This article looks to identify the best tax efficient ETF portfolio to invest in for Global, US and Emerging Market exposure.

For investors who have been engaging a DIY approach to construct your own ETF-based passive portfolio, you are probably well-aware of the tax implications when one is vested in US-domiciled ETF.

For those who are unfamiliar, let me just provide a quick rundown as to why US-domiciled ETFs might seem cheap on the surface but when dividend withholding tax is taken into consideration, the conclusion changes dramatically.

Tax efficient ETF Portfolio Consideration #1: Dividend Withholding Tax

For example, a popular US-domiciled ETF is VOO, Vanguard S&P500 ETF. This ETF has a Total Expense Ratio (TER) of 0.03%.

However, after taking into consideration the withholding tax impact for a Singaporean investor, the total cost increases significantly to c.0.58%.

Let us take a brief look at how the exact math is calculated.

To calculate the dividend Tax Withholding Ratio (TWR), we need four pieces of information:

- L1TW: percentage of tax withholding paid by the fund on the dividends distributed by the underlying international securities held (Level 1). This can be estimated using each fund’s annual report, by dividing “Non-reclaimable withholding tax” by “dividend income”. For a US domiciled ETF with ALL US holdings (for example S&P500), L1TW is essentially 0%. The Vanguard S&P500 ETF (VOO) has 0% L1TW.

- L2TW: Percentage of tax withholding on dividends the individual pays (Level 2). If you are a non-treaty US non-resident investing in US-domiciled ETFs, that number is 30%. If you are investing in Ireland domiciled ETFs and you do not reside in Ireland, you do not have to pay any Irish withholding tax.

- YIELD: Annual yield of the fund

- TER: The fund’s Total Expense Ratio

The calculation is as such:

TWR = (YIELD * L1TW) + ((YIELD * (1-L1TW) -TER) * L2TW)

Let’s use VOO as an example.

L1TW = 0%, as it is US domiciled, holding US securities

L2TW = 30%, US non-resident rate for countries without a US tax treaty (Singaporeans)

YIELD = 1.85%

TER = 0.03%

TWR for VOO = 0% (no L1 withholding) + ((1.85% * (1-0) – 0.03%) * 0.30) = 0.55%

Total expense = TWR + TER = 0.55% + 0.03% = 0.58%

For quick comparison purpose, a similar tax efficient ETF such as the Vanguard S&P500 UCITS ETF (VUSD) will only amount to a total expense of 0.29%. This figure is calculated as below:

L1TW = 15%, as it is Ireland domiciled, holding US securities

L2TW = 0%, no Irish tax withholding on UCITS funds

Yield = 1.45%

TER = 0.07%

TWR for VUSD = (1.45% * 0.15) + 0 (no L2 withholding) = 0.22%

Total Expense = TWR + TER = 0.22% + 0.07% = 0.29%

Hence, purely looking at the TER ratio will result in an erroneous conclusion that US-domiciled ETF, VOO, is cheap vs. other alternatives. This is due to the hefty Dividend Withholding Tax impact.

Tax efficient ETF Portfolio Consideration #2: Estate tax

The second reason why it might not be wise to invest in US-domiciled ETF is due to the US estate tax for foreigners. This is an area that is often overlooked and not given the necessary importance.

If you are a US non-resident alien with no US tax treaty coverage (like Singaporeans), when you die while holding US situated assets (US-domiciled ETFs), the US can apply an estate tax of up to 40% of the balance above a $60,000 exemption.

For example, if you have US$1m in US stocks, 40% of ($1m-$60k) = $376,000 might be payable as estate taxes when you pass away!

However, when you hold ETFs domiciled in Ireland or another non-US domicile, you do not directly hold any US assets. This means that you are now entirely protected from US estate tax surprises.

Most popular non-US domiciled ETFs can be purchased on the London Stock Exchange. These are the UCITS (Undertakings for Collective Investment in Transferable Securities) ETFs.

You will need to find a broker that offers the appropriate exchange, for example, Interactive Brokers. However, because Interactive Brokers is US-based, one should not hold more than $60,000 in CASH (ok for UCITS ETFs), otherwise, US estate taxes again become an issue.

NAOF preferred platform for investing in foreign markets is Saxo Capital which does not have the cash issue associated with Interactive Brokers and due to our still low capital base (<$100k)

Interim Conclusion

Hence the conclusion by now should be to avoid US-domiciled ETFs. Not only is the total expense significantly higher (almost double) compared to a tax-efficient UCITS ETF after accounting for dividend withholding tax, one will have to face the risk of potential estate taxes.

So what are the various UCITS ETF options that allow an investor to partake in the World market? Can one still invest in the S&P500 which has been by far the best performing market index in the past decade?

Best UCITS ETFs to invest for Global, US and Emerging Market exposure

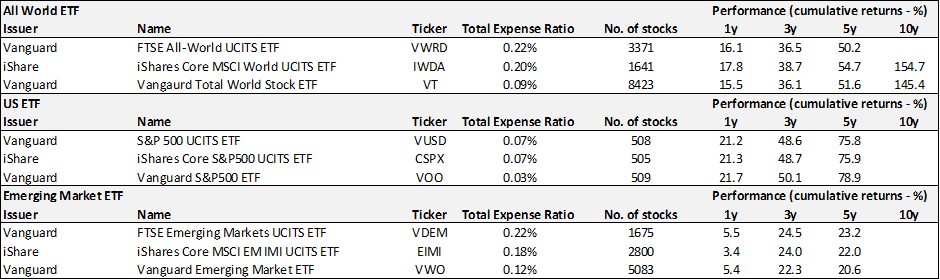

The table below illustrates the 3 major market categories and their respective ETFs, detailing key information such as TER and cumulative performances. I only selected issued ETFs from Vanguard and iShares for comparison basis as they are the largest players in the domain of Exchange Traded Funds.

The third stock of each category is US-domiciled Vanguard ETFs (VT, VOO, and VWO) which are shown to illustrate their respective cumulative performances.

Without further ado, I will showcase which are the 3 UCITS ETFs that comprise my tax efficient ETF portfolio with global, US and emerging market exposure.

For All World exposure ETF

For Singapore investors seeking a global equity exposure, the preferred choice is iShare Core MSCI World UCITS ETF (IWDA). Not only is its expense ratio lower than its Vanguard counterpart, but its cumulative performance over the past 1-10 years is also the most outstanding.

Comparatively, while the US-domiciled ETF, VT, has the lowest TER, we know that the Total Expense after accounting for withholding taxes will be higher than the UCITS ETFs (the calculation is slightly more confusing due to computation of L1TW from various regions, however, the conclusion is the same as what we have previously calculated for VOO and VUSD). Not only that, its 10 years cumulative performance significantly trails that of IWDA.

TOP CHOICE: IWDA

For US exposure ETF

For Singapore investors looking to partake in the US market, particularly the S&P500, both the Vanguard and iShare UCITS ETFs, VUSD and CSPX, are pretty comparable in terms of both TER and cumulative performances over the past 5 years.

While the US-domiciled ETF, VOO has shown better cumulative performances compared to VUSD and CSPX, the outperformance is not by much.

TOP CHOICES: VUSD and CSPX

For Emerging market exposure ETF

We have the iShare Core MSCI EM IMI UCITS ETF (EIMI) which scores more favorably in terms of TER but trails its Vanguard UCITS counterpart, the FTSE Emerging Markets UCITS ETF VDEM in terms of cumulative performance. However, the differences are marginal.

TOP CHOICE: EIMI for greater stock diversity and overall simplification.

For simplicity’s sake, one can just choose to invest in iShares issued UCITS ETFs, given all their ETFs scored well in the 3 categories above.

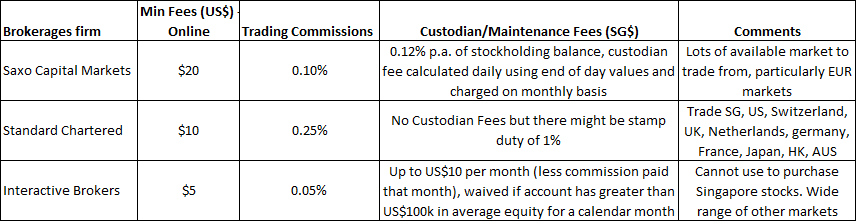

Which are the trading platforms to purchase these UCITS ETFs?

We have previously written an article on the best stock brokerage combination to buy SG, HK and US stocks. Here, we add in the UK option.

While Interactive Brokers is clearly the cheapest platform for purchasing of UCITS ETF on the London Stock Exchange, we have previously highlighted potential risk pertaining to estate tax on CASH Holdings beyond $60,000.

Saxo Capital has a higher min fee and higher trading commission percentage at $10 $20 (we have previously stated as $10 which is erroneous) and 0.10% respectively. In addition, there is a 0.12% custodian fee for Saxo Capital. Interactive Brokers also has a custodian fee of US$10/month which equates to US$120/annum.

Given that our strategy over here is a passive BUY and HOLD after identifying our ideal UCITS ETF to purchase, there will likely be minimal trading.

For an average portfolio size of USD$100k and below, Saxo Capital will be the cheaper solution on a recurring cost basis while Interactive Brokers will be the cheapest if your average portfolio size is larger than US$100k. In this instance, the custodian fees will be waived.

DIY passive or Robo-advisors?

We have shown which are the best UCITS ETFs to purchase for a Singaporean Investor wishing to have Global, US or Emerging Market exposure as well as the relevant trading platforms to consider for the purchase.

A DIY passive portfolio can be created by selecting these tax-efficient UCITS ETFs to invest in.

Alternatively, if these index-hugging UCITS ETFs do not appeal to you and one wishes to pursue a more active approach such as a value-driven UCITS ETFs with greater small-cap weighting vs. benchmark index, then one can choose to invest with a Robo-advisor such as Endowus that provides access to Dimensional funds which are renowned for their long-term stock market outperformance. I have written about Dimensional funds previously in this article.

DIY passive is likely the most cost-efficient manner vs. Robo-advisors where the total recurring annual expense will likely amount to c.1% of the portfolio after accounting for TWR, TER and Robo-advisors platform fees. A DIY passive approach could incur just half the recurring annual fee of Robo advisors. However, that does not necessarily mean that a Robo-advisor is unattractive.

In our example above, we assumed a lump-sum investing approach as there are no trading platforms that present a cost-effective manner to invest in a Dollar Cost Averaging (DCA) approach based on Regular Savings Plan (RSP).

We have written previously that FSMOne provides the cheapest solution for RSP investing in ETFs. However, these ETFs are generally US-domiciled and not tax-efficient.

The only way to invest in a UCITS ETF/tax-efficient funds on RSP approach is through the Robo-advisor route, particularly when the investment amount is small. For example, investing US$200/month through Saxo will incur a min commission fee of US$10 which equates to 5% charges every single month. This does not make sense.

Conclusion

For Singaporean investors, we now have a tax efficient ETF portfolio to invest in, i.e. those that are not US-domiciled. Investing in UCITS ETFs will avoid the short-term 30% dividend withholding tax issue and the long-term 40% estate tax issue, both are key issues with regard to US-domiciled ETFs.

We have made a cost and performance comparison between Vanguard and iShares UCITS ETFs. While the differences are generally marginal, we choose iShares (the largest ETF issuer in the world) as our preferred UCITS ETF issuer due to their all-rounded balanced performance in terms of expense and fund performance seen in all three key categories which we evaluate.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- WHICH S-REITS HAVE THE BEST RECORD OF DIVIDEND GROWTH?

- A BETTER ALTERNATIVE TO DOLLAR COST AVERAGING?

- DIVIDEND YIELD THEORY – THE UNDERAPPRECIATED VALUATION TOOL

- TOP 5 ANALYSTS OF THE DECADE AND THEIR CURRENT FAVORITE STOCKS

- IS DRINKING LATTE REALLY COSTING YOU $1 MILLION AND THE CHANCE TO RETIRE WELL?

- DIMENSIONAL FUNDS: ARE THEY WORTH THEIR WEIGHT IN GOLD?

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

6 thoughts on “Creating the Best tax Efficient ETF Portfolio to Invest in?”

Where did you get the formula for TWR and could you show us the calculations for the other ETFs pls?

After all, the example given is a full US etf. Would the impact be different if the US was a smaller % of the whole ETF?

Hi Oken

The formula was derived from this site:

https://www.bogleheads.org/wiki/Nonresident_alien_with_no_US_tax_treaty_%26_Irish_ETFs

It is not about the full US ETF, you can see in the site that with a global ETF example, where they use VT, with US stocks accounting for 52% of portfolio, the calculated TWR is slightly higher.

If one holds only UCITS ETFs using interactive brokers and there is no cash balance in the account, will estate taxes still be applicable?

Hi Q,

Yes then estate tax will not be an issue