Passive Method

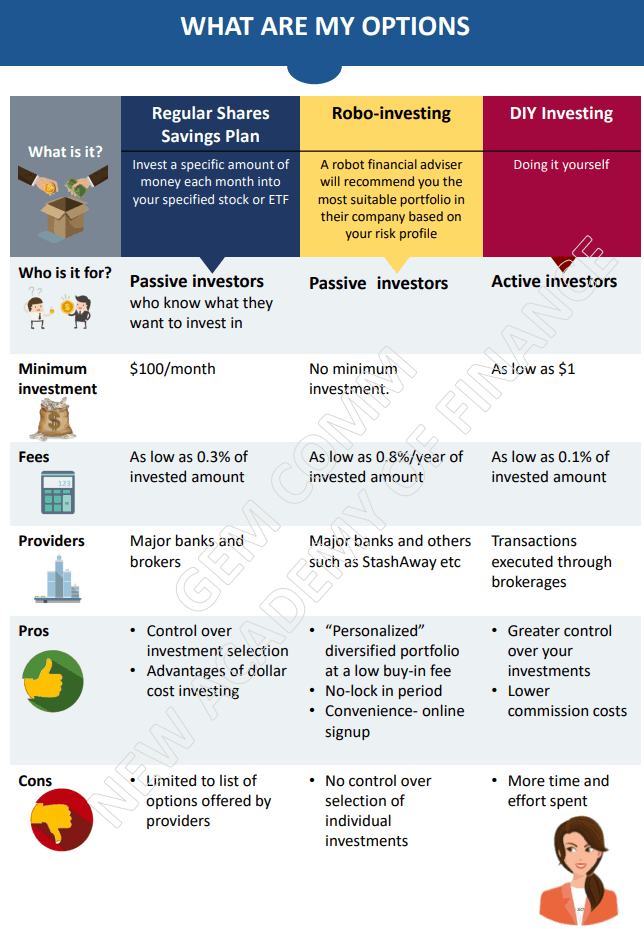

You can engage in passive investing with simple methods such as engaging in a 1) regular savings plan or alternatively 2) investing through a robo advisor.

Regular Savings Plan

Engaging in a regular savings plan or RSP for short is a disciplined and automated approach to start one’s investment journey. In most circumstances, one just need to 1) set up your RSP account such as the DBS/POSB Invest Savers, 2) Select your preferred investment product (equity ETFs, bond ETFs, shares etc), 3) Set up your automated recurring payment, 4) Sit back and enjoy the magic of compounding

RSP offers a way to let young investors start their investing journey at affordable amounts. Typically with less than S$100/month, one can start investing in a RSP with our local banks. This reduces the need for a lump-sum capital, often a luxury for those just starting work.

Another benefit of RSP, which happens like clockwork every single month, is that it avoids “Timing the market“. Instead of trying to “time” the entry of your investment, a RSP automates it by investing at a specific time of each month, paying no regards to the prices of the stock/ETF.

Say for example, an RSP that automates the purchase of Stock ABC every 15th of each month. On 15th Jan, Stock ABC is traded at S$1/share so your S$100 of investment budget entitles you to buy 100 shares. On 15th Feb, Stock ABC is now trading at S$1.10. Your S$100 (same amount each month) now entitles you to buy 90.9 shares.

If on 15th Mar, the price drops to S$0.90/share, you will be able to purchase 111.1 shares. This method of investing is often termed as Dollar Cost Averaging.

Some issues with RSPs

The sales charges associated with RSPs can be relatively costly, particularly if one has a small monthly investment amount, hence it makes sense to be wary of the charges and know which RSP to engage in. Also there are limitations to having a diversified portfolio with international exposure when engaging a RSP method of investing.

You can refer to this article for more information on the above.

Robo-Investing

There are a wide array of robo-advisors currently available for Singaporeans to consider. We have previously written an in-depth article on robo-advisors here in Singapore. Some topics that were touched on include items such as 1) one’s suitability of engaging a robo advisor, 2) the ALL-IN costs associated with using a Robo-advisors, 3) key differences between the various robo-advisors available in Singapore etc.

In a nutshell, investing in a robo-advisor has its Pros and Cons. It is also a simple way of starting one’s investment journey through a diversified portfolio which generally encompass a mixture of global bonds, global equity and sometimes alternative assets such as gold etc.

The ability to re-balance the portfolio on a regular basis is also an area that cannot be replicated at ease using a RSP method or through active investing.

Active Investing

For those interested to engage in active investing, this might entail time and effort to master the trade. From investing in income generating assets such as dividend stocks and REITS to learning about the traits of strong, resilient stock candidates for long-term price appreciation, this requires certain amount of time and effort. But the rewards, if done right are often worth the time.

We will be progressively introducing some basic key financial items/ratios that one should be aware of in identifying good stock candidates that might fit the criteria of a good stock with fantastic long-term appreciation potential.

Conclusion

Be it passive investing or active investing, one should start his/her investing journey ASAP and let the magic of compounding work in his/her favour.

In the following weeks, we will provide more details on how one should go about in engaging a passive/active approach to investing, with more in-depth information on RSPs and robo-advisors. Stay tune!