Table of Contents

Popular Investment Strategies

Most investors are familiar with the 2 Key Investment Strategies: Value & Growth Investing. However, there are other investment strategies that an investor can select to replicate.

Take for example, if one wishes to invest in stocks that recently IPO, can that be done?

How about investing in stocks that have been recently spun off by their parent company? Or what if you wish to invest in stocks with a focus on quality, or a focus on share buybacks?

These investment strategies go beyond just the typical value or growth investing and one can seek to take part in these strategies easily through Exchange Traded Funds.

Exchange-traded funds or ETFs for short are an ideal investing tool that a beginner investor can use to partake in various investment categories such as stocks, bonds, commodities, FX, etc.

There are also many investing strategies that one can partake in using ETFs. In this article, I will highlight 19 of the top ETF Investment Strategies and their associated ETFs which one can purchase to replicate the related investing strategies.

The information is presented in no particular order, although I will highlight in Part 2 of this 2-Part series, which of these investment strategies have been the best-performing ones over the past decade.

Additional Reading: Best Performing ETFs (2023)

ETF Investment Strategies #1: High Beta

One can select to invest in a basket of high beta counters, ie stocks with the highest sensitivity to market movements (or often termed as beta) over the past 12 months. For example, if a stock has a beta of 1.5, this would mean that on average over the past 12 months, the price movement of this stock is 1.5x as sensitive as the underlying market (the S&P 500 is often used as a gauge).

This means that if the market moves up by 1% on any given day, one should expect the counter to see a price increment of 1.5% on average.

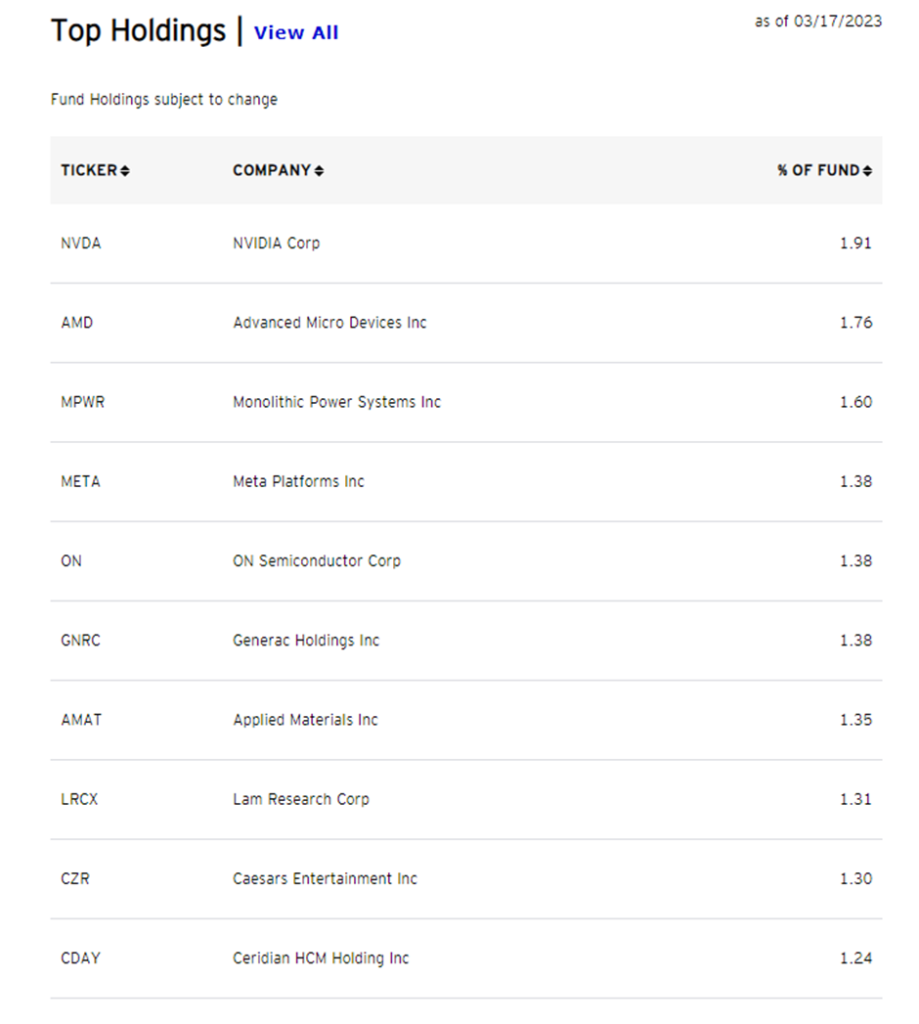

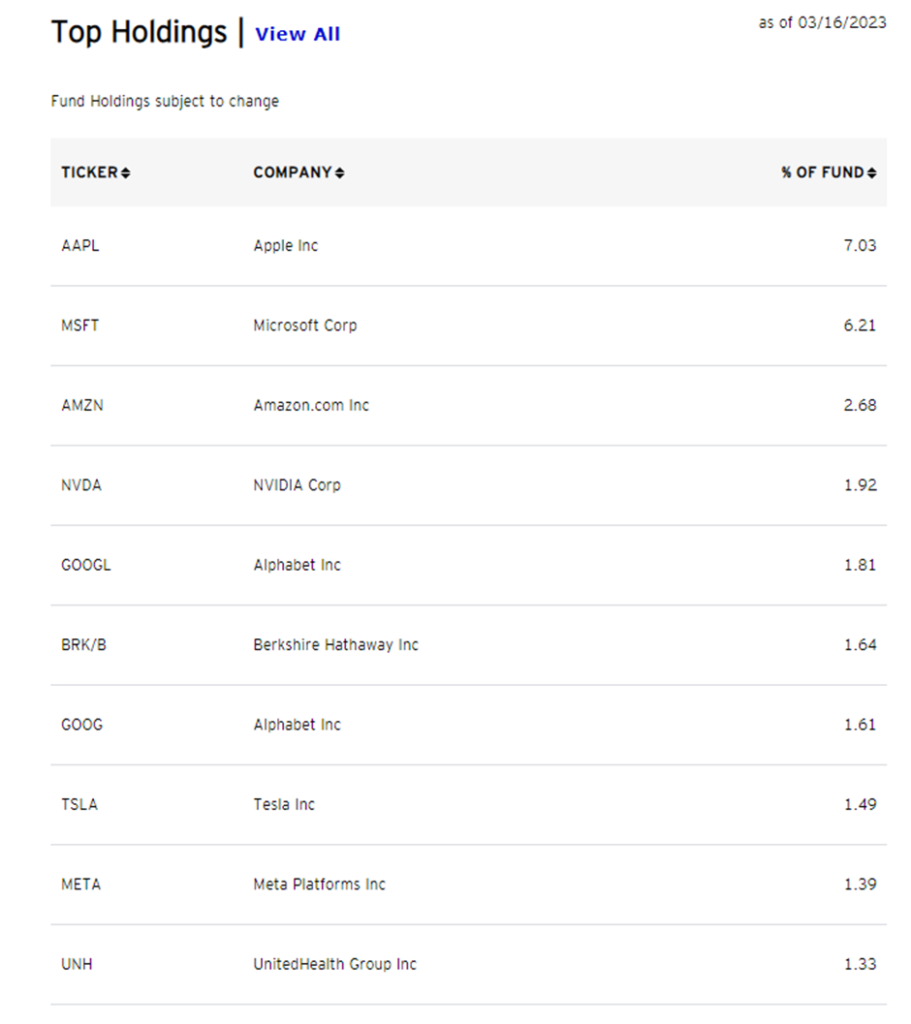

One way in which an investor can partake in a basket of high-beta stocks is through the Invesco S&P 500 High Beta ETF (SPHB).

This ETF consists of the 100 stocks from the S&P 500 index with the highest sensitivity to market movements.

Not surprisingly, tech-related counters encompass a sizable percentage of the holdings here (46%)

ETF Investment Strategies #2: Developed Markets (ex-US) with High Momentum

For diversification beyond US-related stocks, one can also select an investment strategy for some of the largest companies in developed countries but with a slight twist, that being possessing powerful relative strength characteristics.

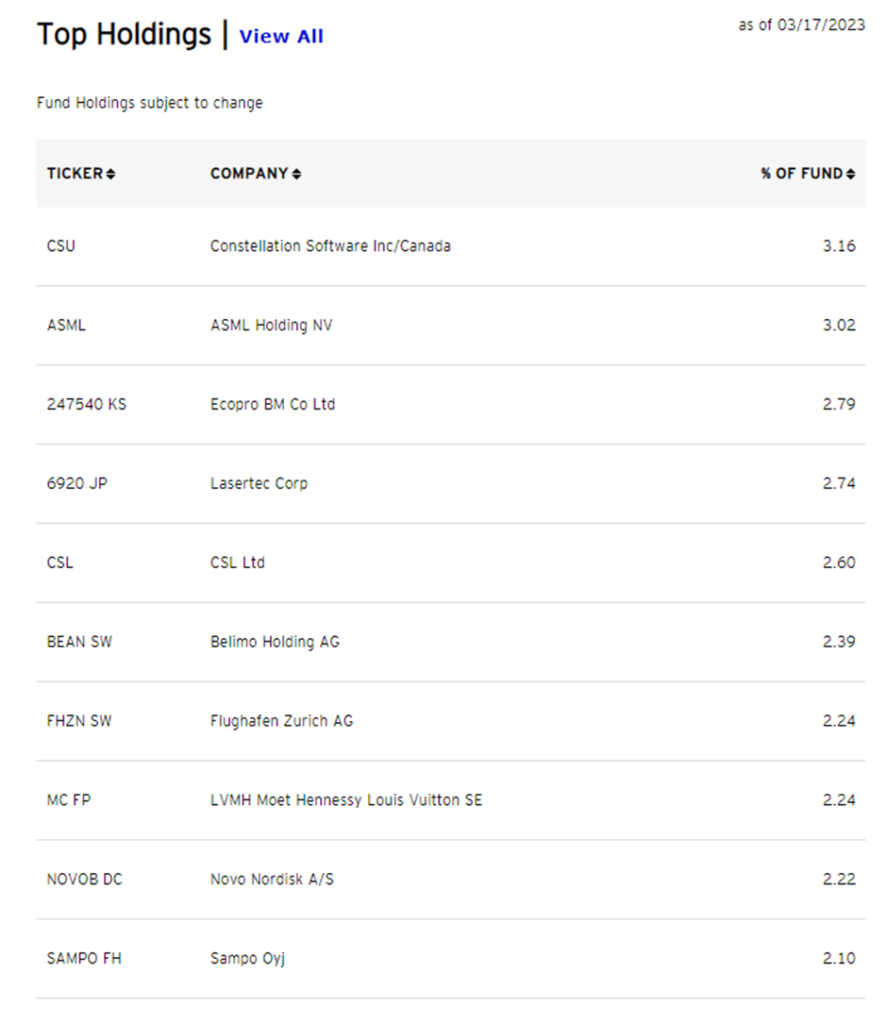

One way to do that is through the Invesco DWA Developed Markets Momentum ETF (PIZ)

Many of these companies vested in this ETF are incorporated in developed countries (but not limited) such as Australia, Canada, Finland, France, Germany, Hong Kong, Italy, Japan, Norway, Portugal, Singapore, Spain, Switzerland, etc.

Most investors would not be familiar with the companies in this list, with its top holding being Constellation Software, a Canadian company.

Its #2 holding is a somewhat more familiar name, ASML Holding.

ETF Investment Strategies #3: High Quality

Investors can select to invest only in the highest quality names, which is one of the most popular investment strategies out there. High-Quality names have consistently shown to outperform their peers, both in good and bad times and this strategy is also the cornerstone of our Stock Alpha Blueprint Portfolio.

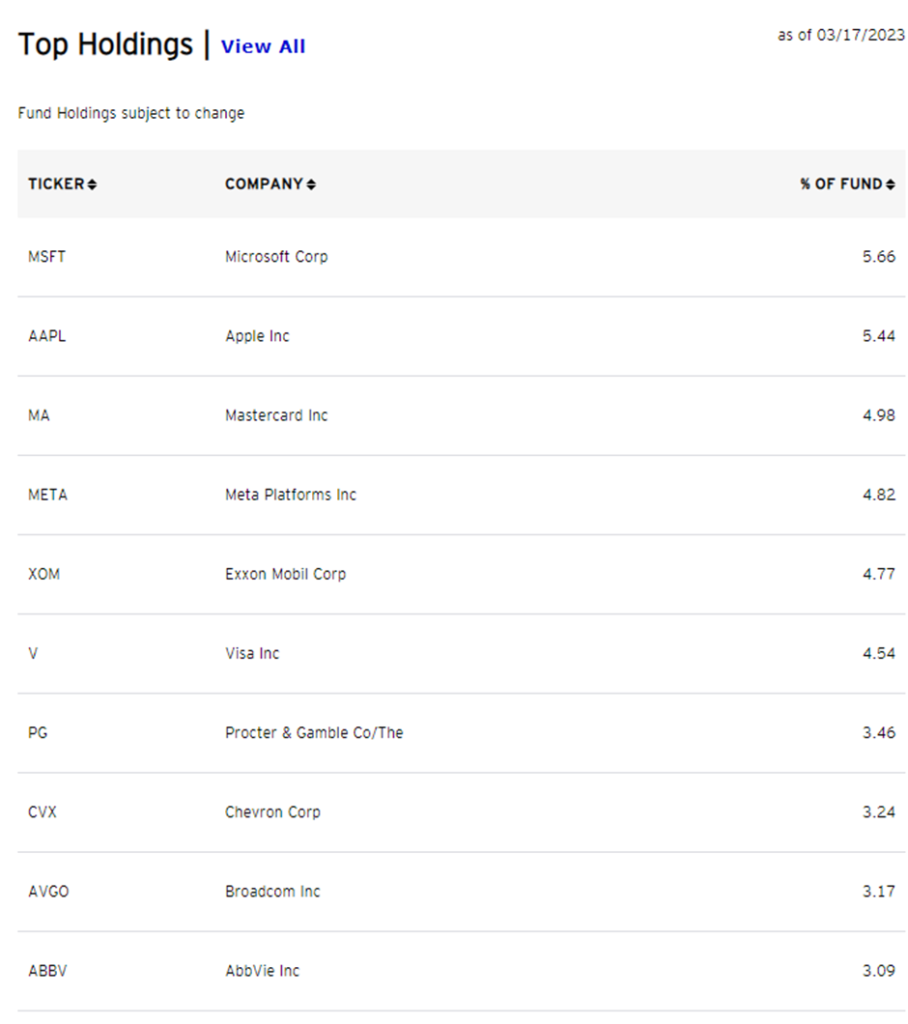

One could select to invest in a basket of high-quality stocks through the Invesco S&P 500 Quality ETF (SPHQ) which invests at least 90% of its total assets in common stocks that comprise the S&P 500 Quality Index.

This index tracks the stocks in the S&P 500 based on 3 fundamental measures: 1) Return on Equity (ROE), 2) Accrual Ratios, and 3) Financial Leverage Ratios to determine an overall quality score for the stocks in the S&P 500 and invest in the top 100 of those stocks.

Currently, the highest weighting in this ETF is Microsoft, followed by Apple and Mastercard rounding up the Top 3 counters.

ETF Investment Strategies #4: Spin Off

This is an investing strategy that is not that common. One can select to invest in companies that have been spun off from larger corporations. The reason to invest in these spun-off companies is that studies have shown, after an initial adjustment period of a few months, spinoffs tend to outperform groups of comparable stocks for several years.

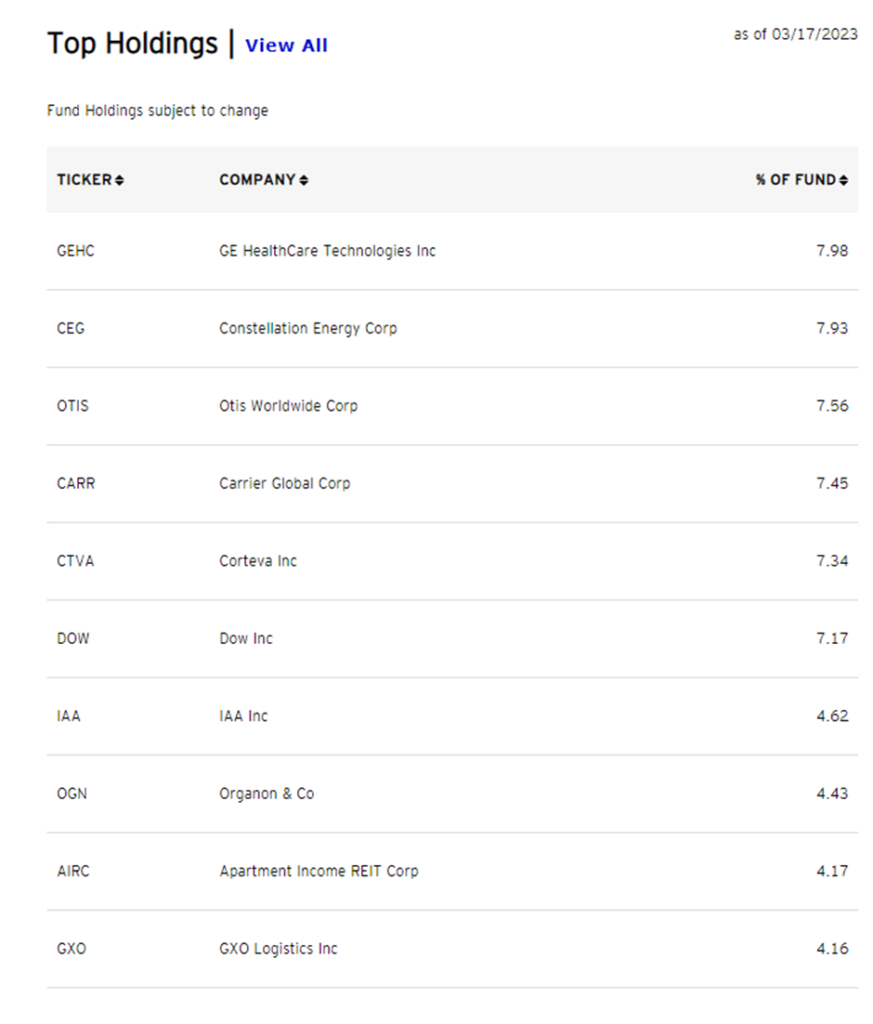

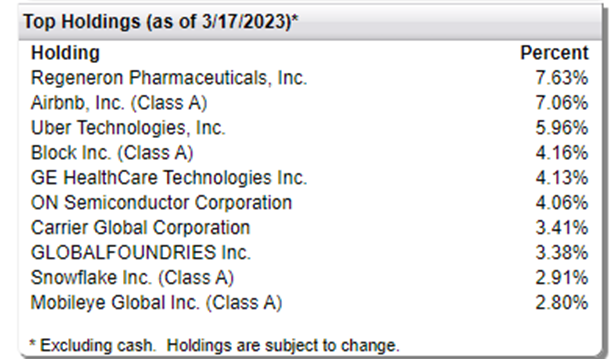

One way to invest in this investment strategy is through the Invesco S&P Spin-Off ETF (CSD). This is a more concentrated ETF compared to the others in this list with its top holding GE Healthcare Technologies comprising close to 8% of the fund.

GE Healthcare (GEHC) was spun off from its parent General Electric (GE) earlier this year and the counter has since appreciated by 34% in YTD 2023.

The table below shows the Top 10 holdings of the CSD ETF

ETF Investment Strategies #5: Buy-Write

Buy write is an investment strategy that incorporates the usage of options. The goal here is to generate additional income through the covered call strategy where one owns the underlying stock and simultaneously sells a call option on the counter.

This investment strategy will outperform the broader index in a bear/neutral market but will underperform in a strong bull market.

One way in which an investor can partake in this strategy is through the Invesco S&P 500 BuyWrite ETF (PBP) which will invest in all the stocks of the S&P 500 (indexed to it) and selling a succession of covered call options, each with an exercise price at or above the prevailing price level of the S&P 500 index.

Dividends paid on the component stocks underlying the S&P 500 index and the premiums collected from the sale of the call options are reinvested.

ETF Investment Strategies #6: US IPOs

Investing in IPOs is one strategy that tends to be riskier since these newly listed companies do not have much track record of operational performance. One way to avoid investing based on pure “hype” or in companies that are too small in terms of market capitalization, an investor can select to invest only in the Top US IPOs through the First Trust US Equity Opportunities ETF (FPX).

The FPX ETF typically invests in the 100 largest and most liquid US IPOs in the IPOX Global Composite Index.

These stocks are selected based on a set of quantitative screens. Eligible candidates are added on the sixth day of trading and remain eligible to be included in the index for approx. 4 years.

Here are the current top holdings of this ETF

ETF Investment Strategies #7: Wide Moat

A moat is a term that describes a company with a clear advantage or value proposition vs. its competitors that will allow it to stay ahead of the game.

A moat could be being the lowest-cost producer (such as Walmart) or possessing certain Intellectual Properties (IP) that allow its products/services to remain ahead of the competition.

Investing in wide-moat companies is made popular by Morningstar, who often track companies that possess a strong level of moat and would recommend investing in these high-moat companies when the price is right.

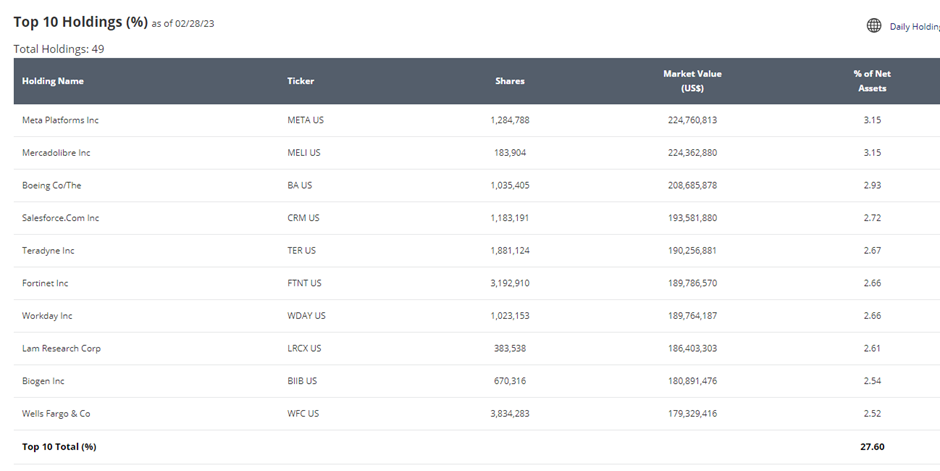

One can now replicate that strategy using the VanEck Morningstar Wide Moat ETF (MOAT) which seeks to replicate as closely as possible, the performance of the Morningstar Wide Moat Fous Index which is intended to track the overall performance of attractively priced companies with sustainable competitive advantages, according to the Morningstar’s equity team.

The top holding in this ETF is 1) Meta, followed by 2) Mercadolibre and 3) Boeing, rounding up the Top 3 wide moat companies trading at attractive valuations.

ETF Investment Strategies #8: Hedge Funds Multi-Strategy

Hedge funds are investment vehicles that are often only accessible to those with a sizable amount of investment capital. These vehicles are not regulated by the authorities, hence, investing in them might entail a higher risk nature.

Some of the best-performing hedge funds include the likes of your Scion Asset Management, Citadel LLC, Bridgewater Associates, Renaissance Technologies, etc to name a few.

These hedge funds investment strategies are not restricted to just going long, but can deploy a mixture of long/short equity, global macro, market neutral, event-driven, fixed income arbitrage, etc, strategies not easily replicated by the man-in-the-street.

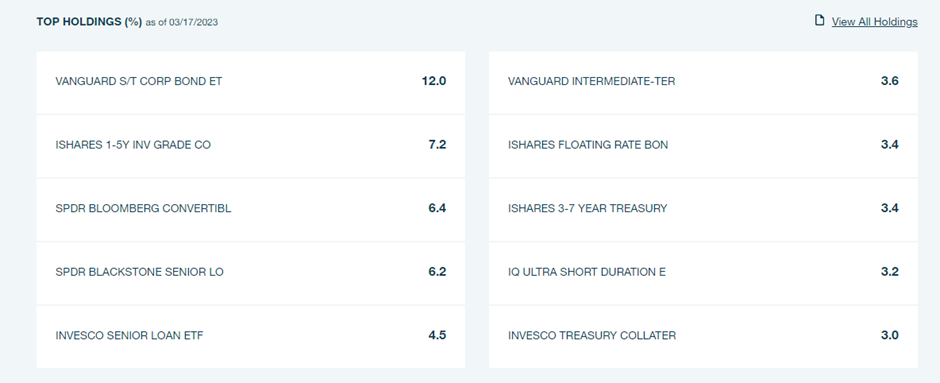

One way to partake in such hedge fund strategies is through the IQ Hedge Multi-Strategy Tracker ETF (QAI) which seeks to track the price and yield performance of the IQ Hedge Multi-Strategy index.

Unlike the earlier ETFs, the top portfolio holdings in the QAI ETF are not equity counters but different asset classes, mainly investment-grade corporate bonds.

ETF Investment Strategies #9: Equal Weight

Many of the index funds are market-cap-weighted. This means that if a company has a greater market cap (for example Apple) it will have a greater weighting in that fund and hence, its price movement will play a more significant role in the overall performance of the fund vs. a smaller market cap company.

Instead of engaging a market-cap weighted approach, one can invest in an equal-weight ETF that allocates the same percentage holding across all entities in the fund, regardless of their market cap size.

One way to do that is through the ALPS Equal Sector Weight ETF (EQL) which is an ETF that delivers exposure to the US Large Cap Equity market by investing equal proportions in 11 Select Sector SPDRs and rebalances quarterly.

Each sector will thus have a weighting of approx. 9%.

Do note that the EQL ETF is something of a fund of funds. It is an ETF that invests in a portfolio of ETFs. The downside to this is that there will be more than 1 layer of expense ratios that will add to the overall recurring costs of holding this ETF.

A cheaper and more popular alternative is the Invesco S&P 500 Equal Weight ETF (RSP) which equally weights the stocks in the S&P 500.

ETF Investment Strategies #10: Hedged Equity

This is a strategy that incorporates a certain level of hedging to protect the portfolio against a market downturn or a huge change in market volatility.

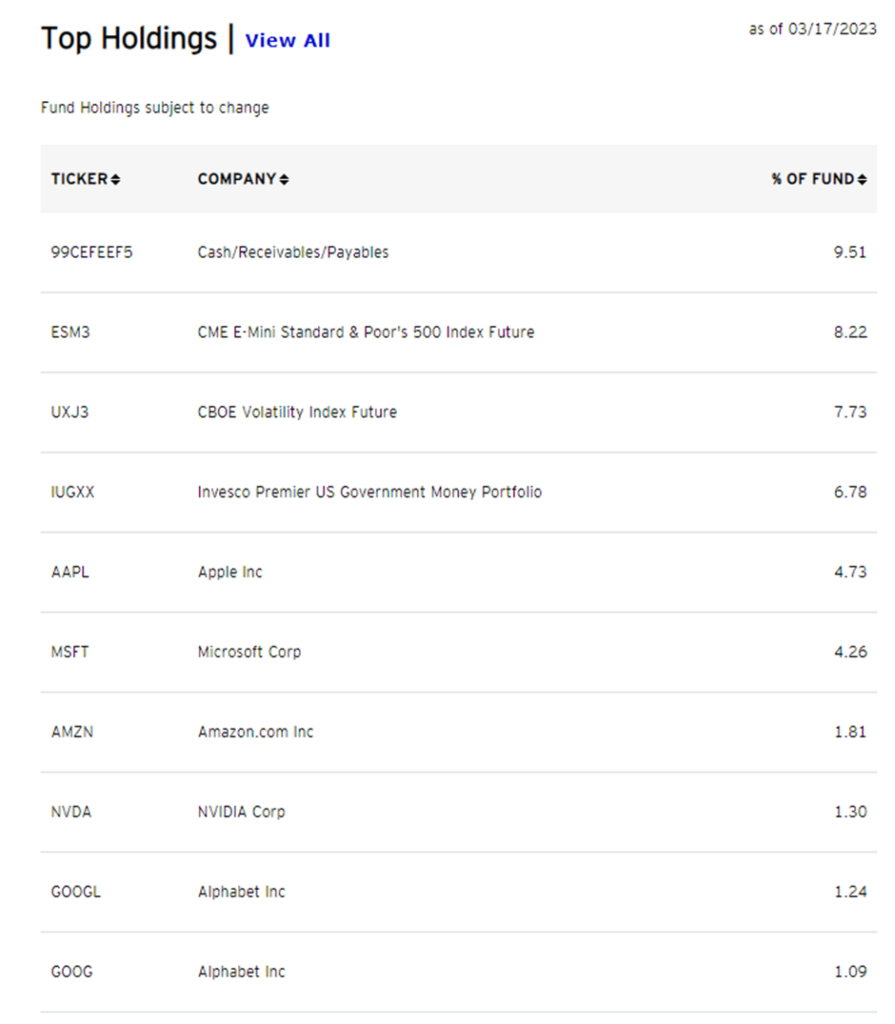

This will involve certain derivatives such as futures. One way to partake in this investment strategy is through the Invesco S&P 500 Downside Hedged ETF (PHDG) which seeks to incorporate 3 different components in its core strategy: 1) Equity, 2) Volatility Hedge, and 3) Cash.

The ETF will invest in S&P 500 stocks and S&P 500 futures but will partially hedge against any downside risk of change in volatility through the S&P 500 VIX Short-Term Futures.

It will also hold a substantial amount of cash as a buffer.

In Part 2 of this article on Top ETF Investment Strategies that you can easily replicate, I will highlight the next 9 strategies followed by a wrap-up of which of these investment strategies have been the best-performing ones on both a short, medium, and long-term horizon.

Do stay tuned for it. For those who are interested to learn more about some of the best ETFs to invest in, do check out this free ETF video guide.

Additional Reading: Best Thematic ETFs (2023)