A quick introduction

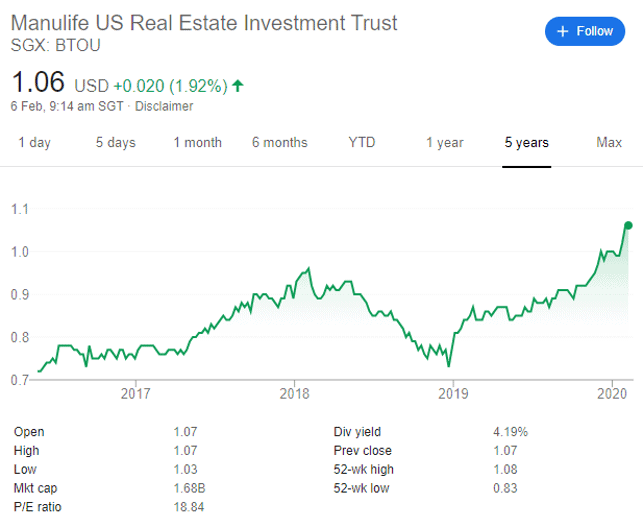

Manulife US REIT has seen strong appreciation in its share price post the counter inclusion in the FTSE EPRA Nareit Index on 23 December 2019. Likely due to institutional funds “front-running” the inclusion (perfectly legal way), the counter appreciated c.10% from 1 October 2019 to the date of inclusion and continued rallying to its recent high of $1.08.

Manulife US REIT closed at $1.04, post its 4Q19 results which I view as a decent set of results. I was fortunate to be able to attend a post-results briefing by the company and seek to pen some of my thoughts in this article.

This is not meant to be a long article but a summary of my thoughts on the company in general and with regard to their 4Q19 results. I believe there have been many previous write-ups on Manulife US REIT by the likes of Kyith from Investmentmoats and Ging Wien from Probutterfly so I will not look to replicate their good work.

Manulife US REIT is unique from the Singaporean perspective as it is one of a handful of US-based REITs listed on SGX, the very first in fact, back in 2016. Keppel KBS US REIT (now known as Keppel Pacific Oak US REIT) followed a year later. Last year saw three new US property trusts (ARA US Hospitality Trust, Eagle Hospitality Trust, and Prime US REIT) listed on the SGX, bringing with them exposure to the biggest real estate market in the world.

Despite its share price currently near all-time listing high, it has not been always smooth sailing for Manulife US REIT which IPOed at US$0.83 back in May 2019 and saw its share price collapsing by c.5% on the stock’s debut. It has been a roller coaster ride since then, with its shares appreciating to a high of US$0.96 at the start of 2018 before dropping all the way back to the low-$0.70s by the end of the year due to US interest rate hike concerns.

However, since end-2018, the trend has been predominantly one-directional, UP, as the Fed embarks on a series of interest rate cuts, with the counter also enjoying the tailwind of the FTSE EPRA Nareit index inclusion in late-2019. Can the uptrend continue in 2020? Let’s gather some clues from its latest 4Q19 results.

A decent but not robust set of 4Q19

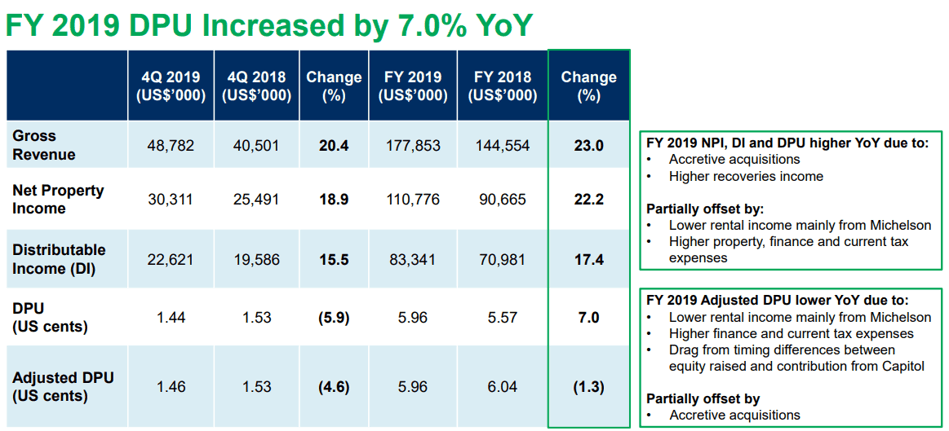

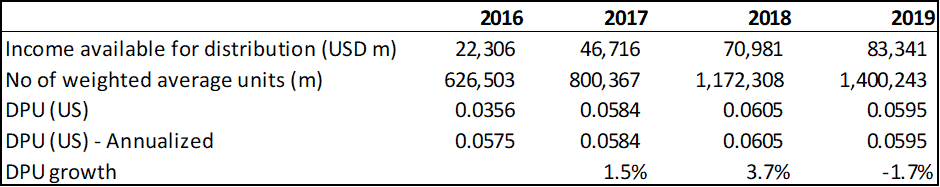

The table below provides a quick summary of Manulife US REIT 4Q19 results.

While 4Q19 net property income grew strongly YoY (up 19%) due to contribution from Centerpointe and Capitol that were acquired in 2019, adjusted distribution per unit (DPU) declined by 4.6% YoY to US1.46 cents for the quarter. That dragged down full-year 2019 adjusted DPU, which declined by 1.3% YoY to US5.96 cents vs. US6.04 cents in full-year 2018.

The key detractors for the weaker YoY performance were due to 1) lower rental income from Michelson, 2) higher finance costs and 3) higher tax expenses. Let’s briefly touch on the three items, starting with the Michelson property

Michelson Property

The Michelson property is Manulife US REIT “trophy” asset, meaning the best of the Class A properties. The asset has enjoyed rising rental way beyond the market appreciation rate. For US REITs, they tend to have rental escalation clauses for the leases (due to them being longer-term in nature vs. S-REITs) which might not be the case for S-REITs.

In the case of the Michelson property, it has been enjoying annual rental reversion of c.3% for contracts stretching out to 10-years in some cases. Its current Weighted Average Lease Expiry (WALE) is 6.1 years. The rate of rental escalation has been much faster than the actual market rental appreciation rate. When these leases finally expire, they will tend to be negotiated back down closer to the market rate.

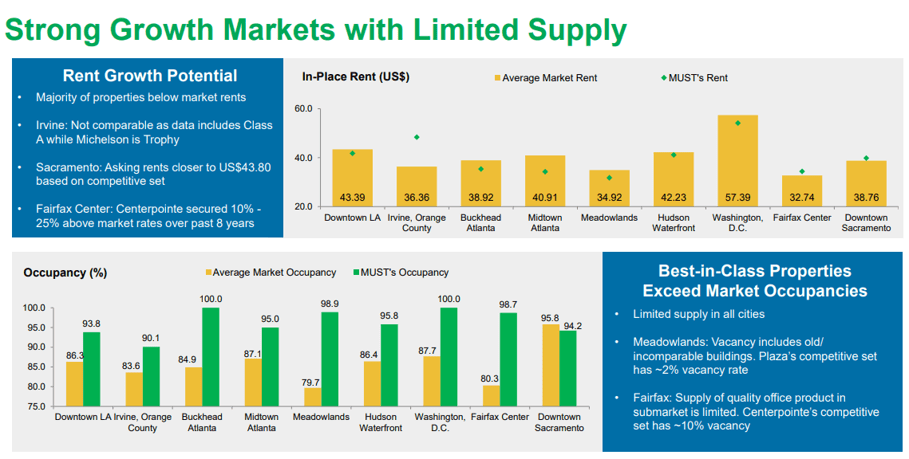

Given that Michelson’s rental rates (Irvine, Orange County) are approx. 20% higher than the ongoing Class A rental rates as seen from the diagram below, there will likely be negative rental revision impact as leases expire. Management highlighted that rental reversion was a strong +12.1% for the whole of 2019 excluding Michelson, but when we include the Michelson property, that figure dropped to +0.5% which meant that the Michelson property alone had a -11.6% impact on 2019 rental reversion rate.

The occupancy of the Michelson property also declined from 96% in 3Q19 to 90.1% in 4Q19 although management is very hopeful of securing new tenants in the coming months and bringing the occupancy rate back up.

Consequently, due to negative rental reversion and lower occupancy rate, the NPI of Michelson declined by 16% in 4Q19. Management, however, highlighted that the bulk of the lease expiries for this property are done and dusted in 2019.

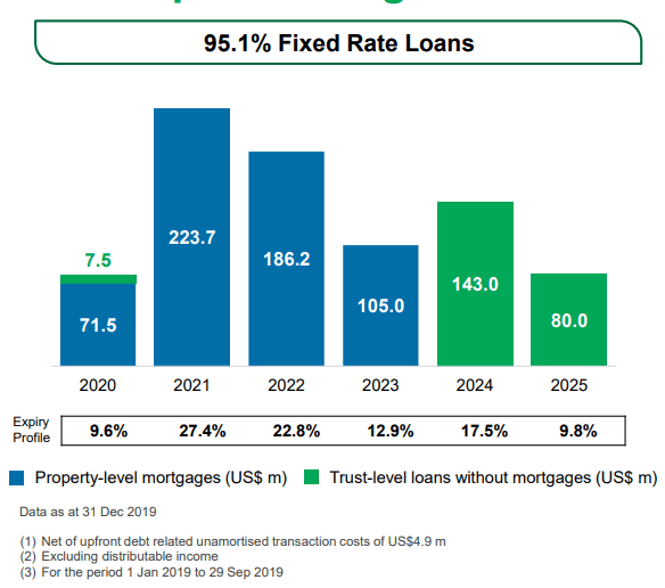

Higher interest cost

Finance expenses increased by 24% YoY in 4Q19 to US$6.8m vs. US$5.6m in 4Q18. On a full-year basis, finance expenses amounted to US$26.2m in 2019 vs. US$19.2m in 2018. The higher interest expenses were in-line with a higher level of borrowings, with total secured loans and borrowings of US$812m as of end-4Q19 vs. US$667m as of end-4Q18.

If we were to do a simple back of the envelope calculation, the US$19.2m interest expense translates to an effective interest cost of 2.88% (19.2/667) for 2018 while the US$26.2m interest expense translates to an effective interest cost of 3.23% (26.2/812) for 2019.

The effective interest cost for 2019 is likely higher than 3.23% given that the higher borrowings (for acquisition purposes) were not drawn down right at the start of 2019.

The higher interest cost in 2019 vs. 2018 illustrates that the REIT has yet to benefit from the decline in interest rate trends in 2019. However, moving forward, management does expect rates to be lower.

For example, in 2020, a total of US$79m of loans are coming due, with the bulk associated with the Peachtree property. These loans were previously secured in the region of 2.5% 3 years ago and if not for the recent decline in interest rate trends, re-financing would likely translate to interest cost beyond 3%. However, management is now confident of securing re-finance loans at a rate below 3%.

Higher tax expenses

The REIT incurred higher tax expenses of US$5m in 4Q19 vs. US$4.76m in 4Q18 despite registering lower net income of US$22.9m in 4Q19 vs. US$25.3m in 4Q18. This is largely the result of higher net fair value change in investment properties of US$16.9m incurred for the whole of 2018 which is counted as a deferred tax expense partially accounted for in 4Q19.

It is interesting to note that 2019 actually saw US$13.5m in net fair value losses of the properties. This was due to capital expenditures and leasing costs exceeding the incremental appreciation in appraised fair values.

It will be a concern to me if the REIT regularly engages in refurbishment and AEI works on their properties but not benefitting from the corresponding improvement in the fair value of those properties. This might however just be due to timing effect. This loss has also no impact on the distributable income to Unitholders.

Income available for distribution to Unitholders

The income available for distribution to unitholders increased by 15.5% YoY to US$22.6m in 4Q19 vs. US$19.6m in 4Q18.

This is slightly weaker than the rise in net property income of 18.9% YoY.

Overall distribution income to unitholders has been buffered by the manager’s base fee and performance fee which were payable in units.

On a DPU basis, the upcoming DPU payment is expected to be 1.45 US cents. With 1.57bn shares outstanding, this translates to a total payment of US$22.8m which is at 100% of distributable income.

On a full-year basis, DPU is at 5.96 US cents in 2019 vs. 5.57 US cents in 2018, a 7% increment. However, on an adjusted basis taking into account private placements and preferential offerings done in 2019 which increased the Unit base, there is a decline of 1.7% from 6.05 US cents to 5.95 US cents, on our calculation.

Outlook

Manulife US REIT’s 2019 DPU has been negatively impacted by the decline in Michelson’s NPI as well as higher finance cost, to a smaller extent due to higher tax expenses, partially offset by new acquisitions.

We believe that the prospect for stable organic NPI growth is decent due to the rental escalation clause build in for most of its leases, taking into account that for the bulk of their properties, Manulife US REIT’s rental rate is still lower than the market rate. We also took into consideration the fact that the rise in finance expense cost in 2020 will likely not be as significant as in 2019, with the management likely to achieve good re-financing terms for its Peachtree property at interest costs lower than 3%.

Last but not least, with the rise in its share price and consequently reduction in its cap rates, Manulife US REIT will have greater opportunities for more value-accretive acquisitions ahead.

My personal sense is that adjusted DPU growth in 2020 might exceed 3%, riding on the back of organic NPI growth (exclude any impact of acquisitions) coming from Centerpointe and Capitol and a slowdown in interest expense growth. Negative NPI growth from Michelson might also taper assuming that there are no major re-contracts in 2020.

Conclusion

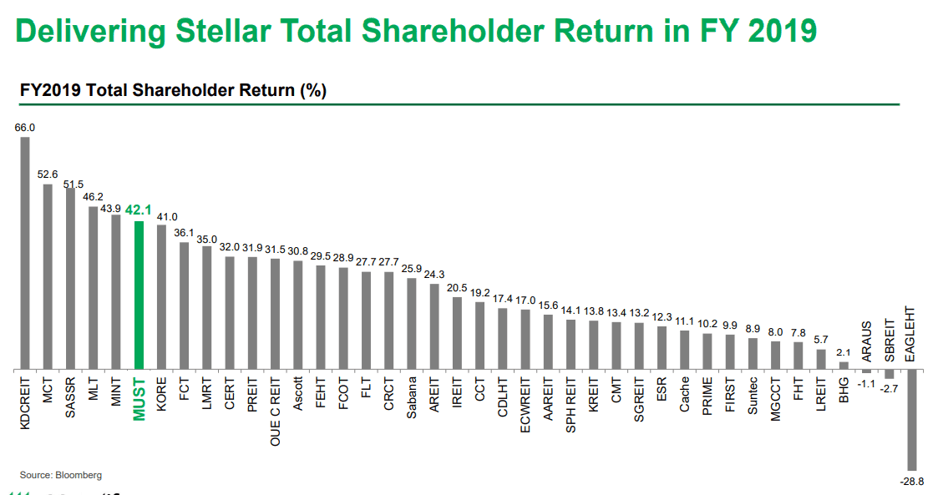

I believe management has delivered in terms of achieving its targeted AUM size, now in excess of US$2bn. Consequently, with a larger AUM base, the REIT has been included in the FTSE EPRA Nareit index with greater trading liquidity and interest from institutional investors. That translated to higher share price performance, with unitholders rewarded by a 42.1% total shareholder return in 2019.

However, Manulife US REIT has not demonstrated that its recent acquisitions (after accounting for share dilution) made over the last 3 years are any better compared to organic growth, which should generate a steady 2-3% DPU growth due to rental escalation clauses in place.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

- THE CONFUSING MATH BEHIND RETIREMENT SUM SCHEME AKA CPF LIFE PREDECESSOR

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.