NIO listing on SGX

NIO is today creating history by being the very first company in the world to be listed on 3 stock exchanges, namely US, HK and SG. The SG listing will happen on 20th May 2022, which will allow Singapore investors an easier avenue to partake in this fast-growing EV play.

The company will have an expected market cap of c.SGD38.6bn, making it one of the largest market cap stock listed on SGX.

Since early 2020, people have been hyping up NIO and it seemed almost certain that the stock would reach its price targets of $80 and above. We’ve seen the stock price run from $2 to over $60. Renowned institutions like JP Morgan and Morgan Stanley all had price forecasts from $75/share and upwards at one point.

The company had also reported impressive quarterly results with each earnings report. Yet, the painful truth is that the stock price of NIO has fallen from its highs of over $60 to well under $20. At the time of writing this article, NIO trades at about $16-17 a share.

Yet, though the current price is a mere fraction of its highs in 2020 and 2021, the company is in a better state than ever – healthy delivery growth, strong revenues, increased free cash flow, and much more!

This begs the question: why is the company trading at such a low price compared to its highs? Was it truly the current inflation situation that has caused the market to correct itself? Was it because of regulatory concerns that exist for Chinese companies? Or was there something fundamentally wrong with the stock’s valuation from the very beginning?

In this article, I will delve deeper into what I feel about NIO stock, where I think it’s headed, and my valuation estimate.

Do note that this is neither a recommendation to BUY or SELL NIO stock but my personal take on the potential of the EV market as well as the attractiveness of NIO as a play on this growing industry. Please do your own due diligence if you consider taking a stake in NIO, particularly since the company will be listed on the SGX exchange on 20th May 2022, making it easier for a Singapore investor to invest into the counter.

The boom of the EV market

We’ve seen a huge move towards electric vehicles in recent years. According to the latest research study, the demand for global Electric Vehicle Market size & share was valued at roughly USD 185 billion in 2021 and is expected to reach USD 980 billion by 2028 at a compound annual growth rate (CAGR) of 24.5% during the forecast period 2022-2028.

With the imminent takeover of electric vehicles, we can expect companies like NIO and Tesla to thrive in a market of increasing demand. In particular, a report by Market Line revealed that the Chinese hybrid and electric cars market grew by 5.1% in 2020, with a value of $22,202.6m. This market is forecast to increase by 343.8% by 2025, reaching a value of $98525.5m. NIO, being a Chinese EV company, looks set to gain big due to the expanding EV industry, especially in China.

Growth potential

NIO is a company with huge growth potential, and it has had an impressive record over the years.

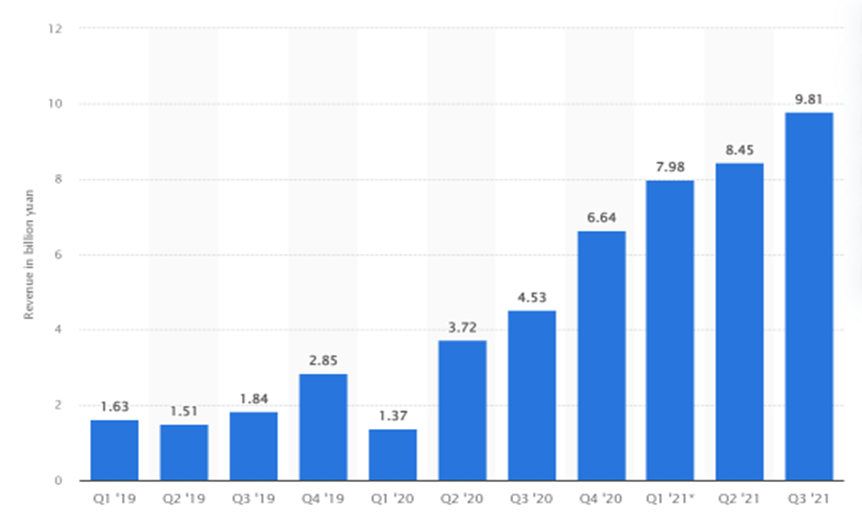

The above chart, obtained from Statista, shows the quarterly revenues of NIO from 2019 to 2021. We can see that it is clearly on a strong upward trend. According to a report on Yahoo Finance, analysts expect to see a huge ramping up of sales by the end of 2024.

To be specific, the company is expected to increase sales by 4 times, from the current CN¥32.8b to CN¥135.9b. In addition, NIO just unveiled the new ET5, and forecasts increased production numbers in late 2022.

One can say that the company, compared to EV giants like Tesla, is still in a relatively earlier stage of its operations. The company itself is not profitable yet, though analysts expect it to be profitable by the end of 2023. This is, however, contingent on the company’s continued upward trend of deliveries and sales and the general expansion of its business.

It helps, though, that the company operates in China, which has one of the largest growing middle classes in the world. We may very well see a good spike in the consumption of NIO’s EV products with increasing affluence paired with the explosive growth of the industry.

Regulatory concerns

It’s no secret that Chinese companies are often under huge scrutiny, both by the SEC and the Chinese government. We’ve seen what happened to DiDi Global, and we’ve heard the delisting warnings concerning Chinese ADRs. This is something that needs to be considered before investing in NIO stock.

Just a few days ago, it was revealed that NIO was added to the list of companies that did not comply with SEC’s auditing requirements, which could mean that the company has taken a step closer to delisting from the US market. It is not certain if the company will be able to completely escape such regulatory concerns one day, and its valuation could be severely affected as investors may move their money out of NIO and into safer investments.

Chip shortage

One consideration that we have to make is the potential semiconductor supply chain issue. Such issues have a direct impact on the company’s production numbers. Just last year, the company announced that its production was severely hit by the global chip shortage and that it had to cut its delivery estimates by a significant margin.

An article by Gartner revealed that using the GIISST (Gartner Index of Inventory Semiconductor Supply Chain Tracking) Index, we could expect to see semiconductor supply chain issues bleeding into late 2022 and even early 2023 before any significant resolution.

Since NIO is heavily reliant on this particular supply chain, we may see a drop in delivery numbers in the quarters to come. Assuming that the supply chain problem is solved in the long run, NIO would have to tough it out for a little longer before it can put such issues to bed.

Fierce competition in China

NIO exists in one of the most competitive industries out there – the Chinese EV industry. While it has proven to be a formidable front runner, its rivals Li Auto and Xpeng have been catching up, and have outshone NIO in terms of earnings and delivery performance for a non-negligible number of quarters.

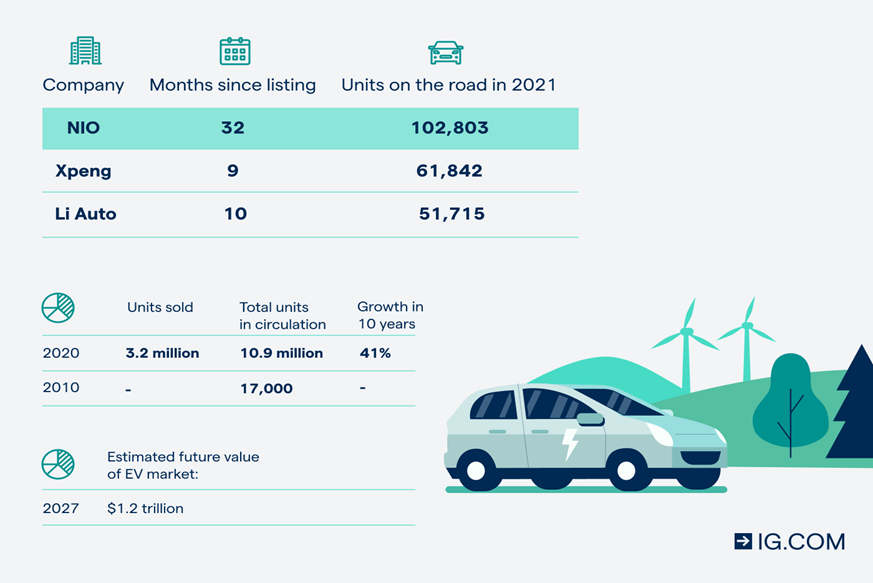

The picture above, taken from IG, shows a brief comparison between NIO, Li Auto, and Xpeng. We can see that while NIO leads the charge, Xpeng and Li Auto are not far behind in terms of the number of units on the road, and they’ve been listed for a significantly shorter time.

We could potentially see either or both of these competitors outpacing NIO’s growth, which would be very detrimental since the increased competition would make it more difficult for NIO to be profitable. Both companies outsold NIO in December last year, and continue to keep the rivalry tight.

Apart from these 2 counterparts, Chinese EV and battery giant BYD also takes a significant share of the pie. BYD sold over 90000 vehicles last December, compared to NIO’s deliveries of slightly above 10000. It is evident that NIO faces extremely strong competition, and it’s not certain whether it will be able to stay in the front seat.

Valuation

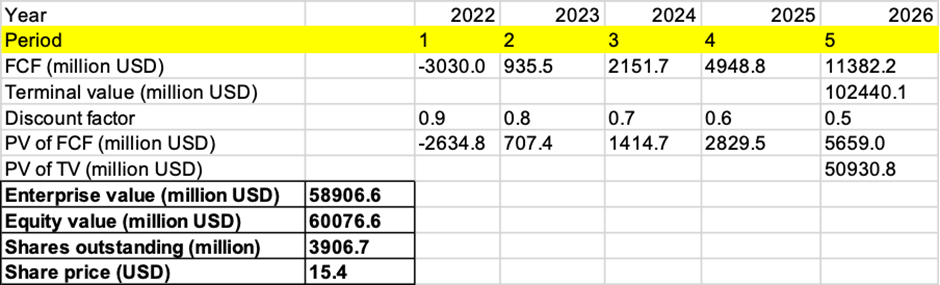

With all these things considered, I will be applying a discounted cash flow model to estimate the intrinsic value of NIO stock. The unlevered free cash flow estimates for the years 2022 and 2023 are taken from Simply Wall Street. I have used a weighted average cost of capital (WACC) of 12%. I also assume a perpetuity growth rate of 3.5%, and an average annual increase in shares outstanding of 20%, since it is likely that they will be issuing more stock for equity financing purposes, and this is consistent with the company’s behavior in the past few years.

Lastly, I assume a yearly 130% growth in unlevered free cash flow, which is the exact increase in unlevered free cash flow between the projected estimates of 2022 and 2023, both of which were taken by Simply Wall Street.

By discounting back to present values, my model has brought me to a price target of $15.40 a share. This is not far from where the company is trading now. However, do note that the assumptions are not a certainty, especially for a relatively small and growing company like NIO, where things could take a huge turn for the better or for worse.

I am decently bullish on the company’s ability to thrive in the electric vehicle market, yet I do think we should exercise caution before investing in the stock. I’ve seen enough people, in real life and online, preaching about how NIO deserves to be trading at $100 at the present moment, and current prices are purely a result of ‘market manipulation’, inflation, and Chinese regulation.

The harsh reality is that the company has also been overvalued for a long period, and the crash in its stock price means that it is finally approaching fair value. I am a buyer of NIO in the low teens and scooped some up when it fell to $12 a share a few days ago.

Note that this is not financial advice, and $12 is not a ‘sure-win price’ by any means. It is simply a bargain based on my valuation and assumptions regarding NIO stock. At the end of the day, investment in NIO stock is definitely on the riskier side of things. Many factors influence the stock, and this explains its heavy volatility over the years. I would say that the company is on a good trajectory, but invest carefully.

Conclusion

NIO’s listing on the SGX is definitely a corporate action that will help “lift the buzz” on our local bourse, allowing investors to partake in a fast-growing company in an exciting niche industry. However, do note that significant price volatility should be expected of the counter and investors should definitely tread with caution. The company remains in a loss-making state and while the street expects the company to turn profitable in the not-too-distant future, all bets might be off if the world plunges into recession.

A key component of car manufacturing, semiconductor products, is woefully under-supplied and this could translate into higher inflationary costs for EV players such as NIO which is highly dependent on semi chips in their “state-of-the-art” new-age EV vehicle.

While the valuation of NIO has indeed declined significantly from its high last year, one should still engage a conservative stance and not “ALL-IN” regardless of how “attractive” one might feel about its current price.

Personally, I have scooped up some shares when it was trading back at US$12/share and I will be engaging a put selling option strategy at the US$12/share strike level to generate some income in the short term, while being prepared to purchase more shares at those price level.

Again, this is by no means a direct recommendation to be apeing into NIO but this is definitely one stock on my “high risk, high reward” radar for further monitoring.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- How to double dividend yield using this simple strategy

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Strong Dividend Growth Stocks Increasing Dividends by up to 19% in 2020

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- A list of “Best” Dividend Growth Stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.