Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

How to research a stock before you buy: A 7-step process

Many of you might have heard others saying “Apple is a great company” or that “3M is risky as it has severe legal overhangs regarding its earplugs lawsuits.” You might be wondering to yourself: “How do I go about learning about such things about a company?”

In this article, I will be sharing with you how I research stocks for a particular company using free resources online that are available to everyone.

I like to think of this process as similar to solving a mystery; throughout the journey of researching the company for stock analysis, I am playing the role of a detective trying to uncover clues that will hopefully allow me to solve the case of the mysterious company at the end.

In today’s article, I will be using Adobe as an example. Curiously, I have never done a dive into the company before despite being familiar with its products, so this would be my first time taking a closer look at the company.

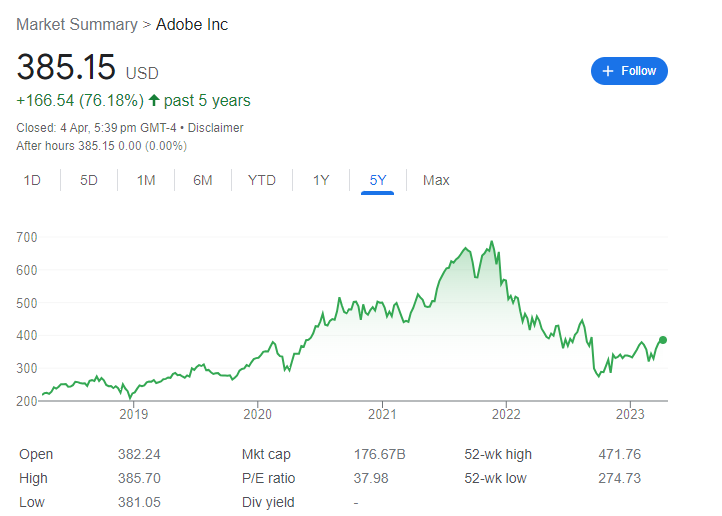

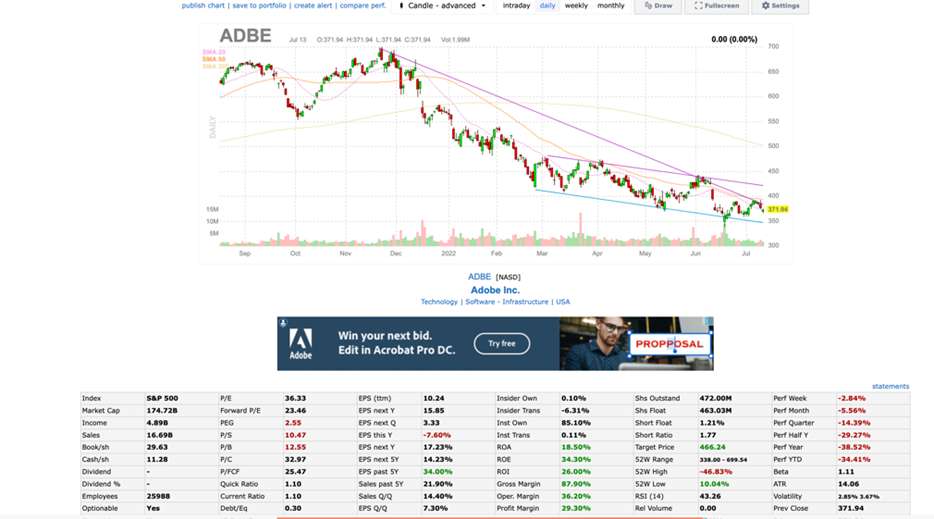

As can be seen from its 5-Year share price history, ADBE’s price has taken a hard knock since peaking in late-2021. The company is seeking to rebound from its low of $274/share and this might be an opportune time for investors who are yet vested in the counter, to take a closer look at ADBE.

Follow me as I bring you through the 7-step process of how to research a stock before you buy. For disclosure purposes, I do currently hold ADBE in my Alpha Blueprint Portfolio. My initial purchase was at a cost of $410/share (still above the current level) but after a series of averaging down into the counter, my average cost currently stands at $367/share.

So how do I identify a stock like ADBE to invest into in the first place? Let us start with Step 1 of the process.

Step 1: Identifying a company for investment

Usually, to find potential investment ideas, I would look to fire up a couple of online scanners that would return interesting companies based on my defined set of parameters (good revenue growth, reasonable debt levels, growing earnings, cash flows, etc.). One of my favorite free scanners is FinViz. You might like to check out this previously written article on free stock screeners for a more detailed dive into how to use various online resources to seek new investment ideas:

For readers who are interested to find out how to identify a stock with Quality Growth features, you can download my Quality Growth Checklist below:

Step 2: Go to the Source

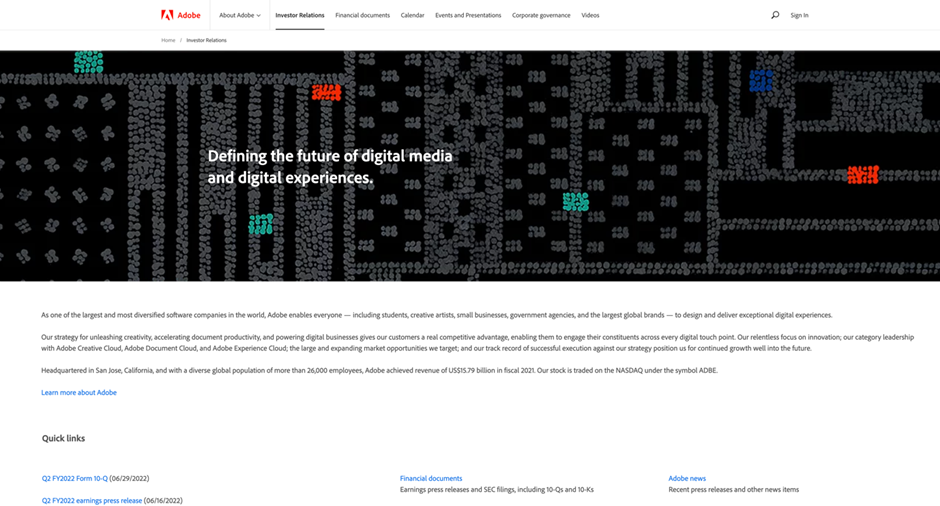

After I have found an interesting company, I would usually look to find out more about the company by going straight to its website. In this case, I will simply google “Adobe IR” (IR: Investor Relations)

Step 3: Investor Presentation

On this page, you will be greeted by a treasure trove of information that is incredibly useful for investors that are interested in / invested in Adobe.

Every company has an IR section on its webpage. For dividend-paying companies, there’s even useful information regarding the dividend (when is the dividend paid, dividend-paying history, an inbuilt calculator that tells you how much dividend you would receive over time with a number of owned shares, and their DRIP program).

After taking a cursory look at the main page of Adobe’s IR, I will make a beeline for any document that says “Investor Presentation” (usually under Events and Presentations).

An investor presentation informs readers of the company’s plans regarding current/future strategy, operations, and plans to increase the shareholder value of the company. It is an immensely useful document to get yourself up to speed with the company.

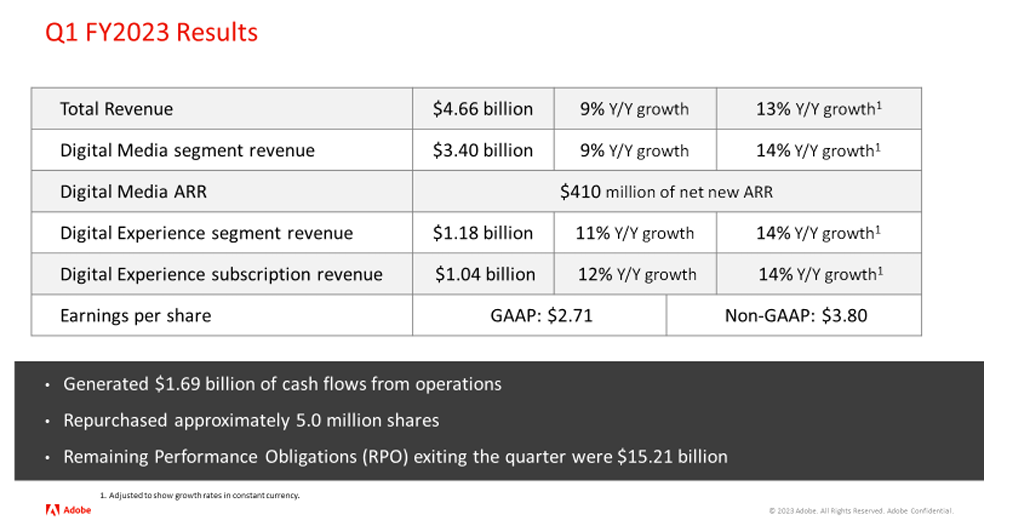

Adobe’s latest investor presentation (Adobe Q1 FY2023 Financial Analyst meeting slides) begins by listing its Q1FY2023 achievements and financial results (compared against its projections).

I do enjoy it when companies present their financial results in this manner as the side-by-side comparison allows you to ascertain if Adobe has managed to meet its expectations. This is the basics of fundamental analysis for a company’s performance which will help us later determine the proper company’s stock price.

As you can see, Adobe has been growing despite a much tougher 2022 operating environment. Companies that consistently underpromise and overdeliver are poised to compound good returns for shareholders, hence justifying their stock price. This is also a barometer of competent management.

Notice that the company has also been relatively aggressive in buying back its shares (5m shares), using free cash generated from its operations.

Step 4: Find the Company’s Strategy to Further its Growth in the Future

Adobe also highlights its current strategy and vision to make Adobe products more accessible and productive to both consumers and businesses.

Most of this information can typically be found in its Analyst Meeting presentation, where management goes beyond simply the scope of quarterly financials, to elaborate on the company’s overall business strategy.

Going through the document, I am extremely impressed by Adobe’s suite of mission-critical products (Photoshop, PDF, Illustrator, etc.), its reach across multiple industries, and the number of premier companies using its products. This highlights the stickiness of Adobe products across both retail consumers as well as businesses.

Step 5: Check out the Company’s Guidance

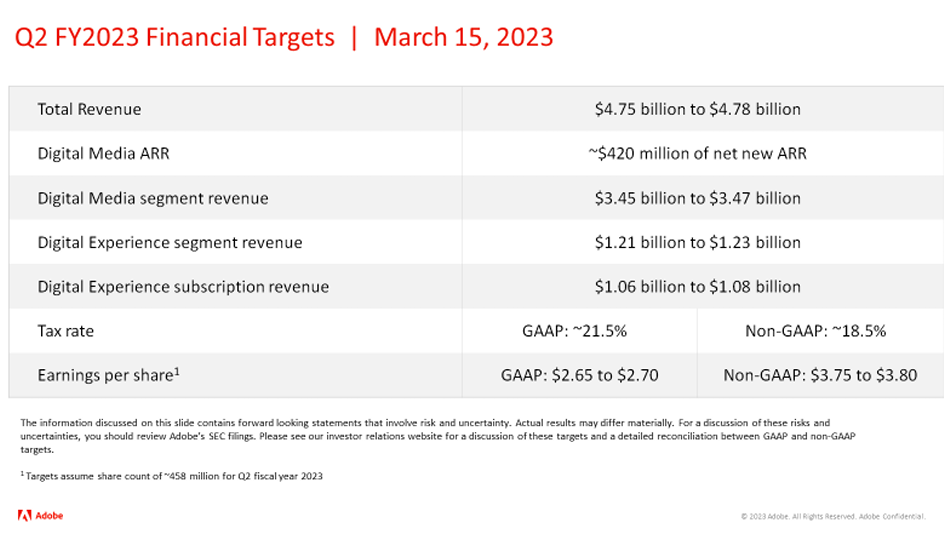

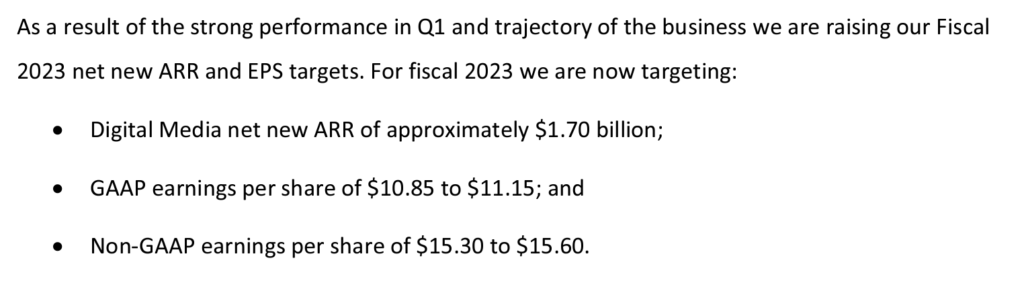

Finally, Adobe wraps things up by going through its financial targets for the upcoming quarter as well as on a Full Year basis. This is what the street typically falls back on to make its forward financial projection for the company.

Do, however, take the words of management with a pinch of salt, as their job is to paint a rosy picture of the company.

ADBE tends to be more conservative in its forward guidance, underpromising and overdelivering most of the time.

Adobe’s investor presentation is seriously impressive: simple to comprehend, detailed, and contains useful information pertaining to management’s strategy, and vision, as well as company-specific metrics to monitor for investors.

Unfortunately, this does not extend to every single company – Apple does not even have an investor presentation!

Before leaving the IR page, you can subscribe to their mailing list to ensure that anytime the company releases a piece of information (including SEC documents), you will be notified via email.

Step 6: Review the company’s SEC Documents

10K:

Does this mean I am ready to be done with my stock research? Absolutely not! Investor presentations are produced by companies to entice investment from retail and institutions. If you are a company trying to do that, wouldn’t you leave some less-than-ideal facts and unpleasant conditions out of the presentation?

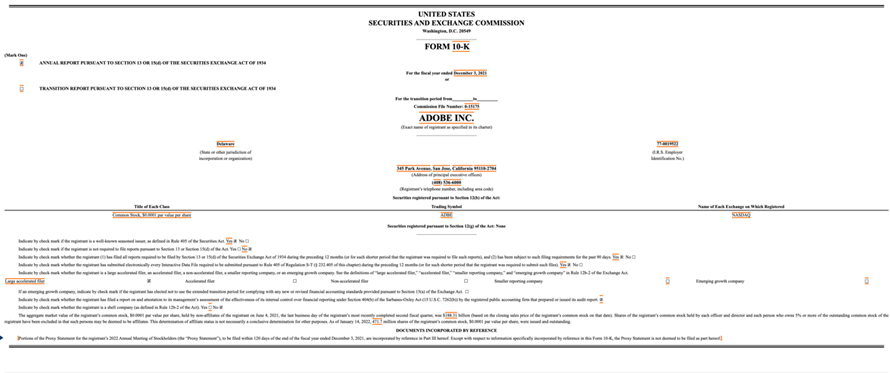

As such, to verify that the company is not hiding any unpleasantness, I will take a look at the company’s 10k document which is filed with the SEC. Every company listed on the stock exchanges has to produce a 10k document in which they detail the company’s performance over the entire fiscal year. Think of it as an end-of-year report card that a child (company) has to submit to their parent (SEC).

A 10k has to contain every single pertinent (accurate) information about the company. The company is not able to just omit/bury any undesirable or unflattering information lest it runs into severe punishments by the SEC. A company 10k is lengthy and filled with different legal and business jargon that makes it intimidating to beginners. However, I will reveal the steps I follow to scan through the 10k efficiently and effectively.

Step 1:

Finding the 10k

- There are 2 ways to go about it

- Use EDGAR (platform to obtain companies’ submitted SEC documents: completely free!)

- Type in the company name (Adobe) and click on it

- You will come to a page that looks like this, click more fillings, then scroll until you find the link that says Form Type: 10K – “Annual Report”

- 10K and other SEC documents can typically be found on the company’s IR page

- Use EDGAR (platform to obtain companies’ submitted SEC documents: completely free!)

Step 2:

Reading the 10K

- The 10K has a table of contents that looks like this

- Each section is hyperlinked which facilitates navigation

If you have the time, I would advise reading every word. However, there are only a couple of sectors that carry the meat of the document: Business, Risk Factors, Unresolved staff comments, Legal Proceedings, Management’s Discussion and Analysis of Financial Results, Financial Statements, and Executive Comp and Ownership.

Step 3:

Business Section

- The main chunk is from pages 3 – 8. Pages 9 – 17 go further into details regarding Adobe’s product offerings as well as how it conducts its operations.

- Easy! As a rule of thumb, if you do not understand how the business functions after reading and re-reading this section, do not invest in the company.

Step 4:

Risk Factors

- Broken into these sections:

- Company-Specific

- Industry-Specific

- Regulatory

- Stock specific

- General

- In my opinion, the more important sections are “Company and industry-specific” risks. The rest are just standard legal filler.

“Risks Related to operations of the business”:

Step 5:

Unresolved staff comments

- I like to see a “None” in this section. A workforce without outrage/dissent bodes well for the company – happy workers result in happy customers.

Step 6:

Legal Proceedings

- An empty section is ideal – no risk of a significant fine/regulatory action that disrupts the company’s operations.

Step 7:

Management’s Discussion and Analysis of Financial Results

- I strongly recommend reading through this section as management is telling you what to pay attention to as an owner of Adobe.

Step 8:

Financial Statements and Supplementary Data

- Absolutely critical. You can check out this previously written article on how to interpret financial statements:

Step 9:

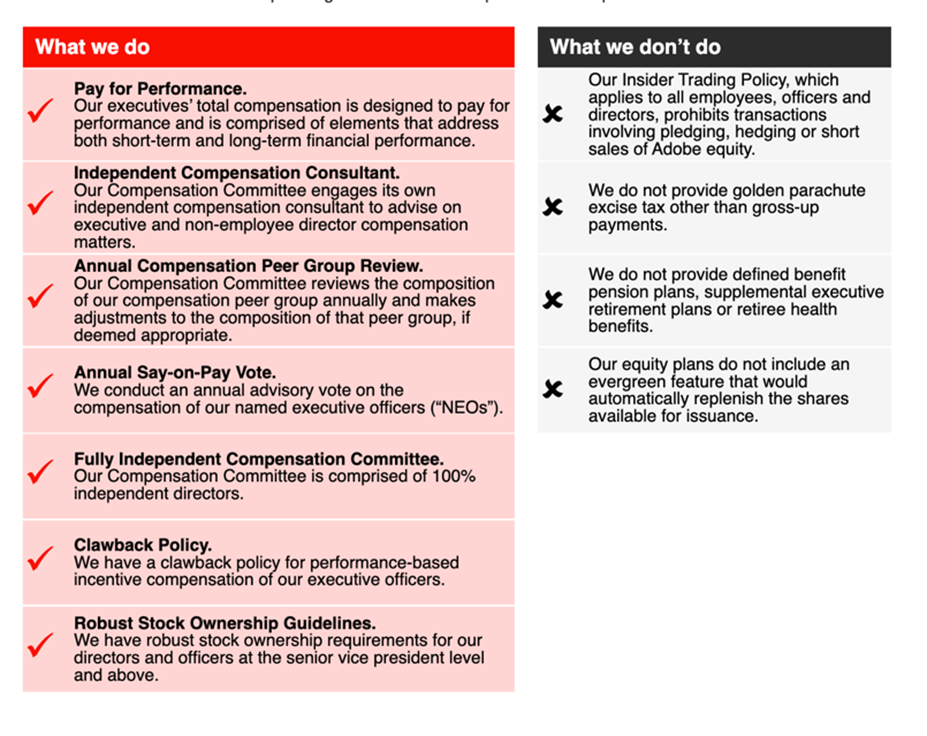

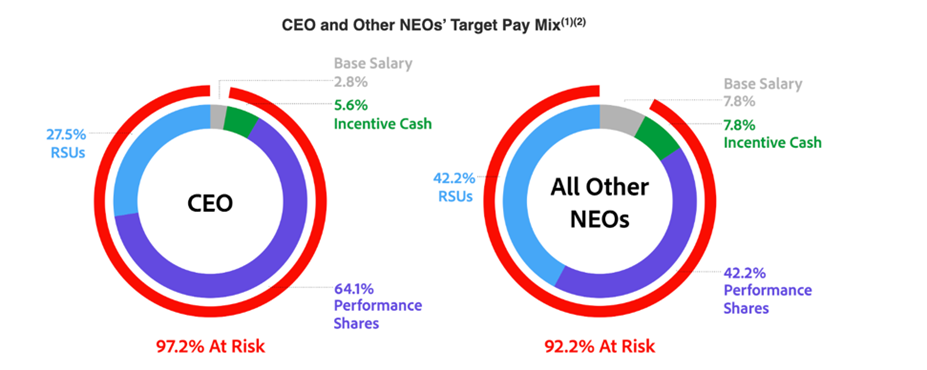

Executive Comp and Ownership (found in the 2022 proxy statement in the case of Adobe)

- You want to ensure that financial incentives are aligned with your long-term goals

- CEO / execs not overpaying themselves while underperforming for the company

- Important Metrics that determine executives’ Pay

- Revenue

- EPS

- Operating Income

- Important Metrics that determine executives’ Pay

- CEO / execs not overpaying themselves while underperforming for the company

I appreciate how a significant amount of compensation for Adobe’s executive team is made up of the granting of shares depending on the achievement of these objectives: total share returns over 3 years for Adobe shares and an increase in net sales and earnings.

- You want high stock ownership from insiders (Board, Executive Management)

- Aligned with shareholder goals

- Do their best in their jobs as they are financially incentivized

- Insiders only hold 0.42% of shares outstanding – while the figure is small, it is not that unusual for a giant company.

- Do their best in their jobs as they are financially incentivized

- Significant Insider Buying

- Huge plus – Insiders only buy stock significantly for one reason: they think it will go up

- Unfortunately, there is not much insider buying from insiders recently.

- Huge plus – Insiders only buy stock significantly for one reason: they think it will go up

- Aligned with shareholder goals

Viola! Now you will have an easier time reading a 10K. Some other SEC-filed documents that I monitor include the following:

- 8K

- Report of unscheduled material events / corporate changes at the company of importance to shareholders

- 10Q

- Quarterly performance card of the company

- Forms 3, 4, 5

- Detailing insider transactions and ownership of stock

Step 7: Check alternative sources of information

Last but not least, there are a couple of alternative sources of information that I rely on to further deepen my fundamental understanding of the company.

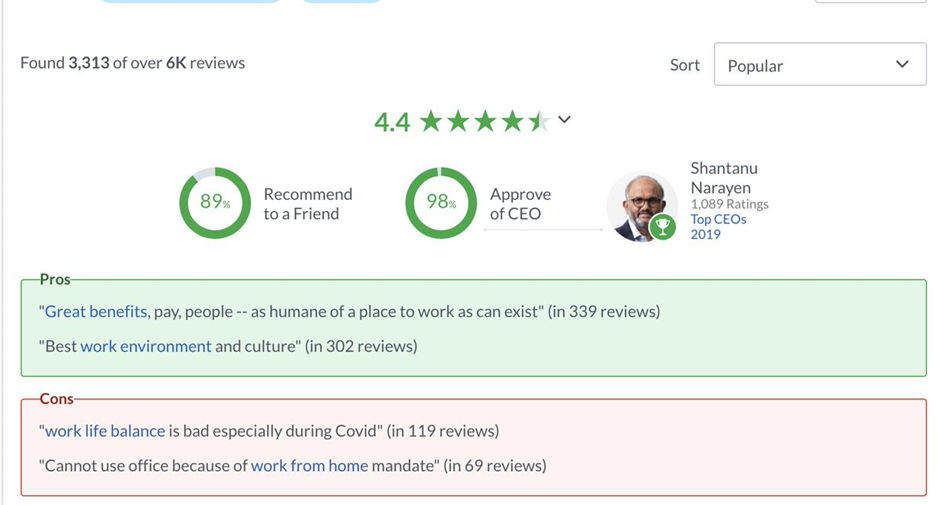

Glassdoor:

Glassdoor can be a great place to gain insight into the company’s working culture. They even have a function that rates the CEO! However, caution must be exercised if the number of ratings is low.

It appears that Adobe has an excellent work environment and their employees deeply respect their leader.

Social media forums

Sites such as Twitter, Stocktwits, and Seeking Alpha can be fertile grounds to look for other people’s thoughts on the company. Although it might take a long time to find a good piece of content, there are times when I have found genuinely great takes on companies that I have been researching.

A simpler process to find high quality growth stocks

And that closes my fundamental evaluation of Adobe. It is a well-managed, highly profitable, company with great growth prospects lying ahead of it. However, before electing to purchase a stock from the stock market, I still would have to value the company to see if it is currently undervalued.

Now the whole 7-step process of how to research a stock before you buy might seem like a relatively cumbersome one. It is the case, in all honesty, and such a process will only appeal to the most fervent stock investors or those who love digging into numbers (like yours truly).

However, most retail investors simply do not have the time (even though they now have the knowledge after reading this article) to do a real deep dive into the companies that they are interested in.

There is, however, a “short-cut” method to identify high quality growth stocks that you can invest in confidently. You see, years of being in the finance industry as both a buy-side analyst and sell-side analyst have allowed me to identify 5 key financial metrics that truly matter when it comes to selecting winning stocks.

I termed these as my Power of 5 metrics and it is what I used all the time to screen for high quality growth stocks such as ADBE to invest in confidently. These stocks are not your fly-by-night hypergrowth counter with a sexy story but can easily disappear overnight.

These are stocks that are typically the market leaders in their respective industries. The key is to find them through a data-driven approach. For those who are interested to learn more about this data-driven approach and how I use it to find high quality growth stocks like ADBE plus 20 other names, do find more details by clicking on the button below:

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.