Netflix: Disastrous 1Q22 results?

Once heralded as wall street’s darling, Netflix (NFLX) could do no wrong as it benefited enormously from the pandemic with millions holed up at home streaming Netflix. The market rewarded the company’s huge influx of revenue and subscribers as the stock climbed 140% from the pandemic lows of $300 / share to a high of $700 / share in November 2021.

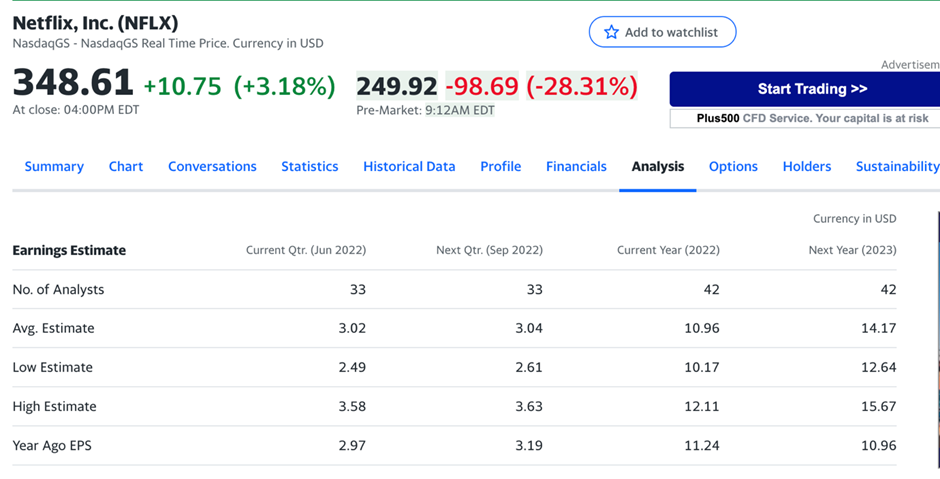

Since then, the stock dropped off a cliff, down ~41% YTD, and was trading at $348 / share just before it announced its Q1 earnings. Since announcing its Q1 earnings, the stock plummeted even further and is roughly down ~25% since announcing its earnings.

Netflix shareholders just cannot catch a break as the stock is now trading at levels last seen in January 2018. This is incredible considering Netflix has added millions of subscribers since and has earned billions in additional revenue while showing healthy profits as of late. Is this the bottom for Netflix? Or is there further downside? In this article, I will take a look at the reasons for this substantial decline in Netflix valuation and review if the stock is at an attractive level right now at roughly ~$250 / share.

1Q22 Earnings:

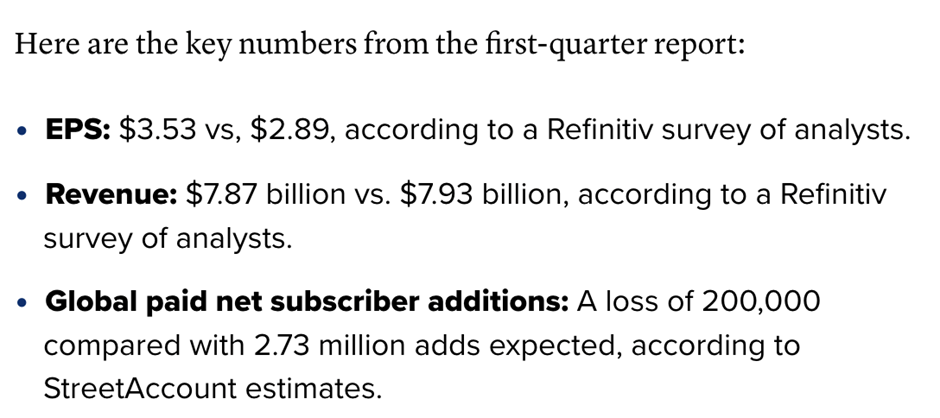

Here’s a snapshot of NFLX’s earnings from CNBC:

At first glimpse, NFLX seemed to have done well with EPS beating expectations by a wide margin of ~22%. Revenue missed slightly by ~1%. The growth of subscribers missing estimates is the true metric that caused such a brutal selloff in the stock. This is notable given that it is the first time Netflix reported a decline in paid users in more than 10 years and is contrary to management’s forecast of adding 2.5 million net subscribers during the first quarter. Management has also forecasted losing another 2 million net subscribers during the second quarter.

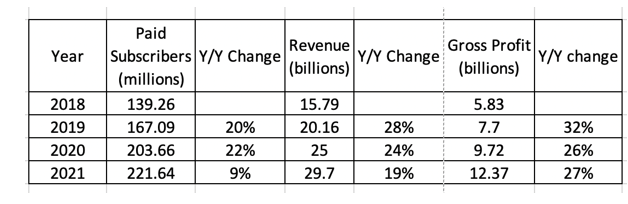

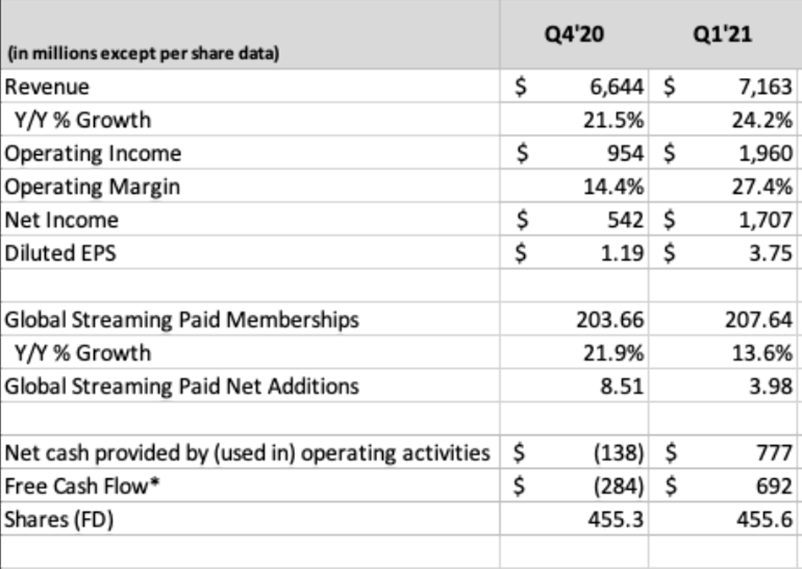

Investors have long valued Netflix as a growth stock whose valuation is contingent on consistently increasing its subscriber base by double digits on an annual basis. As Netflix grows its base of subscribers, it can then raise prices on its different tier accounts. This directly leads to a growth in revenue, gross profit, and cash flows. Hence, investors view Netflix’s loss of subscribers as a sign that the company has potentially reached maturity in terms of growth which would limit its future revenue, profit, and cash flow growth.

Reasons for decline in subscribers:

There are 3 main reasons for Netflix’s loss of subscribers: 1) Pulling out of Russia, 2) Intense Competition, and 3) Inflation / Recession risk.

- Pulling out of Russia:

Netflix’s Q1 loss of subscribers can be partially explained by the company’s suspension of service in Russia due to the Russia / Ukraine war. This led to a loss of ~700,000 subscribers. If you exclude this number due to extenuating circumstances, Netflix would have a gain of 500,000 new subscribers. While this pales in comparison to the Q121 addition of 3.98 million subscribers compared to Q420, it is still a net addition to subscribers.

- Intense Competition:

The more concerning reason for Netflix’s loss of subscribers and what I suspect is one of the main reasons for its Q2 guide of another loss of 2 million subscribers is due to intensified competition. In the past 2 years, there have been many streaming services launched by various entertainment and technology companies. Here are a few streaming services that compete for our eyeballs with Netflix: Disney+, HBO Max, Apple TV+, Amazon Prime Video, Peacock, etc.

As multiple streaming services have surfaced, multiple intellectual properties that used to be available on Netflix have been pulled from Netflix and made exclusive only on the streaming service of the company that owns the IP rights (think: MCU movies and TV shows only available on Disney+ now vs when they were available on Netflix before Disney+ launch).

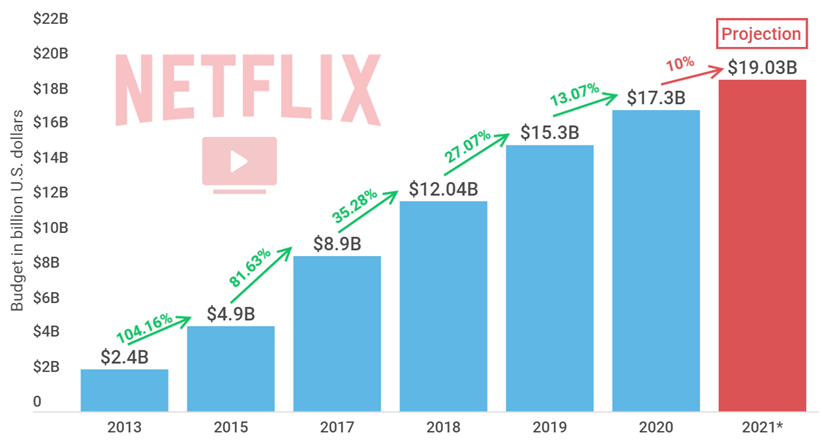

This has caused Netflix to shell out a fortune to create more original content (movies and tv shows) to get their subscribers to continue renewing their subscriptions as well as to entice new subscribers. Netflix’s content spend is slated to increase in the years to come to stave off fierce competition from its rivals. This has a direct negative impact on Netflix’s bottom line of profits and cash flows.

To their credit, Netflix has managed to create some phenomenal content such as Stranger Things and Squid Game. However, while it is easy to get new subscribers to sign up to watch the new “in show”, it is harder to get a user to continue subscribing after one has finished watching the latest hot show.

- Inflation / Recession risk:

As you may now be undoubtedly familiar with, inflation has been causing a pinch in our wallets as necessities such as food and energy have been skyrocketing. This has caused consumers to pull back on some non-discretionary spending to save money for necessities. A new study was done recently which revealed that the number of UK households that canceled their subscriptions to streaming services in Q122 has increased significantly compared to years past. The study also noted that the younger generation (Gen Z) was particularly hard hit by the increase in cost-of-living. I expect this trend to pick up in other countries as inflation persists stubbornly.

Contrary to popular belief, I do not think that Netflix is a recession-proof stock. It is a consumer discretionary company that would see a decline in consumers when a recession hits. Think of it like Starbucks. When we do get a severe and lasting recession that results in many layoffs and/or a reduction in salaries, people would more willing to forgo an $8+ gourmet coffee to fund their purchase of necessities such as food and toiletries.

Ditto for Netflix, people would reduce their spending on entertainment options to save money for essentials. And I think the chances of a recession are heightened due to high commodity prices and financial tightening by The Fed. As we edge towards a recession, more consumers would unsubscribe from Netflix.

Current Valuation for Netflix:

For $230 / share, Netflix is roughly valued at a P/E of 16.2 on estimated earnings per share of $14.17 / share in 2023. However, given their recent Q1 earnings and a poor guide for Q2, their estimated earnings would probably be revised down significantly in the next few days. Hence, this valuation might be too high at the moment given management’s guidance of tough upcoming quarters due to inflation and intensified competition.

I think as Netflix’s growth in subscribers slows, a more appropriate valuation method would be to appraise the company against its expected future growth in revenue, profits, and cash flow. I think it is possible that in the upcoming years, investors would start valuing Netflix against more traditional financial metrics such as P/E or P / FCF. Even if Netflix does not grow its subscriber base aggressively, Netflix could grow its valuation by maintaining its current base of subscribers while introducing more methods to monetize its subscriber base.

A few monetization methods Netflix could undertake to increase their revenue, profit, and cash flow are the following: 1) Increase pricing for their tier accounts, 2) Introduce advertisements for lower-tier accounts, and 3) Introduce merchandizing for their exclusive content. Let me elucidate these suggestions:

- Increase pricing for their tier accounts:

This is a very simple way to increase the revenue it would generate from its subscribers and it is what the company has been doing over the years to increase its revenue and profits. However, caution must be taken to ensure that Netflix’s pricing of its accounts is competitive compared to its rivals to prevent further loss of subscribers.

- Introduce advertisements for lower-tier accounts:

Based on Reed Hastings’ (CEO and Co-founder of Netflix) comments during the earnings conference call, Netflix would look to explore the option of introducing advertisements in their lower-tier accounts. This would go against the ethos of Netflix being a platform to consume content without advertisements. However, it would generate lots of additional revenue as advertisers would look to utilize one of the world’s most popular platforms for entertainment to reach more potential consumers.

- Introduce merchandise for their exclusive content:

Netflix could introduce an additional monetization stream in which they contract a manufacturer to create different merchandise based on their popular content. This would be taking a page out of Disney’s playbook and an example would be that Netflix could introduce official Squid game clothes and figurines. This would be similar to what Disney does for its intellectual property.

What I would do regarding Netflix stock:

I am not interested in owning Netflix as there is heavy competition within the streaming industry against giants such as Disney, HBO Max, and Peacock. While there might be multiple winners within the space, all of these streaming services would burn billions to create more engaging content to attract more subscribers. While this might be beneficial to consumers as we will get more high-quality content, it does not bode well for these companies’ bottom line especially if the increase in content spent outpaces revenue growth. In this space, I am more interested in Disney.

As highlighted above, Netflix has been increasing its gross profits over the years as the company starts to focus more on monetization. If Netflix continues to grow its profits and cashflows reliably while the stock continues selling off, I might be interested in starting a position but not at these levels. It might be worth nibbling a position at the $200 level.

Conclusion:

Netflix has been one of the best investments in the last 20 years. But, every great company in history goes through a period of difficulty in which the future seems murky regarding the company’s ability to stay great. Microsoft had it, Apple had it. Now it is Netflix’s turn. It remains to be seen if Netflix can reinvent itself and find a new avenue of growth. I remain content being on the sidelines while monitoring for any sign of improvement in terms of monetization and/or growth of subscribers.

I will say this, Reed Hastings has been responsible for Netflix’s phenomenal growth over the past 20 years. He has been an excellent CEO and you could do a lot worse than to bet on him.

As always, this article represents my personal opinion on Netflix. Do always conduct your due diligence before deciding to trade Netflix. If you enjoy my writings and would like to participate in a financial community of like-minded individuals discussing personal finance and investing, you can join my discord at: https://discord.gg/Vhmjky4XEe

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats