Table of Contents

How to partake in China reopening with this top China ETF

China stocks were among the most hated in 2022. That was history. Since late 2022, Chinese stocks went from zero to hero and have staged one of the most impressive recoveries, ascending to the throne of being one of the best-performing markets (by geography) since the start of the year.

There are multiple reasons why Chinese stocks are regaining back their mojo. I will list 3 key reasons here in this article. Following that, I will highlight a top China ETF that has performed extremely well on a YTD basis.

This Top China ETF is an attractive alternative for investors to partake in a basket of US-listed China ADRs, all within a single purchase. I will elaborate more on this top China ETF shortly.

But first, here are 3 reasons why you might want to consider having some Chinese exposure in your portfolio.

Reason #1 to play the China reopening story: Chinese households are flush with cash

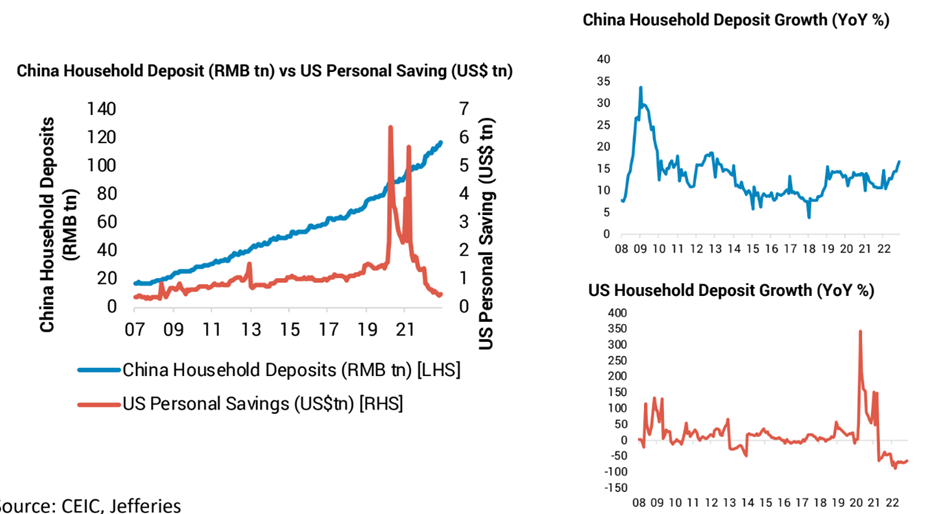

And they are all ready to spend in 2023. China has kept a strict Covid lockdown policy for the bulk of 2022 when most major economies have long accepted the fact that Covid is here to stay.

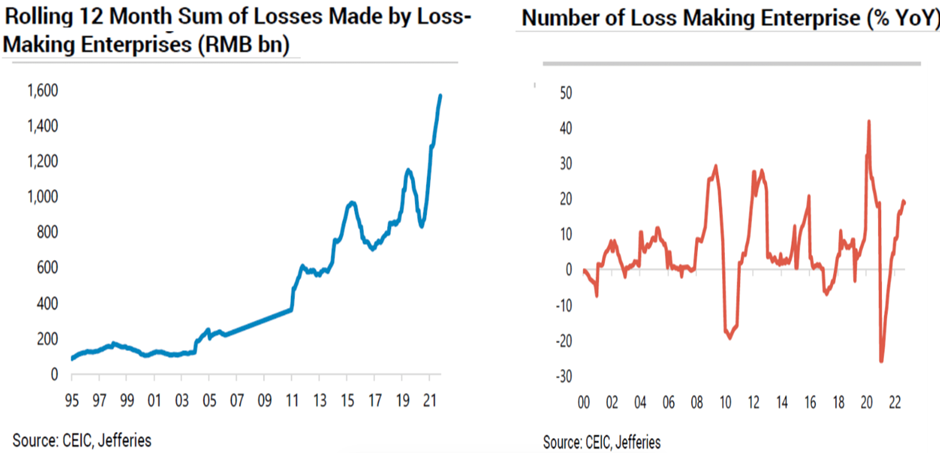

But China has realized the cost of keeping its nation “closed”. Chinese corporates saw their losses “ballooned” significantly over since 2020 and the number of loss-making enterprises has also witnessed a substantial increment in the past year.

Faced with limited viable options, it is not surprising that the Chinese government finally relented with its strict Covid policies and now is in the progress of fully reopening its economy to the world.

This is the time, when households, who have been flushed with cash due to months of lockdown and have nowhere to spend their money, will unleash this pent-up demand, which could mark the start of a strong retail recovery.

This will ultimately bode well for Chinese companies’ earnings, which are forecasted to rise by double digits in 2023.

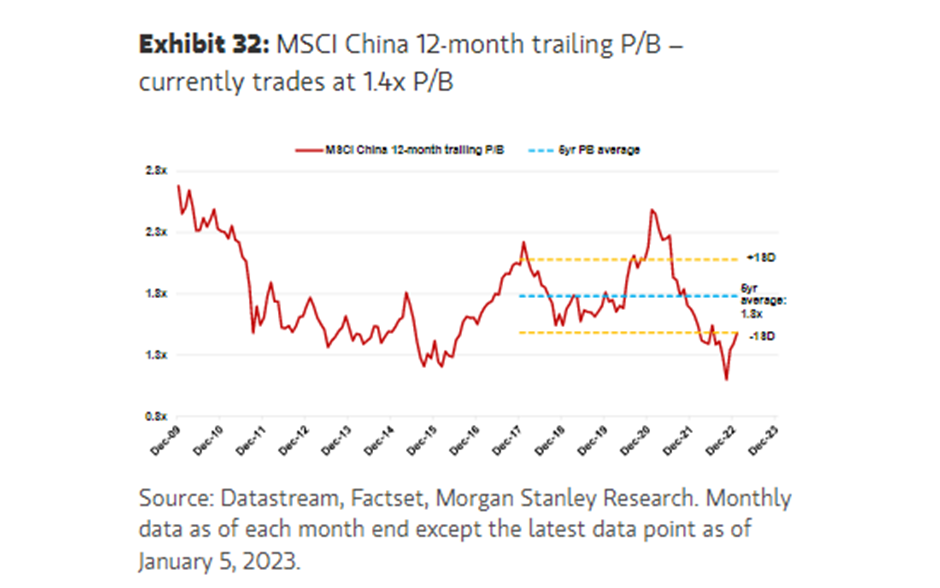

According to Morgan Stanley, this has yet to be reflected in the China stock valuations yet, which could make further upside a distinct possibility.

Reason #2 to play the China reopening story: A “friendlier” Chinese government

While the strict Covid lockdowns have a part to play in tanking the China stock market in 2022, it is not the sole reason. There are other reasons, one of which is the crackdown on the property and tech sectors.

The strong stance taken on its property sector was a necessary measure after several high-profile developers started showing credit-related issues. Given that property accounts for a huge chunk of a Chinese’s wealth, the government cannot afford a nationwide collapse in property prices and thus had to adopt strict measures in ensuring the stability of this industry.

Concerning the tech sectors, many of the industry heavyweights such as Alibaba and Tencent have grown “too big and too powerful” for the comfort of the Chinese government. They thus had to adopt measures to curb the growth of these tech “behemoths” and ensure that their authoritative power is not being undermined.

That saw a change of late with the government taking on more pro-growth policies to support enterprises and a silence on “common prosperity”.

For example, singling out internet platform firms, the officials said they would support the companies in playing a leading role in economic development, creating jobs, and competing in the international market.

Reason #3 to play the China reopening story: Lower risk of China ADRs being delisted?

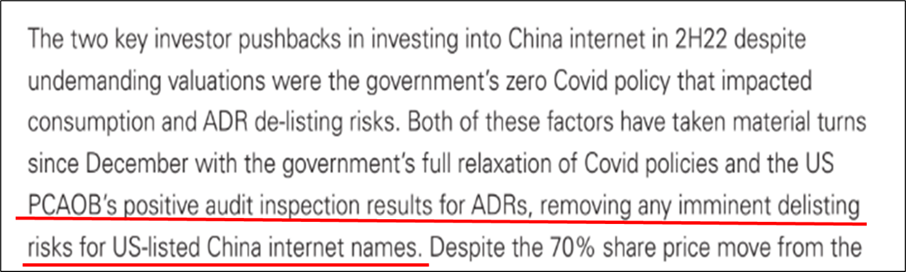

One of the key reasons why investors are hesitant to partake in China stocks, particularly those listed in the US (where the purchase is a lot more convenient) is the risk of China ADRs being delisted.

However, that change of late with the US PCAOB’s positive audit inspection resulted in ADRs, removing any imminent delisting risks for US-listed China stocks, particularly the internet names such as Alibaba, Baidu, JD.com, etc.

This gives all the more reason for investors to re-enter Chinese-related stocks, especially those listed in the US where it is more convenient for investors to make a purchase, compared to say buying those stocks through the HK exchange, where the associated commission costs are also higher.

One way to directly partake in US-listed China stocks is through this Top China ETF that has been one of the best-performing China ETFs over the past couple of months.

This ETF is the Invesco Golden Dragon China ETF (ticker: PGJ)

Invesco Golden Dragon China ETF (PGJ)

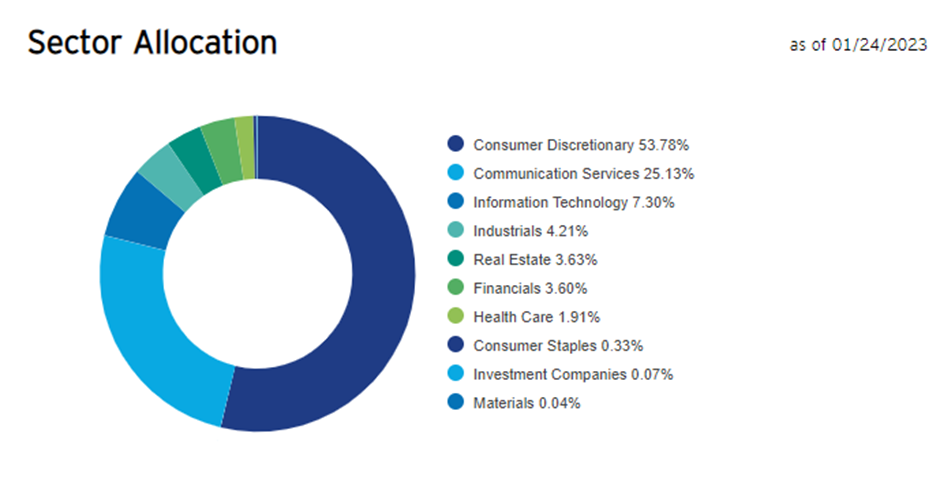

This particular top China ETF is composed of US exchange-listed companies that are headquartered in China. This gives investors an easy way to directly purchase all the US-listed China stocks through a single ETF.

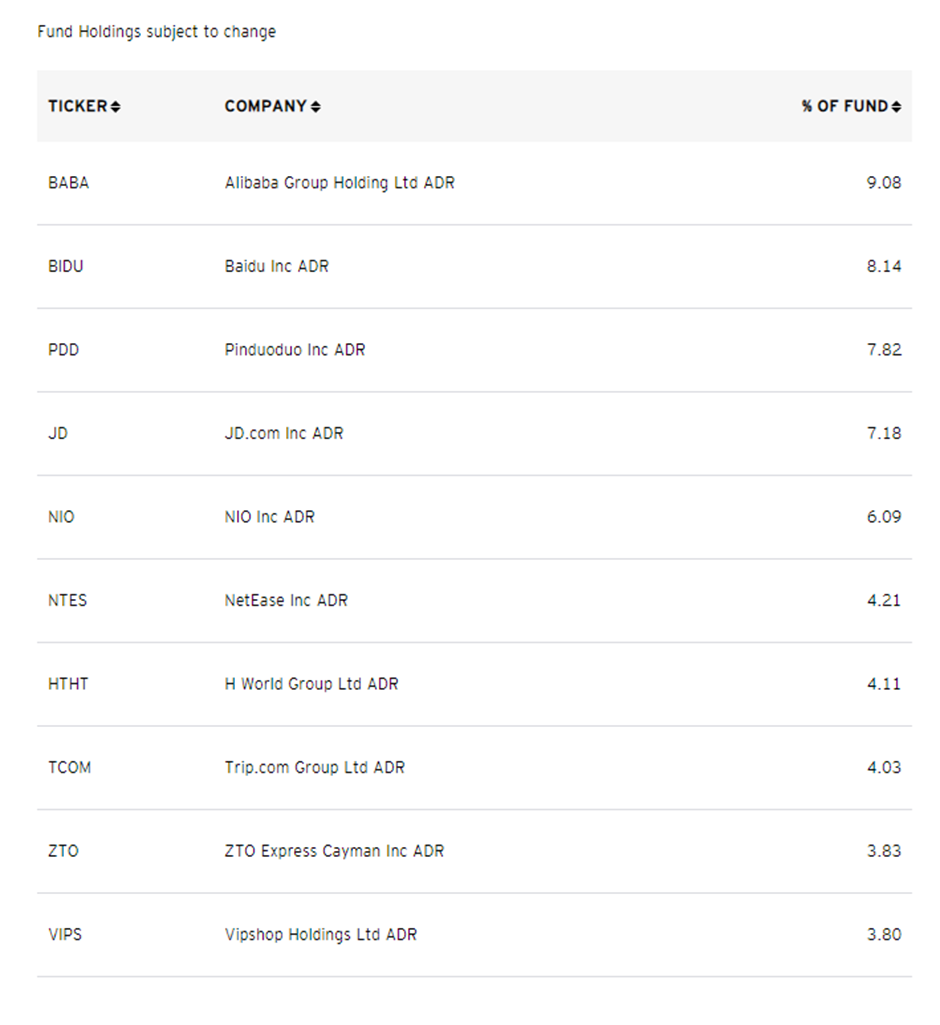

The Top 10 holdings of the PGJ ETF are shown below, with the ETF holding a total of 73 counters in its portfolio.

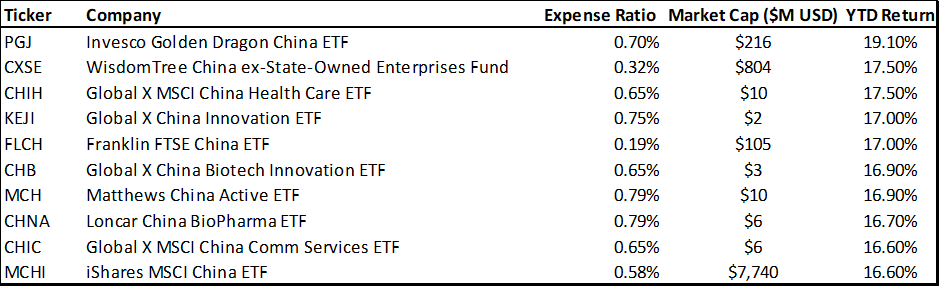

This top China ETF has also been THE best-performing China-related ETF on a YTD 2023 basis, appreciating by 19.1% in less than 1 month.

The table below shows the Top 10 China ETFs based on their YTD 2023 performance.

One of the key issues possibly associated with the PGJ ETF is its relatively high expense ratio of 0.70% and low market cap (which could present liquidity issues).

Nonetheless, for investors looking at a convenient way to purchase US-listed China ADRs, which have been one of the worst performers over a 2-year horizon due to persistent “delisting risks” associated with counters in this fund, now might be the time to capitalize on this rebound.

Conclusion

Like all stocks, investing in China stocks come with risks. While I have highlighted 3 reasons to be more positive on China-related counters, an escalation in global tensions (especially the black swan event of China invading Taiwan), a softening of the government’s pro-growth business policies, further decline in the China property market, etc could all send prices lower.

And with that huge rally since 2023, one should not be surprised at a pull-back, with investors finding a reason to take profit.

Nonetheless, for investors looking to diversify their portfolio with some China holdings, buying into an ETF like that PGJ ETF could be one easy way to do just that.

For investors looking at finding high-quality stocks to purchase, do check out my FREE 3-Part Video Guide on finding high-quality stocks that you can be confident to purchase when the time is right. Just click on the picture below.

Additional Reading on China Articles:

17 US Companies most at risk from escalating US-China tensions

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best China ETFs to buy

- 17 US Companies most at risk from escalating US-China tensions

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only