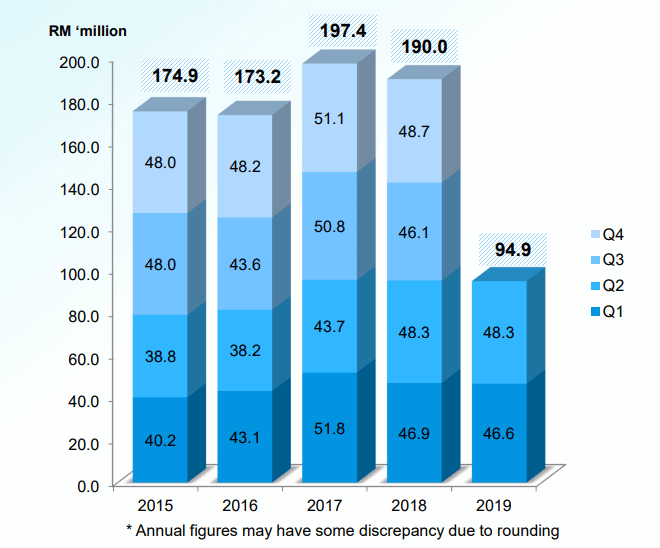

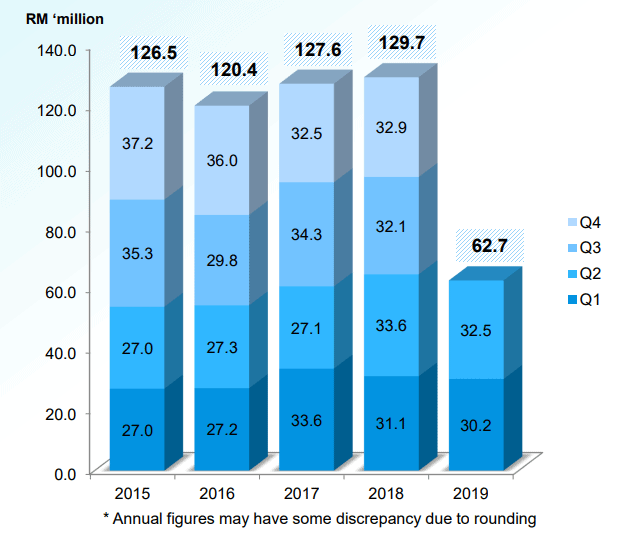

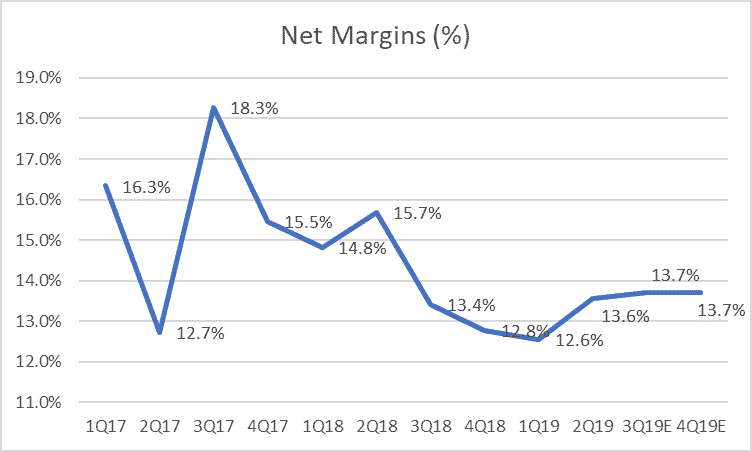

Not so steady on margins

Source: Company

Source: Company

Despite respectable revenue growth, the company has disappointed in terms of margins, due to a combination of pricing pressure and less favorable cost metrics.

This resulted in relatively flat profits over the past 4-years. However, we believe that its fortunes might be turning around, with earnings at an inflection point.

What to expect for 3Q19 and beyond

Tariffs on China gloves

According to various media publications, it was quoted that Malaysia glove manufacturers are expected to benefit from the US 15% tariff imposed on medical gloves made in China, effective 1 September.

Effectively, this will result in more costly China gloves products, thus shifting US demand towards Malaysia. This could give gloves manufacturers in Malaysia such as Riverstone a boost, particularly in their final quarter results.

Improving demand for Nitrile gloves

According to The EDGE article, it was quoted from a 23 October Kenanga Research that there are telltale signs of pent-up demand for nitrile gloves from restocking activities, judging by the industry’s longer delivery lead times which has risen to between 45 and 50 days from 30 to 40 days.

This will benefit Riverstone, given that the company is predominantly a nitrile glove manufacturer.

Increasing demand for Cleanroom gloves

According to a DBS report on 13 August where the brokerage upgraded the counter, it was highlighted that cleanroom (CR) glove demand has seen an uptick since June 2019, with the trend expected to continue in 2H19.

The brokerage noted that demand for CR has grown by about 15-20% compared to 2018, from countries including Japan, Philippines and Vietnam.

CR gloves account for only 15% of Riverstone’s total units produced vs. 85% for healthcare gloves but the former accounts for 53% of Group’s revenue due to its higher selling price. CR gloves also accounted for 75% of Riverstone’s net profit in 2Q19.

Hence stronger CR glove demand tends to bode well for Riverstone in terms of margins improvement.

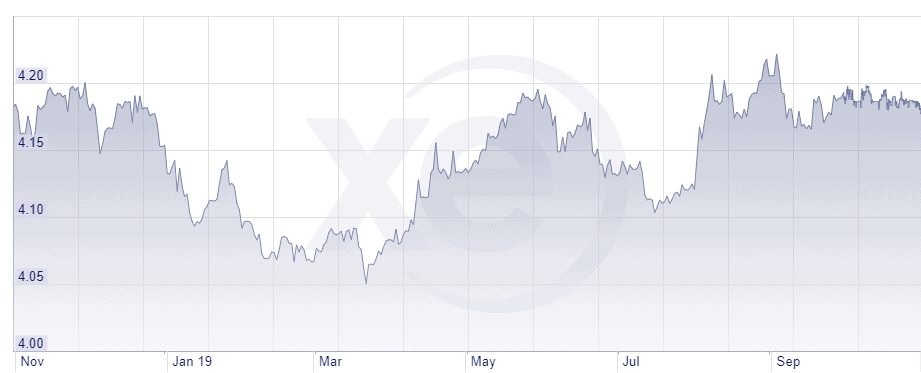

Beneficiary of strengthening USD vs. MYR

Riverstone’s revenue are denominated in USD while costs are mostly in MYR. Hence, the strengthening of the USD against the MYR tends to be beneficial to Riverstone.

Since mid-July 19, the USD has strengthened from 4.11 to the current level of 4.18. This could help boost Riverstone’s gross margins in the current/next financial quarter.

Net margins could have bottomed out

Net margins seemed to have bottomed back in 1Q19 at a trough of 12.6%. 2Q19 saw an encouraging improvement to 13.6%. We believe net margins can stabilize at approx. 13.7% over the coming 2 quarters. This compares favorably to 3Q18 net margin of 13.4%. The potential for out-performance from a low-base in 4Q18 (net margin of only 12.8%) could set the platform for even better YoY comparison in the final quarter of the year.

Earnings to resume growth in 2019?

Based on our expectations for net margins to stabilize at 13.7% in 3Q19E and 4Q19E, Riverstone could generate earnings of approx. MYR36.7m and MYR39.5m respectively in 3Q19 and 4Q19.

This is based on the assumption that revenue can grow at a clip of 12% YoY for 2H19. 1H19 revenue growth rate was on average 13%.

Based on the above assumption, the company can look to generate MYR139m in full year profits for 2019 vs. MYR130m in 2018. This represents a growth rate of 7%. Not overly exciting but its likely a good start from the past 3-4 years lackluster results.

Valuations

Based on a MYR139m earnings forecast, Riverstone (current market cap of SGD724m or MYR2.22bn) will be trading at a 2019E PER multiple of 16x. This compares favorably to peers which are trading at average multiples close to 25x.

Key risks

- Intensifying competition with oversupply due to strong capacity addition from regional players

- Global slowdown could impact CR sales

- Significant drop in USD vs. MYR

- Margins deterioration resuming due to cost pressure that cannot be fully passed on

Conclusion

3Q19 could potentially be the key turning point for Riverstone. However, for a commoditized product such as rubber gloves, it is extremely challenging to carve out a moat in terms of product differentiation. Hence, margins can continue to be rather volatile.

It will likely come down to how efficiently the business is being run by management.

We see initial signs that 2H19 could demonstrate better earnings profile compared to a year ago, taking into account an easier comparison base. The ability to maintain that momentum into 2020 is critical for its share price to appreciate further.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- SHENG SIONG 3Q19. 4 KEY AREAS TO LOOK OUT.

- VALUEMAX: A RECESSION PROOF BUSINESS BUT WE SEE 1 MAJOR RISK

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

- 46 STOCKS IN BUFFETT PORTFOLIO

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.