Digital Banking Singapore

Throughout the years, we’ve seen an emergence of digital banks in the financial industry. This transformation has hit the shores of the Asian market with the likes of Hong Kong and more recently Singapore issuing their very own digital banking licenses. Hong Kong is much more ahead in its digital banking transformation with the likes of “ZA Bank” being in operation since March last year. However, the country just reported that their digital banks are still years away from profit. Can these banks compete with traditional ones?

In this article, we’ll be studying the topic from the perspective of a recent player in the digital banking space – Singapore, with 4 digital banks expected to commence their operations next year.

Traditional Banks vs Digital Banks

Before diving deeper into the digital banking landscape and transformation in Singapore, let’s look at their differences to provide us with some clarity.

Introduction to Traditional Banks

Traditional Banks are often segregated into two key categories – Full Banks and Wholesale Banks.

Full Banks are financial institutions that provide a full suite of services to both retail and corporate clients. It includes the major banks such as DBS, OCBC, UOB that provides:

- Deposit-Taking – Current, Savings, Fixed Deposits

- Trade Financing – Financing exports and imports, letter of credits.

- Cheque services and lending

- Financial advisory services, insurance broking, and capital market services

On top of the services mentioned above, these banks provide a full range of retail services such as fund transfers and insurance of both credit/debit cards which is easily accessible through their wide network of ATMs.

Wholesale Banks are financial institutions such as Deutsche Bank in Singapore that provide almost the same range of services to the public except for two activities:

- Not allowed to accept SGD fixed deposits of less than 250,000 per deposit from non-bank customers

- Not allowed to pay interest on SGD current accounts operated by resident individuals

Introduction to Digital Banks

Digital banks can be seen as the “new age” of banking that provides all the positives of traditional banks while tackling the disadvantages that come along with it. Instead of having physical infrastructure, they seek to provide sleek mobile applications with products created through machine learning and AI.

Ultimately, the purpose of digital banks is to serve both the underbanked and overbanked populations. Before diving deeper into what they offer, let’s look at what are digital full banks and digital wholesale banks.

Digital Full Banks (DFB) and Digital Wholesale Banks (DWB) provide the same suite of services as the traditional versions of themselves. The main difference is that their services are digitalized without physical branches, ATMs, or cash deposit machines.

In December last year, the Monetary Authority of Singapore (MAS) awarded 4 licenses in total. These are the four entities that are expected to be operational in 2022:

Digital Full Banks

- Consortium comprising of Grab and Singtel

- Sea Limited

Digital Wholesale Banks

- Ant Group

- A consortium comprising of Greenland Financial Holdings Group Co. Ltd, Linklogis Hong Kong Ltd, and Beijing Cooperative Equity Investment Fund Management Co. Ltd.

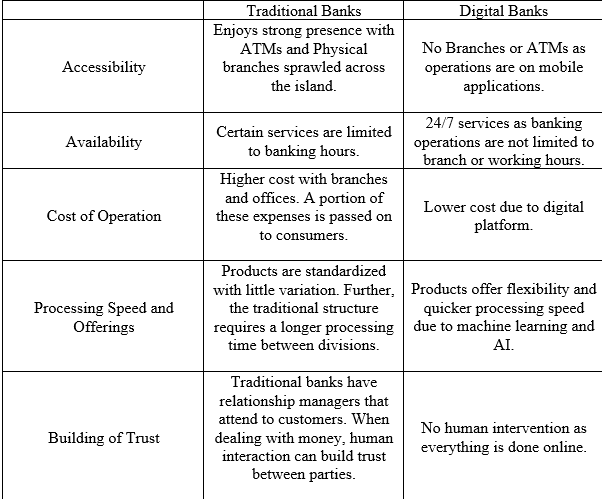

Key Differences between Traditional Banks and Digital Banks

Can digital banks disrupt the incumbents? But could we be trying to fix something that isn’t broken? There are varying views between the two structures and here are the pros and cons. Which is better? You be the judge!

Ultimately, I believe that the rigid structure of traditional banks led to a portion of the population being underserved. Digital banks will transform the industry by providing a wider yet cheaper range of products for consumers. Fees such as minimum account balances will be a thing of the past with digital banks!

To illustrate the transformation that these digital banks will bring, below is just an example from Hong Kong. By offering deposit rates at 6%, traditional banks will be forced to trim their profit margins just to compete with them.

However, a key challenge for Digital Banks will be the ability to build trust with the public. When dealing with a large sum of money, I believe that corporations and large retail customers would prefer dealing with humans. It may take months or even years to gain the trust of the public.

Further, the reliance on technology may serve as a double-edged sword. These banks might be victims of cyber-attacks or even technical issues that can cause severe disruption to their operations.

Digital Banking Singapore

Traditional banks such as DBS and UOB have been undergoing digital transformation throughout the years. One key difference we see today is the banks’ move to phase out physical tokens to verify transactions. With revamped banking applications, the likes of DBS and UOB started to move towards digital tokens instead of physical ones.

Furthermore, the incumbent banks started to utilize “MyInfo” for banking services. For example, opening an account in the past will require one’s manual input to provide personal details. This is a tedious process as the banks will undergo checks to verify the accuracy of information.

Today, this is expedited through “MyInfo” as banks can retrieve this information from one’s Singpass. To illustrate the digital transformation in Singapore, we’ll look at several examples of digital banking in DBS and UOB.

DBS Digital Banking

DBS is at the forefront of the industry’s digital transformation in Singapore with digital payments such as “PayLah”. Their digital revolution started in 2014 and the bank was even named the “World’s Best Digital Bank” by Euromoney. Just early this year, their CEO mentioned that DBS hires twice as many engineers as bankers! Here’s an example of DBS’ Digital Banking services:

NAV Planner

DBS’ NAV Planner is the nation’s first digital advisor that allows users to track, protect and grow their money based on an individual’s profile. Users can access this tool through the DBS Digital Banking Application. I’m a user of NAV planner to track my monthly cash inflow and outflow. Here are some features you can enjoy:

- Visibility of finances: The tool provides users with a “one-stop” platform to gain an overview of finances with DBS. With SGFinDex, users can connect their financial information from other banks, CPF, HDB, and IRAS to get a holistic view

- Budgeting: Tracking of monthly expenses, assets, and liabilities

- The setting of Financial Goals: By charting out one’s retirement plans, DBS can assist to forecast the savings and spending habits required.

Investment Advice: Based on one’s financial goals, health, and profile, the NAV planner can provide investment advice for users.

UOB Digital Banking

On top of the industry-wide transformation such as the use of “MyInfo”, UOB has also been digitalizing its operations. Apart from issuing their first digital bond, this is one recent example of a huge step taken by UOB Digital Banking:

Digital Signatures with Singpass

Just a couple of weeks back, the bank announced a 12-month pilot program to use “Singpass” as digital signatures for approval of transactions or applications. Being the first bank to offer this service, they intend to expand the use of Singpass to their retail and wholesale segments.

The mentioned steps taken by traditional banks are crucial to staying ahead of the upcoming digital banks. As consumers, we will stand to benefit from any competition as incumbents will be forced to react accordingly. Consumers will get to enjoy better rates, lower fees, higher accessibility to funds, and enhanced mobile applications!

Investing in Digital Banks

If you are looking to have a stake in the upcoming Digital Banks in Singapore, you can look into Singtel (STI: Z74), Sea (NYSE: SE), or even Grab (NASDAQ: AGC) that was recently listed as a SPAC. Just take note that digital banks require large capital and it will take years before they can break even!

Beyond Singapore’s digital banks, these are two large players you can consider investing:

Nubank

Founded in 2014, this Brazilian bank is the world’s most valuable digital bank with a valuation of $25billion. To date, the bank has over 34 million users which is the highest among any digital bank. With a large majority of Latin America’s population being unbanked, there is large potential and growth that Nubank can tap into.

Just last month, Warren Buffet got himself a slice of the pie by investing $500million into the company. If you’re looking to invest in an exciting digital bank with expansion plans across Latin America, you can look out for their upcoming IPO in the United States!

Kakao Bank

The world’s first profitable digital bank in South Korea is looking to have an IPO by this year. They were able to break even after 18 months of operations and the bank didn’t look back since then. Profit has been growing constantly and Kakao Bank is the world’s second-largest digital bank. As of 2020, the bank has over 13 million users which is more than 1 in every 5 South Koreans. Investors can stay tune to their upcoming IPO, which is scheduled to debut on 12 August.

Conclusion

Digital banking is a new concept that is undoubtedly changing the landscape of the banking world. Nonetheless, it is still an unproven concept, one which has yet to be battle-tested. According to a survey done by PwC, the majority of Singapore bank users (99%) will not move their primary bank account to a digital bank as of yet. They will however be receptive to trial digital banking and experience what these banks have to offer.

It is likely still early days to call the demise of traditional banking but if existing traditional banking incumbents do not seek to innovate and respond to the changing of times, it will likely only be a matter of time before obsolescence sets in.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- The Ultimate Guide To 2 Essential Stock Valuation Models That Picks Out Wise Investment Choices For You (Part 1)

- How to outperform the market by 100+% [Update May 2021]

- Do Not Invest In This! 5 Kinds Of Stocks to Avoid for Beginners

- Finding companies with good management and the right corporate culture

- How to build an investment portfolio that can withstand the test of time

- Technical Analysis For Beginners: Technical Analysis Indicators You Must Know

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.