Quick summary:

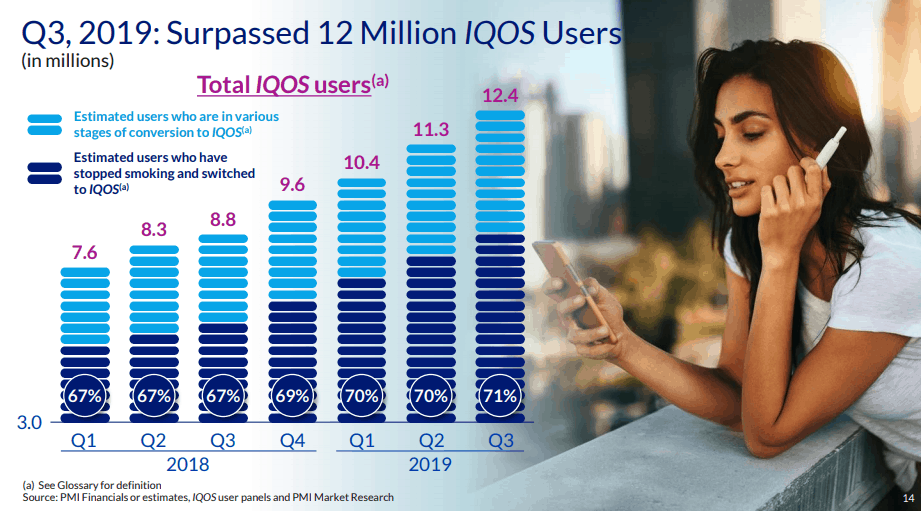

Philip Morris (PM) delivered better-than-expected 3Q19 results although its share fell after the company provided muted 4Q guidance, largely due to timing issues affecting 4Q outlook.

The company’s heated-tobacco products (IQOS) were a highlight in the quarter, with management confident that the company is well on its way to hitting its unit-shipment volume target of 90 to 100 bn by 2021.

This is due to ongoing strength in key IQOS market such as Russia, Japan and Europe. Management also highlighted that IQOS’s launch in the US (being spearheaded by Altria) is off to a good start and that the company is “happy with the relationship” despite merger talks between the two company now fully off the table.

The recent negative headlines surrounding vaping make alternatives such as IQOS all the more attractive.

How does all this affect Venture?

For those who are familiar with Venture, you would be aware that PM is an important customer of the company, where Venture is currently one of two/three key suppliers of PM’s IQOS device.

How significant is their relationship? Well Venture’s management has all-along been extremely secretive of their client relationships and does not openly disclose clients’ contribution to their top-line.

PM is touted to be the largest client of Venture at present and management disclosed in its 2018 annual report that one company encompassed more than 10% of Group’s revenue. How much beyond 10% is up for dispute with the street speculating anywhere from low teens to approx. 30% of Group’s revenue.

Street generally positive on Venture

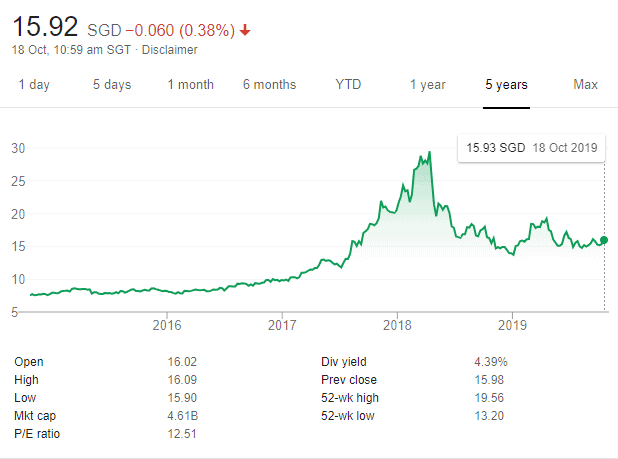

The market has turned generally positive on the company post its 2Q19 result which was ahead of the street’s expectations, with a number of brokers such as UOB, CIMB and RHB all upgrading the counter, taking into account its then share price weakness.

Venture has also gained favour among Phillip Securities which initiated a BUY rating on the counter in a 30 Sep report, with a price target of S$17.68, implying 17% upside from its last-closing price of S$15.98 on Thursday.

However, share price post 2Q19 remain relatively lackluster, likely due to market concerns over US-China trade war issues that will negatively impact product demand for Venture’s top US clients.

Launch of new IQOS product could again be positive for Venture

CIMB highlighted in a 26 Sep report, that its key customer, PM announced the launch of a new product IQOS 3 DUO that will be available in Japan in September and will subsequently be rolled out to most of the markets by the end of 2019. Another possible new product, IQOS MESH (e-vapour) could be formally launched in 2H19.

While the broker maintains its ADD call on the counter with a Target price of S$16.28, it notes that on a technical basis, it remains on a long-term bearish trend with a major hurdle at the S$16.00 resistance level. Key supports are at S$14.50 and S$14.00.

Venture 3Q19/FY19 outlook

CIMB expects Venture to generate core profits of S$90.4m in 3Q19, 11.9% higher YoY when the company release its results on 8 November. According to Bloomberg, the street has a full-year 2019 earnings expectation of S$366m, a slight decline vs. 2018 earnings of S$370m. 9 Brokers have a positive call, with 2 Neutral and 2 taking a bearish stance on the company.

While the US-China trade tension remains a major headwind for tech-related counters such as Venture, strong performance from PM’s IQOS product, with consistent new device launches ahead could continue to drive both top and bottom-line performance for Venture, assuming that PM is indeed a significant revenue/earnings contributor to the company.

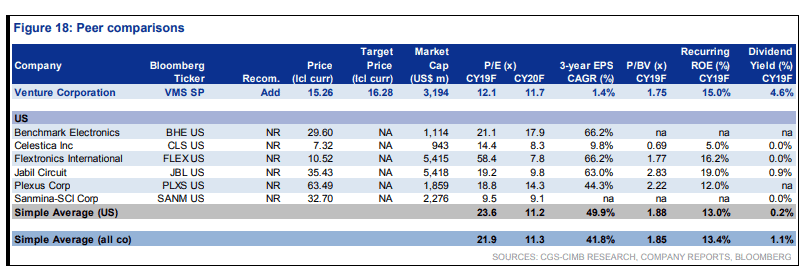

The company is currently trading at consensus forward PER of 12x and looks cheap when compared against international competitors such as Flextronics, Jabil, Plexus etc, trading at average forward 2019 PER multiples of 23.6x, according to CIMB.

With generally positive sentiments (from the street) and cheap valuation vs. peers, why did Venture’s share price declined by 4% last Friday when PM announced positive 3Q19 results?

Why did Venture’s share price declined by 4% last Friday?

This could be due to PM’s 3Q19 transcript comments pertaining to IQOS device sales.

“…We now expect the full year contribution of IQOS devices to total RRP net revenues to be approximately 15% compared to below 20% previously. This primarily reflects the favorable geographic mix impact of greater HTU volume in relatively high margin geographies, notably markets in the EU region, the longer lifespan of the latest IQOS devices compared to prior versions and the impact of IQOS device retail price changes in select market“.

PM’s 3Q19 transcript comments

Look out for Venture’s earnings on 8 November.

Please engage in your own due diligence when considering the purchase of the counter.

SEE OUR OTHER STOCKS WRITE-UP.

- KEPPEL IS SET TO RELEASE ITS RESULTS TOMORROW. WHAT SHOULD YOU BE EXPECTING?

- 46 STOCKS IN BUFFETT PORTFOLIO

- STRACO: IS IT A GOOD BUY NOW?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.