Table of Contents

Best Stocks to Sell Covered Calls

Did you know there is a simple way to increase your passive income potential on your dividend-paying stocks?

Yes, you can put your dividend income generation on “overdrive mode” using this simple technique that can easily double or even triple your overall dividend potential.

Sounds too good to be true?

Now, this simple technique can be achieved using options, through a simple strategy often known as the Covered Call Strategy.

What exactly is the covered call strategy and which are the best stocks to sell covered calls in 2023?

Before I dive into my favorite 6 stocks to sell covered calls on and my rationale behind them, let me take a minute or two of your time to explain the technicalities of what a covered call strategy is.

What is a covered call strategy?

A covered call strategy is a strategy that involves both stock ownership as well as execution using options, specifically to sell call option contracts.

Unlike stock trading where selling short a stock (short-selling) might be rather restrictive, particularly for the normal man-in-the-street, in the world of options trading, there are probably more retail option sellers vs. option buyers.

When one initiates an option contract as a seller, it is typically termed as “Sell to Open”.

As an option seller, one is entitled to receive a premium right from contract initiation. While cash is received, this does not mean that the seller has generated a “profit”. He needs to ultimately “Buy to Close” his contract to realize his profits.

For those interested to learn more about covered calls, I have written a very detailed article on this strategy which one can find from the link below.

Additional Reading: Covered Call Strategy for Income (2023)

As earlier mentioned, a covered call strategy involves stock and options ownership. Essentially it can be summarized from the equation below:

1 Covered Call contract = 100 Shares + Sell 1 Call option contract

A covered call contract entails the ownership of at least 100 shares of the underlying counter, plus 1 call option selling contract on the underlying stock.

The purpose of structuring the call option SALE contract is to generate a premium that can “supercharge” your overall yield potential.

Let’s take a look at an example.

Boosting your Dividend Paying Counter

Imagine Stock ABC, which is currently trading at $100/share, and that pays a yield of 6%/annum. Pretty impressive as a dividend counter. Now imagine you own 100 shares of Stock ABC for $100/share (which entitles you to the 6% yield/annum) because you are positive on its long-term outlook.

It does not hurt that you are being paid 6% ($600/year) on the counter as you await its price to appreciate.

But what if there is a way to double or triple this yield potential by “synthetically” structuring your stream of dividend payments?

That is where one can sell a call option on Stock ABC.

By selling a call option on ABC at the strike of $110/share, expiring in a months-time, a premium of $1/share or $100/options contract is generated.

One has synthetically generated an additional income stream of $100. Now, what is more fantastic is that this call option contract expires in 1 month, and if the price of Stock ABC remains below $110 during this month, the call option contract would have expired worthless.

This means that one has now “realized” the $100 premium and this is now your profit.

You can proceed to structure the next round of call option selling to generate another round of premium and that cycle can continue, indefinitely on paper.

Imagine if you can sell a call option contract every month on stock ABC, generating on average $100 in premium each month.

After Month 12, you would have generated $1,200 in premiums (or your synthetic dividend).

Add the dividend payment of $600 that you are entitled to as a shareholder of ABC, your total income amounts to a hefty $1,800 or 18% yield on Stock ABC.

How fantastic is that!

How to structure your covered calls

Every covered call revolves around 3 components.

The first is the stock that you are selecting to own (for long-term potential)

The second is the term of the call option contract that you are selling on.

The third is the strike price that one is selling the call option on.

The purpose of this article is to cover the first point here, identifying the best stocks to sell covered calls on.

For those of you who are interested to learn more about the second and third components to complete your covered call option structuring, you can check out my detailed covered call article.

6 Best Stocks to Sell Covered Calls in 2023

One major incentive for me to own physical shares of an underlying counter is that the stock pays a dividend. As an option owner, I am not entitled to that dividend payment.

If a counter does not pay a dividend, or if its yield is negligible, I would prefer to own a “deep ITM” call option on it, but this will be a topic for another day.

Hence, the best stocks to sell covered calls on are often those that pay a nice juicy dividend yield, and I can look to further “boost” that yield by selling call options (and hence, receiving premiums) on the underlying.

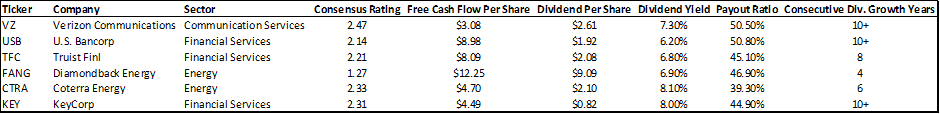

Using the Stock Rover screener, I screened for S&P 500 stocks that are currently yielding more than 6%.

In addition to high-yielding stocks, I am also screening using the following parameters to ensure that such dividend payments are sustainable.

- Dividend Yield > 6%

- Free Cash Flow Per Share > Dividend Payment Per Share

- Street Consensus Rating < 2.5 (Rating from 1 (Strong Buy) to 5 (Strong Sell))

- Consecutive Dividend Growth Years > 3

The table below shows the 6 S&P 500 counters that fulfill my parameters.

Best Stocks to Sell Covered Calls #1: Verizon Communications (VZ)

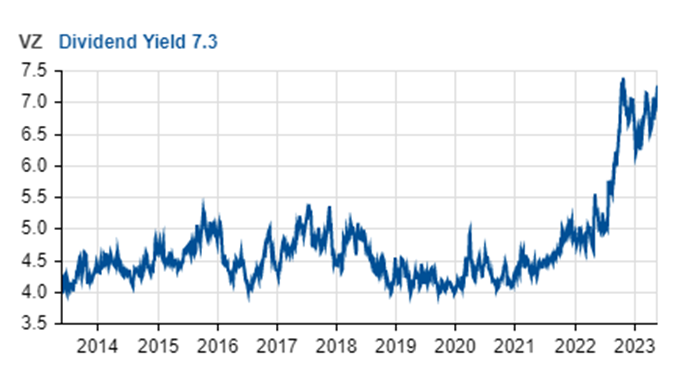

Verizon Communications’s dividend yield of 7.3% at present is one of the highest in the company’s history, as can be seen from the chart below.

The counter is also one of the most consistent dividend growers, having increased its dividend payment for 16 consecutive years.

While communication services stocks like Verizon have not been the flavor in 2023, with its stock hovering at a 5-year low, this might be the time to re-look at the counter.

Besides being paid a juicy 7.3% annual yield, one can further boost his/her income potential through the covered call strategy to generate more than 12% total yield as one waits for the company to emerge from its likely trough at current levels.

Best Stocks to Sell Covered Calls #2: US Bancorp (USB)

US Bancorp is currently spotting a dividend yield of 6.2%. Similar to VZ, USB is trading at its highest yield level over the past 10 years.

Nonetheless, this is still one of the most consistent dividend-paying stocks, with a track record of increasing its dividend payment for 13 years.

While there are fears over bank stocks in 2023 as a result of the collapse of smaller regional banks such as SVB Financials, and Signature Bank, to name a few, this could be seen as an opportunity for bigger regional banks such as USB with a more robust balance sheet.

Best Stocks to Sell Covered Calls #3: Truist Finl (TFC)

Truist Financial (TFC) is another regional US bank that has gotten hard hit by the banking crisis that has been ongoing now for a few months. Not surprisingly, just like USB, TFC is also trading at its highest dividend yield over the past decade.

The company pays a full-year dividend of $2.08/share vs. its free cash flow/share of $8.09 and a payout ratio of 45%, which is still pretty comfortable.

The street has recently gotten more positive on the counter, with upgrades across the street and a target price of between $45 and $53, vs. its current price level of c.$30/share.

With a yield of 6.8% that can be further enhanced using the covered call strategy or the wheel strategy to enhance the yield to >12%, this is one counter that value investors can consider to play the rebound in regional bank stocks.

Additional Reading: Dividend Yield Theory. The Underappreciated Valuation Tool

Best Stocks to Sell Covered Calls #4: Diamondback Energy (FANG)

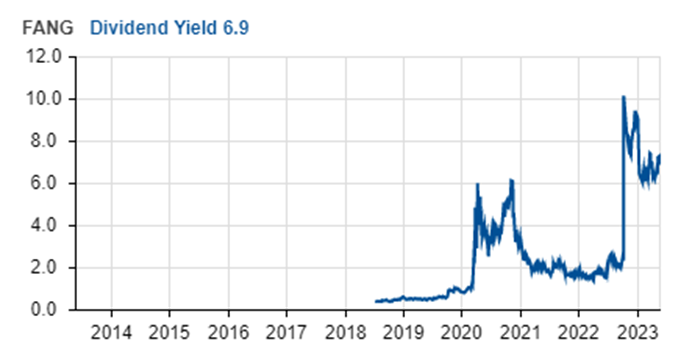

Diamondback Energy has been one of the best-performing energy-related stocks over the past 1-1.5 years. However, the stock has not been spared the recent weakness seen in oil-related counters, with its share price declining by c.8% over the past 1 month alone. Nonetheless, the stock is still in positive territory on a YTD 2023 basis.

With the stock currently trading at an attractive 6.9% yield and a dividend payment that is well covered by its free cash flow, this is one potential energy stock to play the rebound in oil prices, while yet getting paid to wait.

Oil-related counters are also some of the best stocks to sell covered calls on, as premiums received tend to be on the high side.

Among the 6 stocks highlighted in this list, FANG has the highest street rating, with a majority in the street having a Strong Buy on the counter.

Best Stocks to Sell Covered Calls #5: Coterra Energy (CTRA)

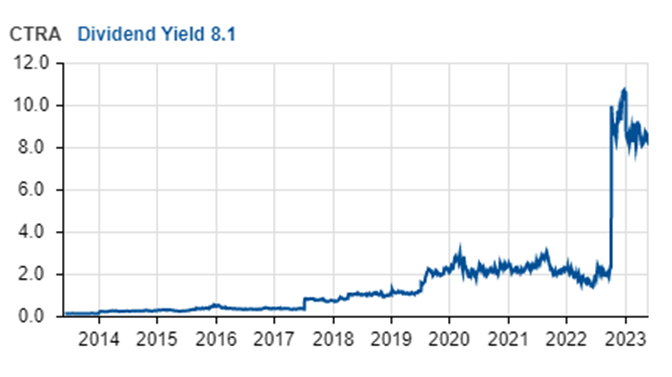

Coterra Energy (CTRA) is a similar stock to FANG, operating in the O&G industry. The company has been increasing its dividend payment for 6 consecutive years, not fantastic, but not too shabby as well, considering how volatile the oil industry can be.

This counter has the highest dividend yield in this list of 6 stocks, standing at 8.1% at present.

With a low gearing ratio of just 0.2x and a payout ratio of less than 40%, the counter is likely able to continue increasing its dividend payments ahead.

As mentioned, oil-related counters are among the best stocks to sell covered calls on. One can easily double or even triple the total yield on CTRA to > 20% using the covered call strategy.

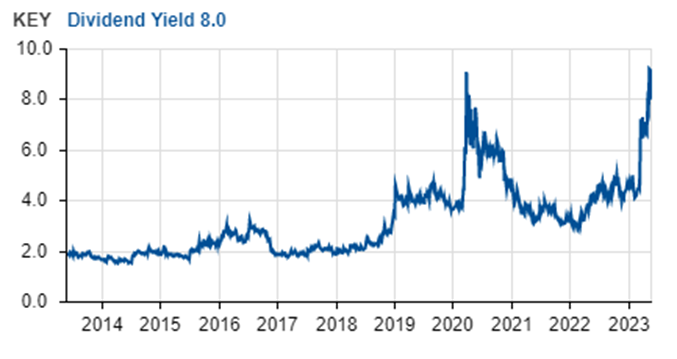

Best Stocks to Sell Covered Calls #6: KeyCorp (KEY)

The final stock in this list is KeyCorp (KEY). KEY is a regional bank with assets of over $170bn, concentrated in its two largest markets: Ohio and New York. The bank is primarily focused on serving middle-market commercial clients through a hybrid community/corporate bank model.

With a yield of 8%, this is another banking-related stock that is looking rather attractive, in terms of where its yield is currently trading vs. its historical level.

This counter has been one of the most consistent dividend payers, with 13 years of consecutive dividend payment increases.

One can also execute a covered call strategy on KEY to further increase its yield potential vs. the current 8% level.

For those who are interested in learning more about the covered call strategy as well as other option-related strategies, do check out the list of option articles below:

Dividends on Steroids. A Low-Risk Strategy to Double Your Yield

4 Option Trading Strategies for Beginners