Cryptocurrency exchanges in Singapore: How to get started

It is 2022 and you’ve probably heard about cryptocurrencies and NFTs, or even seen ads along the lines of “Fortune Favors the Brave” online or at the MRT station. If you haven’t, no worries, but it is good to be aware that the Defi space is undoubtedly transforming the finance space.

The fact that you clicked on this article however shows that you want to get involved in the cryptocurrency space, but if you are relatively new to this area, deciding on what exchange to use can be pretty daunting. In this article, I would be breaking down some factors to consider when choosing which exchange to use.

Before jumping into further detail, it is important to note that most cryptocurrency exchanges in Singapore are on an exemption list that allows them to operate under the Payment Services Act. There is a risk that they may be removed from the list and cease operations in Singapore. Some popular exchanges such as Binance SG or Huobi Global have been excluded from this article as they have ceased or are ceasing operations in Singapore.

What factors to consider in an exchange?

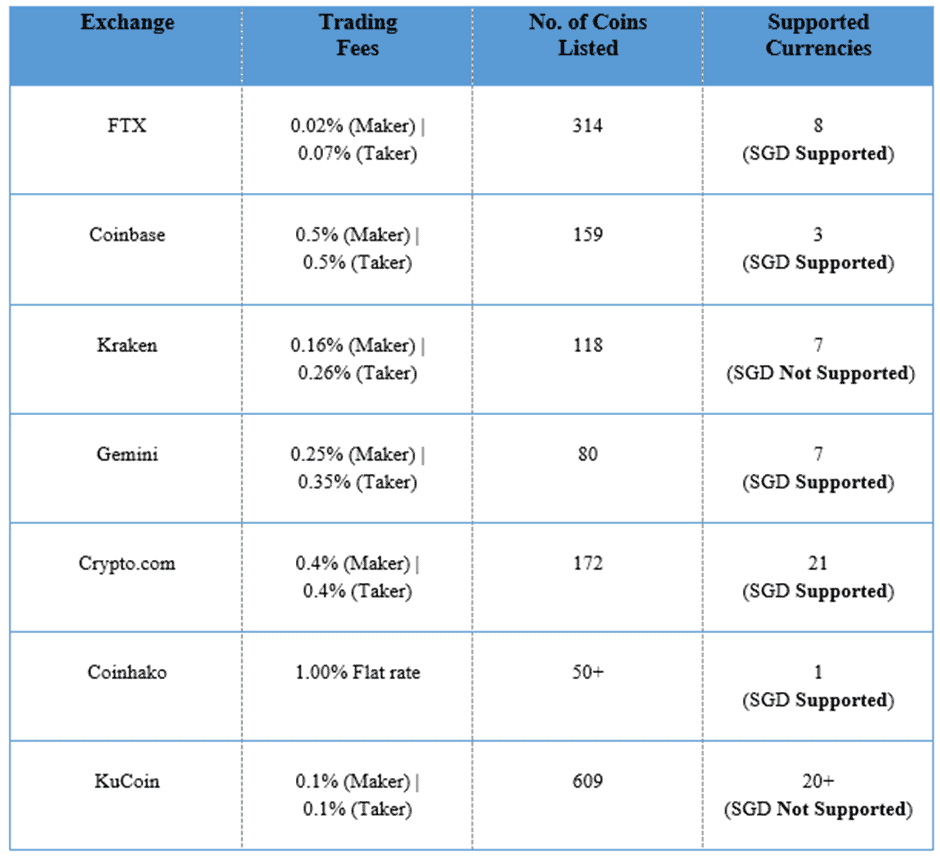

When deciding on what cryptocurrency exchange to use, you should consider some key factors like:

- Trading fees

- Number of cryptocurrencies listed

- Security of the exchange

- Fiats supported

- Any hidden fees

- User-friendliness

Makers: Create liquidity by providing open orders for others to fill.

Takers: Take liquidity by filling maker orders.

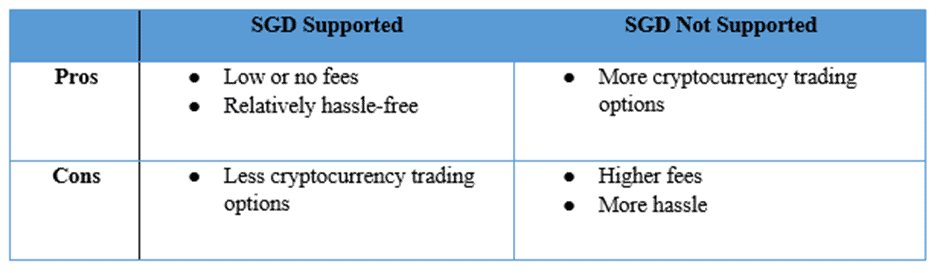

Does it matter if SGD is supported?

Ultimately, it is highly recommended to opt for an exchange that supports the SGD currency since it is much easier for you to deposit funds and the fees incurred are also much lower. For example, FTX allows you to deposit funds using SGD through DBS Remit with 0 fees.

However, if you wish to use an exchange that doesn’t support SGD such as KuCoin due to reasons like a large number of cryptocurrencies supported, it would be slightly more troublesome, but not impossible. Here’s how you can do it:

- Deposit funds into an SGD-Supported exchange such as FTX or Gemini that has relatively low fees.

- Then, purchase some cryptocurrency such as Bitcoin using the funds. Do note, some exchanges charge different amounts for withdrawing certain cryptocurrencies. Personally, a useful website that I use is cryptofeesaver.com to find the cryptocurrency with the cheapest withdrawal fee.

- Transfer the cryptocurrency over from the SGD-Supported exchange, and you’re done!

- If let’s say you transferred Bitcoin, but you want to purchase Avalanche, you would have to go through an extra step of converting the Bitcoin to a stablecoin such as USDT and using the USDT to purchase Avalanche on the market. This may incur additional fees.

Fee structures

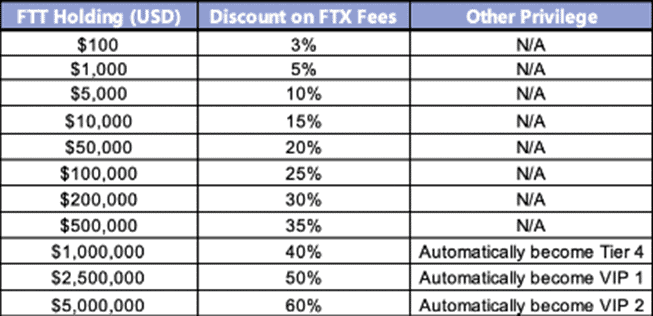

The fees that are highlighted in the table are not fixed for certain exchanges. Some even offer discounts based on your holding of the exchange’s native tokens.

For example, KuCoin offers maker/taker fee discounts if you hold their native KCS token. Additionally, you even get a 20% discount on trading fees if you pay them using KCS. Here is what their fee structure looks like:

Another example is FTX. They offer discounts on maker/taker fees for holders of their native platform token, FTT. Here is what the structure looks like based on your holding of FTT:

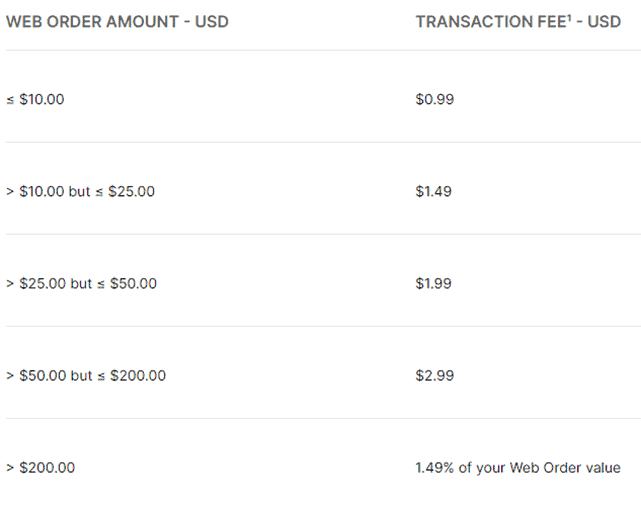

It is also important to note that some exchanges such as Gemini charge a higher fee if you use their simpler and more convenient to use web application. However, they do have a more complicated ActiveTrader interface which I recommend using as it is not very hard to grasp and it would save you a lot of money on fees in the long run. Here is the fee breakdown if you were to use their web application:

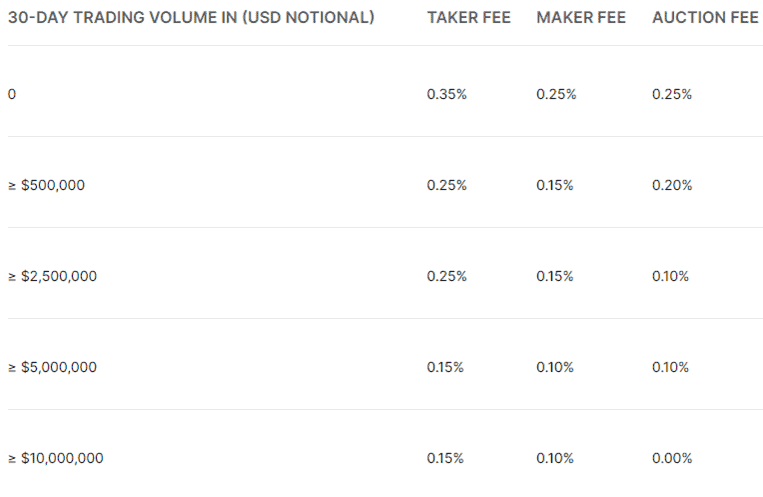

As you can see, Gemini charges a whopping 1.49% in fees for orders above $200. However, if you use their ActiveTrader interface, the fees are as follows:

(Note that the list is much longer, and the 30-Day trading volume goes up to $500,000,000. If you wish to see the full list, you can head over to Gemini’s ActiveTrader fee schedule)

User-friendliness

Ease of use is another key factor when it comes to deciding which exchange is best for you. If you are completely new to the whole cryptocurrency/stock investing space, the interfaces can be quite difficult to understand. Some exchanges however do offer a simpler user interface at a higher fee allowing beginners to buy cryptocurrencies with ease.

As mentioned earlier in the fee structure section, it is recommended to try learning the more complicated interface with all the funky charts to save on fees. But hey, if simplicity is something you are looking for, there is nothing wrong with using the web interface because time is money too.

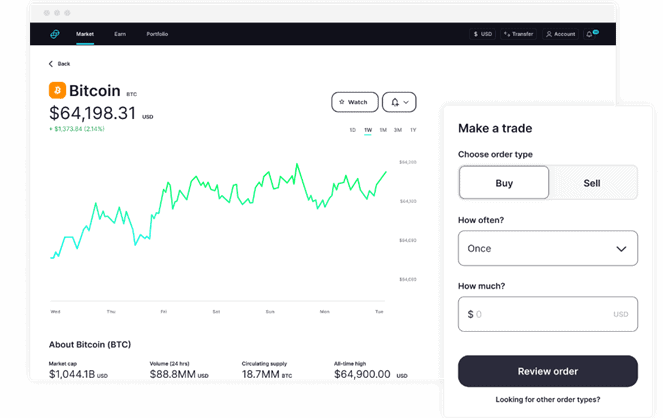

Gemini is one such exchange that charges a higher 1.49% fee for their web interface, which looks like this:

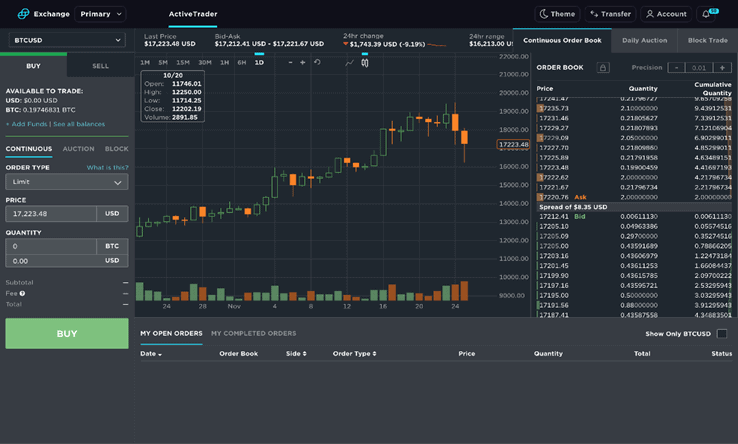

Gemini’s ActiveTrade is the more complicated interface, but it has a lower 0.35% taker fee and 0.25% maker fee. This is what it looks like:

Security

Perhaps one of the most important factors to consider is the security of the exchange because after all, you do not want your cryptocurrencies getting stolen. To ensure security, most exchanges require a KYC verification and also use 2-factor authentication (2FA) to protect your funds.

If you hold large amounts and wish to have an added level of security, you could consider transferring your digital assets to a hot (online) or cold (offline) wallet which are much safer alternatives to storing it directly on the exchange.

In the event the exchange itself is hacked and your funds get stolen by hackers, you don’t have to worry if you use exchanges such as Gemini, Coinbase, or Crypto.com (this is not the full list) since they do provide insurance coverage for your digital assets.

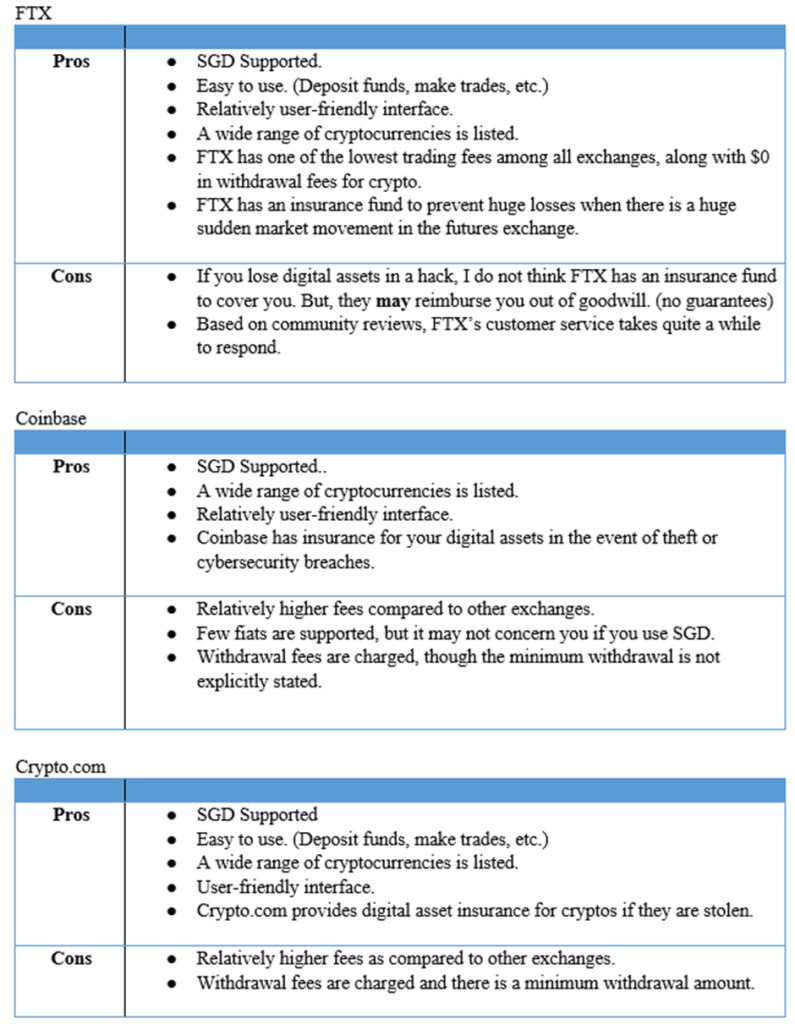

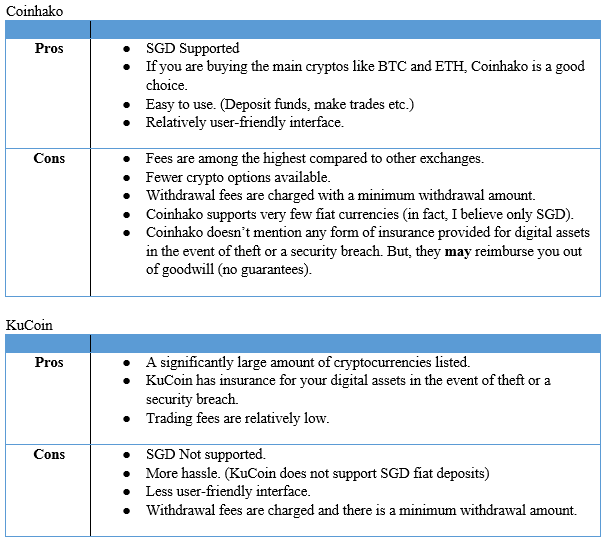

Exchange Comparison

Recommended Picks

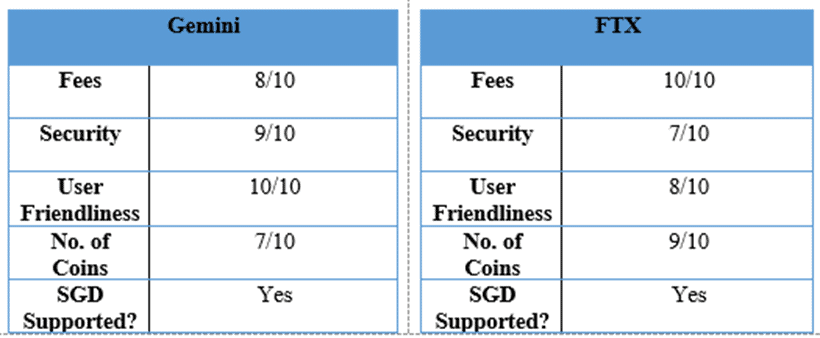

If you are still having trouble deciding which exchange is the best for you, perhaps these recommendations could help. To simplify things, I would rate these exchanges out of 10 based on the factors mentioned above.

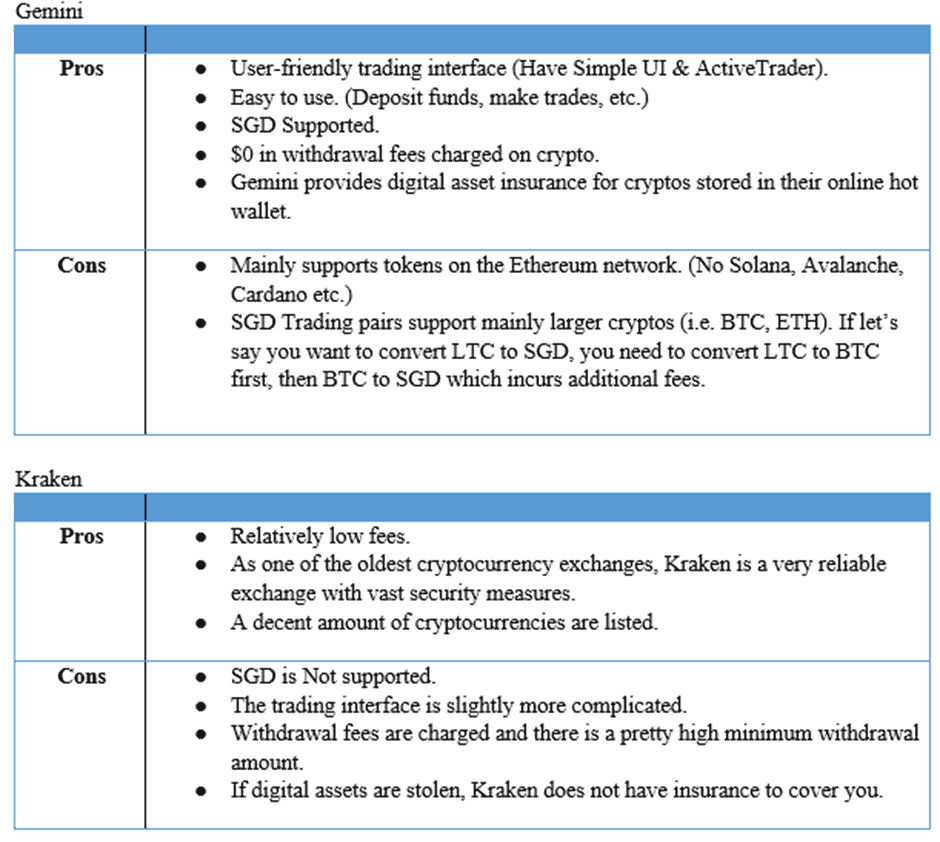

Gemini and FTX are both great exchanges to use if you are just starting due to their relatively lower fees and ease of use. There is also a decent number of cryptocurrencies that you can buy, from the popular Bitcoin to Ethereum or even your Dogecoin and Shiba Inu.

From a security standpoint, both have relatively similar security features from KYC to 2FA. In terms of an insurance fund, Gemini is much safer as it does provide insurance coverage for your digital assets stored on their online hot wallet. FTX on the other hand does not mention any insurance coverage for your digital assets if they are stolen, but they do ensure huge losses on their futures exchange, in the event there is a sudden large price movement.

In any case, if you are intending to hold large amounts of cryptocurrency, I would recommend that you store them in an offline cold wallet as it is the safest option.

For those who are looking to open a Gemini Crypto account, you can click on the affiliate link to get you started.

Conclusion

Getting started on cryptocurrency is not as straightforward as buying stocks. Most wannabe Singapore cryptocurrency investors/traders get stuck on selecting the right exchange that supports the use of SGD fiat currency. At present, SGD can only be used to purchase a handful of more popular cryptocurrencies for most exchanges, such as Bitcoin and Ethereum. Based on my experience using platforms such as Gemini and FTX, the transfer of SGD into the exchange is quite fast (within minutes) once your funding account is approved.

The limitation is that you might not be able to purchase less well-known (but perhaps more exciting cryptocurrencies) with SGD. You will need to fund it with USD and that will require a USD account from your side.

Selecting the right exchange with low fees is also critical since they can all add up easily with multiple transactions (particularly if you are looking to trade it). FTX exchange has one of the lowest fees (if not the lowest) out there and will be the ideal platform for a cost-conscientious SG Crypto investor/trader to get started on his/her crypto journey.

I hope that this basic guide to Cryptocurrency Exchanges in Singapore is useful for Singaporeans to help you guys get started on your very first step towards the world of cryptocurrencies. Do note that cryptocurrency remains a HIGH-RISK asset category so please only invest in spare capital which you can afford to lose it all.

Looking ahead, I will be looking to provide more bite-size articles on cryptocurrencies, with the next article on earning passive income through cryptocurrencies, so stay tuned for that.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Is Solana going to be the “Ethereum killer”

- Beginners Guide to crypto currency. How to get started

- GBTC ETF: How you can buy Bitcoin at a discount

- What are NFTs and my NBA Topshot experience

- Why you should invest in Coinbase stock and how to get a free Disney shares while doing it

- Bitcoin prediction: 5 reasons why its rise this time might be sustainable

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only

1 thought on “Best Cryptocurrency Exchanges in Singapore 2022”

Gemini supports SOL-USD now