Table of Contents

Best Stocks to Buy Before Earnings This Week

Earnings season is upon us again and while 2022 has ended in the red for the major US indices, the market will be eagerly watching the upcoming 4Q22 earnings, particularly for signs of weakness, and hear what management might have to say about their operations in the year ahead.

Buying stocks, specifically before earnings, should be seen as more of a trading strategy. However, do note that price movement associated with earnings-driven results might be extremely volatile and one will need to formulate a good trade plan for consistent success using this trading strategy.

In this article, I will be engaging the use of certain data provided by 3rd party platforms to find the 4 best stocks to buy before earnings this week (Jan 16-31).

These 4 stocks are selected based on their historical track record of performance before/after their reported quarterly earnings report. They will have to fulfill certain criteria to be selected for the list:

- More than 90% win rate based on the pre-determined time horizon before/after earnings (more on this later). This is based on the past 12 consecutive quarters of earnings results

- Average price movement during this time horizon is > +2%

- Market Cap of more than US$10bn

- Having a positive average rating on Wall Street based on SeekingAlpha data

- Upside to the street’s Fair Value from its current price based on SeekingAlpha data

With those criteria in place, here are the 4 best stocks to buy before earnings this week (Jan 16-31)

Best stocks to buy #1: XOM

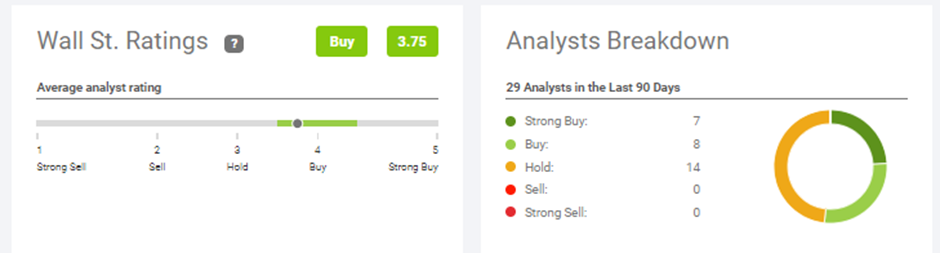

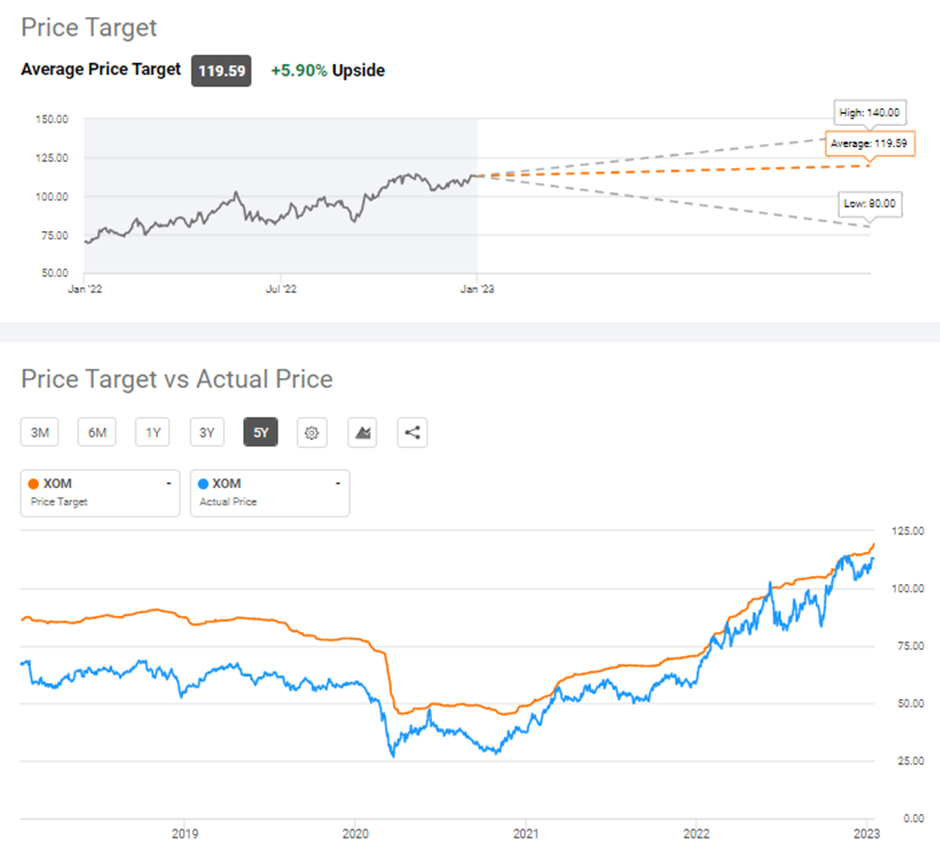

Exxon Mobil (XOM) is one of the 4 best stocks to buy before earnings this week. The company is scheduled to report its results on 31 January 2023 (before market opens). XOM currently has a favorable Wall Street Rating according to data from SeekingAlpha.

The street has also currently assigned a fair value of $119.59 to the counter, implying a 5.9% upside from its current share price of ~$112.

How to trade XOM before earnings

Using this earnings strategy, the Win rate for XOM is more than 90%. That strategy is to purchase stocks of XOM 1-day after (not before) its reported earnings and holds it over the next 1 week. As XOM is expected to report its 4Q22 results on 31 January (Before Market Opens), this strategy would entail purchasing it on 1st February and ending on 7th February 2023.

The average return using this trading strategy for XOM is +2.9% over the specific time frame as detailed above.

Do note that the price action of XOM can be rather volatile even post results, with the largest drawdown over the past 12 quarterly occurrences being an 8.7% decline over the immediate week.

A trader could look to purchase XOM stock direct post-earnings or select to execute a Deep-ITM option trade on XOM for that additional leverage effect.

Alternatively, for those who are more conservative, one could look at selling a cash-secured OTM put option 1-day after earnings and hold it for a week.

Best stocks to buy #2: AMD

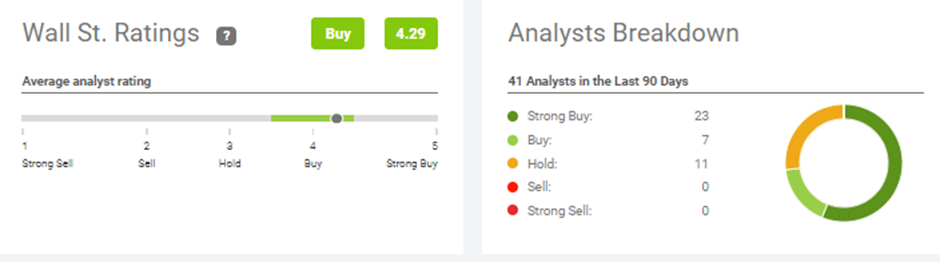

Advanced Micro Devices (AMD) is one of the 4 best stocks to buy before earnings this week. The company is scheduled to report its results, also on 31 January 2023. AMD currently has a favorable Wall Street Rating according to data from SeekingAlpha.

The street has also currently assigned a fair value of $89.53 to the counter, implying a 25.1% upside from its current share price of ~$71.60.

How to trade AMD before earnings

Using this earnings strategy, the Win rate for AMD is more than 90%. That strategy is to purchase stocks of AMD 1-week before its reported earnings and hold them until the day of earnings. As AMD is expected to report its quarterly results on 31 January (After market close), this strategy would entail purchasing it on 24th January and ending on 31st January 2023.

The average return using this trading strategy for AMD is +6.6% over the specific time frame as detailed above.

The risk-reward on this trade is surprisingly good, with the worst decline seen during the past 12 occurrences being a 2.9% decline.

A trader could look to purchase AMD stock direct 1 week before it is scheduled to report its results or select to buy a short-duration OTM call option on AMD 1 week before earnings and close the trade on the earnings date.

One could look to further reduce its capital exposure by constructing a Call Vertical on AMD with a similar short-term time horizon.

Best stocks to buy #3: ABT

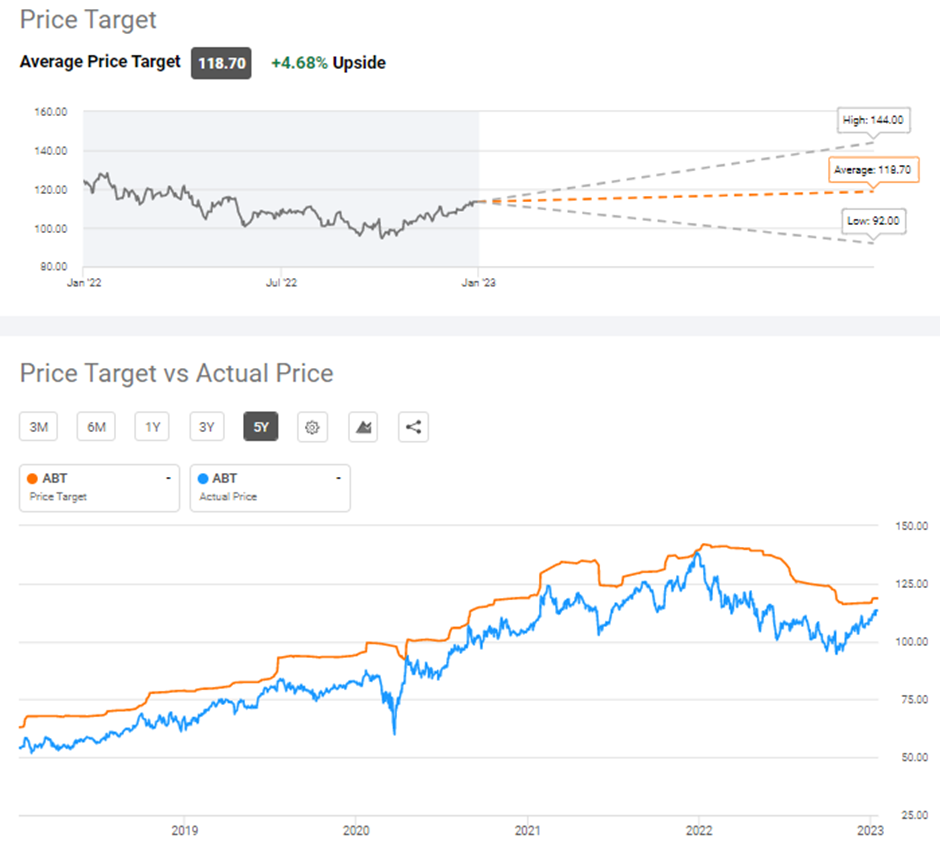

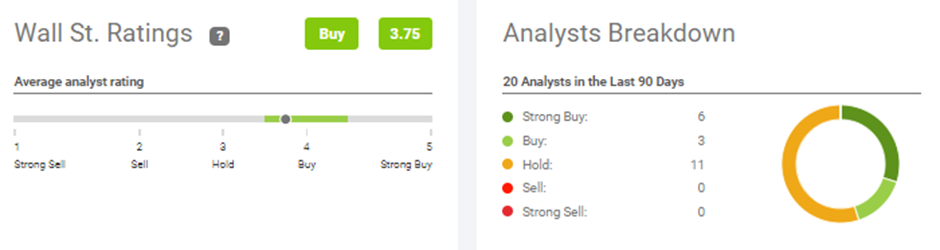

Abbott Laboratories (ABT) is one of the 4 best stocks to buy before earnings this week. The company is scheduled to report its results, also on 25 January 2023 (before market opens). ABT currently has a favorable Wall Street Rating according to data from SeekingAlpha.

The street has also currently assigned a fair value of $118.70 to the counter, implying a 4.7% upside from its current share price of ~$113.4.

How to trade ABT before earnings

Using this earnings strategy, the Win rate for ABT is more than 90%. That strategy is to purchase stocks of ABT 3 days before its reported earnings and holds them until the day before its announced earnings. As ABT is expected to report its quarterly results on 25th January (Before market opens), this strategy would entail purchasing it on 19th January and closing off the trade on 24th January 2023.

The average return using this trading strategy for ABT is +2.2% over the specific time frame as detailed above.

The risk-reward on this trade is decent, with the worst drawdown over the past 12 occurrences using this trading strategy at 1.2%.

A trader could look to purchase ABT stock direct 3-days before it is scheduled to report its results or select to buy a short-duration deep ITM call option on ABT to replicate the underlying price movement.

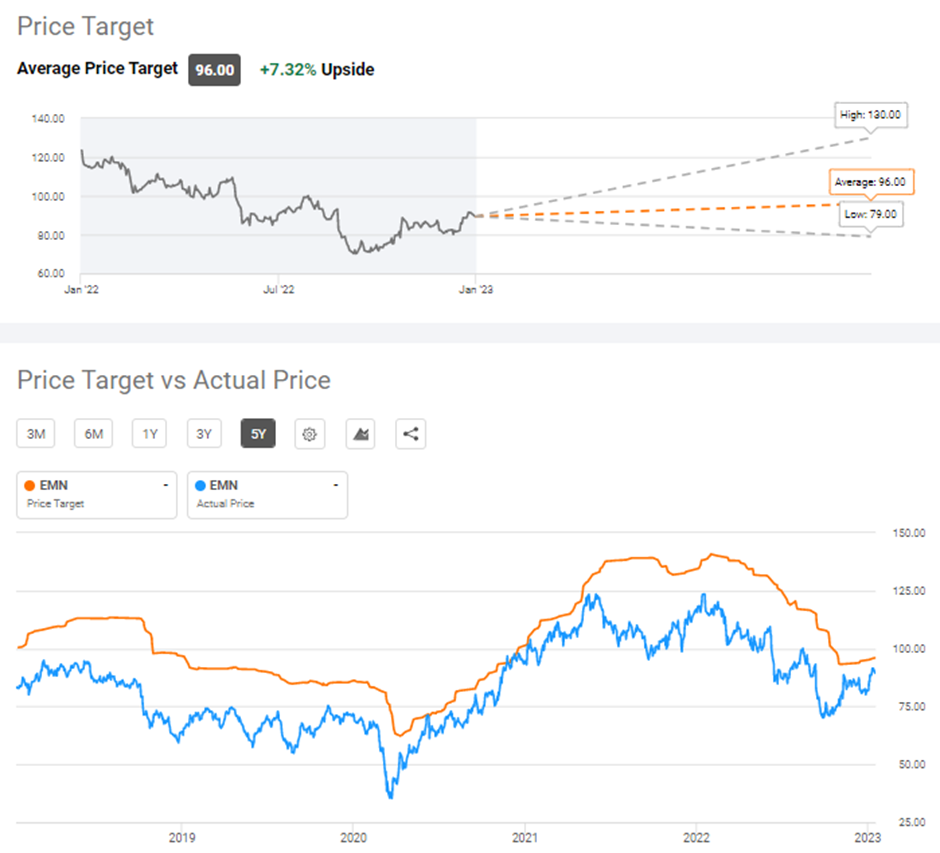

Best stocks to buy #4: EMN

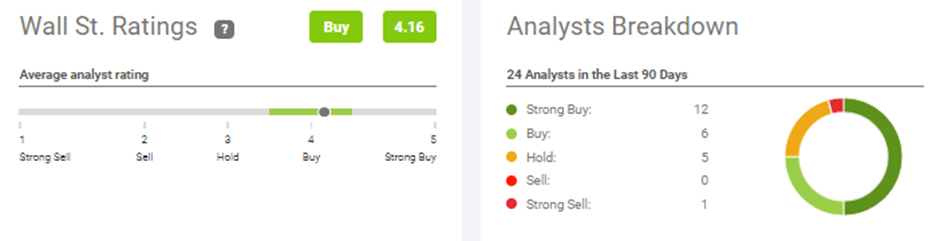

Eastman Chemical Company (EMN) is one of the 4 best stocks to buy before earnings this week. The company is scheduled to report its results, also on 26 January 2023 (after market close). EMN currently has a favorable Wall Street Rating according to data from SeekingAlpha.

The street has also currently assigned a fair value of $96 to the counter, implying a 7.3% upside from its current share price of ~$89.45.

How to trade EMN before earnings

Using this earnings strategy, the Win rate for EMN is more than 90%. That strategy is to purchase stocks of EMN 1-week after its reported earnings and holds them for the next 1 week. This strategy is similar to that of XOM as we highlighted earlier. As EMN is expected to report its quarterly results on 26th January (after market close), this strategy would entail purchasing it on 27th January and closing off the trade on 3rd February 2023.

The average return using this trading strategy for EMN is +4.1% over the specific time frame as detailed above.

The risk-reward on this trade is extremely good, with only a max drawdown of 0.8% over the past 12 observations.

A trader could look to purchase EMN stock direct 1-day after the company reported its results and hold it for the next 1 week or select to purchase a short-duration OTM call debit spread using the same entry time.

Alternatively, another options strategy not widely known but has resulted in a 100% win rate on EMN is to sell an ITM Put Credit Spread.

Conclusion

The article above details 4 of the best stocks to buy before earnings this week. This is a data-driven approach based on historical price performance during the earnings period.

While these 4 counters have all performed relatively well using the stated trading time horizon, there is always a higher element of risks when it comes to trading stocks, particularly during earnings season.

One way I look to reduce my risk exposure is through the usage of options where I can often get an asymmetrical reward to risk structure, as highlighted in some of the trade structures above.

Trading around earnings should be seen as a short-term opportunistic strategy. For investors who are looking at finding high-quality stocks to invest in for the long term, you might wish to check out my FREE 3-Part Video Series on selecting the RIGHT stock to invest in at the RIGHT time for your long-term portfolio. Just click on the diagram below to access the first video immediately.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only

2 thoughts on “4 Best Stocks to Buy Before Earnings This Week (Jan 16-31)”

Thank you Roystan for sharing the short-term trade ideas during this earnings season.

Happy to share some trade ideas based on historical statistics. Cheers!