Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Earnings Recession in 2023

There have been increasing chatters of an earnings recession in 2023, something that hasn’t occurred since COVID-19 blasted corporate earnings results to the ground in 2020.

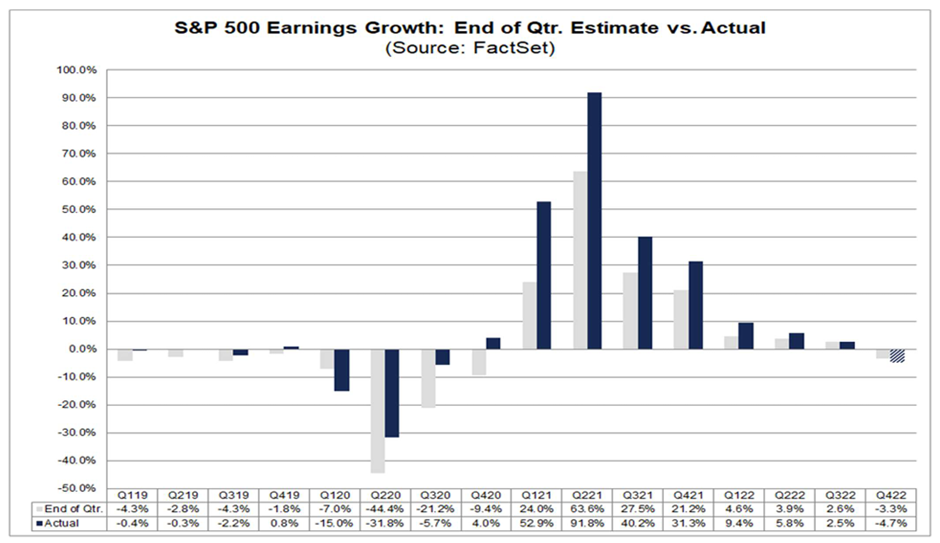

To be clear, the definition of an earnings recession is two-quarters of earnings decline in a row. While 4Q22 results are still underway (82% of S&P 500 has reported results), the street is forecasting corporate profits to have fallen -4.7% from the year-ago period, according to data from Factset.

If -4.7% is the actual decline for the quarter, it will mark the first time the index has reported a YoY decrease in earnings since 3Q20. Negative EPS growth has happened only 4x over the past 23 years, with each year followed by a “significant” price downside in the market.

Looking ahead, the street expects a tough earnings season in the first quarter of 2023 and second quarter of 2023, with an earnings decline of -5.4% YoY and -3.4% YoY, respectively. That will fit the definition of an earnings recession for the US stock market, with two consecutive quarters of EPS decline.

However, weak corporate earnings seen in the first half of 2023 are expected to swiftly reverse in the second half of 2023, where the street’s current consensus is for corporate earnings to grow by 3.3% and 9.7% in the third quarter of 2023 and fourth quarter results, respectively.

Amid the current tough earnings environment and restrictive monetary policy (federal reserve to keep rising interest rates) faced by US corporates, has the stock market already priced in these headwinds?

Additional Reading: 4 Recession-Proof US Stocks in my Watchlist

More Pain to Come?

According to analysts from Morgan Stanley (likely the most bearish investment research house on wall street), they believe that the market hasn’t fully priced in both an earnings recession and economic recession yet, and that will be a major headwind in 2023 when the downturn in business cycle becomes more evident.

Historically, the majority of price downside in equities comes after forward EPS growth goes negative.

I have recently written an article, entitled: 4 Reasons We Are Still in a Bear Market Bounce. One of the reasons pertains to weaker earnings in 2023 that have yet to be priced into the market.

The other reasons are:-

- Increase in consumer debt + decline in savings, resulting in lower consumer spending ahead

- Unemployment starting to increase as seen from widespread retrenchment in tech firms. This could have an impact on economic growth in the coming quarters

- The persistent inverted yield curve

While it pays to be cautious, that should not imply inaction on the part of investors, or going all into cash.

Instead, the wiser move would be to prepare a list of stocks that one can capitalize on any price weakness, resulting from a bear market sell-off.

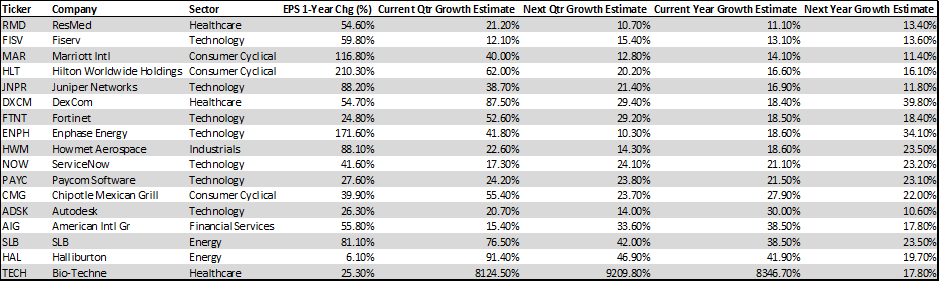

In this article, I will highlight 17 blue-chip S&P 500 stocks that are potentially undervalued and are prime to “avoid” an corporate earnings recession.

These companies are screened based on their ability to continue growing their company profits amid the current corporate earnings recession in 2023, according to analyst estimates. In addition, they are trading at less than 50% of their historical 5-years Price-Earnings Multiple ranges, which could indicate a level of undervaluation.

The screening criteria are as such:

- Historical 1-year EPS growth > 0%

- Current quarter EPS growth > 10%

- Next quarter EPS growth > 10%

- Current year EPS growth > 10%

- Next year EPS growth > 10%

- 5-Year P/E Range < 50%

We are screening for stocks that are forecasted to exhibit earnings growth in both the current and next quarter (1H23) by a magnitude of 10% YoY, a period where many companies are expected to see consumer spending slowing demand and weak earnings performance, notably with a decline in profit margins.

In addition, we want to ensure that these blue-chip companies are also forecasted to grow their earnings this year and into the next, by a magnitude of 10%. This not expects sales weakness ahead.

Lastly, they have to be trading at < 50% of their historical P/E multiples.

There are a total of 17 companies in the S&P 500 that meet these rather stringent criteria. These are potentially undervalued stocks that can weather an earnings recession in 2023.

Additional Reading: 5 US Recession-Proof Companies With 14 Years of Consecutive EPS Growth

Additional Reading: 4 Recession-Resistant Stocks with a Fortress Balance Sheet

17 Blue Chip Undervalued Stocks That Can Weather any Earnings Recessions in 2023

The table below shows the 17 blue chip stocks that meet the stringent screening criteria I set in place.

Do note that these companies are also trading 50% below their 5-year historical P/E range.

An investor should be monitoring these stocks for any potential price weakness as a result of the “earnings recession” driven market sell-off and dare to capitalize when “blood is everywhere on the street”, particularly if these companies continue to beat profit expectations.

The largest market cap counter in the list is ServiceNow – NOW ($89bn in market value) while the smallest market cap counter is Juniper Networks – JNPR ($10.2bn in market value). Noticeably, there are no consumer staples in the list.

There are currently 2 stocks in this list that I am also holding in my Stock Alpha Blueprint Portfolio. This portfolio seeks to find stocks that are of a blue-chip status and often market leaders in their respective industries.

More importantly, stocks in the Alpha Blueprint Portfolio fulfill what I termed as my Power of 5 metrics, metrics that top investors used all the time to find outperforming stocks.

These metrics are based on the following financial characteristics:

- Sales + earnings estimates

- Profit margins improvement

- Cash Flow

- Credit risk

- Efficiency

Last but not least, we seek to capitalize on these stocks when they are trading at the right valuation.

Two of the stocks in the above list fit these descriptions. For investors who are interested to find out more about stocks currently held in the Alpha Blueprint Portfolio, do click on the button below to find out more.