Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Endowus Cash Smart Review

This is not meant to be a post to “shoot down” any Robo Advisors out there, but just to increase the awareness for my readers when it comes to cash management services provided by Robo Advisors.

I have written an article entitled: High Cash Management Rate just a Marketing ploy to Get your Money previously. That article was first written back in the “era” of a low-interest rate environment and Robo Advisory platforms were “pulling out all the stops” to entice clients with cash management services that were of a much higher yielding nature.

2-3% then was like the “holy grail” of cash services!

The situation is very different now, to say the least, with multiple “options” available to generate capital-guaranteed returns over 4%.

However, what retail clients might not be aware of when it comes to cash management services offered by these Robo Advisors, are that these products are NOT capital guaranteed.

Most would have the impression that the capital risk that they are exposed to is not any higher than the platform itself going bust or a “bank-run” scenario.

Unfortunately, there are also product-related risks, and these risks are what clients, particularly retail folks, are not aware of.

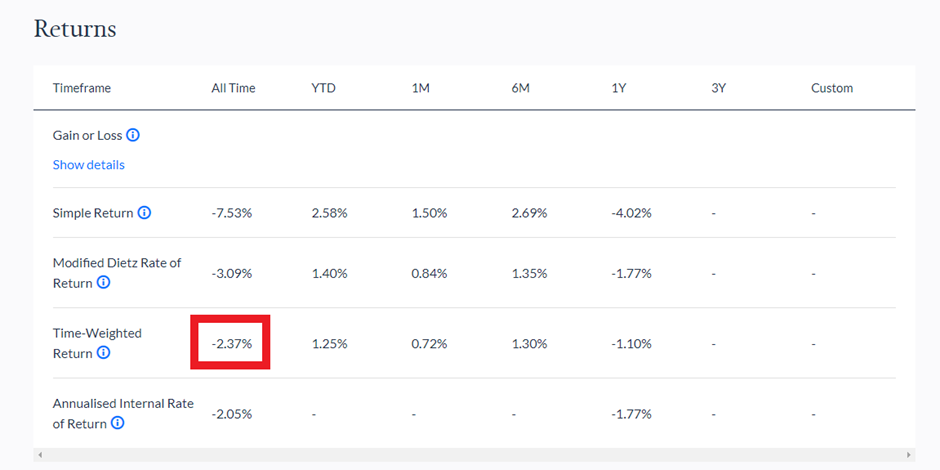

My Cash Smart Ultra returns are currently down 2.4% on a time-weighted basis, after being invested for 1.5 years (and likely already collecting 3-4% in coupon interests).

Not a big issue, considering how weak the equity market performed back in 2022, but this is a product meant to be “safe”.

Endowus Cash Smart Ultra Solution

When I first entered into these solutions, I wanted a safe place to “park” my monies from my SRS account while I look to “time” and capitalize on a market crash.

That was back in mid-2021 when the world recovered strongly from the COVID-19 scare a few months back.

It was great that Endowus Cash Smart Ultra provided a solution to generate approx. 3+% return in a then extremely low interest-rate environment, albeit at a higher risk.

Most people would have focused on that 3+% promoted yield (It is currently being promoted at up to 4.8%). I know I did, without giving any thought to the security of my capital.

BIG MISTAKE.

Well, I did bother to read some of the “risks statements” associated with the Cash Smart Ultra service and the takeaway then was that while capital isn’t protected, if you have a holding horizon of 3-6 months, you will be fine.

Not the case, evidently, now with hindsight.

Why is that so?

Let’s take a closer look at the underlying products in which the Cash Smart Ultra Solution is vested.

Underlying products are higher-risk bonds

When you put your money in the cash smart solutions, they are used to purchase bonds. Bonds are simply fixed-income products that the government or corporates issue to borrow money, with the promise that they will return your principal at the end of the bond tenor.

Bonds issued by strong organizations have a lower risk of default, hence, they offer a lower yield vs. higher-risk organizations.

Higher Risk equals Higher Returns, Lower Risks equals Lower Returns

For Endowus Cash Smart Ultra to offer higher returns, they will need to invest in higher risks bond products offered by “not-so-strong” corporates. This is Part 1 of the risk involved.

Part 2 of the risk accounts for the movement of interest rates. As bonds perform inversely to interest rate movement, a rising interest rate environment will see bond prices decline.

That was what happened for the bulk of 2022 when the world saw interest rates skyrocketing for the first time in decades. Bond values came down.

At this juncture, if you are invested in bond products, you will see their value decline as rates rise.

However, if you can hold these bond products to maturity (until the bond tenor expires), you will be able to recoup your entire principal capital + the promised yield when you first invested.

So why then am I still losing money on Cash Smart Ultra? I have held the product for 1.5 years, way above the 6 months buffer which Endowus “guided” as a safe holding period?

Likely explanations are 1) Some bonds that were invested might have been sold below par/(and cost) instead of holding to expiration, 2) Some of the bonds might have defaulted, and 3) the duration of the bonds is not your typical 3-6 months to expiration, hence to recoup the capital, even without a corporate default, one needs to have a much longer holding period in a rising/high rate environment.

Additional Reading: Investing my SRS Fund with Endowus Cash Smart

The main culprit for Cash Smart Ultra’s weak performance

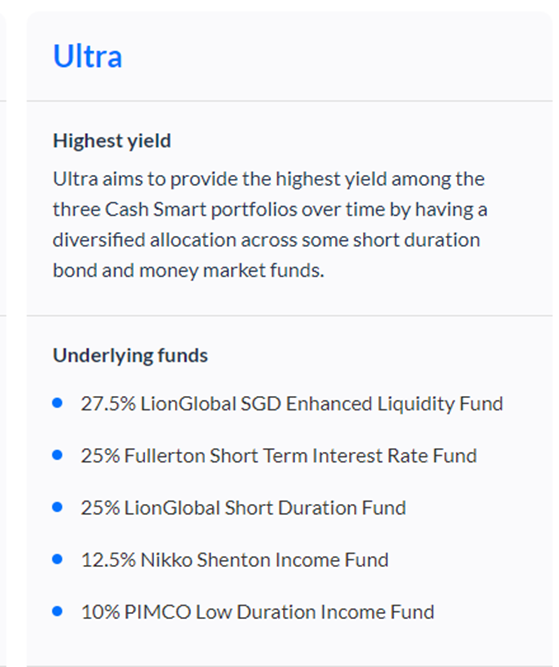

The Cash Smart Ultra invests in several fixed-income funds as illustrated in the diagram below:

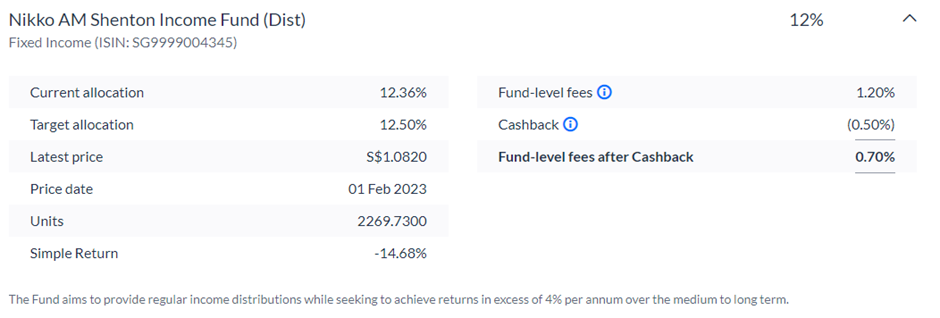

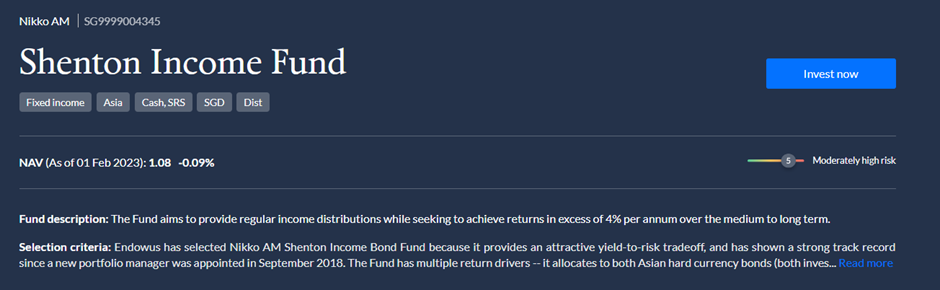

The main culprit associated with its weak performance is due to the fund’s 12.5% exposure to the Nikko Shenton Income Fund. According to Endowus, this fund saw a simple return of -14.68% as seen in the picture below.

This wasn’t the only fund that generated negative returns. In fact, out of the 5 funds on the list, only LionGlobal SGD Enhanced Liquidity Fund saw a positive simple return, according to Endowus.

Rising interest rates are likely to blame for the weak performance seen in these fixed-income products. But why will that be an issue if the underlying bonds that these fixed-income funds invest in are truly short-duration in nature, just like what it has been marketed as?

Assuming no defaults, there should not be any loss of capital when these bonds come due.

As can be seen from the Top 10 holdings of the Nikko AM Shenton Income Fund, some of these bonds have a long duration extending all to way to 2059 (Bank of China). Naturally, these bonds will be affected by rising interest rate movements and for an investor to get out “whole” on its principal, a holding horizon up till 2059 might be required. Of course, the payback would be shorter due to the interest received, assuming again that BOC does not default.

Another explanation of this fund’s weak performance is that beyond the Top 10 holdings, there might be other bonds in there (related to the China real estate sector) which could have defaulted.

Additional Reading: Ultimate Guide to Investing using SRS Account

Stick to the simplest cash management solution

I am not sure why a fund with the second highest level of risk (5 out of 6) is a product used as part of a cash management service.

While it is marketed as a higher-yielding solution, its current stated 12-month yield of 4.07% isn’t particularly attractive for all the risks one is taking.

The bullish argument here is that interest rate expectations have peaked and rates’ price trajectory in the coming years is likely a downward one.

That will be positive for bond prices.

Additional Reading: Ultimate Robo Advisors Singapore Guide

Buy, Hold, or Sell?

For those who have vested in Endowus Cash Smart Ultra solution and are currently sitting at a loss, what will your course of action be?

Would you buy more to “average in” at a higher yield, continue to hold as you don’t wish to “realize” your loss on what you thought to be a capital-guaranteed solution, or bite the bullet and sell it (and finally get to reinvest in the bull market of 2023, so far that is)?

For me, I don’t think the situation for its Cash Smart Ultra solution would improve, given yet another further 3-6 months horizon. Not unless the interest rate takes a sudden dive, which is highly unlikely in 2023.

I have previously (about 6 months back) partially “cut loss” on Cash Smart Ultra and reinvested the proceeds into a 100% equity fund, which was a good move in hindsight, and have again sought to sell another trench of Cash Smart Ultra to partake in the equity market.

Time will tell if this is indeed a SMART move.

Again, this is never meant to be a post to discredit the efforts of Robo Advisors operating in Singapore such as Endowus. Their intention to increase the awareness of investing among retail folks is great.

What is not so great, in my humble opinion, is the aggressive marketing tactics on cash management products that may come with elevated risks.

For those who are interested to learn more about my thoughts on the Robo Advisor and cash management service scene in Singapore, you can check out my FREE Robo Advisor video primer.