Table of Contents

Possible for the average Singaporean to achieve?

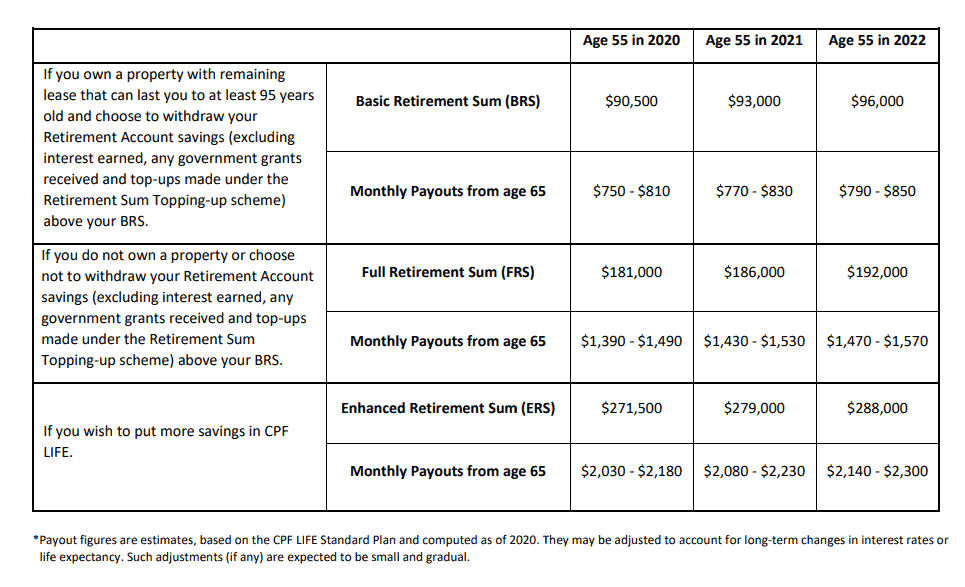

The Full Retirement Sum (FRS) in 2020 is at S$181,000. This means that if you hit Age 55 in 2020, this is the amount you NEED to set aside in your CPF account to contribute to CPF LIFE when you hit Age 65.

As most Singaporeans would already have noticed, the Full Retirement Sum has been steadily increasing. From S$80k in 2003, that figure is now at S$181k in 2020. That is a CAGR of 4.92% over this period.

The government has already stipulated that the Basic Retirement Sum (BRS) will increase from S$90,500 in 2020 to S$93,000 in 2021 and S$96,000 in 2022.

Correspondingly, the Full Retirement Sum, which is essentially BRS X 2, will be S$181,000 in 2020, S$186,000 in 2021 and S$192,000 in 2022. The Enhanced Retirement Sum (ERS), calculated as BRS X 3, equals to S$271,500 in 2020, S$279,000 in 2021 and S$288,000 in 2022.

The table below, derived from CPF, summarizes the key figures and the differences between Basic Retirement Sum and Full Retirement Sum/Enhanced Retirement Sum.

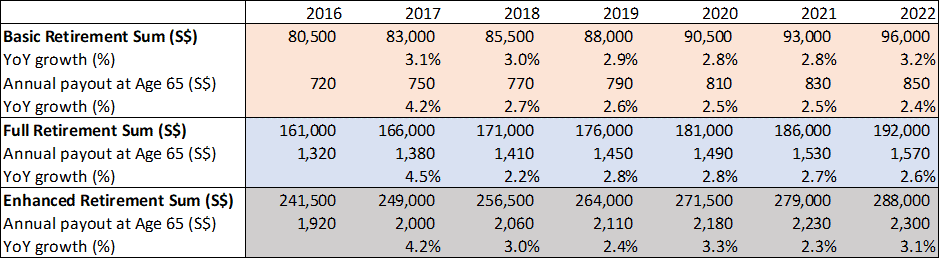

Before I touch on the topic of whether meeting the Full Retirement Sum is achievable for the man in the street, it is noteworthy to discuss the rate of increase of the various retirement sums since 2016.

Rate of increase of CPF retirement sums

As can be seen from my table below, the Basic Retirement Sum has increased from S$80,500 back in 2016 to the projected S$96,000 in 2022. We can observe that the YoY increment is approximately 3% each year. To be exact, the CAGR for the Basic Retirement Sum is 2.98%.

We should expect the CAGR for Full Retirement Sum and Enhanced Retirement Sum to be exactly the same, given that they are multiples of the Basic Retirement Sum.

Compare this to the actual inflation rate in Singapore (2016: -0.53%, 2017: 0.58%, 2018: 0.44%, 2019: 0.67%) and one might be wondering is there a need for such a “rapid” rise in the respective retirement sum amount. Of course, this might be the government’s way of being conservative, so to speak. In addition, this rate has also declined from the 17 years CAGR of 4.92% we highlighted earlier.

What is more interesting to note is the subsequent payout when one hits Age 65 and hence entitled to the payment. In this illustration, we use the maximum payout amount for the Standard Plan.

For Basic Retirement Sum, the payout amount increased from S$720 in 2016 to a projected S$850 in 2022. (Do note that these figures are all estimates given at the point of time and subjected to some minor changes). This is a CAGR of 2.81% which is slightly lower than the 2.98% annualized rate of increase seen in the Basic Retirement Sum.

For Full Retirement Sum, the payout amount increased from S$1,320 in 2016 to S$1,570 in 2022, representing a CAGR of 2.93% while for the Enhanced Retirement Sum, the payout amount increased from S$1,920 in 2016 to S$2,300 in 2022, representing a CAGR of 3.06%.

So far, it seems like the projected rise in retirement sum amount is more or less translating to higher monthly payout amounts from Age 65 onwards.

Additional Reading: The Average Salary in Singapore

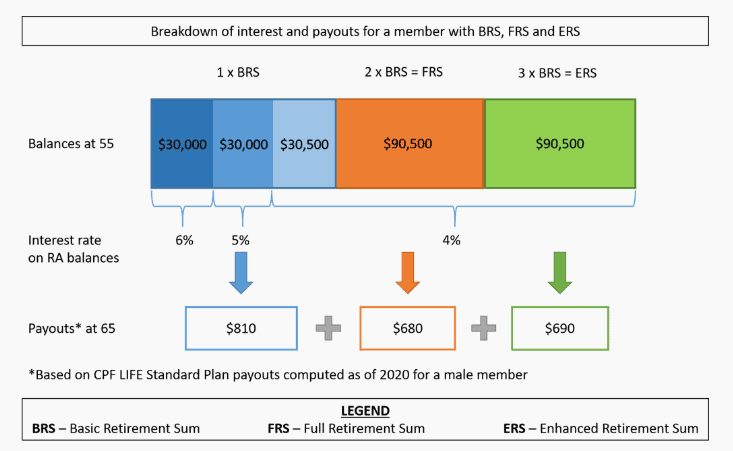

Payout not proportionate

At this juncture, one might notice that the payout amount for the Full Retirement Sum and the Enhanced Retirement Sum is not a simple X2 or X3 of the Basic Retirement Sum amount. For example, the Basic Retirement Sum expected payout is S$850 in 2022. “Theoretically” the Full Retirement Sum payout should be X2 of this amount (S$1,700) since the Principal amount is 2x right.

However, that is not the case, with the projected amount only at S$1,570 vs. S$1,700.

CPF explained that this is due to the difference in the interest rate that your savings are accruing.

For the first S$30k, it is generating interest at 6%. The next S$30k generates interest at 5% and the remaining at 4%. Hence due to the higher interest amount generated for the first S$60k (at 5-6%), the comparative payout amount for Full Retirement Sum and Enhanced Retirement Sum is not a simple multiplication (x2 or x3) of the Basic Retirement Sum payout amount.

Can the average Singaporean meet the Full Retirement Sum amount at Age 55?

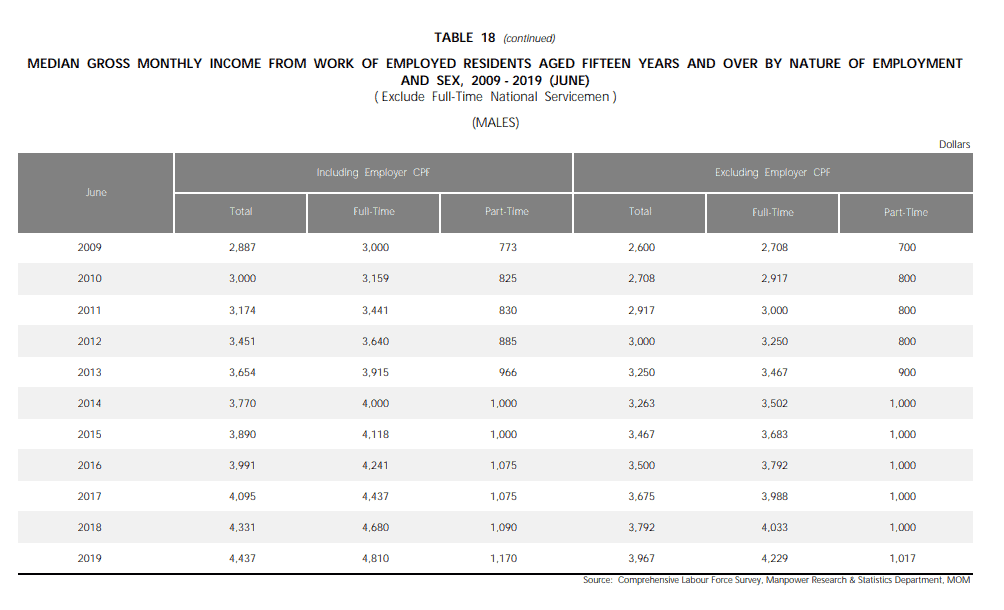

Coming back to our question: Can the Man In The Street generating a Median Income be able to meet the Full Retirement Sum amount at Age 55? That will be a sum of more than S$400k! For a reference point, the median Singaporean Income in 2019 stood at S$4,229/mth excluding employer contribution.

Sounds like mission impossible? Let’s see if the average Singaporean generating a median pay can achieve that. In our analysis, we also took into consideration the purchase of an S$400k HDB flat when the Singaporean is at Age 30.

key assumptions:

Assumption #1: The Full Retirement Sum increases at a rate of 2.98% from 2022 onwards. This means that someone starting at Age 27 in 2020 will see his/her Full Retirement Sum increase from the current S$181,000 to S$412,000 when he/she is 55 years old.

Given the current trend, it might seem that S$412,000 is a pretty realistic Full Retirement Sum assumption that one should expect in 28 years time.

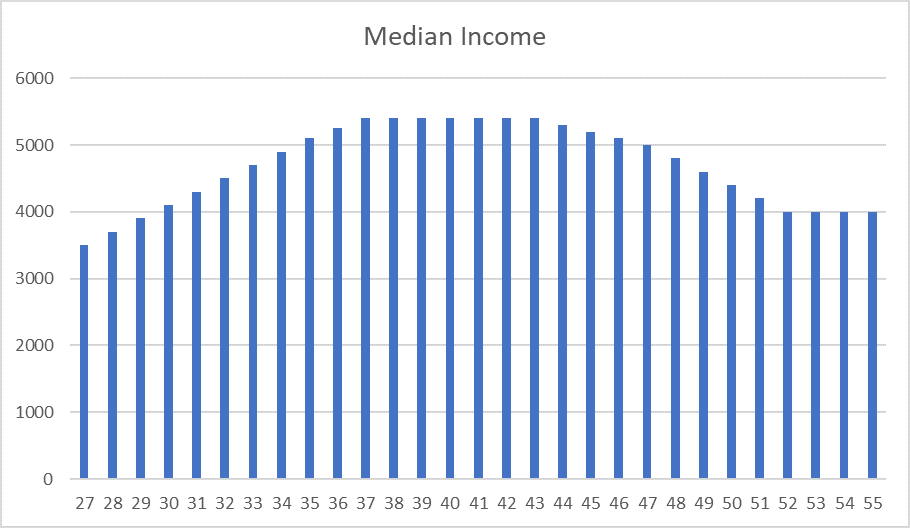

Assumption #2: We assume the man in the street generates a median income which follows a bell-shaped curve that peaks when he/she is in their early 40s with a decline thereafter. This is based on the data gleaned from the Ministry of Manpower.

This median income figure is based on today’s context. In order to have a more realistic and like-for-like comparison, we adjust the yearly median income by a 1% inflation rate.

For example, a 27-year-old, who is currently earning S$3,500, is expected to earn S$5,400 when he is 40 years old (based on median income). However, we need to adjust that S$5,400 figure to account for inflation. This will be assumption 3.

Assumption #3: The median income (based on 2019 figures) is subsequently adjusted for a 1% annual growth in the inflation rate.

This will bring the peak income amount from the current S$5400 to approx. S$6,330 at the age of 43.

Assumption #4: CPF OA balance is used to pay the down payment of an S$400k HDB flat, with the bare minimum payment of 10% of the cost of the flat (split between 2 parties so S$20k each). The remaining amount of S$360k is a loan from HDB at 2.6% interest cost. This translates to S$1634 in monthly mortgage payments. We round that up to S$820/month in mortgage payment for each pax.

With those figures in mind, we generated the table as seen below.

Recall that our target was to achieve S$412k in Full Retirement Sum figure for the man-in-the-street generating a median income.

After adjusting for a 1% inflation rate, it does seem like the Full Retirement Sum figure just misses the mark at S$405k.

We have been CONSERVATIVE in excluding certain figures in our calculation above, such as YEAR-END BONUS accrual, the extra 1-2% interest rate for OA and SA for the first S$20k, etc. Hence, the Full Retirement Sum figure is likely still achievable at the end of the day after adjusting for these figures.

Another key factor is the purchase of the home.

Homeowners taking an HDB loan to finance their home purchase previously have to use up ALL of their available CPF OA funds to pay for the flat before taking an HDB loan. However, from August 2018 onwards, they can choose to leave up to S$20k in their CPF OA to benefit from the extra 1% interest rate.

In our illustration above, the purchase of the HDB flat was made at Age 30. At the end of Age 29, there is only an accumulated OA balance of S$32,494. Note that, he can choose to leave S$20k in his OA, with the remaining balance of S$12,494 to pay for the 10% downpayment. However, since this figure is lower than S$20k required (per pax) for the 10% downpayment, there will be less than S$20k remaining in his/her OA account after the payment.

What happens when the home was instead purchased at a later date, say at Age 33 (instead of 30). Let’s take a look.

Assuming that the purchase of the HDB flat was instead made at Age 33, with a remaining OA sum of S$73,903 at the end Age 32. After subtracting the S$20k maximum figure, there will be a remaining amount of S$53,903 which theoretically goes to fully fund the HDB loan.

In this case, the remaining outstanding loan will be $400k – $53,903*2 = S$292,194. We are assuming that both homeowners have the same earnings power here. We reduce the mortgage repayment years from 25 years to 22 years (so we have the same fully-paid home at Age 55). At a 2.6% HDB loan, the mortgage payment would be S$1,454/month or S$727/month for each individual.

That translates to an annual payment of S$8,724.

Interestingly, the significantly higher mortgage down-payment did not negatively impact the final sum. In fact, the ending balance figure of S$437k is significantly higher than in our first illustration.

Conclusion

It is achievable for the average Singaporean generating just a MEDIAN income to meet the “exorbitant” Full Retirement Sum, which will likely be in excess of S$400k in 2050.

We have to factor in a 1% annual inflation growth rate for the gross income.

When it comes to housing, our analysis seems to imply that if the CPF OA account is left to compound for a longer period (ie, house purchase using CPF OA funds is made in the later years) before mortgage withdrawal, it will increase the final amount of CPF balance.

Our analysis also points to the conclusion that it will be better to pay off as much mortgage loan as possible to save on mortgage cost

In both scenarios, we assume a fully-paid mortgage at Age 55.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- DIVIDENDS ON STEROIDS: A LOW-RISK STRATEGY TO DOUBLE YOUR YIELD

- STASHAWAY SIMPLE. CAN YOU REALLY GENERATE 1.9% RETURN?

- WHY I AM STILL BUYING REITS EVEN WHEN THEY LOOK EXPENSIVE

- TOP 10 FOOD & BEVERAGE BRANDS. ARE THEY WORTHY RECESSION-PROOF STOCKS?

- THE BEST PREDICTOR OF STOCK PRICE PERFORMANCE, ACCORDING TO MORGAN STANLEY

- TOP 10 HOTTEST STOCKS THAT SUPER-INVESTORS ARE BUYING

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

4 thoughts on “Full Retirement Sum (FRS): > S$400k by 2050.”

Thanks for the information!

hey rick, my pleasure. thanks for dropping by