Table of Contents

Investing using SRS account: 10 investments you can make

Do you know that you can get in excess of 20% in “risk-free return” from tax savings just by contributing to your SRS account?

Yes, I know it sounds unbelievable. Before I explain that in a bit, let me highlight what the SRS account is all about. I will also sum up the article with my recommendations at the end.

What is SRS?

Started in 2001, the SRS, which stands for Supplementary Retirement Scheme, is a voluntary initiative whose key purpose is to help citizens, permanent residents (PR) and foreigners build up their retirement nest egg with the added tax incentive.

Contribution to the SRS account will receive a dollar-for-dollar tax relief of up to $15,300 for citizens and PRs and $35,700 for foreigners.

This means that if your taxable income is $55,300 which will result in a total tax payment of $550 (for the first $40,000) plus (7% * 15,300 = $1,071) = $1,621, you can reduce that to just $550 (thus saving $1,071 in taxes to be paid) once you contribute the maximum SRS amount of $15,300, thus bringing your taxable income to $40,000.

| Chargeable Income | Income Tax Rate (%) | Gross Tax Payable (%) |

|---|---|---|

| First $20,000 | 0 | 0 |

| Next $10,000 | 2 | 200 |

| First $30,000 | 0 | 200 |

| Next $10,000 | 3.5 | 350 |

| First $40,000 | 0 | 550 |

| Next $40,000 | 7 | 2,800 |

| First $80,000 | 0 | 3,350 |

| Next $40,000 | 11.5 | 4,600 |

| First $120,000 | 0 | 7,950 |

| Next $40,000 | 15 | 6,000 |

| First $160,000 | 0 | 13,950 |

| Next $40,000 | 18 | 7,200 |

| First $200,000 | 0 | 21,150 |

| Next $40,000 | 19 | 7,600 |

| First $240,000 | 0 | 28,750 |

| Next $40,000 | 19.5 | 6,800 |

| First $280,000 | 0 | 36,550 |

| Next $40,000 | 20 | 8,000 |

| First $320,000 | 0 | 44,550 |

| In excess of $320,000 | 22 |

By contributing $15,300, you immediately reduce your taxes paid by $1,071 in the example above. Your tax savings ROI is (1,071/15,300) = 7%

Now imagine your taxable income is $295,300. By contributing $15,300 to your SRS account, you have reduced your taxes by $15,300 * 20% = $3,060. This is a tax savings ROI of (3,060/15,300) = 20%

Do note however that there is a personal income tax relief cap of $80,000 each year.

I have written pretty extensively on how to go about maximizing your tax benefits and subsequently withdrawing from your SRS account when you hit the age of 62 in both of these articles:

Additional Reading: How you can maximize tax benefits through strategic SRS contribution and withdrawal

Additional Reading: Generating “risk-free” returns using SRS and the art of withdrawal

In this article, I will like to give my 5 cents view of the best methods for investing in your SRS account efficiently. Do note that this is just my personal opinion. Different people will have different investing profiles and risk tolerance.

Some might prefer to be more conservative with your SRS account while others might be more aggressive. So there isn’t a right or wrong answer when it comes to finding the best SRS investment method.

How to open an SRS account

Before you start thinking about investing your SRS monies, you will need to first open an SRS account with any of these 3 banks: DBS, OCBC, or UOB.

While our SRS funds are “parked” with these 3 banks, we do not necessarily need to invest our SRS monies in their financial products and can choose to invest in all available SRS investments with other financial institutions as well such as POEMS, FSMOne, Robo Advisors, etc.

This means that once your SRS account is approved by say, DBS, you can head over to your existing brokerage platform, say FSMOne, and link your SRS Operator (DBS) as well as your SRS Account No. to FSMOne. Thereafter, you will be able to purchase eligible stocks offered by FSMone using your SRS monies.

SRS vs. CPF SA

Most on the street believe that it is critical to invest the money in your SRS account because if left there as cash, it is only generating a paltry return of just 0.05%/annum which is not sufficient to cover the negative impact of inflation, now raging at a 14-year high of 5.5%

If we wish to grow our retirement nest egg through SRS, we will need to invest our SRS account in higher-yielding/returns assets to ensure that we can meet our retirement goals at the end of the day.

Note the difference between voluntarily topping up our CPF Special Account (SA) which is generating a return of 4.0 %/annum for us vs. that of SRS which is only accruing interest of 0.05 %/annum. Both are tax savings solutions but the difference in “cash” return is substantial.

Shouldn’t it then be a no-brainer to contribute to our SA account vs SRS?

For one, while our SA account generates a higher guaranteed return of 4.0 %/annum, once the monies enter your SA, they cannot be taken out until your retirement year at Age 65.

On the other hand, investment into SRS can be withdrawn earlier (which I will advise against early withdrawal if possible) in the event of an emergency but will be subjected to a 5% penalty as well as 100% taxation on withdrawals.

So, if we are withdrawing $120k, for example, before the age of 62, 100% ($120k) will be subjected to tax and that means paying a rather hefty tax amount of $7,950 (excluding 5% penalty) upon withdrawal which will likely have offset a huge chunk of our original tax savings.

Contributing to SRS can also generate a higher tax relief of up to $15,300 vs, $7,000 for voluntary cash top-up of one’s CPF SA account (one can enjoy an additional tax relief of $7,000 if you top up your parents’ Special/Retirement accounts).

Bottom line: People tend to top up their CPF SA account (and possibly their parents’ one as well) to enjoy tax relief. Once their funds are in CPF SA, it doesn’t make theoretical sense in the past (when the interest rate was low) to invest in higher-risk products such as unit trusts, etc since funds in our CPF SA generate a guaranteed return of at least 4%.

On the other hand, it makes more sense to invest in our SRS account, given the low rate of 0.05% annual interest accrues, if parked in cash. Nonetheless, even if one chose not to invest his/her SRS monies “from the get-go”, he/she would still have benefited from the tax savings which generates a high ROI.

Some, like myself, will like to “park” the SRS monies in cash and “time” a better market entry. While I have written extensively about why time in the market is better than timing the market when it comes to investing, I am already actively partaking in the market all the time and these SRS monies act as a cash buffer to capitalize on the opportunities when they present itself.

The next big question: How should we go about investing our SRS funds to generate additional returns?

Investing your SRS account

There are 10 investment assets in which you can invest your SRS account for that additional interest. I will go through each of the 10 in detail in this article.

Investing using SRS account #1: SGX-Listed Stocks

You can invest in stocks listed on the Singapore Exchange with your SRS account. This can be done through your existing brokerage firms rather than through either of the 3 banks administering your SRS account (DBS, OCBC, UOB).

This might be a good way for a seasoned investor who already has a target of stocks in mind which he/she does not mind buying and possibly holding over a longer horizon while benefiting from tax savings at the same time.

There is a wide list of stocks available to be purchased using SRS monies. You can check with your SRS agent bank to confirm if a stock can be purchased using SRS. Small and micro-cap stocks that are highly speculative are probably excluded from this list.

When purchasing stocks using your SRS account, one major headwind is the brokerage commission cost involved.

Going through the standard local brokerage houses, you will probably have to fork out a minimum commission amount of $25 or a fixed rate of approx. 0.28%.

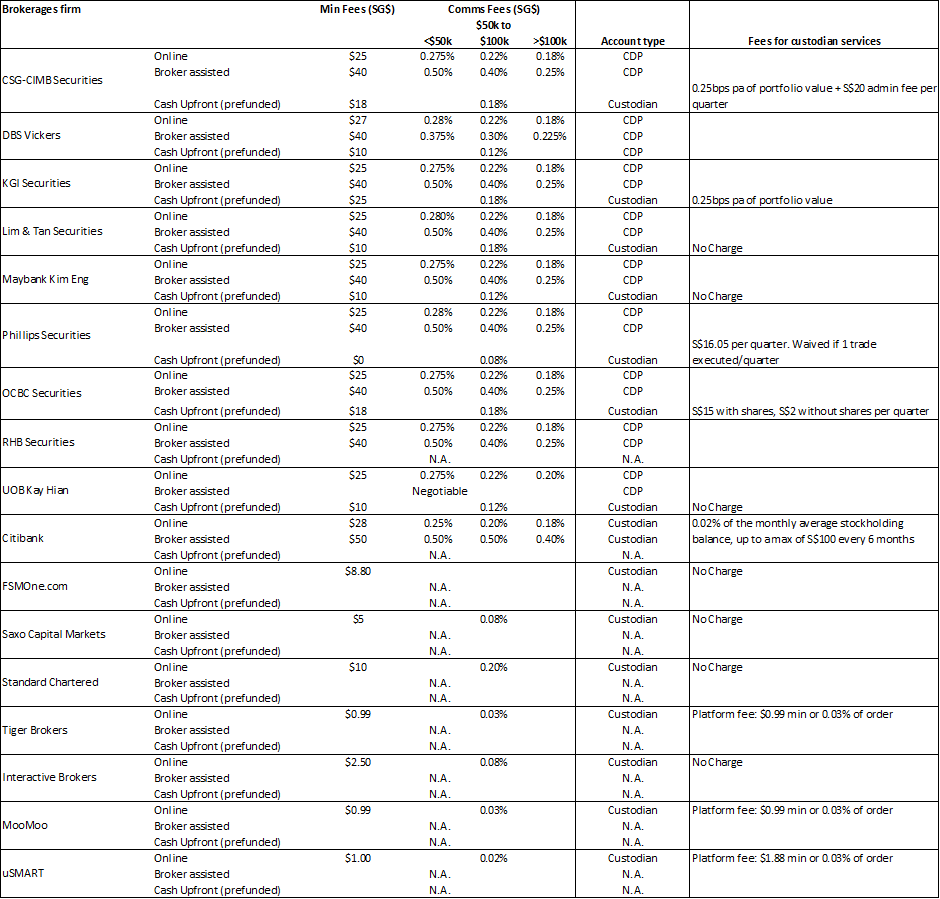

Please see the table below for the latest brokerage charges (updated Apr 2023)

Additional Reading: Best Brokerage Firms in Singapore

Popular low-cost brokerage firms such as Tiger Brokers, MooMoo, Interactive Brokers, Saxo Capital, uSMART, etc DO NOT allow purchases using an SRS account.

This might be a problem for investors who wish to invest a smaller amount every month using a dollar-cost savings (DCA) approach. It is not very feasible executing on direct purchase of stocks with a small investment amount through local brokerages.

The lowest of them all is probably FSMOne at a min commission cost of S$8.80. This makes investing with a lower amount more palatable. Nonetheless, a small investment amount of $200/month with FSMOne will still incur a monthly recurring cost of c.4+% which remains rather substantial.

For someone who is looking at a lump-sum purchase, say the entire $15,300 of your SRS savings, buying through FSMOne will incur a one-off commission cost of just $8.80 (0.06%) which is probably as cheap as it can get.

Instead of buying individual stocks, one can also select to partake in a basket of pre-selected stocks that the brokerage offer such as OCBC’s Blue Chip Investment Plan, etc. More of this is in Item #6.

For those who are interested to find a FREE and useful stock screener to sieve out the highest quality Singapore stocks to buy with your SRS monies, do check out the article below.

Additional Reading: Best Free Singapore Stocks Screener that Rivals Bloomberg

Investing using SRS account #2 ETFs

Investing in Exchange-traded funds or ETFs for short is one of the easiest ways to get exposure to a broad array of stocks. It could be an index fund, a country-specific fund, or one which focuses on a particular sector such as the real estate sector.

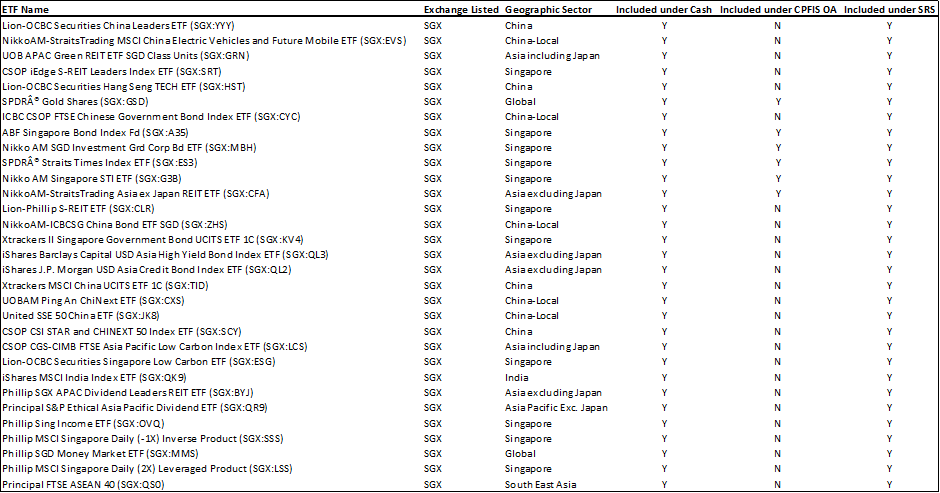

Unlike the CPF Investment Scheme where there are only four CPF-approved ETFs, there is no restriction on the use of SRS funds to purchase most of the ETFs listed on the SGX.

Some of the popular ones favored by local investors out there include ETFs such as the SPDR STI ETF if you wish to get exposure to the Top 30 largest SG stocks, the ABF Singapore Bond Index Fund if you wish to have exposure to some of the highest quality bonds issued by Singapore corporates (many of which are government-linked), Lion-Phillip S-REIT ETF for REITs exposure, etc.

Additional Reading: Lion-Phillip S-REIT ETF: should you be buying this REIT ETF?

For those looking at some foreign exposure, specifically China exposure, you can also use your SRS account to purchase the Xtrackers MSCI China UCITS ETF which is one of the largest ETFs on the SGX in terms of fund size.

Another China/HK alternative is the Lion-OCBC Securities Hang Seng Tech ETF which allows one to capture the growth potential of the 30 largest Tech-themed companies listed on the Hong Kong Stock Exchange.

Again, FSMOne is likely the cheapest platform (similar to stocks) available to purchase these ETFs. The table below shows the 31 ETFs listed on the SGX that one can purchase using the SRS account through FSMOne. There are a handful of ETFs that can be purchased using one’s CPF OA account as well.

Overall, the purchase of ETFs using our SRS account faces some issues similar to that of stock purchases.

First, the lack of a wide variety of ETF choices as we are predominantly limited to those listed on the SGX.

Second, the lack of a cheap solution to purchase them monthly with a small investment outlay.

However, this is likely a more diversified (and safer) solution compared to purchasing individual equities, in my view.

Additional Reading: Ultimate Guide to ETF Investing in Singapore

Additional Reading: Best ETFs in Singapore to structure your inflation-proof Passive Portfolio

Investing using SRS account #3 REITs

REITs or real estate investment trust is an investment product that allows one to have exposure to owning “real estate properties” the easy way.

Again, REITs can be bought and sold just like stocks and one can use your existing brokerage firms to make such purchases with your SRS account.

I have talked about REITs extensively in this article: Ultimate Guide to REIT Investing in Singapore.

One can use their SRS funds to purchase some of the biggest and most popular REITs highlighted in my article above.

A unique feature about REITs that makes them popular among Singapore investors is that they belong to a “high-yielding” asset class. Investors using their SRS account to purchase REIT counters will also be entitled to their dividend payments.

However, the dividend payments will flow back into one’s SRS account and hence not be reinvested seamlessly for an investor to take advantage of compound interest easily.

I am currently vested in REITs through Syfe REIT+, a popular Robo Advisor platform, which unfortunately does not (yet) support the purchase of their products using SRS funds.

Additional Reading: My Favorite Features of this Robo Advisor

Investing using SRS account #4 Bonds

Several bonds are listed on the SGX and we can invest our SRS account in these bonds. The retail bond market is however not very vibrant here in Singapore.

The more popular ones are the Astrea family of bonds.

I do currently have some Astrea IV and V retail bonds.

Its performance has been generally stable. Even during the darkest period of 2020 (March/April), the bond only briefly traded below its par price but has since rebounded to trade at a premium.

One can choose to purchase bonds again on platforms such as FSMOne and POEMs. For FSMOne, there is a processing fee of 0.35% or min of $10 when purchasing bonds. Besides, there is also a quarterly platform fee of 0.05%.

Investing using SRS account #5 Singapore Savings Bonds & T-Bills

Singapore Savings Bonds (SSB)

From December 2018, the Monetary Authority of Singapore (MAS) announced that they would allow investors to buy Singapore Savings Bonds (SSBs) using our SRS funds as well as double the amount of SSBs that an individual can hold to $200k from $100k previously.

Sounds like good news?

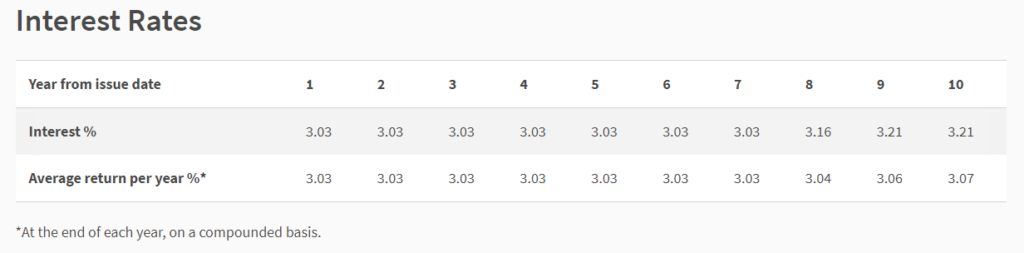

For those who are interested to purchase SSB using your SRS account, you can purchase it through the Internet banking portal of your SRS operator. The current yield to maturity of the 10-year SSB is approx 3.07%.

The min amount is S$500 and subsequent multiples are priced in S$500. As previously mentioned, the max investable amount is S$200k.

Purchasing SSBs is generally kept affordable with just a $2 non-refundable transaction fee for each application.

One can also sell his/her SSB at any point in time without incurring any penalty.

Some might see this as an alternative “cash” solution to park your capital in SRS for the meantime while waiting for a better entry point to enter the market.

While no one can accurately time an “ideal” entry into the stock market, there is no harm in keeping some cash on hand in your SRS account, especially if one is already significantly vested in the capital market, while concurrently benefiting from tax savings. This is what I have been doing and now might be the time to put some of this cash to “work harder” for us.

Do note that the 3.07% highlighted earlier is the Yield-to-maturity of the 10-year bond. You will only get this average return per annum if you are willing to lock up your capital for 10-years.

If your holding period is much lower then this will not be the yield you are getting. The table reflects the actual interest you will be getting for each year. There is, however, not much of a difference.

T-Bills

With the gradual rise in interest rate, another popular ultra-safe alternative to park your cash is to invest in Treasury Bills or T-Bills for short, issued by the Singapore government.

Do note that T-bills do not pay an interest. They are issued to buyers at a discount to face value (the yield) and when they mature, buyers are paid the face value.

One can do that easily through your SRS Operator (DBS/POSB, OCBC or UOB), using their internet portal.

The minimum application is $1,000 while the maximum application is up to $1m per applicant.

The table below shows the current yield (top: 6 months, bottom: 1 year) that one can generate by investing in T-bills.

Notice that the yield is slightly higher than the SSB yield (3.03%) we highlighted earlier. This is because one will need to hold the T-Bills to maturity (6 months or 1 year) once purchased, whereas the SSB can be sold at any time.

Investing one’s SRS monies (which is yielding 0.05% if left untouched) into SSBs or T-Bills is more “of a no-brainer” vs. using one’s CPF OA (yielding 2.5%) account.

Investing using SRS account #6 Regular Shares Savings

A regular shares savings (RSS) plan or some might term it as RSP as well, works on the concept of dollar-cost averaging. It allows new investors to start their investing journey affordably by investing just a small investment amount (can be as low as S$100/month) every month.

This instills some form of discipline in an investor and also allows them to gain confidence as they see their investment portfolio growing “slowly” but “steadily”.

There are currently 4 brokerages currently offering RSS plans. They are:

- OCBC with its Blue-Chip Investment Plan

- DBS/POSB with its Invest-Saver

- Phillip with its Share Builders Plan and

- FSMOne with its ETF Regular Savings Plan.

However, DBS/POSB Invest Savers, Phillip Share Builders Plan, and FSMOne ETF Regular Savings Plans are not eligible for investment using SRS funds. Only OCBC Blue Chip Investment Plan can be done using SRS funds.

I do stand corrected if I am wrong on this matter.

Starting with the OCBC Blue Chip Investment Plan, this plan allows you to regularly invest in 19 share counters mostly from the Straits Times Index (STI) as well as 7 exchange-traded funds. Popular ETFs like the Lion-OCBC Securities Hang Seng Tech ETF can also be invested in through OCBC Blue Chip Investment Plan.

You can download the full list of stocks and ETFs offered by OCBC BCIP here.

One can select to buy the Lion-OCBC Securities Hang Seng Tech ETF, for example, through OCBC Blue Chip Plan where the min commission is S$5/counter or a variable amount of 0.3%, whichever is higher (lower fees if you are younger than 30 years old).

This will mean you need to invest at least S$1,667/month. Any amount less than that and your effective commission rate is higher than the stated 0.3%.

For example, if you only have $200/month to invest, a min commission cost of $5 means that your effective commission rate is at a hefty 2.5%. Not that cheap after all. Hence this might not be the most cost-effective manner to invest your SRS monies.

Do note that buying into ETFs will also incur additional expense ratios (priced into the ETF price) vs. buying individual stocks which will not have that additional cost element.

Investing using SRS account #7 Robo Advisors

Robo advisors are becoming increasingly popular in Singapore. These are platforms that use algorithms to make investment decisions, thus removing the human (and often more emotional) element out of the picture.

I have previously written quite extensively on Robo Advisors as well in this Ultimate Guide to Robo Advisors in Singapore.

I am currently using a number of these Robo Advisors, one of which is Syfe. However, Syfe does not allow one to use his/her SRS account to make purchases at the moment.

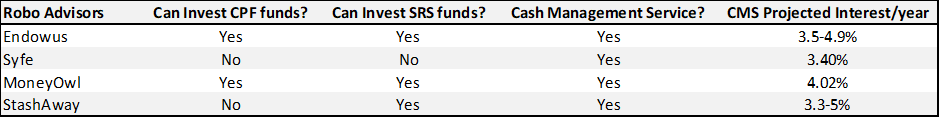

3 Robo Advisors currently allow us to invest our SRS account with them.

- MoneyOwl

- StashAway

- Endowus

Notably, for Endowus, they are also currently the only platform that allows one to use their CPF OA to invest in well-known unit trusts such as the Dimensional and PIMCO funds.

Additional Reading: Dimensional Funds: Are they worth their weight in Gold?

The key advantage of using Robo Advisors for investing in your SRS account is that one can now overcome the main problem of “small investment size” and do it more cost-effectively, unlike OCBC’s BCIP.

Robo advisors work on a management or platform fee basis, ie they charge you x% every year to manage your funds. This works well for new investors just embarking on their investing journey and might not have much capital to spare.

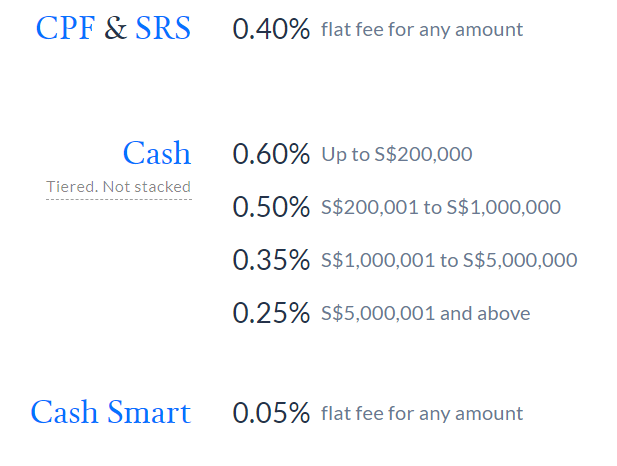

Take for example Endowus. It has a 0.40% flat fee structure for any amount of your SRS funds invested.

Whether you invest $10k/month or $100/month, your commission charges are at 0.40%. So for a $100/month investment, effectively you are just paying $0.40/month in commission fees. This is so much of a savings compared to using the OCBC Blue Chip Plan where the min commission cost is $5 (thus translating to a recurring monthly commission charge of an “outrageous” 5% for a $100 small investment amount).

For Robo Advisors like Endowus, you can also choose to invest on a lump sum basis or a recurring monthly basis. On a lump-sum basis where I assume the amount is substantially big, say $15k of your SRS funds, it will not be as cost-effective as a platform like FSMOne where the latter’s commission charge is a ONE-TIME fee of 0.08% vs. Endowus recurring platform fees of 0.40%.

Say, for example, you decide to invest a lump-sum amount of $15k of your SRS account in a Blue-Chip stock like Keppel for example.

Through the FSMOne platform, all you have to pay is the commission charge of 0.08% *$15k = $12 plus some small miscellaneous charges to SGX, etc and that’s about it. You can hold your shares in Keppel for as long as you want without incurring any additional form of recurring charges (buying individual stocks does not incur recurring costs such as the expense ratio for ETFs or management fees associated with unit trusts).

If you invest your $15k SRS capital through Endowus by purchasing their unit trusts, you will incur their platform fee which is 0.40 %/annum plus the management fees of their unit trusts which average at about 0.40% as well. So, on an annual basis, your total cost is approx. 0.8% = $120 in this example.

Assuming no further investments into Endowus, you can expect this amount (and likely rising due to portfolio appreciation) to be charged to you EVERY YEAR for the duration that you are vested with the Robo Advisor.

Having said that, I believe Robo Advisors are still the easiest and cheapest solution for investing a small amount of one’s SRS monies repeatedly every month.

Cash management services

Another benefit of Robo advisors is that they often provide cash management services. Now, this can be seen as a “gimmick” to entice retail investors to park cash in their cash management services to achieve the stated high-interest level that they are offering.

Given that interest is calculated on a daily basis and cash can be withdrawn out anytime, this is a “liquid alternative” vs. putting your cash in a savings account and accruing interest at a rate of 0.05%.

The typical cash management services offered by some of these pure-play Robo advisors range from 3.3% to 5%. However, do note that the higher the interest level, the higher the risk to be taken. Do not assume that your capital is protected like investing in SSB because it is not.

I have personally invested in Endowus Cash Management Services offering the highest interest level of >2% and my cash portfolio is currently down more than 3% after more than 1 year.

There is nothing wrong with offering better cash management solutions and I believe that all Robo Advisors should do it as part of their holistic investment offerings.

However, it should not be their key selling point because chasing after yield might end badly, and investors who believe their investments in these cash solutions are “rock-solid” and “as good as cash” might be in for a nasty surprise when a black-swan event happens eventually.

For those who wish to make their cash work harder in the current interest rate environment, while yet not wishing to take on more risk, I would suggest going for the lower interest tier (3.3-4%) and not the more aggressive ~5% range that these robo advisors offer for their cash management services.

This solution is slightly superior to purchasing SSB or T-Bills since interest is accrued on a daily basis and there is no lock-up for such cash management services. The cash yield that you can get is also higher. However, do note that there is no explicit guarantee that the capital you invest in these cash management services is capital protected.

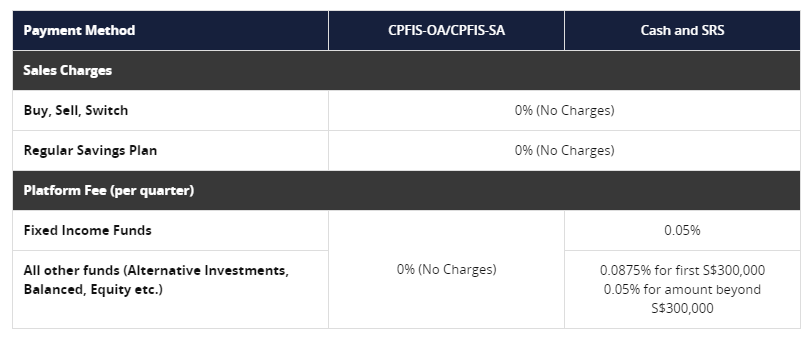

Investing using SRS account #8 Unit Trusts/Mutual Funds

One can also invest in unit trust and mutual funds with your SRS funds. This extends to unit trusts outside of the three SRS administrators, which means we are not limited to investing in unit trusts that are sold by them.

Besides the 3 banks, many other platforms sell unit trusts, such as FSMOne, POEMS, DollarDex, Endowus, etc.

The key advantage I see in investing your SRS account into unit trust is to have options beyond just locally-focused investment products ie SG Stocks, SG-focused ETFs, etc.

Besides Robo Advisors, some of which such as Endowus, also invest your SRS funds into unit trusts with global exposure, a DIY approach to these unit trusts might also be a solution to get a more diversified solution.

However, the main problem with investing in unit trusts is often their relatively high sales charges and fund expense ratios. Sales charges are typically in the 1% arena. While it is a one-off, 1% is still a relatively large amount to pay for commission charges.

Most platforms however are beginning to do away with these one-off sales charges. FSMOne has no sales charge for its unit trusts.

Next, there are also the recurring fund expense ratios which might go beyond 1.75%/annum.

Lastly, there might also be recurring platform fees of around 0.3-0.4 %/annum.

All-in and you are likely down 2% (in some cases) even before your investment portfolio has any chance of making you money. And these costs are recurring every year.

I tend not to purchase unit trusts myself, due mainly to the high expense ratios of the trust and for the fact that they are not as liquid or transparent as ETFs which can be easily transacted like shares through most brokerage platforms. Buying and selling unit trusts, if they are not liquid enough, will incur additional spread charges.

Again, while Robo Advisors allow one to invest with a small amount of monthly recurring capital, a DIY approach to invest your SRS capital into unit trusts/mutual funds will require a higher investment outlay often to the tune of at least $1k minimum investment.

#9 Insurance products/Annuities

We can also put our SRS funds on insurance products and annuities. There are however some restrictions on life insurance products. One can typically only use his/her SRS account to purchase single-premium products. We are also not allowed to purchase critical illness, health, and long-term care products with our SRS account.

Main facts to know

- You can buy single-premium insurance products with SRS

A typical example of such a single premium product is one where you pay a one-time premium, which then gathers value over time to give you a lump sum payout at maturity or a stream of income in the future, starting from a date of your choice. - A portion of investment returns is guaranteed

Insurance products provide a unique proposition: a portion of investment returns is guaranteed, thus making them a good fit for those who prefer more conservative and steady returns. However, this amount is usually pretty low. - The life cover is capped at 3x of the single premium

Upon death or terminal illness, SRS allows withdrawal at full tax exemption up to S$400,000.

I do see the appeal of using your SRS account to purchase endowments and annuities if you have got no clue as to what to do with the capital sitting in your SRS account generating a grand interest of 0.05%.

Might as well get some insurance protection and concurrently enjoy “guaranteed” returns from the investment made on your behalf.

For those who do not have a comprehensive insurance plan for themselves and their family and are averse to making “risky” investments, this might be a solution for you to enjoy tax benefits while also putting the capital into generally low-risk capital-protected insurance solutions.

Do note that such investments tend to have larger initial investment requirements (for example life insurance products have to be single premium) and will have longer lock-in periods.

Also, don’t expect these products to generate stock market-like investment returns since they will be mostly vested into “safer” fixed-income products which are currently not yielding much, as you might already expect in today’s low-interest-rate environment.

I think annuities might be a good solution to minimize your taxes paid when you look to withdraw your SRS funds come Age 62.

I have written about it in this article: Generating “risk-free” returns using SRS and the art of withdrawal.

#10 Fixed Deposits

Last but not least, we have got fixed deposits for those who are very risk-averse and only want guaranteed returns while yet at the same time ensuring that their capital is not “lock-up” for a prolonged period like annuities.

Fixed deposits are possible alternatives to SSBs and T-Bills. They tend to require a longer tenure beyond 6 months vs. 6 months T-Bills. Those who believe that interest rates will start declining, they might wish to “lock in” a high- interest level through fixed deposits.

Some banks will also require a much higher nominal amount for investing in fixed deposits

The table below is a summary of various banks (as of Apr 2023)

| Banks | Tenor (mths) | Min amount($) | Interest (%) |

|---|---|---|---|

| DBS | 12 | 1,000 | 3.2 |

| SCB | 3 | 25,000 | 3.0-3.2 |

| CIMB | 6 | 10,000 | 3.45-3.5 |

| Hong Leong | 10 | 20,000 | 3.4 |

| OCBC | 6 | 20,000 | 3.5 |

| Maybank | 12 | 20,000 | 3.55 |

| UOB | 6 | 10,000 | 3.55 |

| ICBC | 3 | 500 | 3.75 |

| HSBC | 3 | 30,000 | 3.8 |

| Sing Investment | 13 | 20,000 | 3.8 |

| RHB | 12 | 20,000 | 3.9 |

| BOC | 6 | 5,000 | 3.9 |

| Citi Private | 3 | 250,000 | 4.0 |

For those who believe that the current interest rate is as high as it goes and wants to “lock in” the rate for a longer duration, RHB likely offers the best package in terms of tenor and interest rate level.

Compared to T-Bills which also have a “lock in” mechanism and a current 6-month yield trading at about 3.7%, fixed deposits aren’t a more attractive alternative, especially for those with a smaller capital.

What is the best solutions for SRS investments?

I have covered plenty in this Ultimate Guide to Investing using an SRS account.

The SRS account is used primarily for tax savings purposes. By contributing X amount of dollars, we will be able to reduce our taxable income by X dollars immediately. This might be a good way to save possibly more than a thousand dollars in tax by contributing the max cap of $15,300 for Singaporeans.

The next question would be on identifying the best solutions for investing using SRS account. There is no right or wrong answer in this context as every person’s risk tolerance is different, hence certain investing solutions might appeal more to some vs. others.

But let me summarize and offer my 5 cents worth on how you can further maximize your SRS funds, beyond that of the original tax savings accrued.

Investing in riskier products: Stocks, ETFs, Unit Trusts/Mutual Funds, REITs, Robo Advisors

Lump Sum Investing

I will say that the FSMOne platform remains the lowest commission cost platform in terms of lump-sum investing, be it for Stocks, ETFs, REITs, Unit Trusts etc.

At a fixed commission rate of $8.80, investing a full-year worth of SRS ($15,300) on these riskier products will entail only a one-time cost of 0.06%.

Dollar Cost Averaging

However, not everyone is able/willing to contribute a lump sum amount and will prefer a dollar cost average approach every month with a small capital amount. In this case, it is better to select the Robo Advisory platform that does not incur an upfront commission costs but more of a recurring platform fee (0.3-0.4%) + fund fees (~0.4%)

Currently, there are 3 mainstream robo advisory platforms (not including those offered by the banks) which offer SRS investments: Endowus, MoneyOwl, StashAway.

Note that SRS investors selecting this route will be investing their SRS monies mainly in unit trust products.

Investing in safer products: SSBs, T-Bills, Robo Advisors (Cash Management), Fixed Deposits

For those looking at “near-cash alternatives”, selecting cash management services offered by Robo Advisors might be one way of keeping your cash liquid (can be withdrawn out anytime with interest being credited daily) while yet still generating a decently high interest rate

However, do note that anything above 4% (current environment) offered by these cash management services tends to have a higher level of risk baked in and might not be suitable for those who assumed that such services provide “capital guarantee”. They DO NOT.

I made the “mistake” of investing my SRS fund in Endowus Cash Smart Ultra which “promised” a high yield of > 2% at that point (2 years ago) but have instead incurred capital losses on it. To be fair, I know exactly the risk that I am getting into and have blogged about that as well.

The bigger question now is whether to “bite the bullet”, take the loss while using the capital to invest in a “cheaper” stock market, perhaps?

For those who wish to have absolute capital protection, the solution is for SSBs, T-Bills and Fixed Deposits. Note that T-Bills and Fixed Deposits have a “locked in” period and while SSBs can be withdrawn anytime without penalty, the interests is paid out only every 6 months.

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

3 thoughts on “Ultimate Guide to Investing Using SRS Account (2023 Update)”

Very comprehensive & well written article! High recommended to those to read so to generate a better return on their SRS.

Phillips’ cash upfront, is it the same as their Cash Plus? They have extended it till 31 Dec 2022.

Instead of withdrawing cash annually from SRS, says $40000/ to avoid tax, can a person transfer his shares ( equivalent of $40000 approx) instead to his other brokerage accounts to avoid tax in liue of cash withdrawal?

How can i invest into NASDAQ using SRS?