Table of Contents

Best Sector ETFs that have strong share price consistency

In previous articles, I wrote about which are the best sector stocks to invest in 2021 as well as highlighted the 22 cheapest stocks to buy in their respective sectors (2 stocks from each sector). This gives my readers a good starting point for further evaluation of the stocks highlighted in both articles to see if they are indeed worthy candidates for one’s portfolio.

For those who prefer a more diversified approach, one can explore buying ETFs instead of individual stock counters to eliminate unsystematic risks. In this short article, I will highlight the 3 best sector ETFs that have consistently outperformed the market over the past decade. I excluded Technological sector ETFs but instead focus on finding sector “gems” that are currently flying under the radar.

Best Sector ETFs

US News provided a rather comprehensive ranking of the different sector ETFs based on their methodology. In this article, I will highlight just 3 sector ETFs which I own and I believe that they are pretty decent diversification vehicles to partake in specific niche sectors.

These 3 best sector ETFs are not your typical large-cap ETFs that have billions under AUM, hence they might not be as well-known. I have, however, highlighted 2 of these ETFs briefly in my previous articles. Both of these ETFs have since traded higher.

Without further ado, in no particular order, the 3 best sector ETFs in my view are:

- iShares US Broker-Dealers & Securities Exchange ETF (IAI)

- First Trust Water ETF (FIW)

- iShares US Home Construction ETF (ITB)

Best Sector ETF #1: iShares US Broker-Dealers & Securities Exchange ETF (IAI)

Morningstar Rating: 5 stars

Net Assets: $933m

Expense ratio: 0.42%

Style: Large, Core Value

Sector: Financial Services

The ETF seeks to track the investment results of the Dow Jones U.S. Select Investment Services Index composed of U.S. equities in the investment services sector.

The fund generally invests at least 90% of its assets in securities of the underlying index and depositary receipts representing securities of the underlying index. The underlying index measures the performance of the investment services sector of the U.S. equity market.

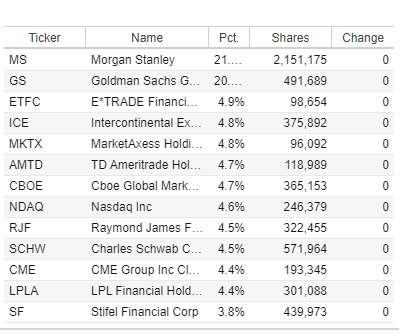

Many of the names are US investment banks, discount brokerages, and stock exchanges. The table below highlights the top holdings in this sector ETF at the moment.

This is a sector ETF that is considered pretty small-cap in nature, with net assets less than $1bn but it invests in counters which most investors are probably familiar with, its top 2 holdings being Morgan Stanley and Goldman Sachs which accounts for more than 40% of the fund’s exposure.

Hence this ETF can be considered rather “concentrated” to the price performances of these 2 investment banking heavyweights.

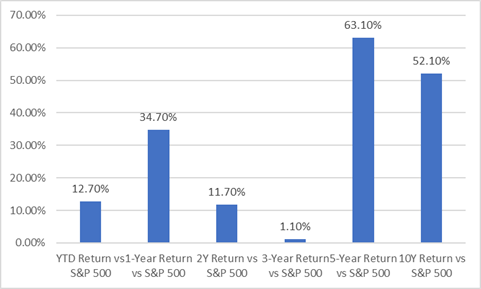

Nonetheless, despite the volatility seen in many financial counters, this is one financial service ETF that has consistently outperformed the S&P 500 over the past decade as can be seen from the table below.

Just this year alone, this ETF has outperformed the S&P 500 by 12.7%, generating a total return of 30.4% vs. the S&P 500 return of 17.8%. For those who wish to partake in the financial service sector, then this is one ETF that you should take a closer look at.

Best Sector ETF #2: First Trust Water: (FIW)

Morningstar Rating: 5 stars

Net Assets: $1,039m

Expense ratio: 0.54%

Style: Medium, Core

Sector: Natural Resources/Materials

The ETF seeks investment results that correspond generally to the price and yield (before the fund’s fees and expenses) of an equity index called the ISE Clean Edge Water Index.

The fund will normally invest at least 90% of its net assets (including investment borrowings) in the common stocks and depositary receipts that comprise the index. The index is designed to track the performance of small, mid, and large-capitalization companies that derive a substantial portion of their revenues from the potable water and wastewater industry, according to Clean Edge.

FIW is an ETF that I recently highlighted in this article: Best Performing Megatrend ETFs in 2021. In that article, I highlighted 14 megatrends that will likely see strong growth in the coming decade and which are the respective ETFs that one can buy into to partake in their growth.

Clean water is one of the megatrends that I highlighted in the article, with the FIW ETF being pointed out as the ideal ETF to buy to partake in this megatrend.

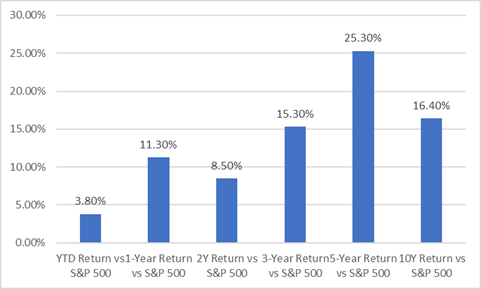

As can be seen from the chart below, this is one “under the radar” sector ETF that has consistently outperform the S&P 500 over the past decade.

I believe that this ETF’s outperformance can continue in the coming decade as well, with clean water remaining a quintessential resource that will continue to be highly sought after 10, 20, or even 100 years down the road (probably even more so as the world run out of this precious natural resource).

Companies that are exposed to clean water technology will see demand for their products/services remain relatively robust in the foreseeable future, in my view.

The table below shows the Top Holdings for this ETF.

Unlike IAI, the FIW is a more diversified ETF with no one single holdings exceeding 5% of the fund. This ensures sufficient diversification. The FIW ETF has also been identified as one of the top 3 natural resource ETFs as ranked by US news.

Best Sector ETF #3: iShares US Home Construction ETF (ITB)

Morningstar Rating: 3 stars

Net Assets: $2,307m

Expense ratio: 0.42%

Style: Medium, Core Value

Sector: Consumer Cyclical

The ETF seeks to track the investment results of the Dow Jones U.S. Select Home Construction Index composed of U.S. equities in the home construction sector.

The fund generally invests at least 90% of its assets in securities of the underlying index and depositary receipts representing securities of the underlying index. The underlying index measures the performance of the home construction sector of the U.S. equity market.

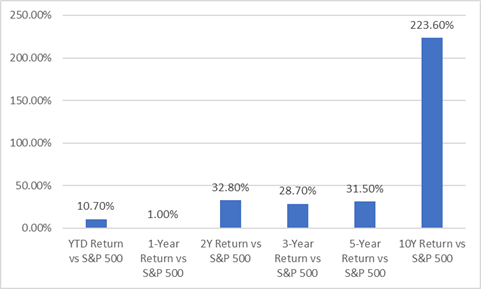

There are many interesting consumer cyclical ETFs such as those exposed to e-commerce/online purchase etc but none of them have achieved consistency in terms of price outperformance vs. the market.

Surprisingly, the ITB ETF, which tracks companies exposed to the US home construction industry, has been able to achieve that consistency, as can be seen from the table below. On a YTD basis, this ETF has generated a total return of 28.5%, substantially outperforming the S&P 500’s 17.8% return. More interestingly, over a 10-years horizon, this outperformance has been a massive 223.6%.

In my article 22 cheapest stocks to buy, I highlighted that Pultegroup (PHM) and Lennar (LEN) are two of the cheapest stocks that one can purchase in the Consumer Discretionary/cyclical sector. Homebuilders are a cheaper way to play the strong rise in house prices seen in the US, many of which have seen its share prices lagged the overall rise in home prices since 2013.

For those who are not comfortable buying into individual stock counters, one can invest into an ETF such as ITB to buy into a basket of homebuilder stocks to diversify out your risk.

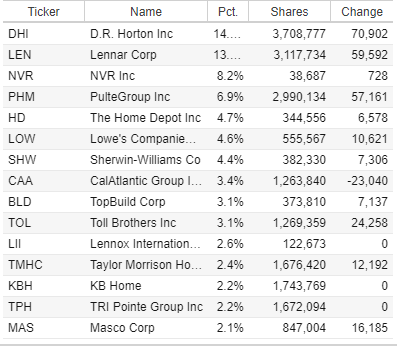

The Top Holdings in this ETF are names such as DR Horton, Lennar, NVR, PulteGroup, and The Home Depot.

Additional Reading: Best Performing ETFs (2023)

Conclusion

These are the 3 best sector ETFs in my view. They are not your large-cap ETFs that seek to replicate the performances of the entire sector. These are more niche small-cap ETFs that target a particular industry. The IAI ETF looks at mainly the investment banking/brokerage industry, FIW ETF looks at clean water and ITB ETF targets the home construction industry.

The common characteristic among all 3 ETFs is their consistency when it comes to their share price performances over the past decade. All 3 ETFs have consistently outperformed the S&P 500 over the last 10 years and I believe that the necessary tailwind remains to further drive that outperformance in the coming decade as well.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.