Interest Rate Hikes. Should you be concerned?

The latest December data indicated that inflation in the US is running at the hottest level since 1982, as prices rose for an array of goods especially housing, cars, and food. The Consumer Price Index or CPI climbed 7% in 2021, the largest 12-month gain over the last 4 decades.

This sets the stage for the start of Fed rate hikes as soon as March. While the Fed has publicly guarded for 3 rate hikes this year, Goldman Sachs believes that there will be 4 rate hikes this year, with a more “scary” prospect being the shrinking of the Fed’s balance sheet.

A rapid rate rise that is supported by strong economic growth is generally positive for the stock market, based on historical data.

However, one has to discern the fact that not all rate rises are the same. This is the very first time since the 1970s/80s that inflation is running that hot. A “forced” rate rise, driven by the need to curb runaway inflation, runs the risk of derailing the recovery efforts from COVID-19.

In such a scenario, should one be concerned over a potential fallout in the stock market?

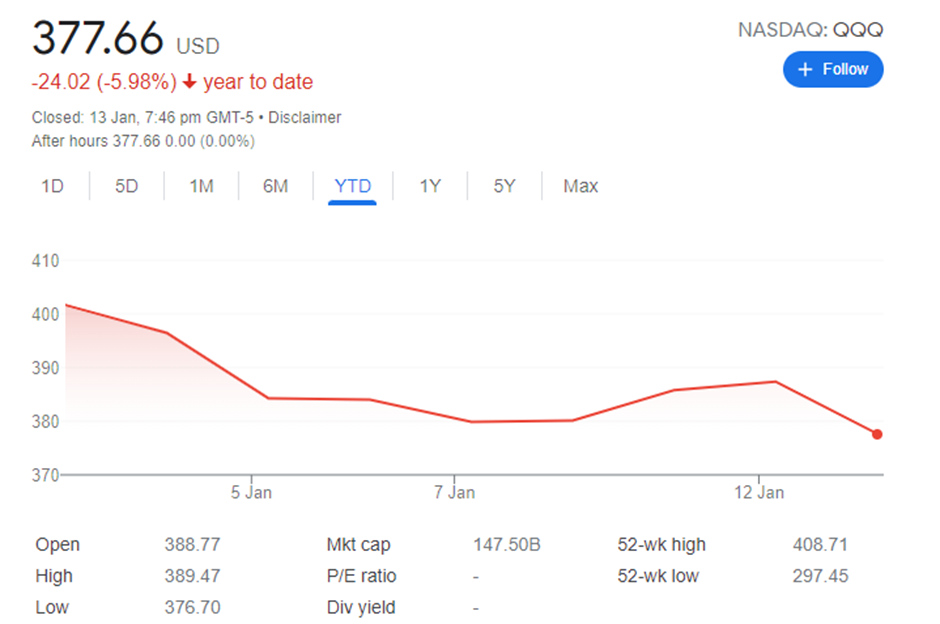

I believe the answer is Yes. Take a look at how the Nasdaq 100, which consists of growth stocks in the technology sector have declined, since worries over aggressive rate hikes to curb inflationary pressure became evident, at the start of 2022.

Growth stocks typically are more “sensitive” to interest rate rises and I will explain that in the next segment.

Here are a few ways in which you can look to protect your portfolio from the impact of imminent interest rate hikes.

Growth to Value

Last year was the very first year that value, as a whole, likely edged out over its growth counterpart, after more than a decade of value underperformance. Value outperformance vs. Growth was rather marginal in 2021, which might be a surprise to some, as large-cap growth stocks continue to perform well, as seen from the chart below, with VUG (Vanguard Growth ETF) coming out slightly ahead of VTV (Vanguard Value ETF)

It is in the smaller-mid cap arena that growth trailed value.

However, value’s outperformance, as a whole, might become more pronounced in 2022 if interest rate hikes start to gain momentum.

Why is that so? That is because, for growth stocks, their business models typically trade profitability today for the promise of higher profits in the future. Higher interest rates, when used to discount the future cash flow/profits of these growth stocks, will reduce the present value of those future profits.

The shift away from growth will tend to benefit value, especially if there is still economic growth and these value stocks can continue to generate higher profitability. The valuations of value stocks tend to look more attractive in such a scenario, thus likely favored by investors over their growth counterparts.

Investors could look to purchase a value-based ETF, the largest of which is the VTV ETF (Vanguard Value ETF). The top 3 largest holdings in this ETF are Microsoft, Berkshire, and JP Morgan.

Bank stocks

A direct beneficiary of interest rate hikes is banks. While major banks typically have a diversified stream of revenue income, one of the largest income streams for any major banks is that of interest income generated from the loans they dish out to corporates and individuals.

And the interest of loans is typically tied to the general level of interest rates in the economy, as dictated by the Fed. So, if the Fed is to raise its rates, you can be sure that the days of cheap loans for your mortgage, car loans, etc are over.

This will lead to higher bank profits. While there are different categories of banks, retail and commercial banks whose business model is based on lending, will generally be a greater beneficiary vs. a pure investment bank, whose business model is dependent on trade flows.

For investors interested to buy into a basket of ETFs, they might want to consider the XLF ETF (Financial Select Sector SPDR Fund) which has one of the lowest expense ratios at 0.12% and the largest market cap among financial-themed ETFs.

The top 3 holdings are Berkshire, JPM, and Bank of America.

It is interesting to note that Berkshire and JPM both featured significantly for our Value and Financial holdings.

From a trading angle, XLF is also looking interesting, with the counter recently breaching its 52-week high with a positive entry signal from the TradersGPS platform which highlights that short-term momentum might be building.

The Systematic Trader

An easy-to-use platform to identify the RIGHT time to buy the RIGHT stocks using a systematic process so that it takes the guesswork and emotion out of your trading.

Focus on shorter-term or inflation-protected bonds

When we think about bonds, most will view them as an asset class to help diversify away from equity risks. A portfolio that is 100% equity is viewed as being a lot riskier vs. a portfolio that has a composition of 50% equity 50% bonds.

When the market corrects significantly, we expect the value of our bond holdings to increase, thus partially offsetting the impact from the equity drawdown.

That is usually true as investors shift from riskier assets (equities) towards safe-haven assets (bonds). However, if the market correction is triggered by rising rates (to curb inflation) without a corresponding improvement in the economy, then your bond holdings will also be negatively impacted.

This is because bonds perform inversely to interest rates. When there are aggressive interest rate hikes, bond values will drop significantly. Bonds with a longer duration (ie longer expiration date such as 20+ year treasury bond) will decline more than bonds with shorter duration, given their greater sensitivity to interest rate movements.

Hence, if you wish to keep your portfolio bond allocation status co, one way to lessen the impact of interest rate hikes is to veer towards shorter duration bonds.

Buying the iShares 1-3 year treasury bond ETF (SHY) could be one way of mitigating the impact of interest rate hikes.

However, an alternative will be to look at inflation-protected bonds, since our view is that rising rates are driven by inflation.

One of the more popular ones is Schwab US TIPS ETF (SCHP) which has an expense ratio of just 0.05%.

Exposure to commodity

Commodities, in general, have done well YTD 2022. Most of the key commodity classes have outperformed the S&P 500 so far this year, with the best-performing ones being Natural Gas, Crude Oil, and Gasoline or Energy-linked commodities.

It is thus no surprise that energy-related stock counters have performed very well at the start of 2022.

According to BlackRock, in this Bloomberg article, commodities could be at the start of a supercycle that could propel prices higher for decades to come.

When we look at interest rates, it has an inverse relationship with commodity prices. This means that a rising rate environment is BAD for commodity prices.

When the rate rises, the cost of carrying inventories will rise and that will encourage consumers of raw materials to buy commodities on an as-needed basis rather than holding stockpiles due to the higher cost of financing those inventories. This is negative for demand.

On the other hand, if rate rise is a consequential result to combat rising inflation, then the higher financial impact stemming from storing inventory will likely be less of an issue vs. rising asset prices as a result of supply/demand skew.

Gold is typically an asset class that comes to an investor’s mind when we talk about hedging inflation. However, in a rising rate environment, Gold is typically frowned upon as it serves no economic purposes and there is an “opportunity cost” for holding gold since it generates no income vs. bonds.

If the Fed’s decision to raise interest rates successfully tames higher inflation, then gold prices might continue to languish. If the Fed is slow in raising rates or reluctant to raise rates as aggressively as they should and inflation powers ahead, then gold will be a key beneficiary, in my view.

The best commodity assets to hold will be those which are supported by strong fundamentals (greater demand vs supply) such that rising interest rates will not have too much of an impact from a financial funding angle while also being an inflationary hedge due to their limited supply.

Copper is one asset class that comes to mind. I have written about copper on several occasions and have also done a video on this commodity asset on why I believe its future is relatively bright.

Additional Reading: Copper might be the new gold. How to partake in this commodity on a new supercycle

Additional Reading: Thematic ETFs partaking in the hottest trends

Copper’s durability and excellent electrical conductivity make it the metal of choice in solar and wind energy projects as well as in EV charging stations. Demand for metal is likely well supported as the world pays more attention to green energy.

The Global X Copper Miners ETF (COPX) might be an ETF to play copper exposure through key copper miners.

Conclusion

I believe that interest rate hikes are a given in 2022. The bigger uncertainty is whether these hikes will derail the ongoing bull market that has been in place since GFC.

Raising interest rates when the economy is growing strongly is typically positive for the market. Doing so to curb rising inflationary pressure is another issue altogether.

The worst-case scenario is one where rapid interest rate hikes to slow inflation, crimp the recovery efforts of the economy as well, translating to negative growth.

That is where we have might be hit with the 1970s/80s like stagflation environment, a “black swan” event that the mainstream media has yet to highlight. When that happens, it will likely be too late.

I hope the above suggestions will help you to position your portfolio to better prepare for the coming interest rate hikes, one which I believe is going to be fast and furious and likely overshoot what the Fed has originally guided the market.

I will be looking to do a video to talk about the 4 ETFs that I will be purchasing to inflation-proof and rate-hike-proof my portfolio. So do lookout for it.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only