Keppel and Sembcorp Marine signed a definitive agreement for merger

Keppel and Sembcorp Marine announced this morning that they have entered into a definitive agreement for the proposed combination of Keppel O&M and Sembcorp Marine to create a new entity that will be focused on offshore renewables, new energy and cleaner O&M solutions.

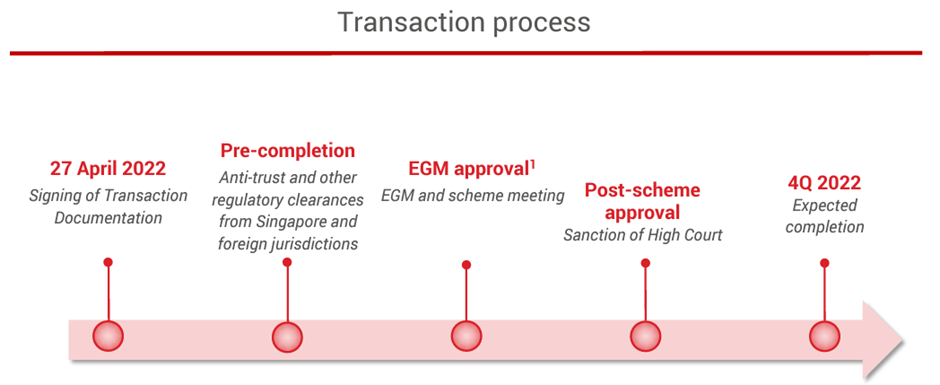

This merger is subject to various regulatory approvals and is expected to be put to respective shareholders for approval in 4Q22.

How will the new entity look like?

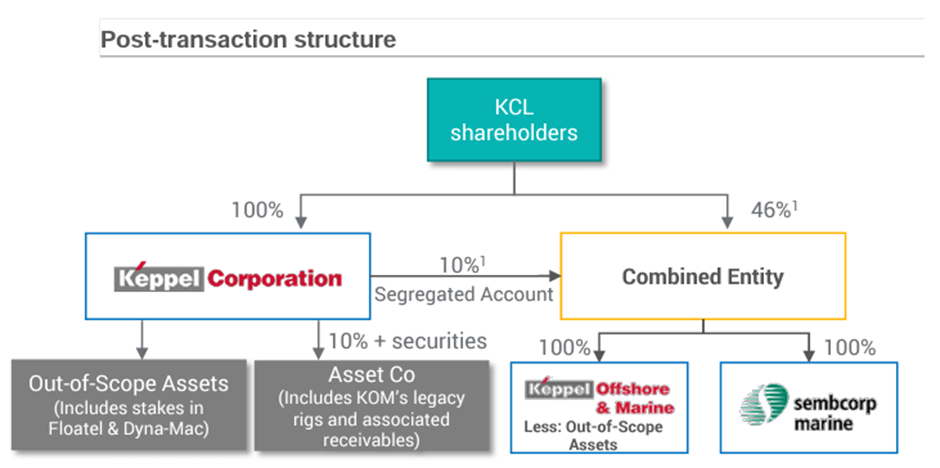

From Keppel’s perspective, the diagram below, taken from Keppel’s presentation, will be how the post-transaction corporate structure be like

.

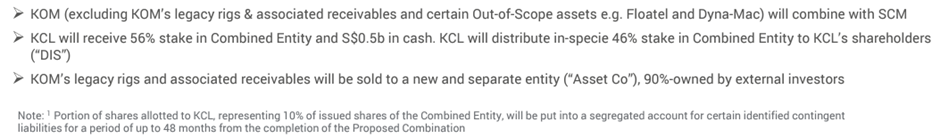

To summarise, Keppel Corp’s shareholders will now own 56% of the combined Oil & Gas focused entity while the remaining 44% will belong to Sembcorp Marine’s shareholders (where there will be a 1-1 share swap). 46% of the 56% stake (in the combined entity) will be distributed to Keppel’s shareholders while 10% will be kept in a segregated account.

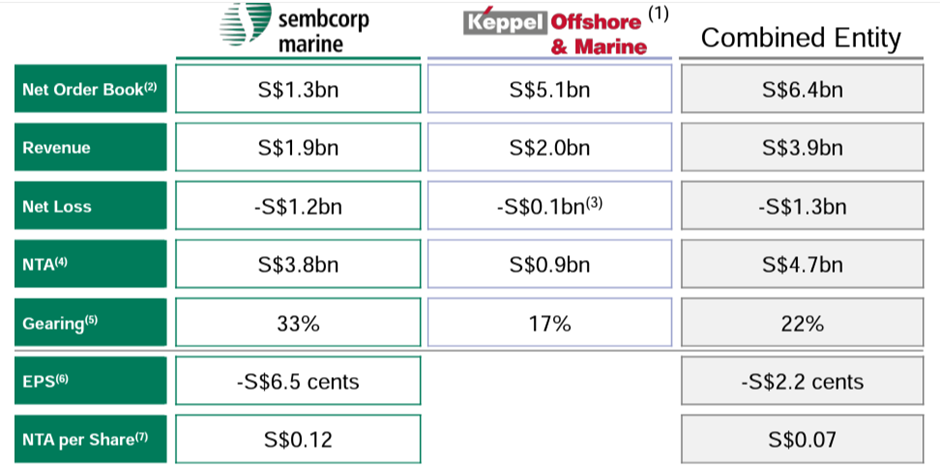

This 56% of the combined entity is estimated by Keppel to be worth S$4.87bn. This means that Sembcorp Marine’s 44% stake has an estimated worth of S$3.8bn which is equivalent to its Net Tangible Asset Value. The valuation of both Keppel and Sembcorp’s stake in the combined entity was derived based on the 10-Trading Day VWAP of S$0.122 price of Sembcorp Marine.

The combined entity will thus have a value of approx. S$8.7bn.

On the surface, it seems like Keppel’s shareholders have gotten a good deal based on the value of S$4.87bn vs. its NTA of S$0.9bn. However, it is likely that other considerations such as its lower gearing, higher net order book, etc are also being taken into consideration.

Does Keppel seem to have a better deal?

This is just my own personal opinion based on first impression, but assuming that Keppel is correct in terms of its valuation, this proposed combination will allow the company to realize S$9.42bn in value over time, comprising:

- S$4.05bn as AssetCo consideration (more on this later)

- S$4.87bn as the value of its 56% stake in the combined entity

- S$500m cash consideration to be paid to Keppel by Keppel O&M

Assuming that this S$9.42bn in total value to be realized over time is correct, then it encompasses approx. 77% of its current market cap, which means that Keppel’s current core Property and Infrastructure business is only worth S$2.78bn, which seems like a major steal?

Of course, the bulk of this S$9.42bn is not cash to be received immediately (only S$500m is). In fact, the S$4.05bn worth of legacy assets and receivables to be sold to AssetCo might not be worth its weight.

AssetCo

This is an entity that will be set up to host Keppel O&M’s legacy assets and their associated receivables, which will be 90% owned by external investors, with Keppel Corp owning the remaining 10%.

Keppel is not paid 90% worth of the valued S$4.05bn in cash but is instead issued $120m worth of perpetual securities and S$3.9bn vendor notes. These notes and perpetual securities will likely be redeemed when these legacy assets are being sold over the next 3-5 years.

The completion of these legacy assets (for them to be sold in the future) will now be the duty of the 90% of external shareholders who will provide the necessary funding for completing these assets. Keppel will no longer be needed to fund the construction of these assets.

How will their share price react?

If I am to render a guess, I believe that when their prices are unhalt, Sembcorp Marine’s price action will be more muted or negative perhaps, given that the value of the combined entity is based on a lower price S$0.122/share vs. current share price level of S$0.13.

The “benefits” associated with the combination is still pretty much “cloudy” despite the fact that the Oil & Gas market is improving due to the current oil price level. However, there remain plenty of uncertainties ahead which include an oversupplied offshore rig market and potential labor shortage.

For Keppel Corp, as mentioned, on the surface, the value accrued to its O&M business at S$9.42bn looks big vs. its current share price, which implies that its remaining business is substantially undervalued.

This is of course, only if Keppel can indeed realize the bulk of the S$9.42bn in accrued value over time, particularly the sale of its legacy assets in AssetCo.

I believe that there will be a knee-jerk reaction, with Keppel’s share price being bumped up by the market when it is unhalted. As I am no longer an analyst, it is thus not appropriate for me to slap a “fair value” but one can easily look at the sum of the parts given by the street to value Keppel’s various divisions to come out with their own conclusion as to how much the company is now worth.

Conclusion

This is just my “quick and dirty view on the Keppel-Sembcorp Marine merger which has been ongoing for a while now. I have written about the merger in the past, with my view that this merger is long overdue.

The completion of this merger will be beneficial for Keppel’s shareholders in my view, given its ability to monetize these assets which have been stuck on its balance sheet for a long time, and the company not willing to put in additional funding to complete legacy assets (which also means there is limited resale value for these rig assets in an oversupplied market)

For Sembcorp Marine, rather than compete with Keppel O&M for jobs, the enlarged entity, with the implicit backing of Temasek (being now its largest shareholder) will be able to compete more effectively for jobs, if and when they become available again.

However, the outlook of the offshore rig building market remains cloudy, at best, and it is necessary for the new combined entity to pivot into other industries where demand is stronger.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Discord channel for an active discussion on all things finance!

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Top websites and apps for free financial news

- How to double dividend yield using this simple strategy

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Strong Dividend Growth Stocks Increasing Dividends by up to 19% in 2020

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- A list of “Best” Dividend Growth Stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.