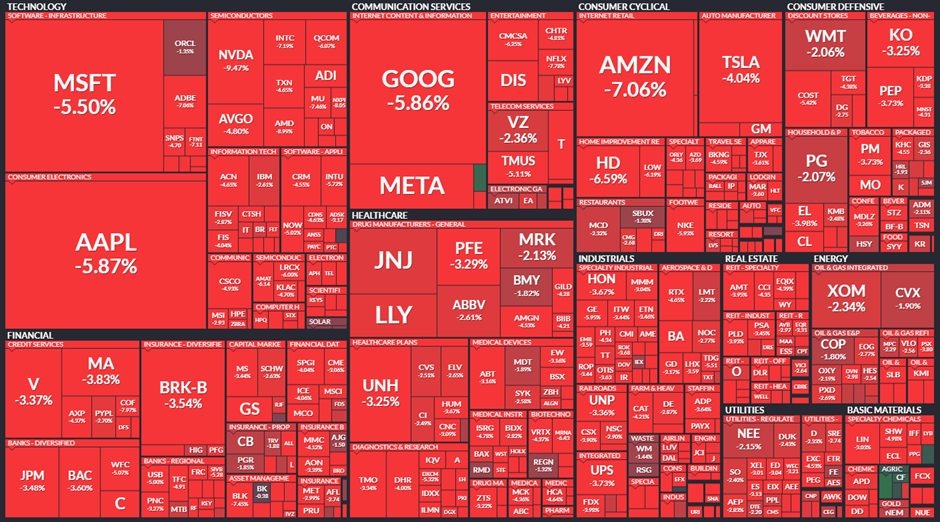

The market has had its most significant drawdown since June 2020, with every sector deep in the red. The key factor driving lower markets was undoubtedly inflation, or how sticky it was.

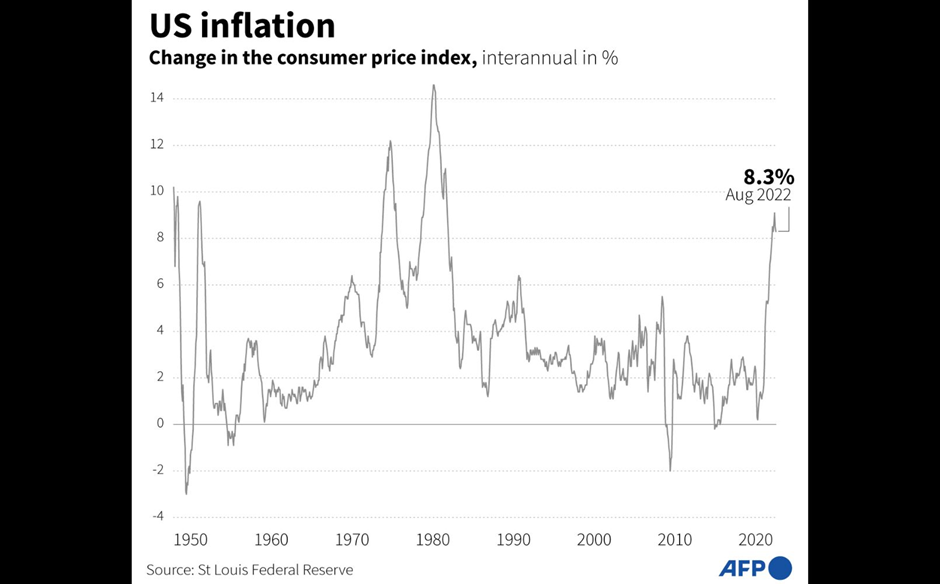

Back in early September, I wrote this article: Has inflation peaked? Don’t bet on that. My thesis was that while inflation showed a downward trend in July, declining to 8.5% from 9.1% in the previous month, that was largely driven by lower energy costs, which can be pretty volatile.

Critically, what is commonly termed as “sticky inflation” or components typically associated with services such as rentals, healthcare, and indirectly wages, are likely the main culprits that will “prolong the inflationary problem”.

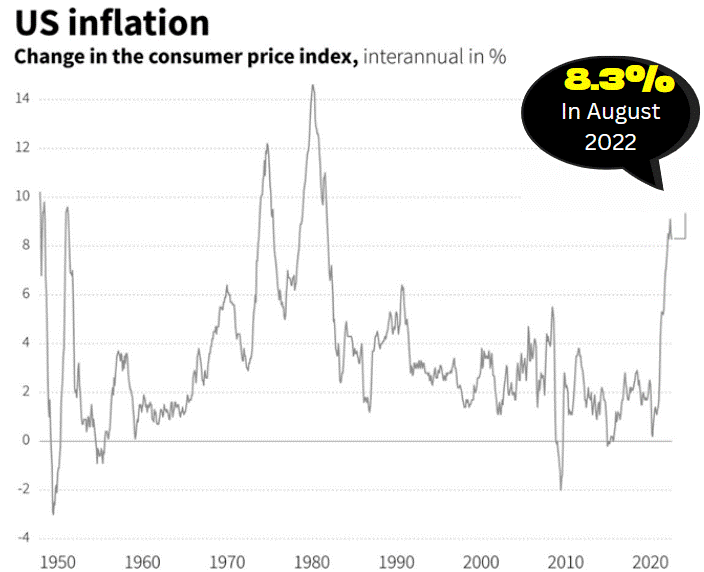

The latest CPI number out last night proved that there is no easy cure to the inflation issue, with headline figures at 8.3% vs. the street’s expectation of 8.1%.

August 2022 CPI figures

While expectations were for a 0.1% decline to 8.1%, August’s CPI actually rose 0.1% MoM and 8.3% YoY.

On the positive side, energy prices were down roughly 5% in August, which is not a surprise. Both crude oil and natural gas prices in the US have been on a decline over the past months and the market has likely factored that in.

On the negative side, service inflation broadly accelerated in August. Shelter rose 0.7%, transportation services rose 0.5% and medical services rose 0.8% MoM. This is likely an indirect consequence of a tight labor market. How so?

When the labor market is tight, employers will need to raise wages to attract labor. Higher wages need to be fully or partially passed through to end consumers. As a result, the service industry, which tends to be more manpower dependent, will have to up its service costs.

The increase in these areas drove Core CPI, which excludes Food and Energy, up 0.6% MoM, back to 6.3% YoY.

It is now back to its highest level since March, breaking its 4-month deceleration trend, thus breaking the hopes of any Fed pivot in the near future.

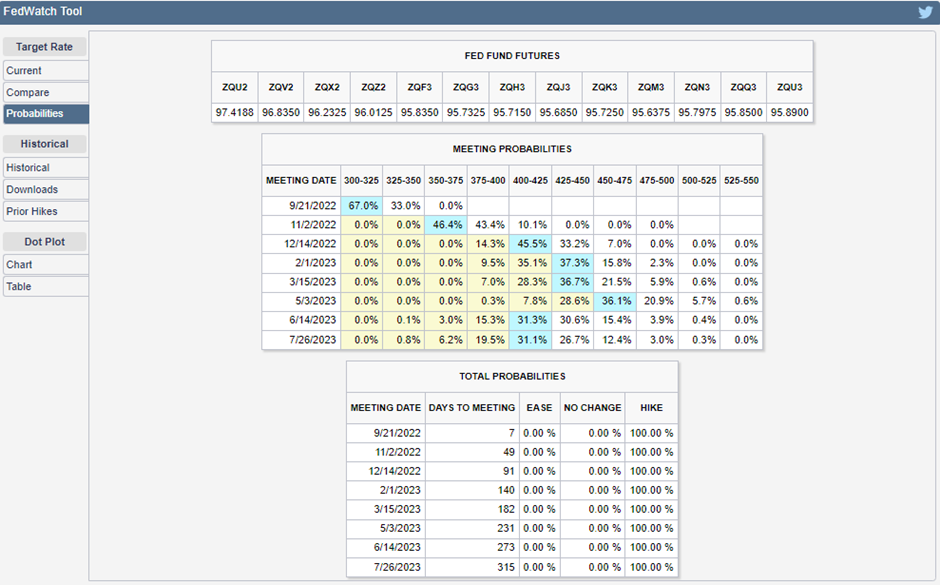

The market has fully priced in a 75 bp hike, with a 33% shot at a 100 bp hike at the Fed’s meeting next week. If the latter is to materialize, then we are no doubt heading for a bumpy ride for the rest of 2022 as it clearly shows how “aggressive” the Fed can be in a bid to contain the inflation problem, potentially driving the economy into a recession.

The Fed announcement will be on 20-21 September.

Inflation Investing

Back at the start of 2022, I wrote this article: How to beat inflation in 2022 with these simple stock strategies.

I detailed 3 strategies in that article which I will provide a quick summary here.

Strategy #1: Buy stocks with pricing power.

Stocks with pricing power are typically those that demonstrate stronger margin performances aka, they generate operating margin improvements in an overall rising price environment. These companies are able to see margin improvement because they are able to pass on raw material/input costs increment to end-consumers in the form of higher product/service prices.

Consumers love their products/services and despite them having to “pay up for it”, they are more than willing to do so.

These are the stocks that will not only survive a prolonged inflationary environment but will thrive in it as well.

One stock with strong pricing power is Automatic Data Processing (ADP), a payroll and human capital management company that has a very consistent track record of growing its operational margin.

Strategy #2: Avoid stocks with high manpower costs

While wages are not a direct component of CPI, but its effect is pretty much evident as I have earlier illustrated using the service industry as an example.

Companies that are highly labor-intensive will see their margins being crimped if they are not able to raise product/service prices faster than their key input cost, labor.

In that article, I screened for stocks with a low sales/employee ratio. These are companies that are highly “labor-intensive” and will suffer in the event that wages start increasing significantly or when they find themselves in a situation of not being able to pass on their higher input costs to end consumers.

On the other hand, stocks with a high sales/employee ratio can be interpreted as “labor-light” companies. One blue-chip company (>$10bn market cap) that features in the Top 10% of companies with a high sales/employee ratio is Apple (AAPL).

Strategy #3: Avoid growth stocks that are loss-making

Growth stocks that are loss-making might well turn out to become “growth trap” candidates, aka counters which are dependent on a high top-line growth narrative to fuel their continual price appreciation. When that top-line growth dissipates, these companies have got no earnings nor cash flow to fall back on.

On the other hand, growth stocks that are increasingly more profitable through operating leverage might see stronger price resilience amid a rising rate environment.

However, there is no certainty that these companies remain immune to the “whims and fancy” of Mr. Market. Stock gyration is likely to be the norm but price decline in this category of stocks should be seen as a long-term opportunity to buy into high-quality market leaders now trading at a discount.

Alpha Blueprint Stocks

High-quality market leaders which continue to exhibit growth characteristics are what I termed my Alpha Blueprint Stocks. These companies are highly profitable, highly cash generative companies that can not only withstand a prolonged inflationary environment but can capitalize on such a scenario by increasing its market share when fellow peers “go under”.

One such Alpha Blueprint Stock which just got on my radar is Meta. It is a hated stock but everyone continues to use its product on a daily basis! It is now at a stage where the street is beginning to turn more positive on the counter and expect the company to generate YoY top and bottom-line growth in 2023. That could finally signal a turning point for the company.

At a PER multiple of 12-13x, this is a growth stock that is now looking pretty cheap.

Inflation or no inflation, I am betting that Meta, at its current price, is worth a shot with a long-term horizon in mind. I am not implying that one should go “ALL IN” to Meta at this stage, but a proper dollar cost averaging strategy at the current level makes sense to me (stock is down 60% from its 52-week peak).

For those who are interested to find out how I screen out for quality stocks that give me the confidence to buy at the right time in a bear-market scenario, click on the link below to read more about the qualities of Alpha Blueprint Stocks.

Conclusion

I am well aware that everyone is kinda weary of “inflation talks” that have been ongoing since the start of the year.

However, it is still likely the No.1 factor that could determine the direction of the market for the rest of 2022 and also an indirect culprit that could trigger a more prolonged recession in the US, come 2023.

When that happens, we will have the dreaded stagflation scenario. I have written about how one can invest in a stagflation environment in this article here: Stagflation investing. How to position your portfolio (2022)

My strategy is to remain nimble and continue to focus on stocks that will do decently well OPERATIONALLY, inflation or no inflation. These are the stocks that I have the confidence to add to my portfolio when they are “unloved” or simply because the whole market is so “spooked out”. Buying these high-quality companies now trading at a discount is what will generate that “portfolio outperformance” over the longer horizon.

This article should not be seen as a recommendation to buy or sell any of the counters highlighted. Please do your necessary due diligence and assess the suitability of these stocks based on your risk profile.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only