Table of Contents

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

Dividend Aristocrats with the Highest Yield

Dividends – cold hard cash paid out by corporates are often seen as an important criteria for a certain group of investors.

These might be 1) folks targeting a steady stream of passive income, 2) retirees looking at dividends as a form of income to fund their day-to-day expenses, or 3) simply more risk-averse investors looking at “value” stocks which are often associated with high annual dividend yields.

There are, however, investors in the opposite camp, who aren’t big fans of regular cash payouts. They argue that these dividend-paying companies have run out of value-adding ways to reinvest their cash pile to grow the business. Hence, they need to “resort” to paying dividends as a rationale for investors to buy into their stocks.

Regardless of where one falls on the dividend spectrum, there is no doubt that some dividend stocks are worth paying attention to, particularly those that have a strong track record of increasing their dividend payments, year-after-year.

Some of the best dividend stocks that have managed to increase their dividend payments for 25 consecutive years are termed Dividend Aristocrats.

Additional Reading: Best Performing Dividend Aristocrats 2023

While dividend aristocrats have a strong track record of dividend payment increases, that does not necessitate them being high-yielding stocks.

The formula for the Dividend Yield of a stock is as such:

Dividend Yield = Dividend Payment Per Share / Share Price of Stock

While a dividend aristocrat’s dividend payment might be growing every year, if its share price grows exactly in tandem with its dividends, then the dividend yields will not change.

If its share price is appreciating at a faster rate vs. dividend growth, the counter’s dividend yield will decline.

Conversely, if its share price is appreciating slower vs. its dividend growth rate, the counter’s annual dividend yield will increase. If its price weakness is seen as a temporary phenomenon, then this dividend-paying stock might be undervalued. Hence making it one of the high quality dividend stocks.

This is the dividend yield theory on finding dividend-paying stocks that might be undervalued.

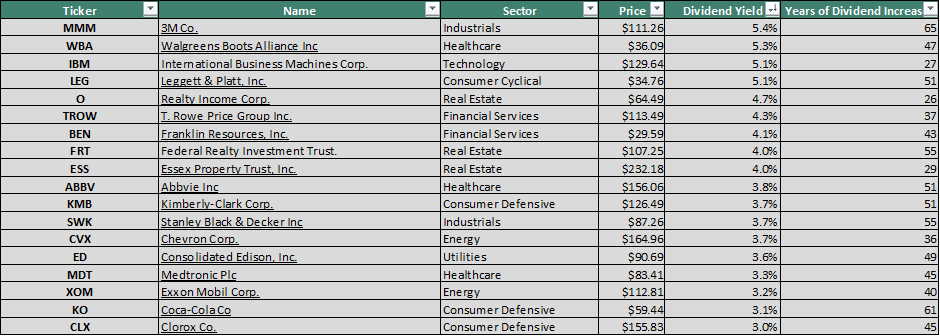

In this article, we will be looking at some of the best dividend aristocrats with the highest dividend yields. These are not only dividend-paying stocks that have raised their dividend payments by at least 25 consecutive years, but they are also yielding over 3%.

Might these dividend aristocrats be undervalued, based on the dividend yield theory?

Dividend Aristocrats List By Yield

Here are the 2 key criteria to be included in the list of dividend aristocrats by yield:

- Stocks that are on the Dividend Aristocrats List

- Dividend yield at least 3%

There are a total of 18 Dividend Aristocrats that fulfill the above 2 criteria. In case, you want to look at more such stocks, you can peak at the S&P 500 dividend aristocrats list.

However, right now the dividend aristocrat with the highest yield is none other than 3M Co (MMM) which currently spots a dividend yield of 5.4%.

This is followed closely by Walgreens Boots Alliance (WBA) at 5.3% and International Business Machines Corp (IBM) at 5.1%, rounding up the Top 3 Dividend Aristocrats with the highest yield.

Might these dividend aristocrat stocks be undervalued? One can use the dividend yield theory to make a judgment.

The theory states that if the current yield of the stock is greater than its historical average value, the counter might be undervalued. Let’s evaluate the top 3 dividend aristocrats by dividend yield using the dividend yield theory.

Do, however, note that the dividend yield theory-derived fair value is just one potential consideration and should not be seen as the “holy grail” of dividend stock fair price evaluation.

The full list of Dividend Aristocrats and their respective dividend yield and price performance can be found at the end of this article.

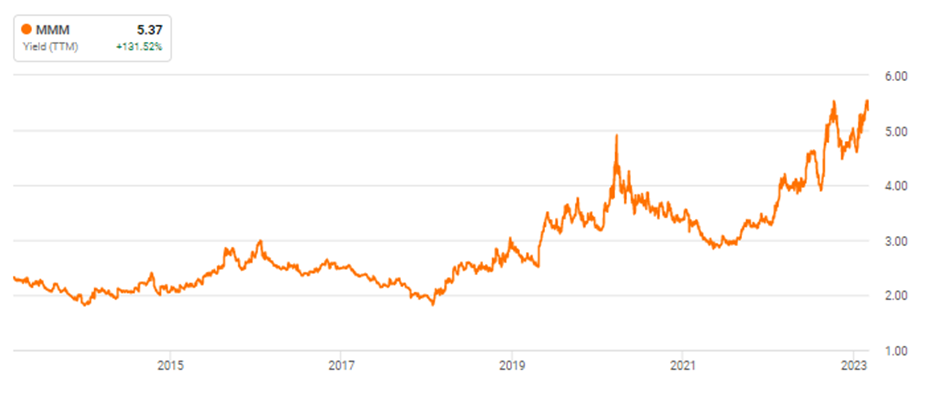

3M Co (MMM)

The current dividend yield of MMM is approx. 5.4%. The counter has a 5-year average yield of 3.88%. Using the Dividend Yield Theory, the fair value of 3M is:

Fair Value of MMM = 5.4% / 3.88% * $111 = $154.48/share

Walgreen Boots Alliance (WBA)

The current dividend yield of WBA is approx. 5.3%. The counter has a 5-year average yield of 4.22%. Using the Dividend Yield Theory, the fair value of WBA is:

Fair Value of WBA = 5.3% / 4.22% * $36.09 = $45.33/share

International Business Machine (IBM)

The current dividend yield of IBM is approx. 5.1%. The counter has a 5-year average yield of 4.89%. Using the Dividend Yield Theory, the fair value of WBA is:

Fair Value of IBM = 5.1% / 4.89% * $129.64 = $135.2/share

As earlier mentioned, using the dividend yield theory to derive the fair values of dividend aristocrats with the highest yield, is just one of the many potential considerations to determine if a dividend aristocrat is indeed undervalued.

This theory is based on the assumption that the current dividend yield of the stock will ultimately revert to its medium/long-term average. However, this might not necessarily be the case if the underlying fundamentals of the dividend-paying stock have been structurally impacted.

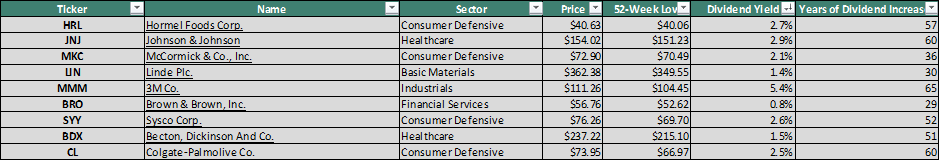

52-week Low Dividend Aristocrat stocks

I have also provided a table showing the 9 dividend aristocrat stocks at a 52-week low. This is based on the dividend aristocrats’ current share price <= 10% above its 52-week price level

Among this list, 3M remains the “most attractive” dividend aristocrat based on its yield, while Brown & Brown (BRO) is the lowest yielding in this list of dividend aristocrat stocks at a 52-week low.

Additional Reading: How to Invest in Dividend Stocks

My Strategy for High-Yielding Dividend Aristocrat Stocks

A high-yielding dividend aristocrat stock like 3M might warrant direct stock ownership. However, considering that this counter is still stuck in a downtrend, there might be a better way to play this counter using the Options Wheel Strategy.

Instead of taking direct ownership of 3M at present, I would select to sell a Cash-Secured Put at a strike price of $105 (5.4% discount from current price level), expiring in 47 days, collecting a premium of $175 (1.7% yield).

This translates to an annualized yield of 12.9%.

I am ready to take ownership of 100 shares of 3M if the price dips below $105 in 47 days. Holding physical 3M shares allows me to receive an annualized yield of 5.4%.

I would then select to sell a covered call on 3M at a strike price of $120 (option expiring in 320 days). Assume that I can collect a premium of $730, which will mean an additional yield of 6.9%.

Yield from Options Wheel Strategy on 3M = Yield from Sell Put (1 round) + Yield from Dividend (annualized) + Yield from Sell Call (1 round over 320 days) = 1.7% + 5.4% + 6.9% = 14%

Overall return if 3M is > $320 after 320 days = 14% (from yield) + 14% (from capital appreciation) = 28%.

Generating a 28% return on a potentially undervalued annual dividend aristocrat stock like 3M sounds like a decent return to me. This is likely achievable beyond depending solely on its dividend yield.

Do note that there could be dividend withholding tax charges for foreign investors (Singaporean investors at 30%) that will result in a lower net dividend yield received.

Even if the price of 3M remains flat at $111 after 1 year, one can still take comfort from the higher-than-market average return of 14% from this dividend-enhancing options wheel strategy.