China Stock Market Crash. Down c.30% from peak

Since the Chinese / HK market made a top in February 2021, these indices have seen steep declines. The CSI 300 Index, an index that tracks the top 300 companies listed on the Shanghai Exchange, is trading at 4,222 or roughly ~28% down from its peak of 5,917.1, achieved at the start of 2021.

The HK index, an index that contains popular Chinese technology companies such as Alibaba and Tencent, is trading at 22,000 or roughly ~30% down from its Feb 2021 high of 31,063.

The Nasdaq Golden Dragon Index (HXC), one which tracks large and mid-cap China stocks, mostly in the Consumer Discretionary, Communication Services, and Information Technology sectors, stocks such as Baidu, Netease, Alibaba, JD, NIO (top 5 holdings) has declined by a massive 65-70% from its peak back in Feb 2021.

Why has the China stock market crashed so badly in the past year? Is there deep value now or should you avoid the Chinese and HK markets altogether?

Reasons for China stock market crash

Generally speaking, three reasons led to this vicious decline in the Chinese / HK markets: 1) Increased governmental regulation by Beijing, 2) the threat of de-listing from US exchanges, and 3) the possibility of China helping Russia in the Ukraine conflict along with the potential Western sanctions being levied on China. In the following paragraphs, I will share my thoughts on each issue.

Increased governmental regulation by Beijing:

It all started in late 2020 when Jack Ma, the majority owner and founder of Alibaba, came out swinging against the Chinese government by criticizing the government for its supposedly stifling of innovation.

That did not sit well with the government as President Xi Jinping personally ordered the suspension of the highly anticipated Ant Financial (the fintech arm of Alibaba) IPO on the grounds of the company’s non-compliance with new lending rules the government introduced shortly after Jack Ma’s tirade.

This heralded the start of an anti-monopoly crusade the Chinese government launched against its big technology companies like Alibaba, Tencent, Pinduoduo, Meituan, etc.

These regulations include the likes of making it illegal for education technology firms to derive profits from the provision of tuition services, new laws that limit firms from acquiring data under laws covering data security and personal information protection, antitrust restrictions that led to rolling back of merger deals and exclusive partnerships, increasing scrutiny, and regulations on applications which led to the removal and/or slowdown in the proliferation of new applications.

All in all, these curtailed the abovementioned technology firms’ revenue and profit growth rates, prevented certain firms from going public (Ant Financial and Tiktok), and even wiped out an entire subsector in online education as their business models were rendered illegal.

These have caused a deserved reduction in the valuation and share prices of companies such as Alibaba and Tencent. However, even at reduced rates of growth and profit, the current valuations of these technology companies are criminally undervalued in my opinion as the market has more than priced in the worst.

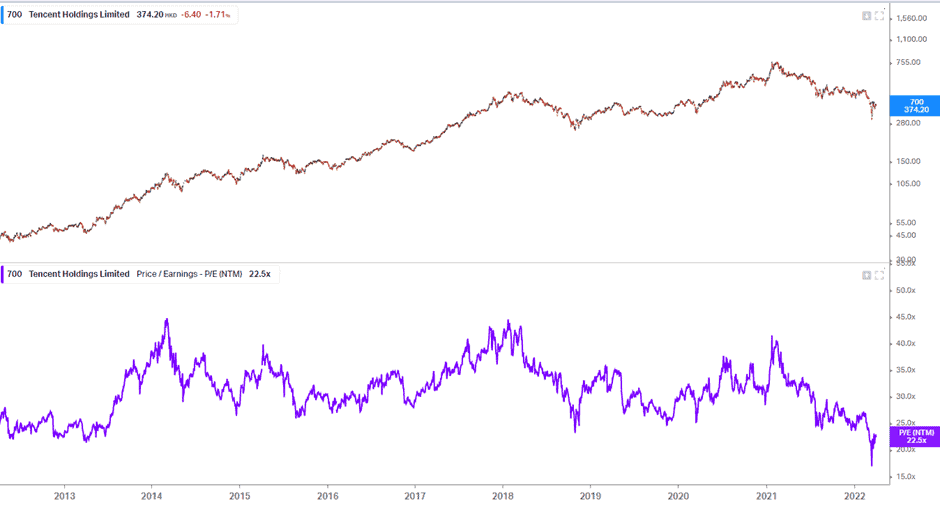

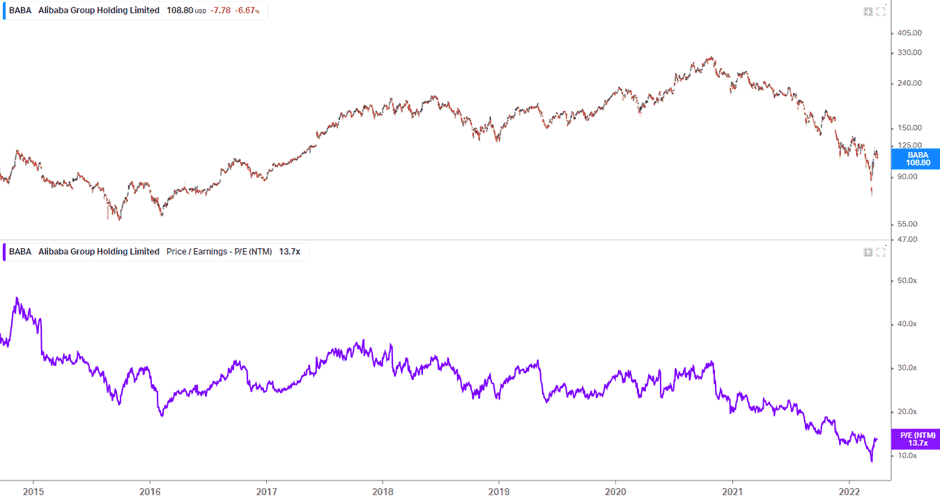

Tencent, for example, is trading at its lowest forward Price/Earnings multiple (currently at 22x) over the past 10 years (average of 33x)

Alibaba’s valuations paint a similar story, now trading at an undemanding valuation of just 13.7x forward P/E.

De-listing of China stocks trading on US exchanges:

Another prevalent factor that has been contributing to the slump of Chinese and HK companies would be the fear that the US securities commission would be looking to de-list China / HK companies over a lack of disclosure regarding their auditing process and/or accounting information. If confirmed, the companies would be delisted by 2024.

A Bloomberg report just released highlighted that the US continues to maintain its tough stance on delisting China stocks if they failed to adhere to better audit disclosure.

I think this fear is, however, rather overblown. The Chinese Ministry of Finance, along with the Chinese Securities Regulatory Commission, has issued a statement vowing to communicate and cooperate with the US Public Company Accounting Oversight Board.

This includes asking the US-listed firms such as Alibaba, JD, Baidu, etc. to prepare audit documents for the 2021 financial year for US inspection. It is important to also note that these companies are audited by some premier audit companies such as PwC, Deloitte, KPMG, and E&Y.

As such, I am not overly worried about any material misstatements or fraudulent financial reporting, at least for these blue-chip US-listed China stocks.

Possibility of China helping Russia & potential Western Sanctions:

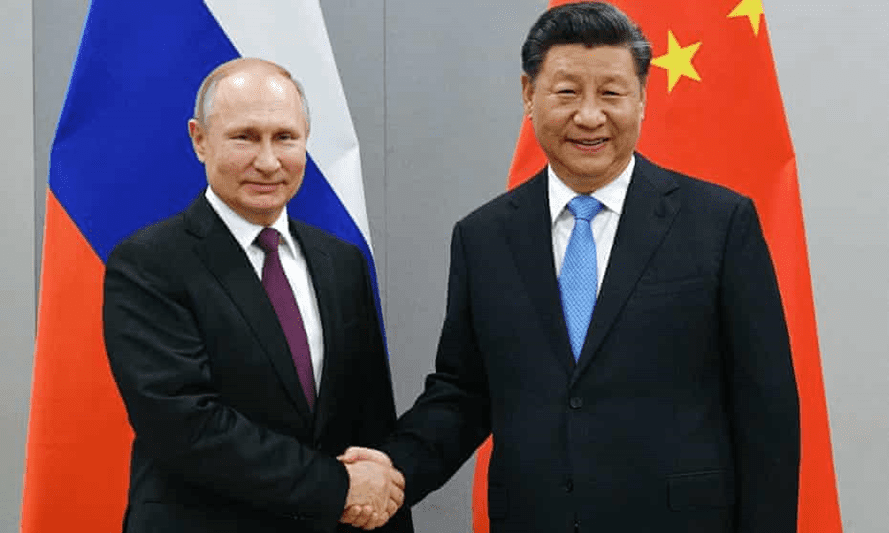

China’s recent ambiguity towards the Ukraine conflict, her refusal to condemn Russia’s invasion of Ukraine, Russia’s attempts to seek help from China, and China declaring their friendship with Russia has “no limits”, as investors worried that China would ally with Russia and have economic sanctions levied on her by the West.

President Biden has even vowed consequences should China support Russia in Ukraine. While this situation is in constant flux, I believe ultimately China would not provide direct aid to Russia as shown by their announcement that they would not be providing military aid to Russia.

Also, China appears to be treading a line similar to India where although they are not outright condemning Russia’s actions, they are still calling for a peaceful resolution to the conflict and both countries are sending humanitarian aid to Ukraine. As such, economic sanctions that have been levied on Russia by the West are unlikely to be levied on China, in my view.

There are, however, lingering worries about what China might do to Taiwan in the future, as what Russia had done to Ukraine at present.

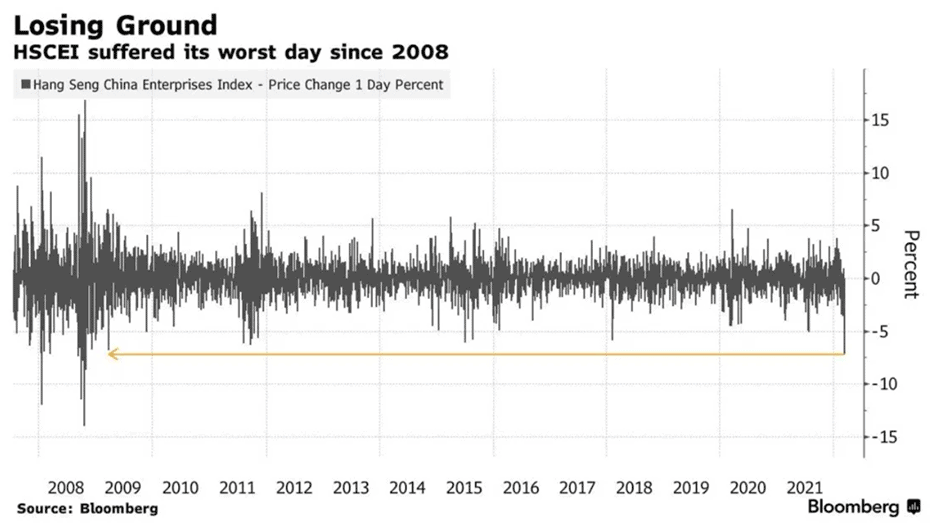

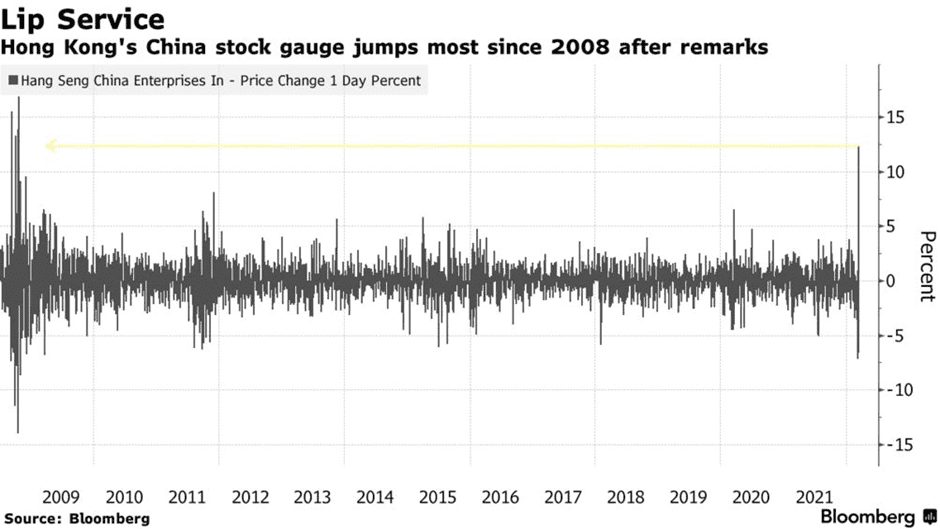

All these factors as well as the insolvency of The China Evergrande Group (a major player in China’s real estate industry) have led to the worst-selling in Chinese equities since the 2008 financial crisis.

However, this non-stop puking of Chinese equities might present some compelling opportunities especially due to Beijing’s recent announcement.

The Beijing Put

After the historic capitulation in Chinese / HK stocks on 15 March 2022 in which JPM downgraded all the Chinese / HK stocks by claiming that they are un-investable over the next 12-18 months, Beijing finally responded.

On 16 March, Beijing vowed that there would be actions taken to stabilize financial markets, to deal with the property market crisis, and further regulations would be introduced cautiously to not shock the markets. Additionally, policies impacting equity markets have to be cleared by the committee of Financial Stability and Development Committee under the State Council chaired by a senior Chinese official: Liu He.

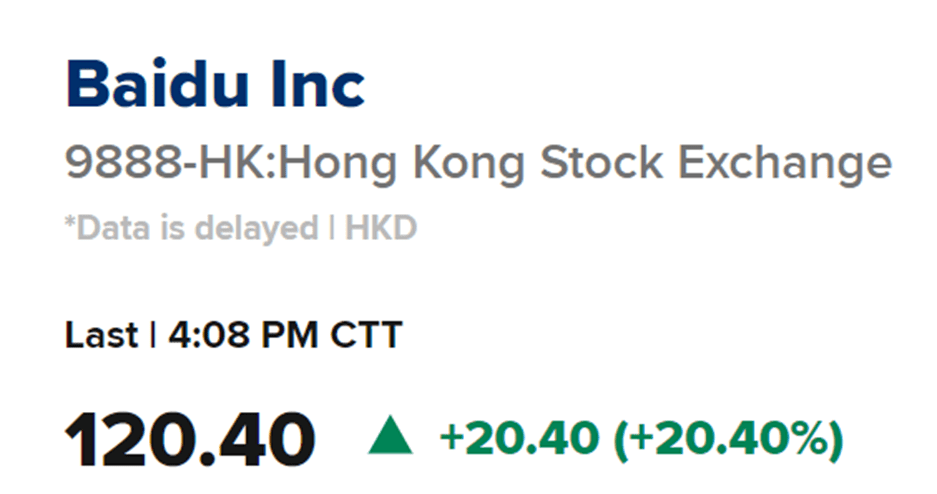

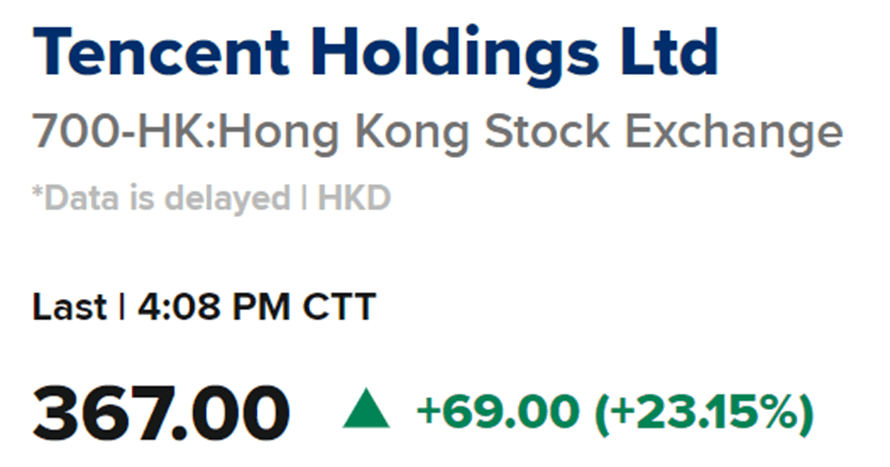

This led to the wildest panic buying and short-covering I have seen in the past 3 years. The HK index surged 9.1% on the day while the CSI 300 leaped 5+%. Individual components of the indices such as Alibaba, Tencent, Baidu jumped 27.3%, 23.2%, and 20.4% on the day.

Others such as Nio and JD jumped more than 30+%. Mega cap companies with market capitalizations of >100+billion trading like penny stocks! Absolutely insane.

China is also looking to support its economic growth by keeping monetary policy accommodative by introducing rate cuts, reducing reserve ratio requirements of banks, and injecting credit into the economy.

It is vital to note that this is necessary for China to have a chance to hit its ambitious goal of growing GDP by 5.5% this year. Xi Jinping is also seeking a major win for the upcoming Communist Party National Congress in November in which he should announce his third term as president.

Hence, he would need a strong economy going into the event which should ensure the continuation of accommodative financial conditions.

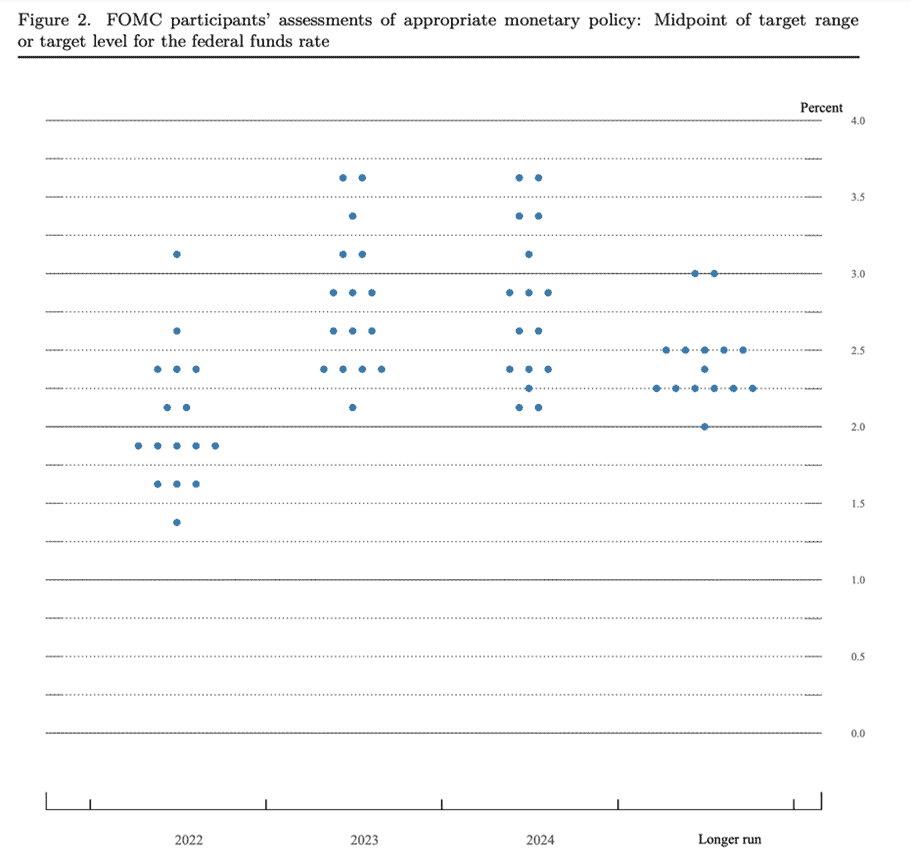

China’s easing of financial conditions runs counter to the US’ tightening of financial conditions. The Fed is likely to hike interest rates six times to ~2% to counter the high inflation experienced by the US.

This makes Chinese / HK equities immensely more attractive compared to US equities as Chinese / HK equities’ valuation should rerate higher while US equities rerate lower due to the difference in monetary policies. I believe Chinese / HK stocks are criminally undervalued.

How to take advantage of this?

There are two ways investors can look to take advantage of this undervaluation of Chinese / HK stocks. One could look to purchase individual equities or an ETF that tracks a basket of Chinese / HK stocks.

I would rather gain exposure to the Chinese / HK equity market through the purchase of ETFs as I would need not pay attention to individual companies’ earnings. The primary ETFs I would look to purchase track the HK index and the CSI 300 Index.

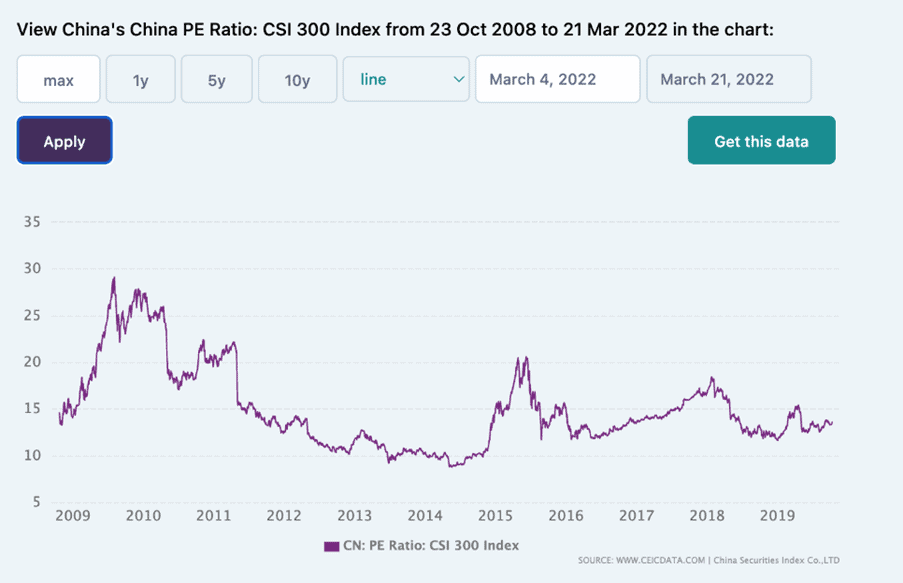

On the US exchange, ASHR is an ETF that tracks the CSI 300 index. This ETF holds physical China A-shares of the top 300 largest and most liquid Chinese shares traded on the Chinese market. Its current valuation of ~15 P/E is undemanding compared to its long-term average valuation.

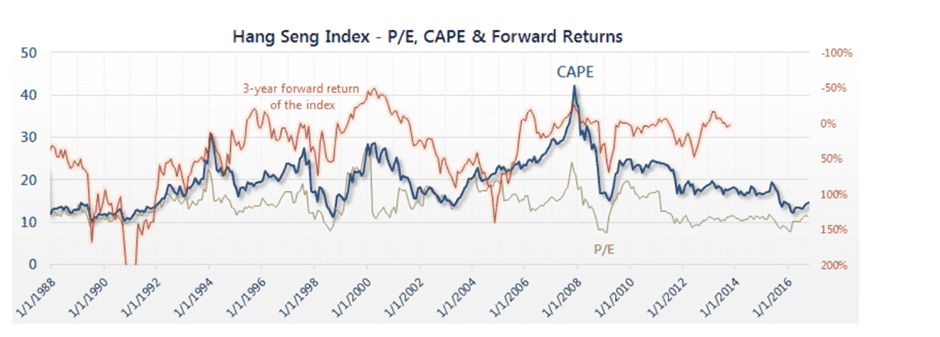

For exposure to the HK index, I would look to purchase the 2833 ETF listed on the Hong Kong exchange. 2833 is an ETF that looks to track the HK index. The HK index is currently trading at a valuation of ~13 P/E which is towards the low end of its historical valuation. A reminder that you have to purchase a minimum of 100 shares if you are looking to purchase an equity / ETF on the Hong Kong exchange.

These ETFs are chosen as I believe they offer the best value in terms of low expense ratios while tracking the indexes (HK index and the CSI 300 index) that I think are undervalued.

Conclusion:

In this article, I have shared the main reasons behind the precipitous declines in the Chinese / HK markets. I have also shared why I think these markets are undervalued and might be bargains compared to the US market.

Is this the bottom for Chinese and HK stocks? No one can be sure and it is exactly these “uncertainties” that are present that provide an opportunity for interested investors to buy into these China companies that are now trading at the low end of their valuation range.

“The future is never clear; you pay a very high price in the stock market for a cheery consensus. Uncertainty actually is the friend of the buyer of long-term values”

Warren Buffett

I would be looking to increase my exposure to both markets via the ETFs I have mentioned above. As always, these are my analysis on the Chinese / HK markets and are not meant to be financial advice. Please remember to do your due diligence before deciding to buy these ETFs to gain exposure to the Chinese / HK markets.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- How to double dividend yield using this simple strategy

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Strong Dividend Growth Stocks Increasing Dividends by up to 19% in 2020

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- A list of “Best” Dividend Growth Stocks

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.