Why dividend growth matters

At the beginning of the week, I released a massive guide on Dividend Investing, detailing a step-by-step process on getting better acquainted with all things dividends.

In this article, I will be looking to identify 6 high-quality blue-chip dividend growth stocks that have consistently grown their dividends over the past decade.

These dividend growth stocks need to exhibit the few basic dividend growth characteristics to qualify:

- Past 5 years average dividend growth > 3%

- Past 3 years average dividend growth > 5%

- Past 1-year average dividend growth > 10%

- Dividend yield of at least 2%

- More than 10 years of consecutive dividend growth

- Market Cap > US$20bn

What we are identifying is not just a dividend growth stock, but one that has consistently increased its dividend growth rate over the past 5 years, with the latest dividend growth rate being double-digit.

Let me show you why such a dividend grower is the “preferred” stock over a “high yielding” dividend payer.

Let’s assume 2 scenarios.

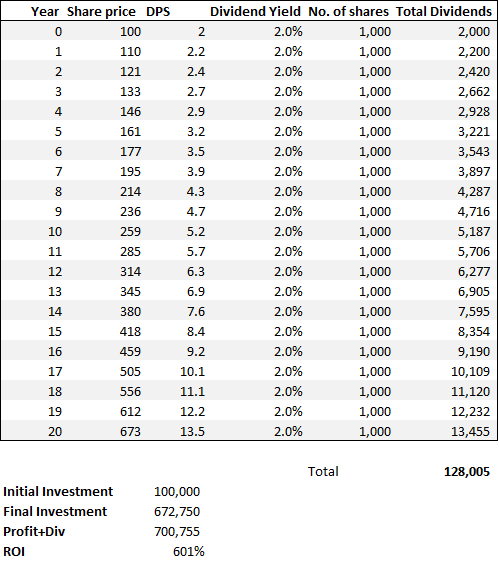

Scenario 1

Peter has $100,000 to invest and he decided to invest in a stock priced at $100/share with the counter paying $2 dividends per share (DPS). This counter is growing its dividends at 10%/annum. With $100,000, Peter is entitled to 1000 shares of the stock and received $2,000 in dividends in his first year.

We make a key assumption here that the stock continues to trade at a 2% yield over the next 20 years while concurrently growing its DPS by 10% a year. Hence in year 2, his DPS will be S$2.20 while his share price will have appreciated to $110/share or also a 10% appreciation.

After 20 years, assuming that Peter did not reinvest his dividends, he would have received a total payout of $128k solely from dividends. His initial capital would also have grown from $100,000 to $672,750.

His total profits, including dividends, would have equated to approx. $700k for a 600% return over this duration.

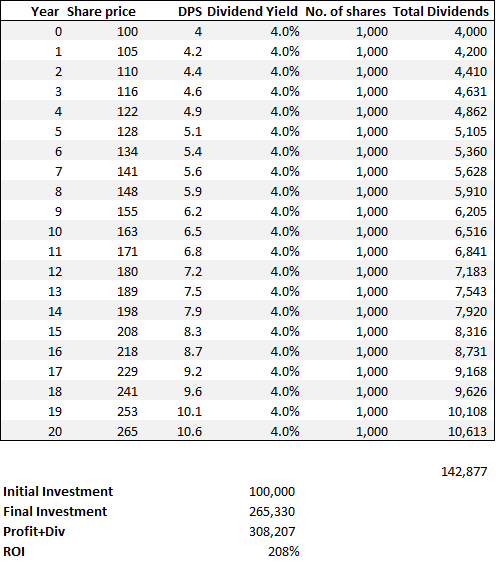

Scenario 2

Mark, on the other hand, decides to invest in a higher-yielding stock, one that pays a yield of 4%. This dividend stock however is growing its dividend by just 5% annually.

Using the same initial capital assumption as in Scenario 1 ($100k), you will see that Mark generates a higher total amount of dividends over 20 years $143k vs. $128 for Peter. However, in terms of share price appreciation, assuming that the stock continues to yield 4% over the entire horizon, the final investment will only be worth c.$265k vs. Peter’s $672k.

Mark’s total ROI, including dividend received, will amount to just 208% which is a huge reduction vs. Peter’s massive 600% ROI over the same period.

The above 2 scenarios assume that there is no yield compression or expansion in both cases.

From this simple example, one can see that a strong dividend grower is the preferred choice vs. a high yielding counter.

Of course, the best of both worlds will be to find a high dividend-yielding stock (>4%) which is also a strong dividend grower (growing dividends by 10% annually). However, such stocks are almost non-existence.

On the other hand, we can identify a handful of blue-chip candidates that currently yield more than 2% while yet sporting a consistent dividend growth profile, as illustrated in our screening criteria.

Without further ado, let’s take a look at these strong dividend growers. We exclude financial counters on this list.

Blue-Chip Dividend Growers

Blue-Chip Dividend Growth Stock #1: Automatic Data Processing (ADP)

Sector: Industrials

Market Cap: $55bn

Current yield: 2.8%

Automatic Data Processing Inc competes in the human resources administration services industry. It provides services that satisfy companies’ human resources needs, such as payroll processing and benefits administration. ADP was founded in 1949 and has its headquarters in Roseland, New Jersey.

The company has been hard hit by the COVID-19 crisis, understandably so as the unemployment rate skyrockets in the US due to business shut-downs.

The company is currently paying $3.64 DPS and yields 2.8% at its current share price. With a payout ratio of 61%, a strong balance sheet with net debt of just $441m vs. annual free cash flow of $2.2bn, the company is in a comfortable position to continue its track record of paying higher dividends in 2020 despite expected earnings to drop by 12% this year.

ADP sports a 10-year average yield of 2.5%. Hence with its current yield at 2.8% (based on trailing DPS), it seems to indicate a certain level of undervaluation. This is rather attractive for a blue-chip dividend growth stock such as ADP whose operations are temporarily impacted by COVID-19, unless one holds the view that a high unemployment rate is here to stay.

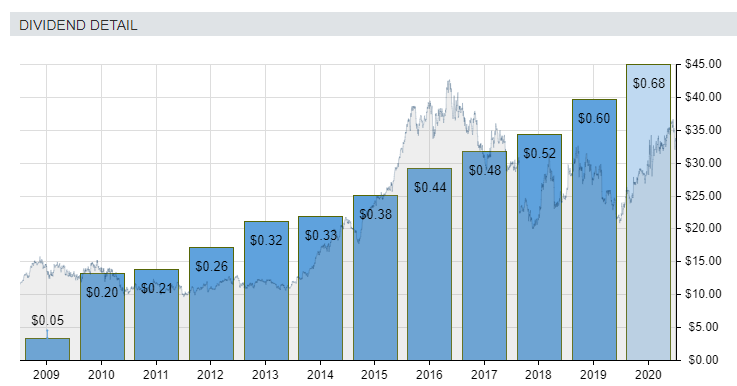

Blue-Chip Dividend Growth Stock #2: Best Buy (BBY)

Sector: Consumer Cyclical

Market Cap: $27bn

Current yield: 2.1%

Best Buy is one of the largest consumer electronics retailers in the U.S., with product and service sales representing 9.3% of the $450 billion-plus in personal consumer electronics and appliances expenditures in 2019 based on estimates from the U.S. Bureau of Economic Analysis.

The company is focused on accelerating online sales growth, improving its multichannel customer experience, developing new in-store and in-home service offerings, optimizing its U.S., Canada, and Mexico retail store square footage, lowering the cost of goods sold through supply-chain efficiencies, and reducing selling, general, and administrative costs.

The counter has hugely outperformed the index, with a total return of 24% YTD vs. the S&P500 1.6% return.

Nonetheless, despite its strong performance in 2020, the counter still yields a decent 2.1%, just above our cut-off mark of 2%. BBY pays a DPS of $2/share with a payout ratio of just 33%, putting the counter in a strong position to continue raising its dividends regardless of the current dire macro outlook.

Also, BBY sports a net cash position, generating a free cash flow of c.$1.5bn per annum. This more than covers the dividend expense of c.$530m/annum. Assuming that the counter can continue to raise its DPS per share by 10%, that will imply a DPS of $2.20. At its current price of $106, that will imply a forward yield of 2.1% which is at the lower end of its 10-years average dividend yield of 2.7%.

Blue-Chip Dividend Growth Stock #3: Home Depot (HD)

Sector: Consumer Cyclical

Market Cap: $288bn

Current yield: 2.3%

Home Depot is the world’s largest home improvement specialty retailer, operating nearly 2,300 warehouse-format stores offering more than 30,000 products in-store and 1 million products online in the United States, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals.

The acquisition of distributor Interline Brands in 2015 allowed Home Depot to enter the maintenance, repair, and operations sector, while the tie-up with Company Store brought textile exposure to the lineup.

HD has been one of the major beneficiaries of COVID-19, with citizens “stuck” at home deciding to engage in home improvement activities to past time. The company has also benefitted substantially from the strength seen in its e-commerce segment

A very consistent grower of earnings, HD saw its EPS increasing from $1.86 back in 2010 to $10.06 in 2019. Consequently, the company also managed to grow its DPS from $0.94 in 2010 to $5.44 in 2020, or a CAGR of 21.5%.

While there might be concerns over a substantial net debt amount of $26bn on its balance sheet, this is offset by the free cash flow generation of $11bn a year.

HD currently has a payout ratio of 52% and I believe its dividend payment is at no risk of being cut. The street is likely forecasting for another strong double-digit growth in dividend payment to $6/share. Its forward yield will equate to 2.25% at the current price. That will be generally in-line if not slightly undervalued vs. its 10-year dividend yield average of 2.15%.

Blue-Chip Dividend Growth Stock #4: Kroger (KR)

Sector: Consumer Defensive

Market Cap: $26bn

Current yield: 2.2%

Kroger is the leading American grocer, with 2,757 supermarkets operating under several banners throughout the country as of the end of fiscal 2019. Around 82% of stores have pharmacies, while over half also sell fuel.

The company also operated more than 300 fine jewelry stores at the end of fiscal 2019. Kroger features a leading private-label offering and manufactures around a third of its own-brand units (and 42% of its grocery own-label assortment) itself, in 35 food production plants nationwide. Kroger is a top-two grocer in 90% of its major markets (as of late 2019, according to Planet Retail and Edge Retail Insight data cited by the company. Virtually all of Kroger’s sales come from the United States.

Kroger has weathered the COVID-19 crisis relatively well, with the stock up 16% YTD vs. the S&P500 appreciation of just 1.6%. The company is seen as a defensive play, one which will continue to do well regardless of the COVID-19 situation. The company’s increasing e-commerce exposure also bodes well for its future growth prospects.

The street is expecting strong growth in EPS in 2020 at $3.17 vs. 2019 level of $1.96. However, that figure is expected to normalize to around $2.68 in 2021.

While KR’s earnings have not been as steady as HD, the counter has been a very consistent DPS grower, with a 10-year CAGR of 13.3%. Assuming that it grows its DPS to $0.72, the forward yield will be at 2.2%. I believe that KR has the propensity to maintain such strong growth in its DPS, given its substantially low payout ratio of just 24%.

While there might be some concerns over its high gearing profile, this is partially offset by its strong free cash flow generation.

Blue-Chip Dividend Growth Stock #5: Merck & Co (MRK)

Sector: Healthcare

Market Cap: $209bn

Current yield: 3%

Merck makes pharmaceutical products to treat several conditions in some therapeutic areas, including cardiovascular disease, asthma, cancer, and infections. Within cancer, the firm’s immuno-oncology platform is growing as a major contributor to overall sales.

The company also has a substantial vaccine business, with treatments to prevent hepatitis B and pediatric diseases as well as HPV and shingles. Additionally, Merck sells animal health-related drugs. From a geographical perspective, close to 40% of the firm’s sales are generated in the United States.

The street is generally positive on the counter, with 9 recommending a strong buy with a median target price of $92.50. While MRK’s earnings have not been as steady as some other healthcare names, they are expected to grow strongly over the next 2 years, with the street forecasting EPS growth of 50% in 2020 and 11% in 2021.

Based on the street’s estimates, DPS is expected to grow to $2.44 in 2020 vs. $2.26 in 2019 or an 8% growth rate which is slightly lower than the 1-year growth rate of 12-13%. With a forward DPS of $2.44, the counter is yielding 3%. Based on its 10-years average yield of 3.5%, the counter might be seen as still over-valued. However, the counter’s yield has depressed to 3.1% over the past 5-years, hence it is not drastically “over-valued” in that sense.

With a payout ratio of approx. 58%, MRK does have a further propensity to continue growing its dividend profile.

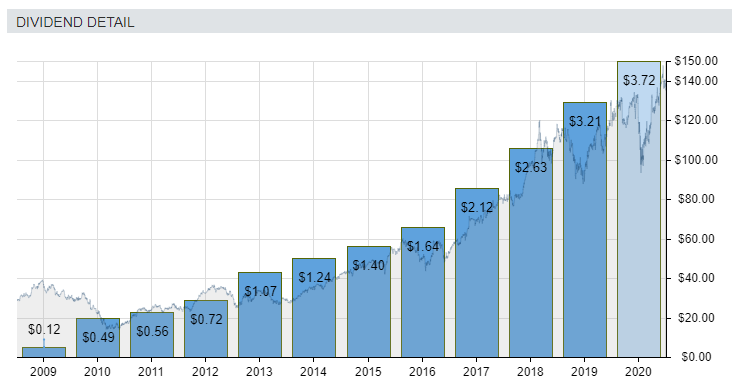

Blue-Chip Dividend Growth Stock #6: Texas Instruments (TXN)

Sector: Technology

Market Cap: $124bn

Current yield: 2.7%

Dallas-based Texas Instruments generates about 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world’s largest maker of analog chips, which are used to process real-world signals such as sound and power.

Texas Instruments also has a leading market share position in digital signal processors, used in wireless communications, and microcontrollers used in a wide variety of electronics applications.

TXN witnessed a substantial decline in revenue and earnings in 2019, even before the onset of COVID-19. The street expects its earnings to decline marginally by -1.3% in 2020 followed by a more modest rebound of 5.4% in 2021.

Despite some earnings woes, the company has been a strong dividend grower, with its DPS growing by a CAGR of 23% over the past decade. Assuming a more modest 10% growth rate vs. its 2019 DPS of $3.21, the company will be paying $3.60 in 2020 or a forward yield of 2.7%. This is in-line with its past 10-year average yield of 2.7%.

TXN has a strong balance sheet profile, with net debt of just 1.8bn vs. 5.7bn or $6.16 per share. With the counter paying just $3.60 in DPS, this is well covered by its annual free cash flow generation.

Conclusion

These are the 6 blue-chip Dividend growth stocks that have an extremely high probability of continue growing their dividends in the coming years due to a combination of operational resilience as well as balance sheet strength, with many of these counters having a low payout ratio below 60%.

These 6 stocks on average, yield 2.5%. Assuming a constant dividend growth rate of 10% over the next 2 decades, a $100k initial investment in a basket of these 6 stocks could generate a total dividend payment of $160k over 20 years, with a total ROI of 633% assuming that these stocks continue to yield on average 2.5% after 20 years.

Based on the dividend yield theory, it will seem that ADP, HD, and KR are potentially undervalued at the current price while BBY and MRK are overvalued with TXN being fairly valued at its current price. There is nothing wrong with buying stocks at fair value. Of course, it is always ideal to purchase at bargain prices when possible, with a decent margin of safety.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

SEE OUR OTHER STOCKS WRITE-UP

- Top 20 Best Growth Stocks to buy [2020]

- Thematic ETFs partaking in the hottest trends

- 6 Top Investment trends (2020): Finding safe havens in a pandemic-driven market

- Top 8 technology trends accelerating due to COVID and the stocks to benefit from it

- 5 outperforming stocks that crush the S&P500 in 1Q20

- Best performing ETFs which consistently outperform the S&P500 over the past decade

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.