Wilmar’s “other businesses” valued at just 3.7x PER?

This post looks to provide a quick “evaluation” on the big question: Is Wilmar substantially undervalued despite being one of the strongest STI component stock in 2020?

I have written about Wilmar previously in this post, Wilmar China IPO: Listing Imminent? For those who are unaware, Wilmar is looking to list a small portion (10%) of its China subsidiary, Yihai Kerry Arawana (YKA), the largest supplier of cooking oil in China under its “Arawana” brand.

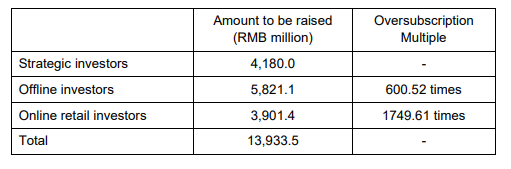

The listing of YKA is currently in its last leg, with Wilmar highlighting that the listing is expected to happen in mid-October. The listing of YKA is expected to raise the largest sum of money (CNY13.9bn) among the first group of 32 firms that have been accepted to go public on the ChiNext since the board started its registration-based system pilot. In total, the 32 firms are looking to raise a combined (CNY31.2bn).

Raising CNY13.9bn (10% stake) will mean that YKA is worth a combined CNY139bn which equates to approx SGD28bn. Wilmar’s 90% stake will amount to SGD$25.2bn. Wilmar’s current market cap is at SGD$28.2bn which means that the market is essentially valuing its “other businesses” at a total value of SGD$3bn.

According to CIMB, these “other businesses” generated a net profit of SGD$812m in 2019, which means that the company is essentially valuing its other businesses at an ultra-discounted trailing PER of just 3.7x. Is this a fair value to be accruing to its “peripheral” businesses?

Of course, the counter-argument can be that the listing of YKA at a trailing PER of 31x based on normalized 2019 earnings is substantially overvalued. However, Wilmar did highlight that peers trading on the exchange are being valued at 41x PER, a 30% premium relative to its IPO valuation.

Should YKA, being the market leader in its field, command a valuation premium rather than a hefty discount?

Strong demand for YKA’s shares

In addition, the company just highlighted that the demand for its IPO has been EXTREMELY well-received, with offline investor’s over-subscription at 600x and online retail investors’ over-subscription at a mind-blowing 1,750x.

To be fair, IPOs listed on China exchanges tend to command over-subscriptions of hundreds of times. This is due to the authorities putting certain restrictions in place to ensure that these IPOs are not over-valued from the onset which tend to generate big gains on the first day of trading.

The main reason for their early gains (on average 44% higher historically) is that nearly all such shares are floated at a price of no more than 23 times earnings, under guidelines designed to make sure every deal is successful. Although the price cap is not official, it is an unwritten rule well known to stockbrokers and issuers, and eagerly enforced by regulators.

However, on the STAR market in which YKA is to be listed, the regulator has completely waived the unwritten rule of IPOs being sold at a maximum of 23 times earnings and imposes no limits on how much new shares can rise or fall in the first five trading days. Unprofitable companies are allowed to list on the board and a more market-based registration system has been implemented for vetting applications.

YKA’s listing valuation of 31x might seem “excessive” based on the previous valuation cap of 23x. However, as previously highlighted by management, peers’ are currently trading at 41x PER, notwithstanding the fact that YKA is the market leader in its field. Add to the fact that the offline investors’ over-subscription is 600x and I would say that it is a fair statement to say that YKA could potentially “pop” 30% on its debut to trade “in-line” with peers’ valuation.

At the very least, I would expect YKA to end its trading debut 10% higher. That will imply a valuation of CNY138bn (SGD$28bn) for Wilmar’s 90% stake in YKA. This will then mean that Wilmar’s “other businesses” are valued at almost ZERO valuation based on today’s price.

Record listing for recent “household” name

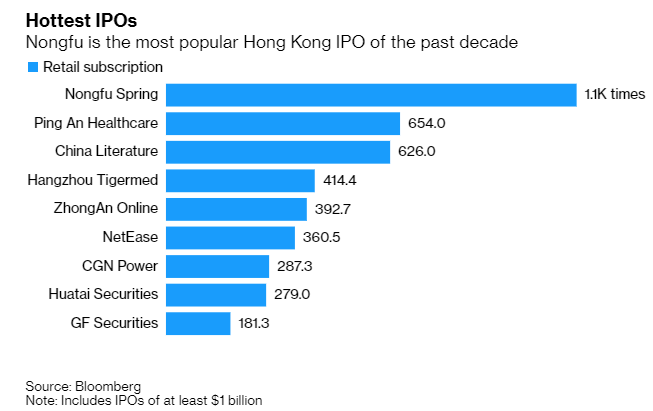

Nongfu Spring, another household name in China, recently raised more than USD$1bn from its HK IPO, with its IPO being over-subscribed by more than 1,000 times. The company’s IPO was priced at HK21.50 and soar as much as 85% to HK39.80 before ending at HK33.10, 54% higher than its IPO price.

Zhong Shan Shan, the founder of Nongfu Spring, temporarily leapfrogged Jack Ma to become the richest man in China with a net fortune of close to USD$59bn (when its price was close to HK40/share), according to the Bloomberg Billionaires Index.

The company is the most popular Hong Kong IPO of the past decade with an over-subscription of 1,100x. Ping An Healthcare and China Literature both were oversubscribed by more than 600x when it was listed. While Ping An Healthcare ended its first day flat (no guarantee that a hot subscription equates to a strong trading debut), China Literature saw its share price doubling on its trading debut. However, note that Ping An Healthcare was loss-making when it IPOed (and still is now) while YKA is strongly profitable.

While the strong oversubscription of YKA’s share gives “hope” that there will be strong demand for its shares on the first day of trading, there is also no guarantee that YKA will end the day substantially “in the green”. However, in the event that YKA does appreciate by 10%, then Wilmar’s “peripheral” businesses are essential “FOC”.

Conclusion: Is Wilmar substantially undervalued?

This is a quick article that looks to highlight the potential undervaluation of Wilmar based on YKA’s potential listing. One can however counter-argue that the whole China market might be “over-valued” and hence YKA’s valuation of 31x PER is actually “not cheap”.

My sense is that the SG market is just not “appreciative” of the fact that YKA’s Arawana is indeed a household brand, whose product is a quintessential item in the kitchen of all homes in China, with a 40% market share. Add to that the fact that Wilmar is one of the largest integrated palm oil player in the market with a diversified business model, one which is not highly dependent on palm oil (CPO) prices, and that in itself should warrant a substantial premium vs. the current 16x PER which the company is trading at.

Again, a counter-argument can be the fact that its valuation multiple of 16x is above its 5-year average of 14x forward PER. However, that was without the clarity from the monetization of YKA which is now an event that is highly probable to materialize in the current context.

With that in mind, I believe that Wilmar is indeed one of the few remaining SG blue-chip companies that are actually “undervalued” despite being one of the strongest performers on the STI Index YTD.

Post listing, the next catalyst could be the announcement of the special dividend (from the listing) to reward existing Wilmar’s shareholders for “patiently” waiting for this listing, which is an event way overdue.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- HYPHENS PHARMA: IS THIS PHARMA COMPANY UNDERVALUED?

- SEMBCORP INDUSTRIES: WHAT MIGHT BE ITS FAIR VALUE?

- SEMBCORP INDUSTRIES AND MARINE DEMERGER: WHAT YOU NEED TO KNOW AND WHAT TO DO

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 2]

- TOP 10 SINGAPORE GROWTH STOCKS FOR 2020 [PART 1]

- A LIST OF “BEST” DIVIDEND GROWTH STOCKS

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.