Hedging with options to insure against a market sell-off

Previously, I wrote this article: How to hedge stocks. 5 levels of hedging. In that article, I explore various ways of protecting your portfolio, from the easiest way which is to simply keep cash to more advanced methods such as using leveraged inverse ETFs.

One of the hedging strategies involved using options (level 4 of hedging). This is not an intuitive method for most people, given that the usage of option is still often seen as a “black box”. However, in my frank opinion, options should be seen as a quintessential tool as part of your trading arsenal and not something to be feared of.

With the right knowledge, options can be extremely flexible, with one of its key valued functions as a hedging mechanism.

In this article, I will go slightly in-depth as to how hedging with options can be done to protect part of your portfolio. This might be of interest to NAOF readers amid the current volatile stock market climate.

Hedging is for protection, not speculation

Hedging strategies are used by investors to reduce their exposure to risk if a stock price falls or an asset, in their portfolio is subject to a sudden price drop.

Hedging should not be seen and used as a speculative tool, although the temptation is always there. Look at how Bill Ackman spectacularly made $2.6bn from his hedges vs. his $27m cost of buying that insurance. That is a payout of 100x!

I am not saying that Bill Ackman is a huge speculator here but such reports tend to “dramatize” the allure of hedging, encouraging people to go crazy buying protection, not as a means to protect part of their portfolio but to try and “time” and profit off a huge market correction.

I have been guilty of that in the past.

As Peter Lynch, the famous ex-fund manager of Fidelity once said:

“Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in corrections themselves”.

Peter Lynch doesn’t say investment portfolios won’t lose value during corrections and bear markets. Sure they do. However, investors that are focused on anticipating a bear market more so than having a sound portfolio with a solid long-term investment plan tend to lose more money buying too much protection than is needed.

Hedging when done right, reduces uncertainty and limit losses without significantly reducing the potential rate of return of your portfolio. That should be the aim. When used strategically, derivatives such as options can limit investors’ portfolio losses in a bear market.

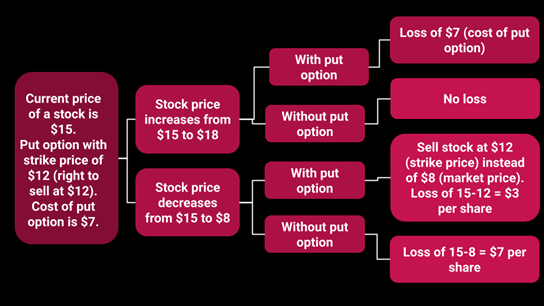

A put option on a stock price or index is a classic hedging instrument that can be used for portfolio protection.

Before I go into more details as to how I use Put options to hedge against downside risk, let me first briefly touch on how Put Options work.

Additional Reading: 3 Safe Option Strategies better than stock buying

How Put Options work

Put Options gives the BUYER the right to SELL an asset at a specified price (strike price) within a predetermined time frame (contract horizon).

Take, for example, Peter bought Stock ABC (a biopharma stock) for $20/share, believing that the price of this stock will go up. However, he is also concerned that Stock ABC might witness a huge correction, given how notoriously volatile biopharma stock price can be.

He decides to buy a Put Option with a strike of $15, paying $3/share in premium, with the contract duration effective for 1-year.

During the 1-year horizon, if the stock price of ABC goes up to $25/share, Peter will not have the incentive to exercise his right to Sell Stock ABC at $15/share. No one in their right frame of mind will do that.

He decides to let his Put Option “lapse” or expire out-of-the-money. He thus “foregoes” his $3 in premium he paid, but more than compensated that from the rise in Stock ABC.

However, if during the 1-year horizon, the intrinsic value of Stock ABC drops from its original cost of $20/share to $10/share, Peter now has the incentive to exercise his right to Sell Stock ABC at $15/share.

Instead of losing $10 from his investment in Stock ABC ($20 cost – $10 current value), Peter has mitigated his losses to $8 ($20 cost – $15 sales price + $3 premium cost).

By purchasing a put option, Peter is transferring the downside risk to the seller. In general, the more downside risk Peter (the buyer) seeks to transfer to the seller, the more expensive the hedging strategy will be.

This means that a higher strike of $18 (downside protection from this price onwards) with the same contract horizon will cost more than the $3/share in premium which Peter paid to seek downside protection from a strike of $15.

Similarly, the longer the contract duration, the more expensive Peter will have to pay for the “insurance” protection.

Let’s talk about this in the next segment.

Consider Expiration Date and Strike Price

Once an investor has determined which stock (stock with weak momentum perhaps or one which is fundamentally weak) or index they like to purchase a Put Option as a hedge, there are 2 key considerations:

- Days to Expiration (DTE) or simply the contract horizon

- The strike price (at which level they wish to start their downside protection). In Peter’s example, that price is $15/share. At any price below $15/share, Peter has the incentive to exercise his right to Sell Stock ABC at the higher price of $15.

When it comes to Put Options purchase as a hedge, I typically will select a long days-to-expiration (DTE) contract (typically 1 year and more) and select a Put Option strike that is out-of-the-money (OTM).

The key rationale is that such an option contract is relatively “inexpensive”.

Long Expiration Date

Let’s take for example the available Put Options on the SPDR S&P 500 ETF, one of the most liquid and widely traded ETFs in the world, whose performance looks to replicate that of the US S&P 500 index.

Say, David, whose portfolio consists of mainly US stocks, might wish to buy some protection to hedge against the downside movement of US stocks.

The current price of SPY is $376.23

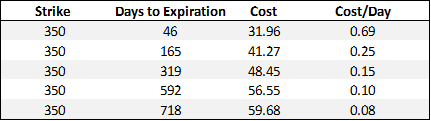

Using the same strike price, the table below shows the cost of the different Put Options based on the different expiration periods.

There are several observations from the table above.

The cost of buying Put Options (at the same strike price) is not proportionate to the days to expiration. In laymen’s terms, the cost of buying a Put Options contract with 165 days to expiration is NOT 3X the cost of buying a Put Options contract with 46 days to expiration.

While the Put Option cost is higher as the contract horizon increases (need to pay more for additional time for the price to potentially move in your favor), the cost/day drops as you extend the horizon.

The most “expensive” option (718 days to expiration costing $59.68/share) provides an investor with the least expensive protection per day.

This also means that put options can be extended very cost-effectively. If an investor has a 6-month put option on a security or index with a determined strike price, it can be “rolled” by selling off the original contract and replacing it with another contract with a suitably long horizon as well.

Typically, I will buy a long DTE Put Option with at least 1-year to expiration and when the remaining DTE falls to 3 months, I will look to either 1. Close off the contract and take my profits/losses or 2. Roll the contract to further extend the contract horizon.

By rolling a put option forward, I can potentially maintain a hedge for many years.

Strike Price

When it comes to the selection of the right strike price to purchase my put options, I will typically buy an out-of-the-money Put Option.

An OTM Put Option is when the strike price is BELOW the current market price.

Say, for example, the current price is $20 and I purchase a Put Option with a strike price of $15. This option is OTM.

Only if the share price drops below $15 will I (as the Put option buyer) have the incentive to exercise my right to sell my shares at $15 (when the market price is below that).

The reason for buying OTM options is because they are less expensive. A Put option with a strike of $15 will be less expensive than a Put option with a strike of $18 and that Put option with a strike of $18 will be less expensive than a Put option with a strike of $25.

However, the price of the stock needs to move from $20 to below $15 ($5 price drop) before it makes sense for me to exercise my $15 Put option whereas for the $18 Put option, that decline only needs to be $2/share.

Nutshell, the more expensive it is, the greater the probability of you potentially profiting from it.

The key question then is: What is the right balance between NOT over-paying for a Put option while yet balancing the potential profitability of the trade.

I like to purchase Long-Dated (first point) OTM Put Options with a DELTA (measures the sensitivity of the option price movement relative to the underlying price movement) of around 0.3-0.4.

The nature of these Put Options serves as a good hedging instrument in my opinion.

They are not overly expensive, neither are they extremely cheap which consequently reduces the effectiveness of the hedge.

As a rule, long-term put options with a low strike price provide the best hedging value. This is because their cost per day can be low. Although they are the “most expensive” in terms of the initial outlay, they are effectively the cheapest when you view the cost on a per-day basis.

When NOT to buy put options

However, there are occasions when hedging using Put Options (1 leg) might be costly. That is when the Implied Volatility Rank of the counter is high.

What is implied volatility?

Implied Volatility of a counter tracks the degree of price fluctuation seen in the stock over a specific period.

You will expect the implied volatility of a counter such as Tesla (significant price variation) to be higher than a more stable stock such as McDonald’s, all else constant.

However, does that mean that one should never buy options on Tesla because these options are perpetually “expensive” all the time?

A better gauge would be to use the Implied Volatility Rank (IVR for short) of the counter.

Take for example a relatively low implied volatility stock such as McDonald’s. Over 1-year, there will be periods where the implied volatility is higher vs. other periods.

The IVR gives a quick gauge as to the “expensiveness” of the counter now, benchmarked across a certain horizon (say 1-year).

For example, you would expect the implied volatility rank of McDonald (a low volatility stock) to be elevated during earnings season vs. normal periods. That is when you should NOT buy Put options to avoid overpaying for downside protection.

In such a scenario, it might be better to structure a bear put spread, which is another cost-effective hedging strategy.

How I use option hedges for the equity portion of my portfolio

It is important to note that Put options are only intended to help eliminate risk in the event of a sudden price decline.

A good hedging strategy is one that continues to favor a market uptrend (the market tends to drift higher on a longer-term basis) but yet provides some downward protection in the event of a sudden bear market.

Typically, I tend to implement a hedge that covers 30-40% of my equity portion of my portfolio.

Say, for example, my equity portion of my portfolio is valued at $100k. I will tend to ensure that around $30-40k of the downside risk is covered.

This can be done through Put Options. Using the SPY ETF as an example again, buying 1 Put Option contract (equivalent to 100 shares of stock) will give me exposure to roughly $376 * 100 shares = $37,600 worth of equity value.

However, one will need to take into account the Delta of the option purchase, ie the sensitivity of the option price movement relative to the underlying.

If SPY declines by $50 and the Put option value increase by $20, that option has a Delta of (20/50 = 0.40).

To ensure that I am getting the right level of hedging exposure, I need to multiply the equity exposure ($37,600) by the delta (0.40) to derive a net exposure of c.$15,000.

To have net exposure of $30k, I will need to purchase 2 Put Option contract with a delta of 0.40.

If the market trends higher, these Put Options will lose value and the delta will decline. I will thus “top up” my hedges accordingly.

For example, if SPY increases to $400/share, the delta of the 2 put option contracts might decline to 0.30 (increasingly OTM). The net exposure will thus be 2 * $400*100 shares * 0.30 delta = $24,000.

This is below my preferred net exposure of having 30-40% hedged (new portfolio value = 400/376 * 100,000 = $107,000

Required hedge value = 35% * 107,000 = $37,000.

I might thus add an additional Put option contract (with a delta of 0.30) to bring my total Put option contracts to 3, in this example.

Similarly, if the market declines, I might look to close off part of my hedges (if the value of the hedges exceeds 40% of my portfolio value) to offset my portfolio losses or roll the contracts to a lower strike price to take some profits off the table.

I will also close/roll the hedges when there are only 3 months to expiration.

Hedging with options: Use as part of a diversified portfolio

Hedging strategies should always be combined with other portfolios management techniques like asset class diversification and periodic portfolio rebalancing.

A well-diversified portfolio (across different asset classes with low correlation) will ensure that one sleeps well at night.

Take for example a $100,000 portfolio that has a 60% exposure to equity and 40% exposure to bonds. In a significant market bear market correction, say equity drawdown of 30%, the equity value will decline from $60,000 to $42,000.

Assume that the value of the bonds appreciates by 5% in this scenario, from $40,000 to $42,000.

Total portfolio value = $84,000 or a decline of 16%.

If the original equity portion ($60,000) is 30% ($18,000 exposure) hedged through “cheap” long-dated OTM put options, the hedge ($18,000 worth) value will now be (1.3*$18,000 = $23,400), translating to a profit of $5,400 which will help to partially mitigate the portfolio loss.

Total portfolio value + hedges = $84,000 + $5,400 = $89,400

Portfolio value decline = slightly north of 10% in a 30% bear market

While the overall hedged portfolio still loses money in a bear market, the 10% decline in portfolio value is not as significant as the 30% decline in a 100% equity portfolio or the 16% decline in the balanced portfolio (60% equity, 40% bond).

Additional Reading: Sell Puts to win in any scenario

Conclusion

It is always prudent to take some of your profits to purchase “cheap” Put Options as insurance against a sudden and swift market downturn.

I typically look to hedge 30-40% of my equity portion of my portfolio through long-dated OTM put options. I will periodically monitor my exposure and look to trim/add more put option contracts and close/roll them as and when necessary.

Long-dated options might seem expensive on an upfront cost basis (all else constant) but they are much cheaper when the cost is viewed on a per-day basis. This cost can be further reduced by purchasing OTM options. I tend to select OTM options with a delta of around 0.3-0.4 as my ideal strike prices.

This is my personal preference and is by no means the RIGHT or ONLY way of hedging using Put options.

At the end of the day, hedging using options should not be seen as a speculative way to profit from a potential bear market. That bear might never appear.

For those who are interested to find out more about how you can trade options effectively and how you can generate a consistent stream of passive income every month, do join me in this FREE 2 hours Options Training Session where I will share with you more about the flexibility of using options and how they can be a useful tool in your trading arsenal.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- How to hedge stocks: 5 levels of hedging

- Too late to buy Gold? How to play it with Options for >100% annualized ROI

- Best ETFs in Singapore to structure your passive portfolio

- Decoding Basic Investing Terms: A Beginner’s Guide (Part 1)

- Bitcoin Prediction: 5 reasons why its rise this time round might be sustainable

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.