Stock Valuation Models: DCF & DDM (Part 2)

In part 2 of this stock valuation models guide, we will dive into the dividend discount model or DDM as it is more commonly known

In part 2 of this stock valuation models guide, we will dive into the dividend discount model or DDM as it is more commonly known

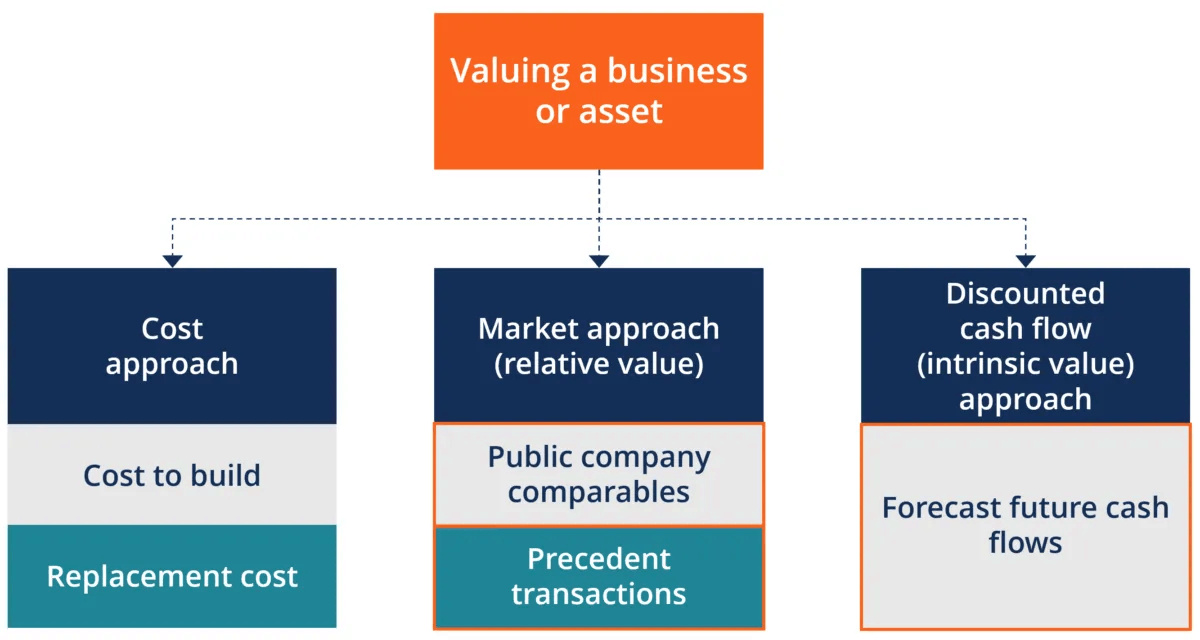

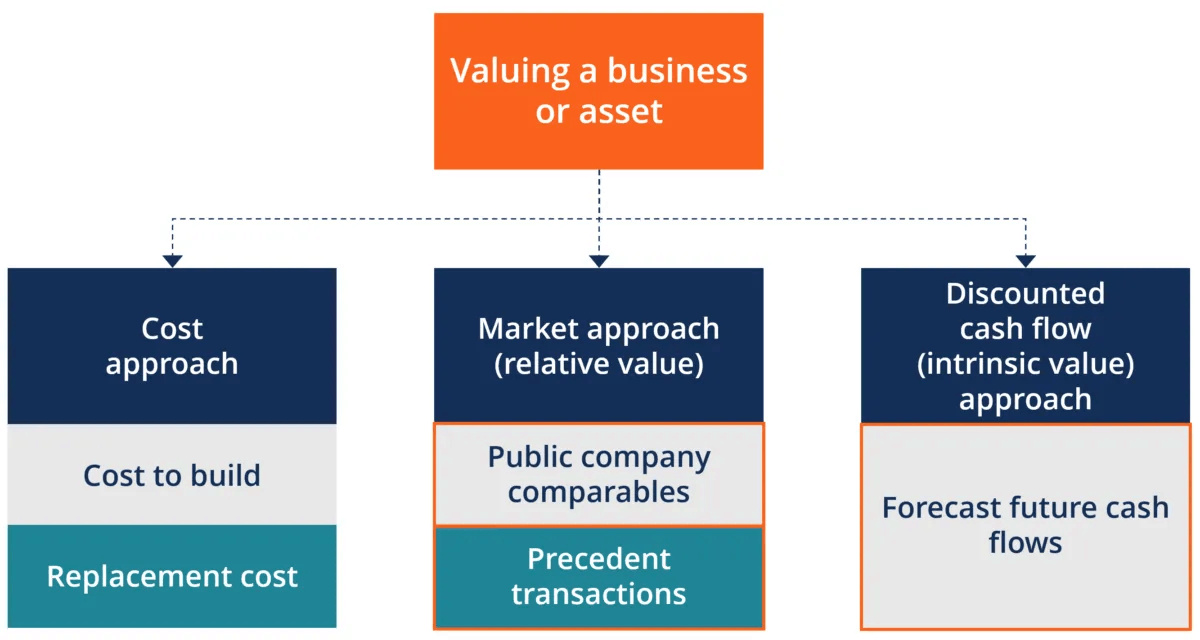

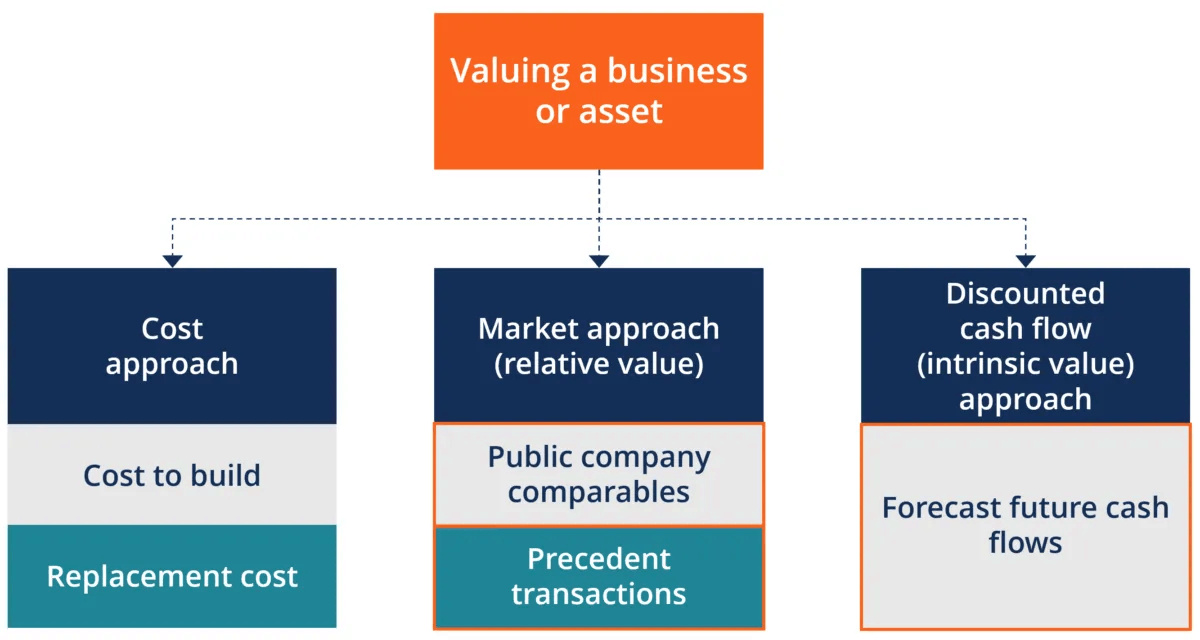

The Discounted Cash Flow model is one of the most popular stock valuation models used by analyst to determine the intrinsic value of a company

Warren Buffett’s Berkshire Hathaway sold almost $10bn worth of stocks in the latest 4Q22. Is this a bearish signal coming from the Oracle of Omaha

Some option strategies are safer than others. I detailed 3 safe option strategies you can consider to boost your trading income in this article.

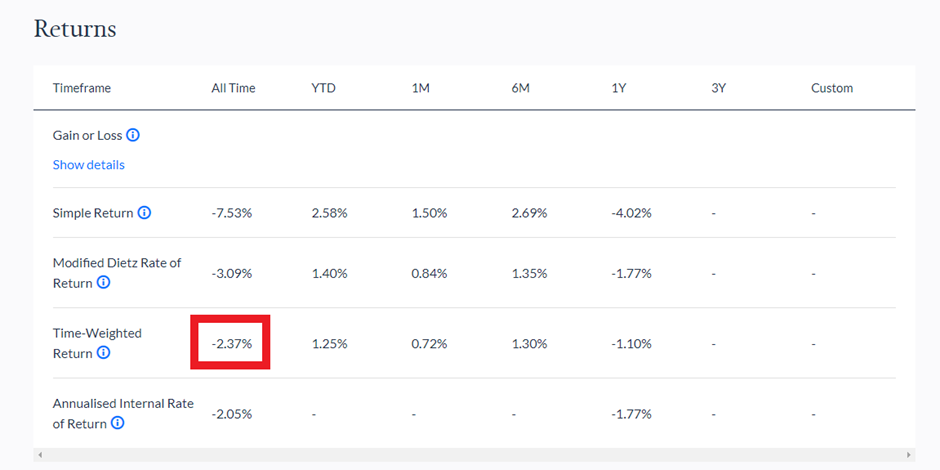

Endowus Cash Smart Review: Why is my cash smart ultra losing money after a 1.5 years holding horizon? Is this cash management service safe?

Here are the pure play AI stocks to get leverage exposure to the trending AI theme. Pure Play AI stock #1: C3.ai, Pure Play AI Stock #2: Soundhound

Is it too late to be buying ASML, a top semiconductor equipment manufacturer that has seen its price almost doubling since October 2022?

Here are the Top 5 Best-Performing Industries in 2023. Rank #5: Uranium, Rank #4: Auto Manufacturers, Rank #3: Internet Content & Information

The Poor Man’s Covered Call strategy is a useful bullish option strategies to buy a stock at a 50% discount or more while generating monthly income

How do you use the Poor Man’s Covered Call strategy to effectively generate a steady stream of recurring passive income?

Here are the 4 Best Seasonal Stocks to buy in the month of February with good track record of outperformance

Here are 3 reasons to play the China Reopening Story and how you can do that with this Top China ETF. Reason No.1: Consumer to boost spending

Here are the 4 best stocks to buy before earnings this week (Jan 16-31). Stock #1: XOM, Stock #2: AMD, Stock #3: ABT, Stock #4 EMN

Here are 5 ways to make money in a bear market: Strategy #1: Invest in the right asset. Strategy #2: Opportunistic short term opportunities

Who needs a bull market when you can generate steady short term returns using the covered call strategy for income

Here are the 4 reasons why we are still in a bear market bounce in 2023: 1) Expect earnings to decline amid a recession, 2) Increase in consumer debt