Has inflation peaked?

Since mid-June, the S&P 500 has been on a “bear market rally”. While proponents from the bull camp such as Tom Lee from Fundstrat who believes that the downtrend is over and the S&P 500 is on track to hit his year-end target of 4,800, other naysayers such as “ almost perma-bear” Jeremy Grantham, insist that the worst is yet to come amid “superbubble” cycle.

One of the key drivers, in my humble opinion, which will continue dictating the direction of the market is inflation. This has been the buzzword over the past year. Everyone is talking about it and everyone seems to have their own conclusion to the all-important question. Has Inflation peaked?

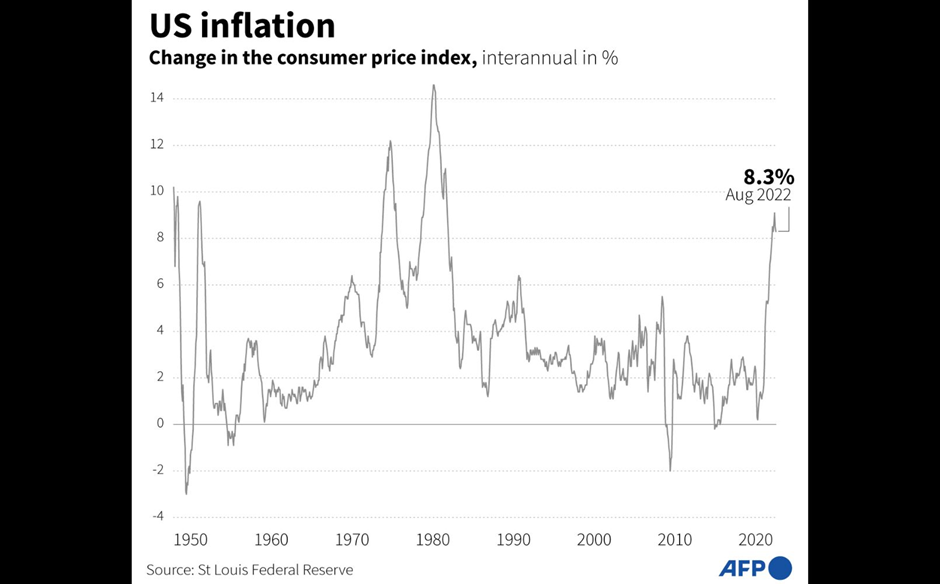

If I am to chime in and offer my 5-cent worth of view, I think it remains too early to pop the champagne just because the inflation figure has “moderated” from a sky-high 9.1% in June to (a still sky-high) 8.5% in July.

Yes, we are heading in the right direction, but the main factor contributing to that dip is the decline seen in energy/gas prices as well as commodity prices. However, those numbers could as easily “rally back up” in an instant amid the continual political uncertainty with regard to the Russia-Ukraine war.

Add the possibility of a Taiwan-China skirmish and the declining commodity price trend becomes a lot more uncertain.

On the other hand, there is the “sticky” inflation component that has yet to “rear its ugly head”.

Sticky Inflation

Sticky inflation typically refers to certain components that contribute to inflation that will go up and remain up. It is not as “volatile” as gas/energy prices which might exhibit more short-term variability.

The main example is rent. Rent tends to go up late in the cycle and then remain stubbornly high. Those inflationary items will be tougher to bring down than goods, energy, and commodity prices.

Another sticky inflationary contributor is wages.

Imagine your boss giving you a raise this month, in line with higher inflation numbers, and then cutting your pay the next month because inflation has declined.

If such practices become the norm, we will likely be witnessing anarchy on the street. Once your wage increases, you will expect that to stick, with the only path being UP from hereon, am I correct?

Structural inflation

When inflation becomes ingrained in our minds, it could become structural in nature. An extreme example is Japan but from a deflationary angle. In Japan’s case, prices have not risen and wages have stayed stagnant as the economy suffers from structural deflation forces for decades. It becomes a cycle that is tough to exit from, with the nation stuck in a deflationary mindset even after 20 years.

The same could happen to the world (just in reverse format) if we are not careful when it comes to managing inflationary expectations and ensuring it does not turn structural.

At present, that is a challenge. Take rent(shelter) for example. As seen from the chart above, rent picked up by 0.7% in July from June, and over the past year, this figure is up 6.3% vs. an increment of 3.5% in a typical year. Since rent accounts for 1/3 of total inflation, this is something to be mindful of.

As the Fed remains hawkish and raises short-term rates aggressively, this could well translate into higher mortgage costs, putting home purchases out of reach for many first-time buyers.

If people who would otherwise buy a home remain stuck in apartments and rented houses, it could further compound the booming demand for rental, pressuring rental prices to remain high. That might yet be priced into our headline CPI figures.

Hawkish Fed engineering a recession, but will it be soft?

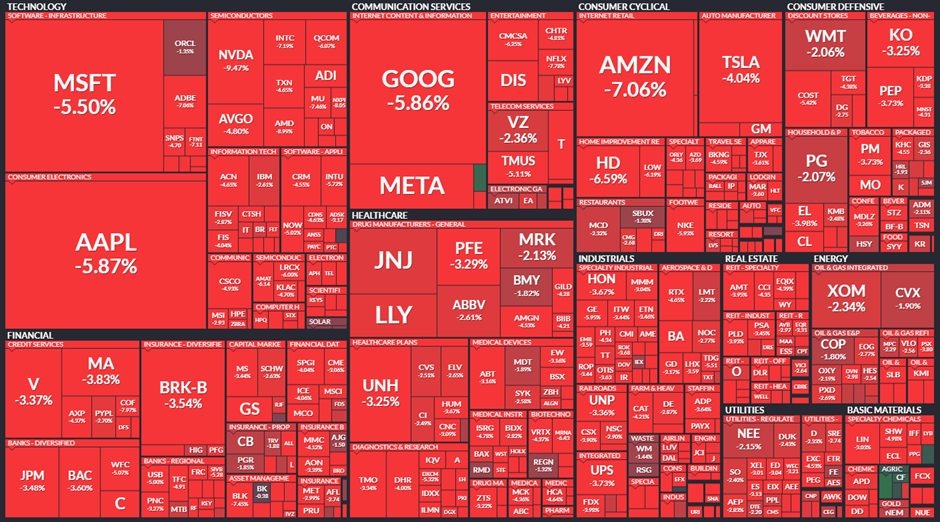

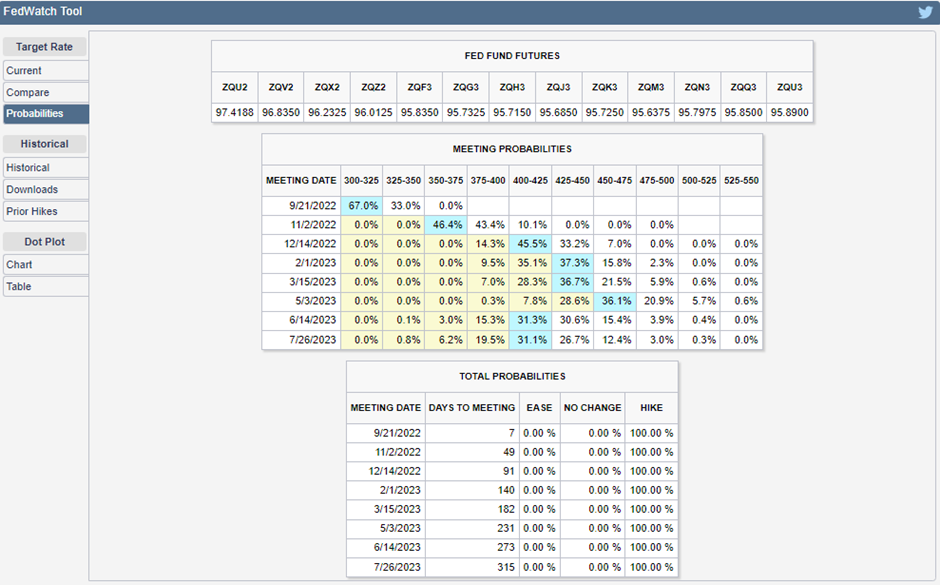

The Fed’s hawkish stance took the market by surprise which led to the market sinking significantly into the close last Friday.

With inflationary pressure “ebbing” in July, the expectations were for a more dovish stance on the part of the Fed. Instead, Jerome Powell broke that “thought-bubble” by insisting that rates will likely stay high for some time in a bid to combat inflation.

That hawkish stance significantly raises the odds of a recession next year as rising rates will come at the expense of future demand and growth.

The big question might no longer be IF a recession is happening but more towards WHEN will it happen and HOW BAD will it be when it comes to the overall health of the economy and consequently the translation to earnings declines for corporates.

What to do now?

September is typically a bad month for equities. The decline in September this year might be more pronounced if the August inflation data remains elevated. That will give the Fed more reasons to maintain their hawkish stance and for the market to finally “give up” on a quick Fed pivot into the dovish camp.

Another data point would be strong employment figures, where “good data is interpreted as bad”. A tight labor market will translate into a higher probability of wage-driven inflation. The latest data, however, point to the US adding the fewest jobs since early 2021 in August 2022.

September will also set the stage for corporates to assess the impact of how the forces of inflation might continue to impact their 3Q22 operational performance.

In the event that the street starts to downgrade corporate earnings in a big way, anticipating a recession in early 2023, could pave the way for more downside pressure on the market.

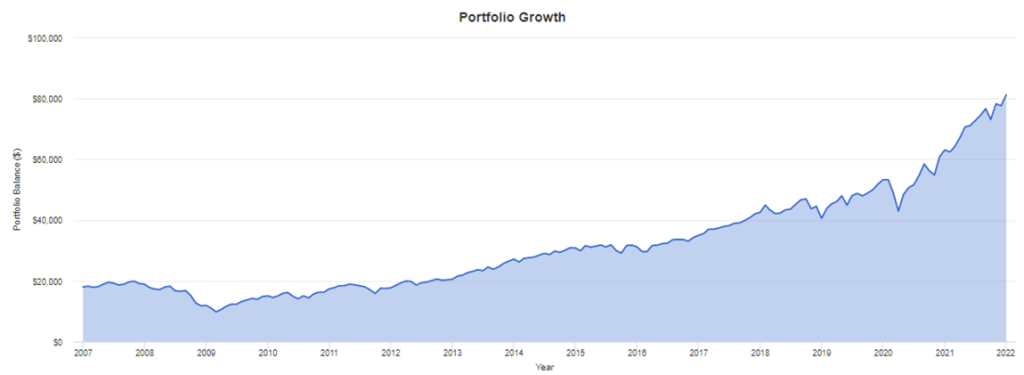

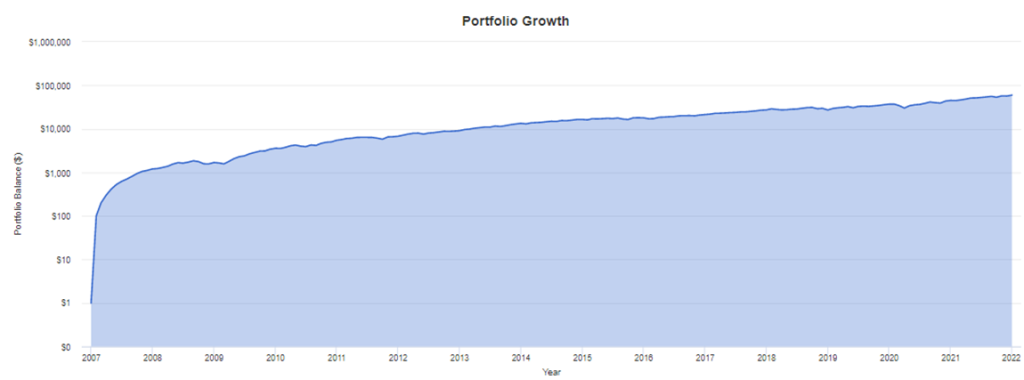

While I have got no crystal ball to predict the temperament of the market, what I know is that it still pays to remain in the market for the long run and a subsequent market sell-off, if that happens, will provide me with the opportunity to “buy when there is blood on the street”.

I have a list of stocks that I termed as my Alpha Blueprint Stocks. These are companies that are the market leaders in their respective industries, are fundamentally robust to withstand an economic recession, and have the necessary resources to capitalize on opportunities just when their peers are facing financial difficulties as a result of a deteriorating macro environment.

These are the stocks that I am readying my war chest to BUY MORE when there’s blood in the street, even if some of those blood is my own.

There are currently 3-4 blue-chip companies in this list that are in my “strong valuation zone”. Note that despite their superior fundamentals and growth potential (these stocks are still expected to generate a minimum of 10% EPS growth in 2023), these stocks are not immune to the tantrums of the market.

But that also presents the perfect opportunity for me to increase my shareholdings in these highly cash-generative, highly profitable companies, now trading at a discount.

For those who are interested in using a simple but yet effective strategy to identify winning companies that can withstand the test of time, do click on the link below for more information.

Conclusion

I am not a perma-bear. But neither am I a “hopeless” bull chanting BUY, BUY, BUY come what may. It pays to be cautious at this juncture but that should not lead to “action paralysis”. Take this opportunity to review your portfolio while yet positioning yourself to capitalize on “once in a lifetime” opportunities when they so present themselves.

While I have my personal doubts that inflation has peaked, as per the arguments in this article, I could be wrong. This article is not meant to be seen as giving financial advice, so please do your own due diligence work.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only