Are retirement expectations too high?

Retirement is a pretty touchy topic for most people and here in sunny Singapore, it is no exception. While most of us will like to retire in comfort, without having to worry about $$$, how realistic is this dream going to be in a nation where the daily living expenses is one of the highest in the world. In this article, I will try to address the question of How much to retire in Singapore?

This article was first written back in end-2020, with additional data points and conclusion made in this new write-up.

According to this survey done some time back in May 2019, it was noted that a single elderly Singaporean needs S$1,379/month to meet basic living standards. A couple aged 65 and above would need $2,351/month.

This is just a broad guideline and the amount likely varies across individuals. However, it is always an ideal scenario to be over-prepared than under-prepared.

According to an OCBC survey done in Nov 2020, 78% of Singaporeans underestimate the amount required for retirement by more than a third, and 75% highlighted that they are not on track with their retirement planning either.

“The survey shows that Singaporeans are not very good at planning for retirement and the pandemic has even made it worse.”

Ms. Koh Ching Ching, OCBC’s head of group brand and communications.

There are several key issues highlighted:

- Singaporeans do not keep track of their monthly expenses in the first place

- They remain complacent over their financial health

- They feel that it is ok to start later and do not plan for retirement until they are much older.

A more recent survey done by Manulife in March 2021 highlighted that only 1 in 4 Singaporeans invested in a retirement plan, with 72% of retired respondents regret not saving for retirement sooner and almost half of them wish they had invested in a retirement plan.

Based on respondents” estimates, they believe that a retirement portfolio of S$1.1m is required to retire well. We will talk more about this magical six-figure retirement sum later.

All these issues compound in addition to the fact that their current expenses will likely “inflate” substantially in their retirement years and them searching “high and low” for the best savings accounts is not going to overcome the dire consequence of neglecting inflation.

Without a good head start in their retirement planning, many who only start taking action in their “twilight” years will realize that it is close to impossible to retire comfortably in Singapore, even with the aid of our pension scheme aka CPF LIFE.

That is why it is crucial that young adults in their 20s and early 30s start planning for retirement immediately. With time on their side, they will allow the power of compound interest to work its magic. While compound magic might seem like a non-issue in the short term (as illustrated in the comic strip below), its effect will be magnified in the long term.

Let’s use an example to illustrate.

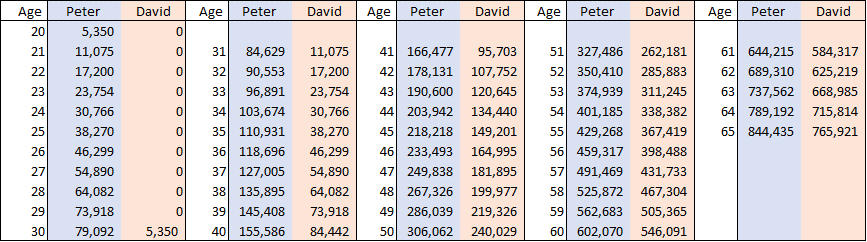

Let’s assume there are 2 friends, Peter and David, both of who are currently Age 20. Peter starts investing $5,000 annually immediately from Age 20 to Age 30 (10 years) for a total capital outlay of $50k. David on the other hand started investing only from Age 30 onwards to Age 60 (30 years) for total capital of $150k.

Guess who ends up with more $$$ at Age 65? Peter who started early and contributed only $50k ended up with a portfolio of $844k while David who started late and contributed a total of $150k capital ended up with a portfolio of $766k.

Start early!

In this article, I will be introducing my retirement calculation to demonstrate the hard truth that our pension funds (aka CPF) are likely insufficient in helping us retire in comfort and one will need to start investing conscientiously every month to achieve your magic retirement figure.

I will look to introduce this in a simple step-by-step guide while explaining the rationale and assumptions used in each step.

7-Steps process in calculating how much to retire in Singapore

Step 1: Determine your monthly retirement expenses in today’s dollars

As highlighted, the national survey done is that a single Singaporean will need at least S$1,379/month TODAY to get by comfortably.

Let’s assume we use a figure of S$2,000 in today’s dollars, after factoring in additional travel and holiday expenses (hopefully by the COVID-19 is no longer an issue). This is a rough estimation and the figure will likely vary substantially from one person to another.

I have previously written about a 9-steps early retirement plan which one can reference, to find out realistically how much YOU will need in terms of your current monthly expenses.

Step 2: Determine your monthly retirement expenses in future dollars

Again, we assume that the context here is a 30-year old, named John, looking to retire at the standard retirement age of 65. This means a 35-years horizon to retirement.

$2,000/month or $24,000/annum retirement expenses in today’s context will translate to an annual retirement expense of $67,500/annum by the time John hits 65 years old. This is due to the effect of inflation which we assumed is at 3% (Do note that our CPF LIFE min-sum is increasing approx. at a rate of 3% per annum).

“$24,000 today will have the same purchasing power as $67,500 in 35 years into the future, due to the effect of inflation”.

This annual retirement expense will be smaller for a current 40-year-old, named Peter, who will retire in 25 years time at Age 65. His retirement expense (assuming it is also $2,000/month in today’s context) at Age 65 will be $50,250/annum at an inflation rate of also 3%/annum.

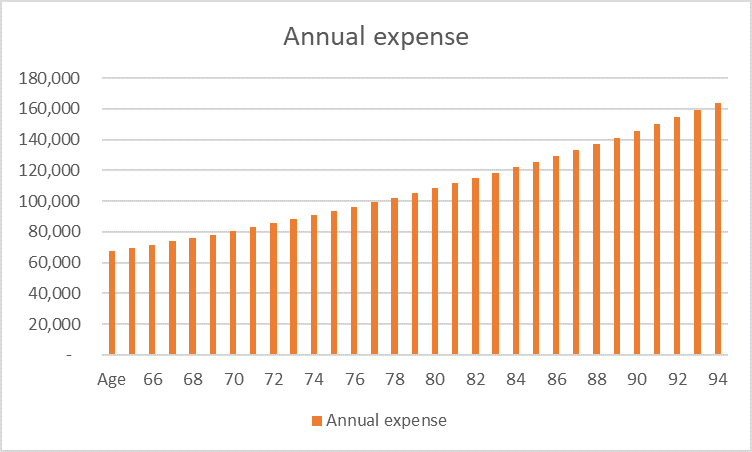

Note that the retirement figures for John and Peter thereafter are not going to remain stagnant, but going to increase at an assumed rate of 3% due to inflation (ie, Age 66 retirement expenses = 1.03 * Age 65 retirement expenses and so on and so forth).

Step 3: Calculate your future retirement liability

John has come to a rough conclusion that he needs $67,500/annum in retirement expenses when he is Age 65, increasing by 3% every year to the Age of 95 which he assumed is when he will pass away.

Some counter-argument with this growing annual retirement expense assumption is that the older we live, the less we will spend. Why would a 95-year old require an annual expense of $164k (yes, this is no typo)? That might be true in terms of spending on “luxuries” but one will also need to account for higher medical expenses as we grow older.

So, for argument’s sake, let’s assume that John’s retirement expenses continue to grow by 3% every year to mainly account for higher medical fees. As highlighted earlier, by the age of 95, his annual expense will now amount to $164k.

For John, that will mean a total retirement liability of $3.38m when he retires.

We get this figure by adding up the annual retirement expenses, adjusted for inflation, from Age 65 to Age 95.

Step 4: Calculating how much our pension fund can support us

Most of us will probably rely on our pension funds, aka CPF Life to fund our retirement expenses. Let’s do a quick calculation to see if that is sufficient to support a S$3.38m retirement liability. You can probably guess the answer!

We make a key assumption here that John can fully meet his Full Retirement Sum or FRS for short when he hits Age 55, which many Singaporeans can’t to be honest.

The FRS amount is $186,000 in 2021. Assuming the current 3% appreciation rate, this figure will be a hefty $389,000 in 25 years, when the current 30-year-old John is 55-years-old. We thus assume that John will have sock away S$389,000 in his CPF funds by 55-years-old.

This will translate to a monthly payout of approx. $2,805 (or annual payment of $33,700) when John hits 65-years-old. Assuming we go by the standard retirement plan (ie fixed monthly payment till death), John will be entitled to $33,700/annum from Age 65 till his death.

Notice that this FRS payout figure does not adjust for inflation, which might be problematic since our retirement expenses continue to increase alongside inflation.

One will immediately notice the shortfall. At age 65, John’s annual retirement needs are $67,500/annum (and growing due to inflation) while his CPF will only cover $33,700 of it (constant payout till his death as not adjusted for inflation).

At this juncture, one might be wondering. The $3.38m in future financial liability for a current 30-year-old is a “mind-boggling” figure. Does one need to become a multi-millionaire to live “decently” on a monthly expense of just $2k in today’s context?

Of course, in my scenario, I assumed constant inflation of 3%. If I used a 2% inflation rate, the $3.38m figure will reduce to $2m, and based on a 1% inflation rate, it will be “just” $1.2m. That is still a pretty big number for most. Can it be realistically achievable?

The short answer is YES but one will need to start investing ASAP. How much to invest? This will be covered in Step 5 where we determine how much John should invest per month and what is his ideal retirement portfolio by Age 65.

Step 5: Determine how much to invest per month to cover that shortfall

John’s shortfall at Age 65 is ($67,500 – $33,700) = $33,800. His CPF is likely only able to fund 50% of his retirement expense at Age 65 and this ratio will decline every year since his retirement expenses will continue to increase due to inflation while his CPF payout is fixed.

He needs to find out how much he needs to invest every month from now (when he is Age 30) so that he will have sufficient capital in his portfolio when he retires to fund the retirement expense shortfall.

Using my retirement calculator based on the key assumption that the market generates a before inflation-adjusted return of 7% (this means that the after-inflation adjustment real return is at a conservative 4%/annum), I calculate that John will need to invest “only” $490/month to cover his retirement shortfall.

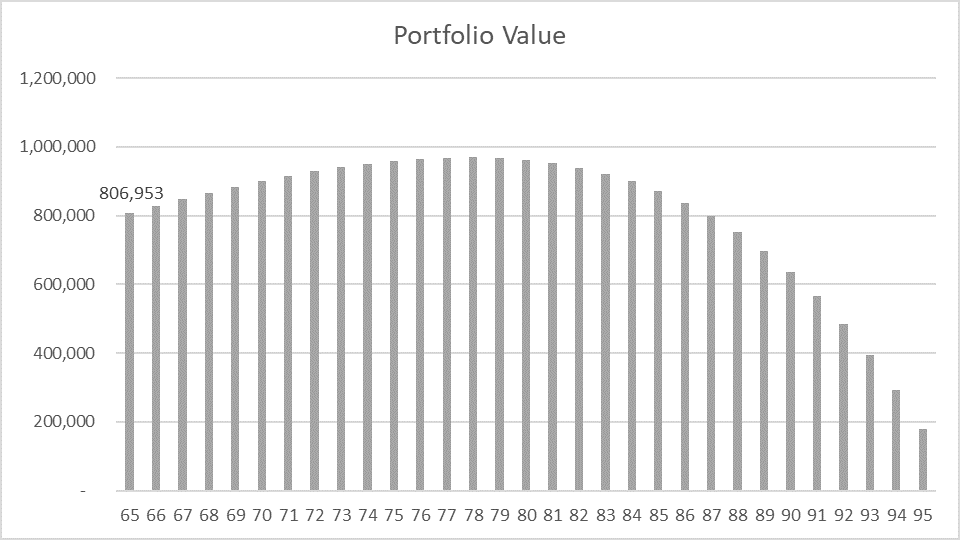

Specifically, when he retires at age 65, he will have $807,000 in his investment portfolio. Notice that this amount is drastically lower than his future liability of $3.38m over the next 30 years. This might give us some clue that the $1.1m expected retirement portfolio amount for a comfortable retirement highlighted in the Manulife Survey might be slightly over-inflated.

However, this $807k excludes his CPF retirement amount. If one includes the FRS figure of $389k (which John manages to hit when he is Aged 55, which will entitle him to approx $2.8k in monthly payout from Age 65 onwards), the total retirement portfolio will be close to $1.2m, which is slightly above the “ideal retirement figure”.

The question next is, how is a portfolio of $807,000 able to support a retirement liability of $3.38m over the next 30 years? Assuming that CPF Life covers a portion of that ($33,700*30 years = $1m), how is the shortfall of $2.38m going to be satisfactorily covered by the $807,000 in portfolio value at Age 65?

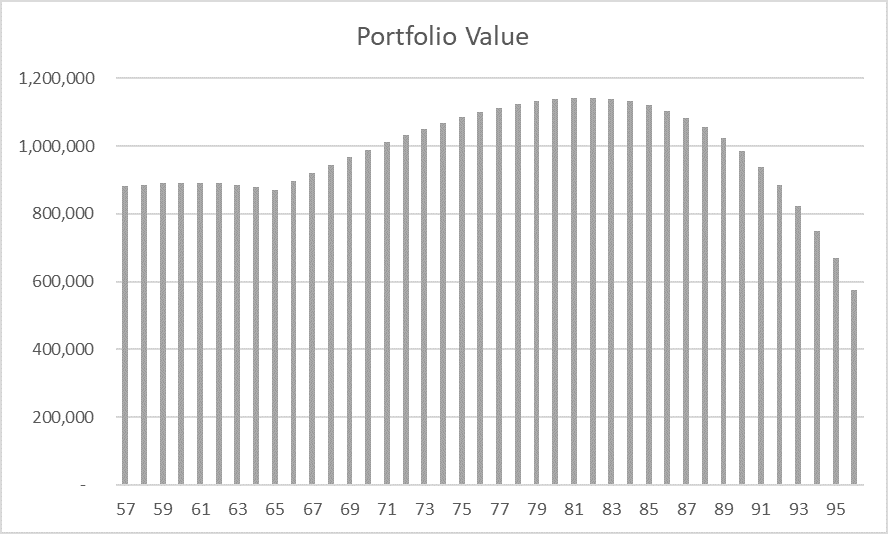

That is because John’s portfolio value of $807,000 at the start of Age 65 can continue to grow at an average market return of 7%/annum before inflation. Hence despite increasing annual retirement expenses, John’s investment portfolio will continue to grow and only peak when he is Age 78.

Thereafter, it will continue to decline and be fully “expensed” off after Age 95.

For Peter who started saving for retirement only at Age 40 (current age), while his future retirement liabilities are less than John ($2.5m vs. $3.4m), he will need to fork out $790/month vs. John’s $490/month to meet his retirement goals at Age 65.

Note that the retirement portfolio needs to be able to achieve an annual average growth rate of 7% (before inflation adjustment). If one’s portfolio asset allocation is too conservatively vested predominantly in bonds, there will likely be a shortfall.

Step 6: Find out when you can exit the rat race

For John, if he conscientiously put aside $490/month into his investment portfolio, he will likely have no issue in meeting his retirement expenses.

For Peter, who is starting his investing journey only at Age 40 today, he will need to save approx. $790/month if he wishes to also retire “comfortably” at Age 65.

For Peter, at age 65, he will have approx. $590,000 in his investment portfolio.

A current retiree’s (today at Age 65) retirement liabilities will be significantly less than a future retiree’s (35 years later) retirement liabilities due to the effect of inflation.

It might be erroneous to state that all who want to retire at age 65 will need to have a fixed $xxx in his/her account. Even with the same assumption used (monthly expenses in today’s term, inflation rate, market return, etc), this figure will vary according to the individual’s current Age.

If you are Age 55 today with 10 more years to retirement, you don’t need $807k (like John) in your retirement portfolio to retire well. That is because your future retirement liability (over the next 30 years) is NOT going to be $3.38m. It is going to be approx $1.6m. To fund that $1.6m, you will need to have a portfolio of approx $350k in 10 years’ time + FRS sum of $186k today = $536k.

Now that looks a lot more achievable vs. the blanket statement that one needs to have $1m in his/her retirement portfolio to retire well.

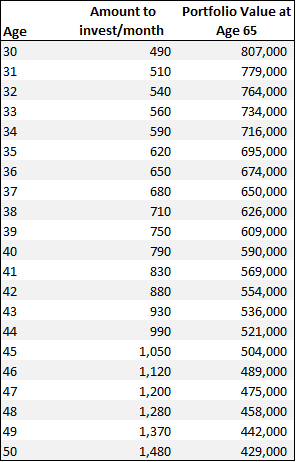

The table below illustrates the different monthly investment amount required based on starting investment age (assume zero retirement savings) and the respective retirement portfolio value at age 65 (the official retirement age in Singapore today is 62 but that is expected to be raised to 63 in 2022, with the government targeting to raise that figure further to 65 by 2030).

While the required portfolio value at Age 65 gets smaller, the monthly contribution will get significantly higher if one starts to embark on his/her investing journey late in the game (again assuming no additional savings beyond CPF LIFE).

Assuming you have a routine investment amount every month that you allocate to your investment portfolio, one can calculate the rough Age at which you can exit the rat race.

For example, instead of allocating only $490/month, John decides to be aggressive in allocating a larger portion of his savings, say $1,000 to his investment portfolio meant for retirement.

Based on the same assumptions, his $1,000 monthly investment will allow him to exit the rat race at age 57, 8 years earlier than his original planned retirement Age of 65.

At age 57, he will have approx. $880,000 in his investment portfolio. This amount will need to meet his full retirement expenses of approx. $53,000 that year (and increasing at a rate of 3%/annum) and for the next 7-years before his CPF Life funds kick in at Age 65.

Nonetheless, based on the assumption that the market continues to generate a return of 7% (before inflation, 4% after inflation), his investment portfolio should sufficiently cover his annual retirement expenses from Age 57 to Age 65 without seeing huge declines in portfolio value.

Step 7: Monitor your progress

You have started your investment journey and calculated what might be the year you can finally exit the rat race.

Now it is time to start monitoring your progress to see if you are indeed on track to meet your retirement goals.

Using the retirement spreadsheet, you can track your progress to see if you are indeed on track to meet your retirement goals.

Let’s assume that 5-years have passed (the Year 2025) and John, now Aged 35, will like to see if he is still on track to retire comfortably at Age 65 based on a monthly investment contribution of $490 (all other assumptions the same)

According to the retirement spreadsheet, he needs to have at least $36,200 in his investment account (excluding pension contribution) at the end of the 5th year.

If John has this amount in his investment portfolio, then he is still on track to meet his retirement goal of retiring comfortably at Age 65.

What if he has an amount that is significantly more, say for example $70,000 at Age 35 because he actively contributes his year-end bonuses, etc into his investment portfolio.

Can he now afford to retire earlier while maintaining his monthly investment contribution of $490?

By adjusting the year (from 2020 to 2025), age (from 30 to 35), and Initial investment portfolio value (from $0 to $70,000) in the retirement spreadsheet, he can calculate his new retirement year which is now at Age 60. That is 5 years earlier than the originally planned retirement age of 65.

This retirement spreadsheet can also be used to find out what is the potential retirement age if one already has a starting investment portfolio value (instead of at $0).

For example, David who is currently also age 30, has plans to contribute $490/month into his investment portfolio. This is similar to John.

However, he inherited $100,000 from his grandparents. So unlike John, who is starting his investment journey from scratch, David has the luxury of having a $100k “headstart”.

By inputting this initial $100k investment amount into the spreadsheet, David can afford to retire at age 55 which is substantially earlier than John.

For Peter who is currently Age 40 but is also starting his investment journey with $100k in his portfolio, he can now afford to contribute the same amount of $490/month and retire at age 61. This is in contrast to his required $790/month contribution and a targeted retirement Age of 65 if he is starting from scratch.

Conclusion

The key takeaway from this retirement planning exercise in finding out exactly how much is needed to retire in Singapore is that there is no magical retirement figure when it comes to retirement, even if everyone concurs that a median retirement monthly expense should translate to approx $2,000 in today’s dollars

If you are 55 today, you will need $536,000 in your investment portfolio (including CPF) when you retire in 10-years-time at Age 65. If you are 30 today, you will need to hit that magical 6-figure retirement number, in fact, slightly more at $1.2m when you retire in 35-years-time, also at Age 65. If you are 65 today and a newly “minted” retiree with $599k in retirement savings (as in the Manulife survey), this figure should be a comfortable figure to last you through for the next 30 years vs. the common notion that you need $1m. This is based on a “comfortable” monthly expense of $2k

This might seem unfair for the younger generations but that is reality, the direct consequence of inflation.

It will be erroneous to ignore the effect of inflation when planning for one’s retirement expenses in x-years away.

While my inflation assumption might seem overboard at 3% in today’s low inflationary environment, it might again be a “recipe for disaster” if one assumes a low-inflationary rate environment (and thus uses a small inflation rate figure in the calculation) for the next 3-4 decades amid persistent money-printing by central banks all over the world.

I tend to err on the side of caution.

It will also be a mistake to solely depend on our pension fund to fund our future retirement expenses/liabilities, one which can be a huge figure (and continue climbing) if inflation does rear its ugly head.

Nonetheless, despite the huge retirement liability a current 30-year-old might have to bear, this can be “easily’ managed with early retirement planning and starting his/her retirement journey ASAP.

Do note the major assumption used in the analysis which is the average annual growth rate of your retirement portfolio. If one is too conservative with his/her portfolio allocation predominantly skewed towards fixed-income assets upon retirement, then there will likely be a shortfall in retirement income based on the stated retirement portfolio size.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER STOCKS WRITE-UP

- Early Retirement Plan – A 9-Steps Ultimate Guide

- The IDEAL retirement portfolio structure

- Full Retirement Sum (FRS): > S$400k by 2050.

- Don’t let Sequence of Returns Risk be your retirement pooper

- Generating “risk-free” returns using SRS and the art of withdrawal

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.