We are almost at the half-way mark in 2021 and assuming you are ready to kickstart your investment journey, it is now time to select a stock brokerage account. In this article, we evaluate the various brokerage houses available to Singapore investors, and ultimately, we pick our IDEAL brokerage combination for local and international (HK+US+UK) investing.

The bulk of the content here might not be new to those already familiar with the local brokerage landscape. However, I believe there might be pockets of information that even a seasoned and “cash-savvy” investor might have overlooked.

The information in this article will predominantly be focused on four commonly traded markets relevant to Singapore investors: SG, USA, HK and UK.

We will be looking at areas such as stock brokerage fees, ownership of stocks (CDP vs. custodians), platforms to use for local and international trading while taking into account key items such as custodian costs, etc.

Let’s start with the discussion within the SG context.

SG Market

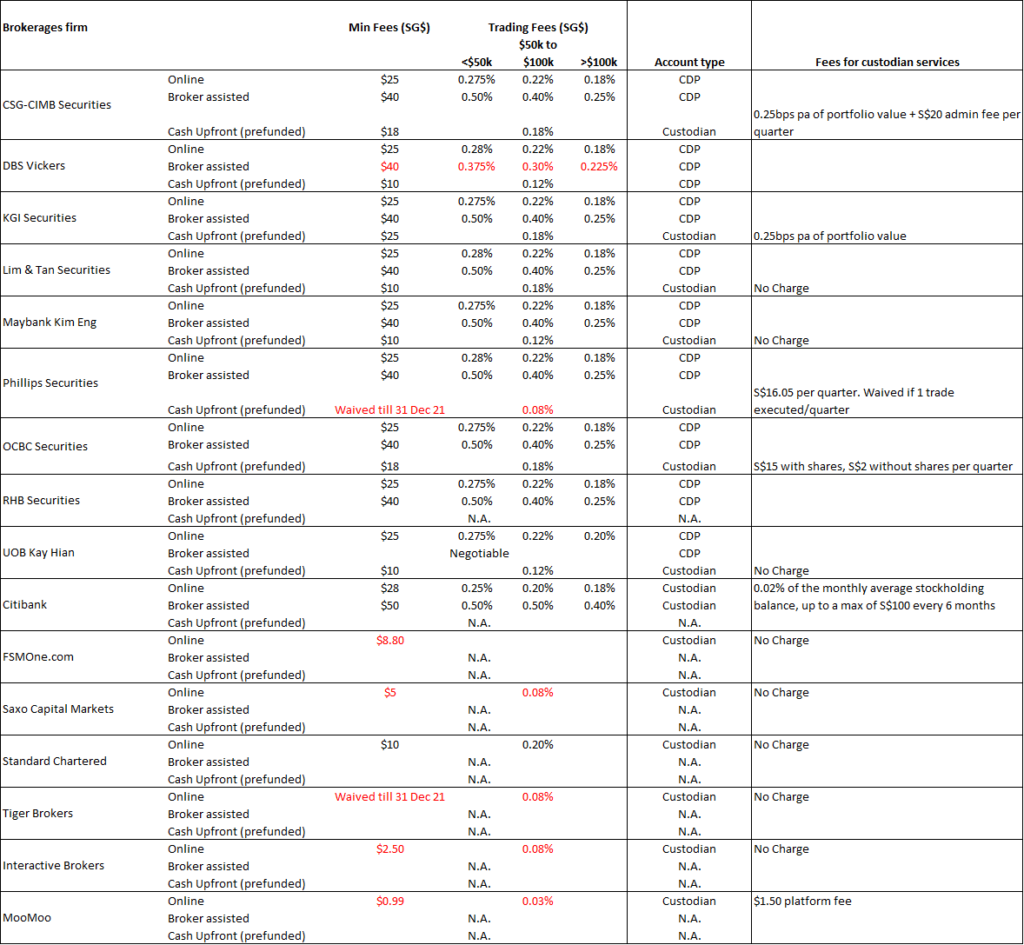

The table below summarises the key information pertaining to stock brokerage costs in Singapore.

Let’s get straight down to the conclusion:

- Online fees are cheaper than broker-assisted (offline) fees. DUH! If you are not savvy with executing trades online on a DIY basis and prefer having some form of human interaction, then DBS Vickers offers the lowest broker-assist fees.

- There really aren’t many differences in fees between the brokerage houses when it comes to online trades which ultimately flow into one’s CDP account. The standard min fees are S$25, with a trading fee of 0.275-0.28% (<$50k), 0.22% ($50k-$100k), 0.18% (>$100k).

- Some brokerage houses offer pre-funded accounts. This means that you need to have the cash in your account before you can buy stocks. This is unlike the “normal” account where you can trade on a “contra” basis without the need to have cash in your account. pre-funded accounts typically have a lower min fee requirement + lower trading fees. Notice that pre-funded trades are mostly done through custodian accounts, with the exception of DBS Vickers (more on this later).

- For pre-funded/custodian accounts, There are now a couple of brokerages that offer ultra-low commission fees of ZERO min and 0.08% trading fees. They are POEMS and Tiger Brokers. If you prefer your stocks to be in your CDP account (vs. a custodian account), then DBS Vickers is the best option when it comes to minimizing brokerage costs ($10 min, 0.12% trading fees).

- There might be custodian costs (even for SG stocks) for some brokerage account. This is information that might not be widely known as most would assume that having an ALL CASH FUNDED account will not incur any costs, particularly when one is buying SG stocks. However, because these are custodian accounts, there might be fees associated with it even if they are SG stocks. Some examples of brokerage houses that charge a custodian fee for SG stocks include, CSG-CIMB, KGI, Phillips Securities, OCBC and Citibank.

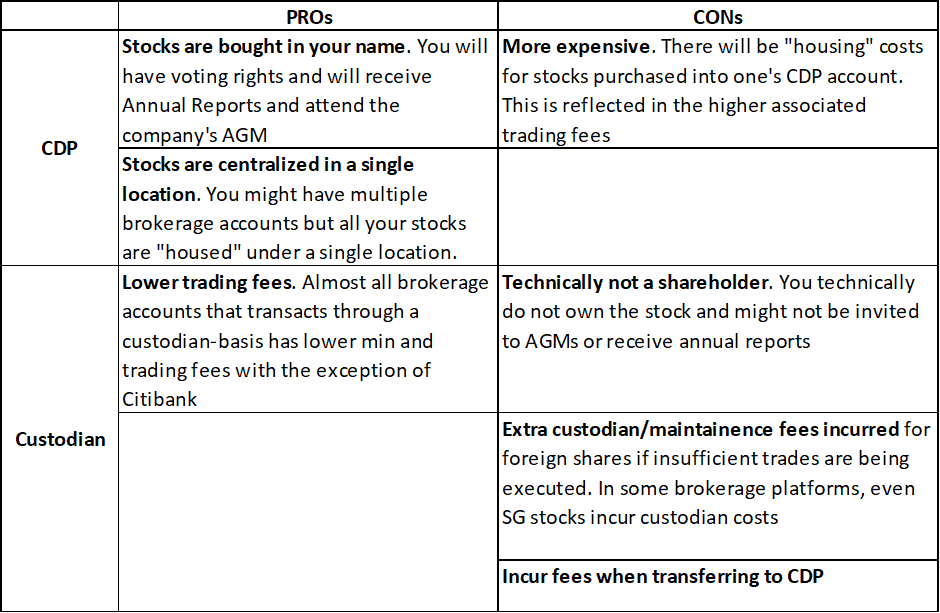

CDP vs. Custodian accounts

A CDP securities account is one where all the stocks you have purchased are “stored”. You can be using DBS Vickers to buy Stock A and Maybank Kim Eng to buy Stock B. Ultimately, these stocks will be deposited in a single location which is your CDP account.

Stocks you purchased and subsequently deposited in your CDP account outright belong to you and there will not be any legality issue.

Stocks you purchased and deposited in a custodial account (for example, a pre-funded account) belong under the name of the brokerage firm. You are technically not a shareholder and in the “extremely unlikely” event that the brokerage firm goes belly-up, you might have trouble claiming ownership of the shares you purchase. Most brokerage houses however assure their clients that custodian accounts are kept separate from the house account and will not be affected should the company goes into insolvency or liquidation.

In my opinion, the key benefit of a CDP account is the assurance that you have outright ownership of the stock whereas the key benefit of a custodian account is the lower trading fees.

For a retail investor, particularly those who trade pretty often (but still not considered a “whale” and hence unable to negotiate for better terms with the brokerage house) within the SG-context, it will actually make sense to go with a pre-funded/custodian account to enjoy the benefits of the lower trading costs.

[April 2021 Update]: For trading/investing in SG stocks, the brokerage business has become increasingly competitive (which is good for investors). A number of brokerage houses stand out. DBS Vickers provides the best of both worlds from the context of having all the benefits of a CDP account as well as the key advantage of a custodian account in terms of low trading fees.

POEMS and Tiger Brokers are now head to head in terms of providing ZERO min commission fees while variable comms rate is at a competitive 0.08-0.10%. For wannabe investors who have yet to open a Tiger Brokers account, you can potentially get 1 FREE share of Starbucks if you fund your account with $2k. T&C applies. While stock last

The latest new kid on the block is MooMoo. The brokerage firm is offering a low min commission fee of $0.99 with a variable commission rate of 0.03% for SG stocks which is also the lowest in terms of variable rates across all the brokerage firms. Only FSMOne does not charge a variable commission rate (fixed rate of $8.80 which is not suitable for small-sized accounts)

![Best Stock Brokerage in Singapore [Update April 2021] 1](https://newacademyoffinance.com/wp-content/uploads/2020/11/tiger-brokers.jpg)

Tiger Brokers

One of the new fintech brokers that is bringing low-cost commission trading in Singapore to a whole new level.

Trading in SG stocks is now at ZERO commissions with US min commission at a very competitive US1.99/trade

Note that Singapore Investors can now use Interactive Brokers to trade in SG stocks. This was previously a major shortfall of IB – not able to allow SG Investors to trade in SG Stocks. The change in the commission rate of Saxo has made it one of the more competitive platforms with min charges of S$5 and variable fees of 0.08% which is similar to Tiger and IB.

For illustration purposes, you can purchase up to S$8333 worth of stocks through DBS Vickers and incur the $10 min fees whereas you can purchase up to S$12,500 worth of stocks through POEMS, Tiger Brokers, Saxo, Interactive Brokers, and FSMOne and still incur the same $10 min fees.

I would avoid using Citi to transact in SG stocks as not only do they have the highest costs (despite being a custodian account – terms changed since 2016), there are additional custodian charges associated with SG stocks.

Rank 1: DBS Vickers for BUY-and-HOLD with peace of mind that the stocks legally belong to you

Rank 2: POEMS, Tiger Brokers and MooMoo to take advantage of the zero/low min comms structure.

Rank 3: Interactive Brokers and Saxo. IB and Saxo’s min charges, while not at ZERO are rather competitive (IB at S$2.50 while Saxo at S$5), particularly with Saxo’s change in commission charges. The key benefit of IB and Saxo over DBS/POEMS/Tigers is their wide array of market availability at low cost, particularly in the case of IB.

Next, let us look at the HK context.

HK Market

Another market that might be of interest to Singapore investors would be the HK market where one can get access to many blue-chip China-based stocks such as Tencent and Alibaba etc through the HK market.

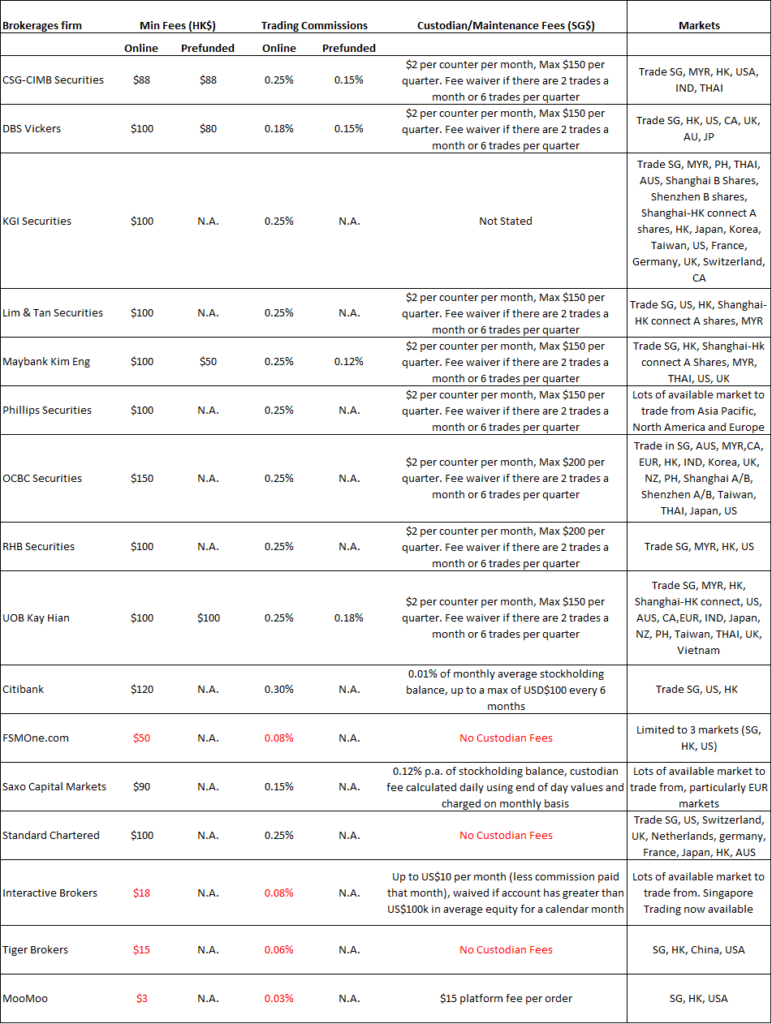

Trading in a foreign market will necessitate a custodian fee for most of the local brokerage houses. The table below summarizes the key associated trading and custodian fees.

One of the standouts (on a cost basis) would be using Interactive Brokers when it comes to purchasing HK stocks as it has the lowest associated min fees of only HK$18 (when all others average HK$100) and the lowest trading fees of 0.08%.

There are however three two key problems associated with Interactive Broker.

Singaporeans do not have the flexibility to purchase SG stocks through this international brokerage platform as it is not registered by the Monetary Authority of Singapore (MAS). However, it is still a good option for investors looking to purchase international securities.- There is a monthly fee of US$10 which adds up to US$120pa if one’s account size is less than US$100k or does not trade actively (10 trades a month to fully offset custodian cost) to offset the US$10/month custodian cost.

- The platform is not exactly user-friendly and generally for seasoned investors/traders. Is an ideal platform for option trading

For these two reasons, it will not be advisable to use Interactive Brokers to engage in the purchase of HK stocks. However, if you have an account size larger than US$100k or is an active trader/investor, then this platform might make sense.

The introduction of Tiger Brokers and MooMoo has significantly changed the game. Previously, FSMOne stands out as one of the lowest-cost brokers with no custodian fees (unlike IB). However, Tiger Brokers’ HK brokerage offering is now at an almost unbeatable $15 min and 0.06% variable comms. For MooMoo, on a standalone basis, its HK$3 comm cost is the best, but it also charges a HK$15 platform fee for each transaction. This brings the total min comms to HK$18, still one of the lowest in the industry.

This essentially beats all other brokerage companies hands down. For those who are concerned about using this new kid on the block, the brokerage house uses DBS as its custodian bank here for SG and IB for HK/China.

Tiger Brokers also does not charge a custodian fee. This is unlike the other local brokerage houses which will generally incur a custodian fee of S$2 per counter per month. There are however waivers associated with this custodian charge, generally if one makes 2 trades a month or 6 trades per quarter.

Assuming if an investor like myself who only wishes to purchase 2 counters in HK: Tencent and Alibaba, with a BUY and HOLD intention. Each stock investment quantum is SG$5k equivalent.

Total Outlay = S$10k

Total custodian costs per annum = $2 * 12 months * 2 stocks = S$48

Annual recurring cost = S$48 / S$10K = 0.48%

This is equivalent to having a “recurring management” fee of 0.48% on the portfolio of these two stocks. If the outlay is only S$5k in total, then the recurring management fee will be 0.96%/annum.

Recall that Tiger Brokers also ranks tops in terms of the ideal platform for SG stocks. Hence, if one’s key trading markets are restricted to SG and HK, then Tiger Brokers will be the ideal brokerage platform if using a custodian account is not an issue. This fintech brokerage house has essentially “usurp” FSMOne as the cheapest brokerage to use for these two markets.

The only downside of Tiger Brokers is the lack of market alternatives, with the option of only trading/investing in SG, HK, China, and USA stocks. The same goes for MooMoo which is restricted to trading the SG, HK, and US markets. Other brokerage platforms provide a lot more market alternatives. For example, if one will like to invest in an emerging country like the Vietnam market, then UOB Kay Hian is the only broker platform with that option.

Rank 1: Tiger Brokers and MooMoo – BEST pricing with no custodian fees for HK market. Do note that MooMoo has a platform fee incurred for each transaction

Rank 2: FSMOne – GOOD pricing with no custodian fees for HK market

Rank 3: Interactive Brokers – BEST Pricing but higher account benchmark of US$100k. Can consider for active traders (if 10 trades are executed each month, no custodian charges)

For account size < US$100k equivalent, go with Tiger Brokers or FSMOne as they provide the best pricing relative to the account size.

For account size > US$100k, go with Interactive Brokers as they provide one of the BEST pricing of min HK$18/trade (SG$3.15 equivalent). There are also no custodian fees with this account size. In addition, it offers a wide array of markets to trade from.

There are no changes to commission rates for Saxo for trading in the HK market. Its min comms of HK$90 and variable charges of 0.15% look on the high side when compared to Tiger, FSMOne, and IB. In addition, there are also custodian fees when trading in the HK market.

Some might suggest using Standard Chartered for account size larger than US$150k or SG$200k- equivalent which will allow you to fall under the priority client category and not having to pay a min fee, with trading fees of 0.20%. However, compared to the low min fee that Tiger Brokers offer at HK$15/trade and Interactive Brokers offer at HK$18/trade, the $0 min fee by Standard Chartered is likely, not relevant. The trading fees of 0.20% by Standard Chartered pales in comparison to Tiger Brokers 0.06% and Interactive Brokers 0.08%.

The HK market is now home to many big-tech companies that have chosen to dual-list in HK as well as in the US. The HK market will now get a new tech index to track stocks like Alibaba and Tencent as well as 28 other tech peers.

I suspect that if the China “bubble” does not burst, trading on the HK bourse will be increasingly popular with the addition of all these big tech names as well as funds buying into these tech names.

With that, let’s look at the USA market, which I believe should also be an area of emphasis.

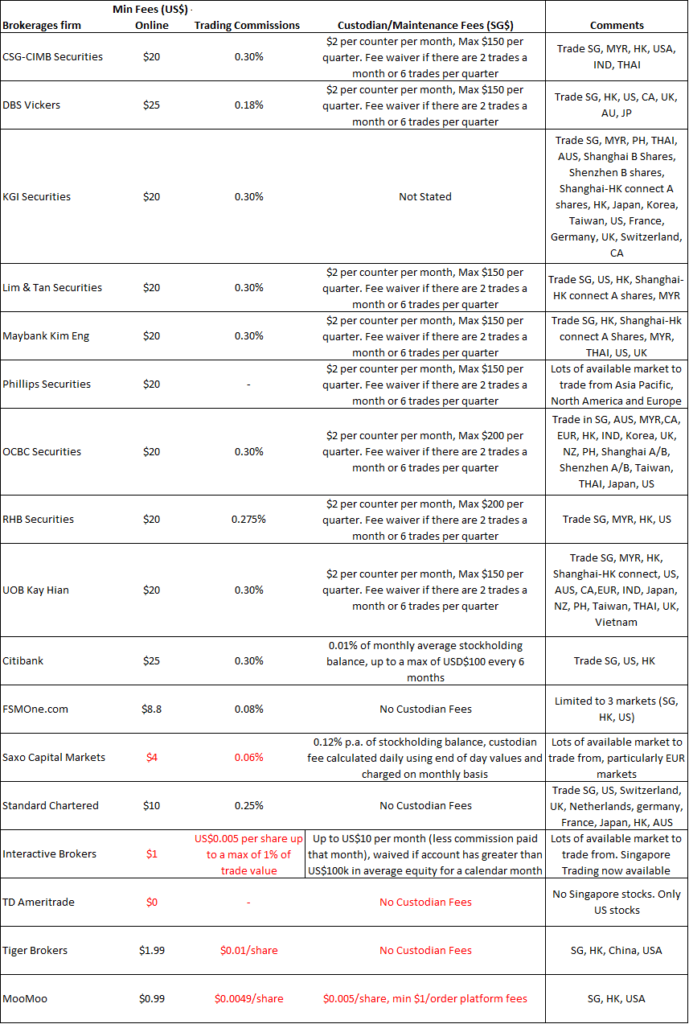

USA Market

The US market is home to quality companies such as Apple, Microsoft, McDonald, Coca-Cola, etc, companies that have been around for decades and still continue to demonstrate respectable growth profile over the foreseeable future.

The same cannot be said of SG stocks, unfortunately. That is why I believe a Singaporean investor should look to invest beyond the realm of the SG market, might it just be on a passive basis through index-ETFs.

From 3 August 2020 onwards, trading in US-listed stocks and ETFs will be commission-free using TD Ameritrade. This places the brokerage firm in pole position when it comes to commission costs for US stocks trading.

I have written a comprehensive article on TD Ameritrade and its thinkorswim platform previously.

![Best Stock Brokerage in Singapore [Update April 2021] 2](https://newacademyoffinance.com/wp-content/uploads/2020/11/TD-1024x1024.jpg)

TD Ameritrade (TOS)

TD Ameritrade which uses the ThinkorSwim (TOS) trading platform is the first online brokerage to bring ZERO commission trading of US Stocks to Singapore investors.

TOS is also one of the most comprehensive platform when it comes to trading of Options.

More importantly, there are absolutely no custodian fees associated with TD Ameritrade. So if you do have a large account size, for example, US$100k, that will cost you US$120 in custodian fees using Saxo. This again as I mention is a small fee compared to a Robo platform which has a recurring management/platform fee of approx. 0.40-0.60%/annum.

Interactive Brokers again score highly in terms of cost, with its min US$1 fee an unbeatable amount across the various brokerage options. Its trading fee of US$0.005/share up to a max of 1% per trade is also low, given that the price of a single US-listed stock is generally a large amount.

For example, the average US-listed Blue Chip stock is priced at around US$70/share. 100 shares will entail an outlay of US$7,000. This will only cost 100 shares * US$0.005/share = US$0.50 < US$1 min amount. Comparatively, buying a US$7,000 stock through one of the local brokerages like Maybank will result in a brokerage cost of US$7,000 * 0.30% = US$21.

3rd place goes to Tiger Brokers and MooMoo which has the next best pricing option at min fee of US$1.99/trade (Tiger Brokers) and US$0.99 + $1 in platform fees (MooMoo) respectively.

Saxo is now relegated to 4th place with a min cost of US$4/trade and variable comms of 0.06%. [April 2021 update]: From now till 31 Sep 2021, new customers to Saxo will be entitled to ZERO commission US trades. For existing clients, the US$4/trade min comms still apply

Again the introduction of Tiger Brokers which offers investors the opportunity to trade in the US market at a low cost has changed the dynamics of the competition. The counter also offers the ability to trade in US options, very much like all the international brokerage here. Below is a comparison of the account fees for different account sizes. Tiger Brokers is probably one of the more cost-efficient firms due to its low fee structure as well as the absence of custodian fees for small-size accounts. However, with the latest offerings from TD Ameritrade, Tiger Brokers is now relegated to third place.

Rank 1: TD Ameritrade ThinkorSwim platform (zero comms)

Rank 2: Interactive Brokers (US$1 min)

Rank 3: Tiger Brokers (US$1.99 min), MooMoo (US$0.99 min+ US$1 platform fee)

Rank 4: Saxo (US$4 min)

Comparison across account size (US market)

I have also done a comparison across account size. The tables below summarises the findings.

US$50k account size – US market

![Best Stock Brokerage in Singapore [Update April 2021] 3](https://newacademyoffinance.com/wp-content/uploads/2020/08/best-brokerage-account-50k-account-size.png)

US$100k account size – US market

![Best Stock Brokerage in Singapore [Update April 2021] 4](https://newacademyoffinance.com/wp-content/uploads/2020/08/best-brokerage-account-100k-account-size.png)

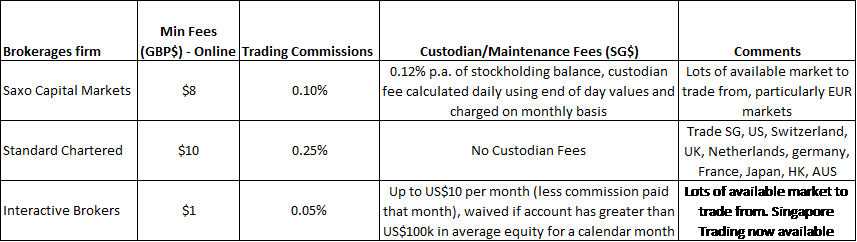

UK Market

For those who are interested in purchasing UCITS ETFs (tax-efficient ETFs) through the UK market, the obvious choice is using Interactive Brokers which is by-far the cheapest solution. However, you need to select their Tiered Pricing instead of Fixed Pricing.

I have written a comprehensive article on UCITS ETFs previously which one can refer to.

Rank 1: Interactive Brokers. They are undeniably the most cost-effective by a wide margin. For investors who are interested in engaging a dollar-cost average investing in UCITS ETFs, choosing IB is likely the most obvious choice. For the rest, it just does not make sense to engage a DCA approach every month if the investment amount is small

Rank 2: Saxo Capital. For small account size, this is the preferred account over Standard Chartered due to custodian fees charged.

Rank 3: Standard Chartered. For large account size, go for Standard Chartered over Saxo to enjoy Priority rate where there are no minimum charges and the variable commission is reduced to 0.20%. Since there are no custodian fees as well, it will be more cost-effective over Saxo.

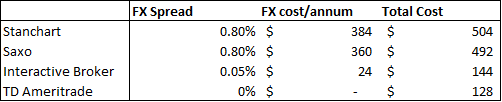

Forex-related fees

In my previous assessment of the best brokerage house to purchase US stocks, I did not take into account the forex-related fees. This could turn out to be rather substantial, potentially much more than the commission fees itself. Hence it is definitely worth taking Forex cost into consideration and look at minimizing them.

The problem arises when you fund your account in SGD but transacts in USD or other foreign related currency.

The FX spread between USD and SGD ranges from 0.05% to approx 0.8% based on my understanding.

In some cases like Saxo, they stated quite clearly that their currency conversion fee is the mid-point (roughly 0.1%) of the bid-ask spread plus 0.75%. The total fx-cost could be around 0.8%. This is quite substantial. For others such as Stanchart, they baked it directly into their bid-ask spread. According to Kyith who previously wrote about his experience with standard chartered, he mentioned that the spread is around 0.8%.

For Interactive Broker, it seems that their spread is very competitive, around 0.05% so pretty much negligible while TD Ameritrade has no repeated FX conversion cost (except for initial funding) since it only trades in US stocks.

The currency conversion cost can result in a substantial addition to your total cost. For example, for account size less than US$50k, Saxo used to be the most competitive at an annual total cost of US$108 based on the above example. However, after taking into account conversion fees, that figure increases to US$492.

US$50k account size (with forex conversion fees)

Saxo has cut its FX conversion fee from 0.75% to 0.30%. This will effectively reduce its total cost quite substantially. However, do note that conversion fees are slapped every time you transact in a different foreign transaction. For a more cost-effective manner to purchase foreign-denominated stocks, check out the next segment on How to avoid paying Saxo recurring conversion fees.

Despite the cut, when it comes to trading in US stocks for a Singaporean Investor, both TD and IB remains the most competitive in terms of all-in cost.

How to avoid paying Saxo recurring conversion fees

The easiest way to avoid the huge currency conversion fees when making foreign currency-denominated trades is to open a US sub-account with Saxo (assuming your main account is funded in SGD). In this way, you avoid paying the conversion fee every time you purchase a US stock. However, for you to do that, you need to have an AUM size of at least S$10k.

You will only incur the conversion cost once when you convert from SGD to USD. According to Saxo FX spread website, the spread between USD and SGD is approx. 8 pips. That means the spread cost is about 0.06% which is competitive. Adding the fixed spread of 0.75% will see all in conversion cost slightly north of 0.8%. You incur this cost once when converting and subsequently when trading US stocks, you will not have this conversion cost.

To request for a Sub Account:

- Login to the platform.

- Go to the Sub Account request form (example below), select currency, accept the conditions and submit. The Sub Account form is found here:

- SaxoTraderGO: Account > Other > Contact support > Sub-account request

- SaxoTraderPRO: “?” > Contact Support > Sub-account request

- SaxoInvestor:

> Contact Support > Sub-account request

> Contact Support > Sub-account request - SaxoMobile: Menu > Contact Support > Sub-account request

A few important notes on Sub Accounts:

- Before you do a trade, you will have to choose which Sub Account you wish to trade from. If you do not choose a Sub Account, the system will choose your default Sub Account.

- We are not able to reverse a trade that was executed on the wrong Sub Account.

- If you have accidentally chosen an account with an insufficient balance, your trade will still go through, and the cash balance on the respective Sub Account will go into negative.

- A negative cash balance in each respective Sub Account will be subject to interest.

- A trade can only be opened and closed on the same Sub Account.

- To transfer funds between Sub Accounts, please read this article: How do I transfer funds between sub accounts?

- To transfer Stocks and Bonds between Sub Accounts, please read this article: How do I transfer funds between sub accounts?

A word of caution on Interactive Brokers

For Interactive Brokers, it has the most competitive currency spread, so the associated cost is low when it comes to converting your SGD into USD to purchase a USD stock. However, you should always remember to convert your currency (from SGD) when purchasing USD stock to avoid incurring interest costs.

For example, you enter into a transaction to purchase a security which is denominated in a currency that you do not hold and assuming that you have a margin account and sufficient margin excess, Interactive Brokers will create a loan for those funds. Note that this is necessary as Interactive Brokers is obligated to settle that trade with the clearinghouse solely in the designated currency of denomination.

If you do not wish to have such a loan created and incur its associated interest costs, you would need to either first deposit funds into your account in the required currency form and amount or convert existing funds in your account using either IdealPro (for amounts in excess of USD 25,000 or equivalent) or odd lot (for amounts below USD 25,000 or equivalent) venues, both available through the TWS.

Best Overall Stock Brokerage Account

Rank 1: Tiger Brokers – best all-round pricing (smaller account size) but limited market options to trade from. Need to convert currencies to trade in different currency equity.

Rank 2: Interactive Brokers – BEST Pricing but higher account benchmark of US$100k to avoid custodian fees. Can consider for active traders (if 10 trades are executed each month, no custodian charges) as well as those looking to invest in LSE for UCITS ETFs purchases.

Joint Rank 2: TD Ameritrade – Zero commission trading for US market for Singaporean investors. It also provides one of the best options platforms available. However, the downside is that it is limited to just trading in the US market for equities.

Rank 3: SAXO – decent pricing (smaller account size) with plenty of market options to trade from. Need to create a different currency sub-account. Its lower comms pricing now makes it more attractive compared to closest peers such as Standard Chartered.

For account size < US$100k equivalent, go with Tiger Brokers (best all-around pricing) or Saxo (reduced pricing. Custodian charges not substantial if AUM is small)

For account size > US$100k, go with Interactive Brokers as they provide UNBEATABLE pricing of min US$1/trade. There are also no custodian fees with this account size. There are also a wide variety of markets to trade with using IB. This is a major shortfall of Tiger Brokers at the moment.

New Academy of Finance Brokerage Account strategy

For myself, I use 3 accounts (previously 2):

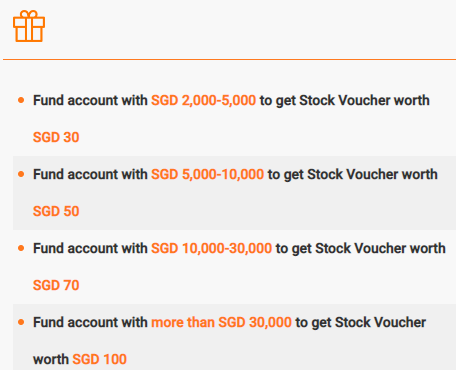

1. Tiger Brokers: For SG, HK, and US stocks. Unbeatable pricing and I love their mobile platform. I have written about Tiger Brokers in this review piece which you might like to check it out. You can use my affiliate link to sign up an account with Tiger Brokers where you will be entitled to the following stock voucher rewards. Stock vouchers can be used to offset your stock purchase.

[April 2021 update] Tiger Brokers is now running a promotion where you will be entitled to 1 FREE STARBUCKS share if you are a new customer (limited to the first 5,000 new sign-ups) and you fund your account with $2k. Do note that it has to be your first funding. Do not send a dummy $1 fund to “test-drive”. You will no longer be eligible if you do so. Do note that you will also need to complete 10 trades before you are able to “cash-out” on your Starbucks stock.

TIGER BROKERS REVIEW: POSSIBLY THE CHEAPEST BROKERAGE IN TOWN. IS IT RIGHT FOR YOU?

Additional Readings: How I use Tiger Brokers to find stock gems

Since Tiger Brokers’ offering is pretty similar to MooMoo, I will not be switching to this new platform although new customers might want to try it out and get a free Apple share while doing so.

2. FSMOne: For my RSP investments

I have previously written that FSMOne provides the most cost-efficient method of investing through an RSP structure in this article: FSMOne now the cheapest regular savings plan (RSP) Option.

3. Saxo: For other international markets

Conclusion

The above combination of using Tiger Brokers for SG, HK and US and using FSMOne for RSP works well for me at the moment. However, I am restricted by the lack of available markets on the Tiger Brokers platform and hence will need to use Saxo as a supplement.

However, I might look to change to Interactive Brokers when my account exceeds US$100k to take advantage of the lower commission trading fees and the fact that there are no custodian fees at this portfolio level as well. More importantly, it will serve as an all-in-one platform that can now allow me to trade in both SG stocks as well as in multiple markets. However, this factor might not be so important for you if you are just focusing on SG, HK and US. The Tiger Broker platform is well-suited to fit those needs for a retail investor.

In a separate article, I will be talking about my IDEAL passive portfolio structure (I have talked about engaging a recession/inflation-proof retirement portfolio structure in previous articles) with detailed trades as well as the platform used to purchase those investment assets.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- FSMONE SINGAPORE: STEP-BY-STEP GUIDE TO OPEN YOUR FSMONE ACCOUNT AND START TRADING

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- FSMONE FEES: THE CHEAPEST REGULAR SAVINGS PLAN (RSP) FOR ETF (2020)

- TOP 5 BEST STOCK MARKET MOVIES AND HOW TO WATCH THEM FREE

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

15 thoughts on “Best Stock Brokerage in Singapore [Update April 2021]”

Doesn’t saxo charge currency conversion fees that mark up the cost of each US trade substantially? Why not use FSM for US Trades too?

Hi Lewis, you can transfer your SGD funds to saxo using TT which will incur a one-off fee (TT) and conversion costs. Thereafter the costs are per the commission rates.

Yes you can use FSMOne as well for US trades but their comms are higher and you will also incur corporate action charges and dividend handling charges as well.

Hi

Super informative post!

Just opened a USD sub account as you described but have a dumba-ss question.

To fund USD purchases, do I have to pre-fund USD to make USD trades or will SAXO convert from the SGD in my main account?

Will it incur the 0.75% conversion rate again?

Thanks in advance!

If you pre-fund USD, then you will need to go through TT where there will be transaction fees base on your bank. I believe you need to state your new USD sub-account as the right account to credit into. If you fund your main account in SGD then convert it to your US sub account, there will be a one-time conversion charge of 0.75%.

Hi RT,

thanks very much for the informative article, especially useful for newbie as like me.

Can I ask what about the FX cost for Tiger then if we are to buy US stocks as it was not covered in your article (or did I miss it)? Is it as competitive as well?

Regards.

Hi JOR,

Their FX cost is not the lowest but still relatively competitive at around 0.3-0.5%

Thanks for your reply.

Hello. You wrote that Tiger brokers have no custodian fees for HK market. But in the table, there’s a up to HKD 10?

Hi Kay,

Thanks for highlighting the error… yes, no custodian fees

Very good article. Some of the challenges I am facing and need views also:

– IBD: USD 10/ month inactivity fees is too much. This kills the whole ‘cheap’ theory.

– TD Ameritrade: couple of months waiting time for opening account and NO FRACTIONAL share trading. Again removes the benefit of zero commission. You can as well open account in Kristal Robo platform- zero charges until USD 50K investment.

– TIGER Broker: USD 2/ trade, OK and good as no inactivity fees. But no UK market- a downside- but still palatable. I would rank this over and above IBD anyday

– Saxo: USD 4/ trade- I think Saxo is still living in jurassic age- the world has changed and they need to reduce it considerably to survive. Not sure if it even offers fractional shares.

I am looking at Futu (Moomoo)- any idea it offers fractional? fees is USD 1/ trade

The search is on for less than USD 2/ trade+ fractional shares. I am very inflexible abt fractional- as I avg out on a daily basis.

Considering sending money, currency change, and so much permutations/ combinations- I am very comfortable investing via our beloved robo stashaway- it has been a god gift for people like me who want to invest fractional- small amnts daily- and not worry at my end of currency conversion- etc

Hi I would like to request MT4 In HK I has inverted usd 10k now I would like to withdraw my Amount but broker is not Able to respond so what could I do please Advise to me that is my one year Hard salary to Invested please give me Some Advice to I can withdraw my money from my MT4 Account

Hi,

Thanks for the comprehensive article. As you mentioned about transferring out your holdings from Tiger to IB once you reach AUM over 100K, please note that there is additional charge of USD 100 per counter that is charged by Tiger. However, I am not sure if that applies for transfer to IB since IB is handling the back-end settlement for Tiger if I am not wrong. Therefore, that will add to your switching cost.

Hi Winson,

Appreciate you dropping by and thanks for highlighting the additional charge by Tiger. I would think it still applies as you mention as tiger will no longer be benefiting from the trading activities done.