Table of Contents

We have heard of value investing and growth investing, the two main dominant investment styles. Not talked about that often is quality growth investing.

What exactly is quality growth investing?

Quality growth investing is selecting stocks that present certain superior financial characteristics that differentiate them from peers.

The MSCI World Quality Index, it aims to capture stocks with high-quality scores based on three main fundamental variables: 1) High Return on Equity (ROE), 2) Stable YoY earnings growth, and 3) Low Financial Leverage.

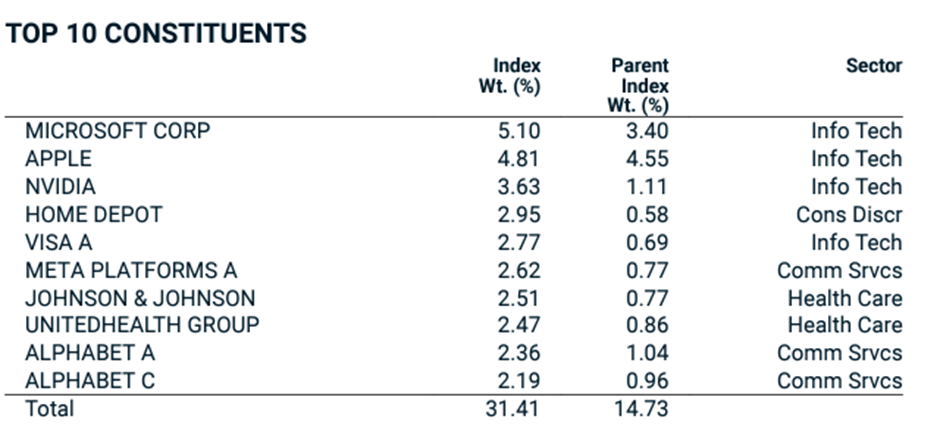

The MSCI World Quality Index consists of 300 constituent members, out of which Microsoft has got the largest weighting, encompassing 5.1% of the index weight, followed by Apple at 4.81% and Nvidia at 3.63%.

The table below shows the Top 10 constituents of the MSCI World Quality Index.

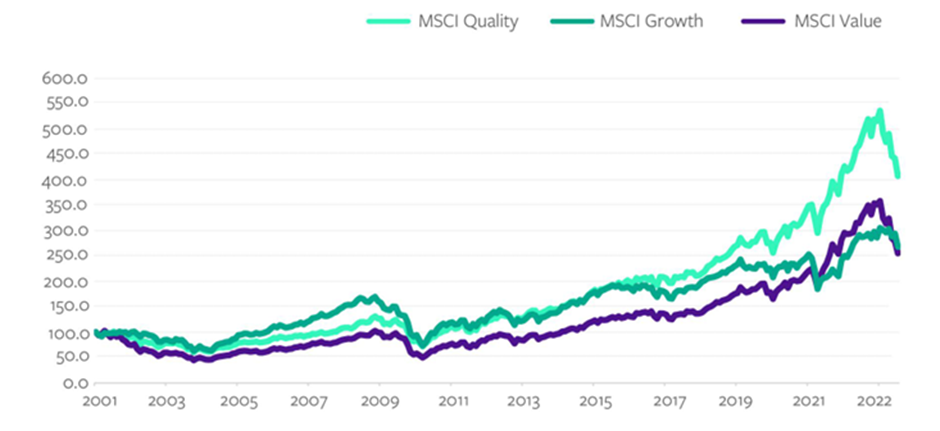

A study by IQ EQ Fund management highlighted that a strategy of Quality Growth investing outperforms that of a pure growth or value investing strategy, using data from 2001.

This is based on tracking the performance of the MSCI World Quality Index, MSCI World Growth Index, and MSCI World Value index respectively.

Not only have quality growth stocks been superior based on long-term performance, but they have also proven to be more resilient in down markets as they exhibit defensive characteristics that may be valuable to investors in periods of uncertainty.

How to find Quality Growth stocks?

As we highlighted earlier, quality growth investing involves finding stocks that exhibit both quality and growth characteristics.

While the quality factor might be a tad subjective, the growth factor is pretty clear-cut, so let us start with some of my own financial criteria revolving around the growth factor.

Growth factor in quality growth stocks

First, the company needs to be generating sales/revenue growth on both a trailing and forward basis.

Second, the company needs to be profitable and earnings is seen to be growing ahead.

The second factor differentiates quality growth stocks vs. hyper growth stocks, the latter exhibiting very strong sales growth but is often loss-making. This highly increases the risk of obsolescence in an economic recession.

Quality factor in quality growth stocks

Moving on to the quality factor which can be rather subjective, my own definition of a high-quality stock is one which possesses the following financial characteristics:

First, it needs to be a highly efficient company that generates a high return on its capital that it deploys.

Second, it needs to be displaying the right form of leverage. Good leverage is operational leverage which is evident through growing margins. Bad leverage is credit leverage. This brings us to the 3rd point.

Third, a quality company cannot be highly geared ie having huge borrowings relative to its equity level.

Fourth, it needs to be cash self-sustaining. This means that the company’s free cash flow is growing alongside its profits. Companies that only exhibit earnings growth without a corresponding growth in their free cash flow is a major red flag, in my view.

Quality + Growth

When we combined the essence of both quality and growth investing, we likely have a winning combo of uncovering quality growth stocks that can do extremely well in both a bull market and is also highly resilient in a bear market.

Using the above financial characteristics, I screened for 4 stocks that exhibit characteristics of being a quality growth stock.

2 of these stocks are large cap (>$10bn market cap) while the remaining 2 are medium cap ($2-10bn).

Quality Growth Stock #1: ASML (ASML)

I have written about ASML in this article: Is it too late to buy this top semiconductor equipment manufacturer?

ASML is one of the most important companies that the world cannot do without. This is because it supplies high-end chip equipment to the largest chip manufacturer in the world, TSMC. Without that specific lithographic equipment, TSMC will not be able to produce high-end chips that go into the likes of our iPhone, Smart TV, etc.

And ASML has a monopoly over high-end lithographic equipment that no other company in the world can manufacture.

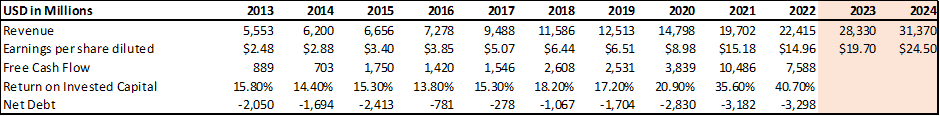

This is a company that exhibits both Growth and Quality features, as I have highlighted above.

ASML is a stock currently in my Stock Alpha Blueprint Portfolio, one in which I highlighted to my students about its potential when it was trading at $300+/share back in late Oct 2022.

It still has a place in the portfolio despite the significant run-up seen in its share price as momentum remains strong for this semiconductor play.

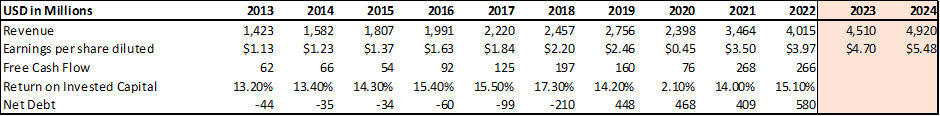

Quality Growth Stock #2: Microsoft (MSFT)

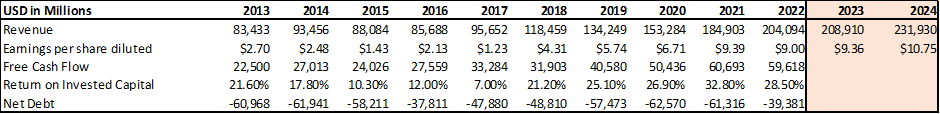

Microsoft, the second largest company in the world (based on market cap), needs no introduction. The company is undoubtedly a high-quality blue-chip company, one that is unlikely to disappear due simply to an economic downturn.

This stock, as I earlier mentioned, is also the number 1 stock holding in the MSCI World Quality Index.

Microsoft also fits all the financial criteria that I set in place for a quality growth stock.

While its performance has not been as impressive as ASML YTD 2023, it has seen a slight resurgence of late, and investors who have been patient with this blue-chip stock and added on to their stakes on price weakness would have been nicely rewarded.

While revenue growth is expected to taper in 2023, the street expects growth to re-accelerate in 2024 and Microsoft is one company that continues to achieve operational leverage and generate tons of free cash flow that it can use for both organic and inorganic expansion.

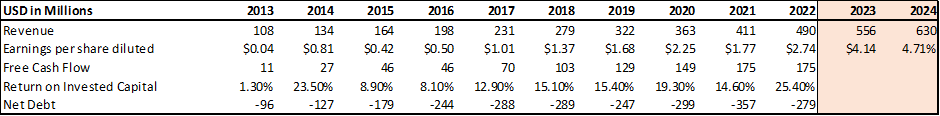

Quality Growth Stock #3: Qualys (QLYS)

Most people would not have heard of Qualys but likely it’s bigger and more popular peer, Crowdstrike, operating in the cybersecurity business.

Qualys Inc is a provider of cloud-based security and compliance solutions to enterprises, government entities, and small- and medium-sized businesses.

The firm’s solutions are delivered through the Qualys Cloud Platform and provide security intelligence by automating the life cycle of IT asset discovery, security assessment, and compliance management.

The cybersecurity business is a growing segment and I believe is a theme that will see structural growth expansion over the coming decade.

I have written about how one can get exposure to the cybersecurity industry in this article: Thematic ETFs partaking in the hottest trends

Qualys is one of those smaller-cap cybersecurity names that will benefit when “the rising tide lifts all boats”.

Despite its smaller size in nature, its financial performance over the past decade has been pretty impressive and this company could still be in the early stages of growth.

Quality Growth Stock #4: Texas Roadhouse (TXRH)

Texas Roadhouse is a restaurant company operating predominantly in the casual dining segment. It currently has more 700 restaurants in the US and in 10 foreign countries.

While this name might not be very well-known here in Singapore, this is one company that has been very popular in the US for the fact that each restaurant employs a butcher and a baker that prepare fresh food every five minutes.

This is one casual dining company that could be as popular as Chipotle Mexican Grill (CMG), a company that has grown by 3700% since 2006. TXRH is still in its early stages of expansion, with its presence only known mainly in the US.

As can be seen from the above table, the company is currently growing both revenue and earnings strongly. This is accompanied by a growing free cash flow pile as well.

TXRH, while not exactly a blue-chip company in the purest sense, is a company that possesses both growth as well as quality criteria.

On a YTD basis, TXRH’s shares have appreciated by about 14%, outperforming the S&P 500’s 3% return. This stock has also been a very consistent long-term outperformer vs. the S&P 500.

$10,000 invested in TXRH 10 years ago would have generated an ending portfolio of $55,400 vs. $21,000 in the S&P 500 index.

At a market cap of only $7bn, this is one company that could witness tremendous growth in its share price if it keeps up with its excellent operational performances, as evidence of a quality growth stock.

Finding Quality Growth Stocks the Easy Way

If you are interested to invest in high quality growth stocks like ASML and MSFT which have shown to consistently outperform the market in almost all market conditions, then you need to check out the Stock Alpha Blueprint Course. These are 2 stocks my students have been alerted to invest in “when blood is all over the street” and is currently reaping the rewards from the subsequent rebound.

Alpha Blueprint Stocks are all quality growth stocks that fulfill stringent financial criteria that I have set in place to screen for only the Top 1% of US stocks aka the “RIGHT” stocks.

Knowing the right stocks to buy is the first step toward success. The second step would be to include a timing element.

This is where I use my Smart Impulse Factor to include a timing element for that “RIGHT” time.

What you are going to get is a simplified but yet elegant manner to invest in the RIGHT stocks (high quality growth stocks) at the RIGHT time (when valuations are unjustified or when momentum is strong).

For those who are interested to find out more about Alpha Blueprint Stocks as well as the various financial criteria I use to select this pool of high quality growth stocks, do click on the button below: