Table of Contents

If you are just beginning your investment journey, it can be wise to lay a strong foundation for your portfolio by investing in exchange-traded funds (ETFs) in the stock market. In this article, we will be exploring some of the best-performing ETFs which have outperformed the S&P500 index over the past decade.

What are ETFs?

An exchange traded fund (ETF) is a type of security that involves a collection of securities, such as stocks that often track an underlying index although they can invest in any number of industry sectors or use various strategies.

They are similar to mutual funds, a key difference being that they are listed on exchanges, and ETF shares trade throughout the day just like ordinary stocks in the stock market.

One of the key advantages of ETF is its ability to allow an investor to partake passively in a broad basket of stocks, hence a popular choice for diversification.

There are different types of ETFs which could include Bonds ETFs, indexed-stock ETFs, Industry-specific Stock ETFs, Commodity ETFs, Currency ETFs, Country (Emerging markets, developed markets) ETFs, leveraged ETFs, Inverse ETFs, etc.

Additional Reading: Best Gold ETFs with Lowest Costs

Some of the Pros and Cons of investing in ETFs are listed below:

Pros

- Access to many growth stocks across various industries

- Low expense ratio unlike unit trusts

- Risk management through diversification

- Available to access thematic ETFs

Cons

- Some ETFs might have a high expense ratio

- Single industry-focus ETFs limit diversification

- Lack of liquidity might hinder transactions

All in all, ETFs remain a particularly useful asset class for a new investor to start his/her investing journey without the hassle of selecting individual stocks in the stock market which will expose them to unsystematic risk. This is a risk that is inherent in a specific company. By investing in a range of companies, unsystematic risk can be drastically reduced through diversification.

Largest ETFs by NAV

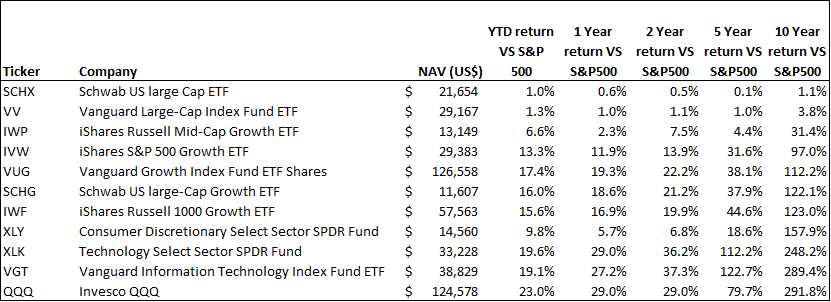

The table below shows some of the largest ETFs in the world by net assets (>$40bn), sorted first based on the best-performing ETFs over the past 10 years.

New investors who wish to participate in the largest and most liquid ETFs in the world can consider these ETFs. These ETFs are also ideal for engaging in options given their liquidity status.

In the table, I have highlighted the SPY ETF, which is often the ETF used to represent the performance of the S&P 500, as the benchmark to beat. Most of these large-cap ETFs highlighted in the list, have however underperformed the SPY ETF over both a medium and long-term horizon.

There are only a handful of index ETFs that have managed to outperform the SPY ETF over a 10-year horizon, most of these ETFs being counters that are exposed to the tech sector (aka growth stocks). Even then, these ETFs (QQQ, IWF, etc) have not been consistent in their outperformance as seen from their higher negative returns over the past 1-year.

In the following segments, I will showcase the Best Performing ETFs over their respective time horizon, before wrapping up this article to highlight a few salient ETFs that you should be aware of.

Best Performing ETFs in 2023

Using the Stock Rover screener, I screened out ETFs with NAV (market capitalization) of more than $20bn, and have managed to generate excess returns vs. the SPY ETF in YTD 2023 as well as for longer time horizons (1-year, 2-year, 5-year and 10-year). Do note that the rankings here will change when the information is being updated dynamically.

Growth Stocks found favor back in 2023, after a disastrous 2022. This is evident from some of the best performing ETFs on a YTD 2023 basis being growth-related ETFs exposed to the technology sector. Many high growth stocks have rebounded this year. However, it remains to be seen if their strong price performance is sustainable.

Best Performing ETFs Past 1 Year

Over a 1-year horizon, XLE ranks as the best ETF in terms of its price performance. This is not surprising considering how strong energy-related counters have done in 2022 when many other sectors faltered. Many of the top ETFs during this time horizon are international and Europe-linked ETFs as well as Value-related ETFs.

Best Performing ETFs Past 2 years

Over a 2 year horizon, many dividend-related ETFs have done well, outperforming the S&P 500 index.

Best Performing ETFs Last 5 Years

Over a 5-year horizon, tech-related counters have demonstrated strength vs. the broader market, some of which (XLK, VGT) outperformed the SPY ETF by more than 100%.

Best Performing ETFs Last 10 Years

Over a 10-year horizon, there is no question that tech ETFs reigned supreme. An investor who invested $10,000 passively into the best tech ETFs (VGT) would have seen its value increase to almost $50,000 during this period.

Any ETFs that outperform S&P 500 across all time horizons?

The above list shows the best-performing ETFs across different time horizons.

Unfortunately, there is NO single ETF that has managed to outperform the S&P 500 (as represented by the SPY ETF) across all time horizons. However, there are a few ETFs that are worth highlighting from these lists of passive index ETFs.

Additional Reading: Thematic ETFs partaking in the hottest trends

Growth ETFs

Vanguard Information Technology Index Fund ETF (VGT)

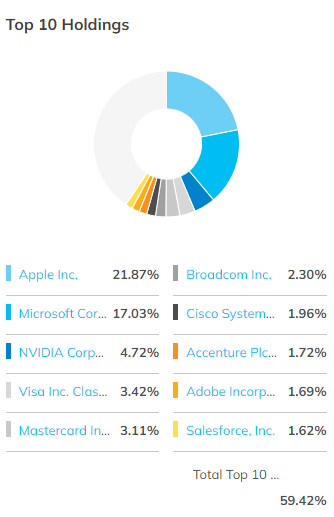

Compared to the more popular Invesco QQQ Trust Series 1 (QQQ) ETF, the latter typically used to represent the Tech-heavy Nasdaq index, a better ETF to play the technology sector is the Vanguard Information Technology ETF (VGT).

As can be seen from the 5-year and 10-year tables, one in which tech-heavy ETFs have generated strong outperformance vs. the S&P 500, the VGT ETF has been the superior performer vs. the QQQ ETF. On a YTD 2023 basis (as of March 2023), it is ranked the Top index ETF in terms of performance, with a YTD return of 14.5% vs. the QQQ’s return of 13.4%.

VGT is one of the most diverse market-cap-weighted technology ETFs available, yet it still reflects the concentrated nature of the space. It represents the market well, including more small- and micro-caps than most of the other broad tech sector funds while still managing to keep all-in costs extremely low.

Definitions of “tech” differ from fund to fund: VGT includes credit card firms but excludes telecoms. Gaming and internet services companies were moved to sibling VOX following a GICS revision in 2018. (Note that Fidelity’s FTEC tracks a nearly identical index).

VGT reliably delivers the returns of its underlying index. For investors who want broad, plain-vanilla exposure to the US technology market at a low cost, VGT gets it done.

Top 10 Holdings of VGT

VONG vs VUG vs. SCHG

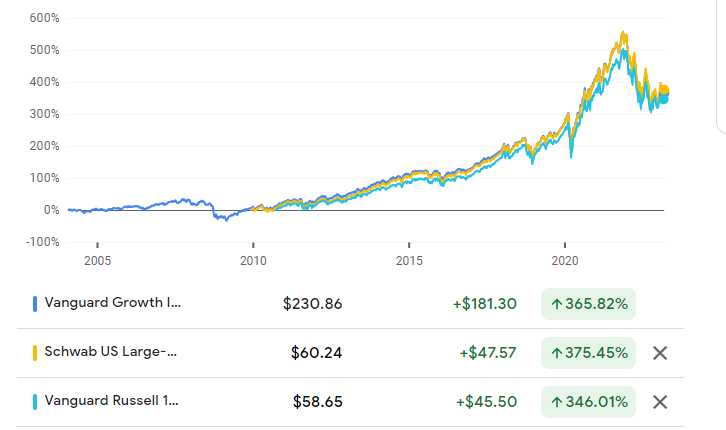

Three very popular growth ETFs that investors might be also interested in are 1) Vanguard Russell 1000 Growth ETF (VONG), 2) Vanguard Growth Index ETF (VUG), and 3) Schwab US Large Growth ETF (SCHG).

Only VUG is featured in this list. This is due to the smaller market cap nature of both VONG ($13bn) as well as SCHG ($15bn), hence they are not included in the list.

In terms of performance, it is interesting to note that SCHG ETF has a better performance vs both VUG and VONG on a long-horizon basis, as can be seen from the diagram below.

Dividend ETFs

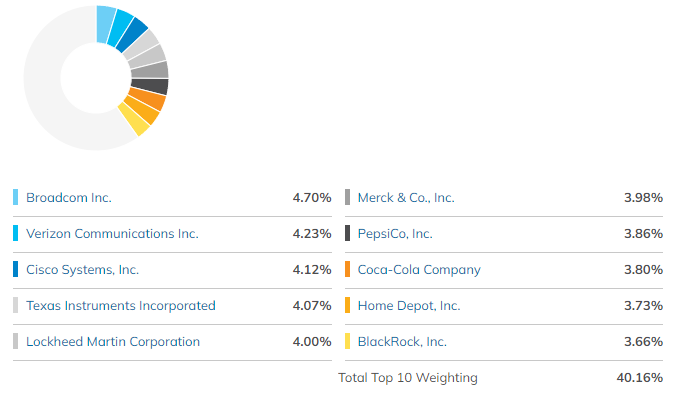

Schwab US Dividend Equity ETF (SCHD)

While the SCHD did not manage to feature across all time horizons, it has managed to outperform the SPY ETF rather convincingly over a medium-term horizon and narrowly missed out on the 10-year list with a total return of 141%.

Nonetheless, this is still one of the best dividend ETFs that one can buy into, with a yield of about 3.4% at present. I will be doing an article to compare the best dividend ETFs that a dividend investor can consider.

The objective of SCHD is to focus on quality companies with sustainable dividends. As such, this approach gives the fund a modest large-cap tilt and excludes REITs entirely. Individual securities are capped at 4% and sectors are capped at 25% of the portfolio.

The top holding in this list (as of March 2023) is Broadcom, a tech-related play that also pays a very generous yield of close to 3% which is not very typical of tech-related holdings.

Top 10 Holdings of SCHD

S&P 500 ETFs

iShares Core S&P 500 ETF (IVV)

The IVV ETF is pretty similar to its more popular peer, the SPY ETF. In fact, IVV, SPY, and VOO are often being compared in the same light for investors looking to invest in the S&P 500 index.

The main difference between these 3 ETFs is their expense ratios, with the SPY ETF costing the most at 0.09% while both the IVV and VOO ETF have an expense ratio of just 0.03%.

As can be seen from the above tables, as a result of their lower expense ratios, the IVV and VOO ETFs typically rank ahead, in terms of performance, vs. the SPY ETF.

| S&P 500 ETFs | VOO | SPY | IVV |

|---|---|---|---|

| Expense Ratio | 0.03% | 0.09% | 0.03% |

| Net Assets (bn) | 792 | 380 | 307 |

| Yield | 1.59% | 1.56% | 1.57% |

| Top 10 Holdings (%) | 27.4% | 27.4% | 28.4% |

| Year of Inception | 2010 | 1993 | 2000 |

Sector ETFs

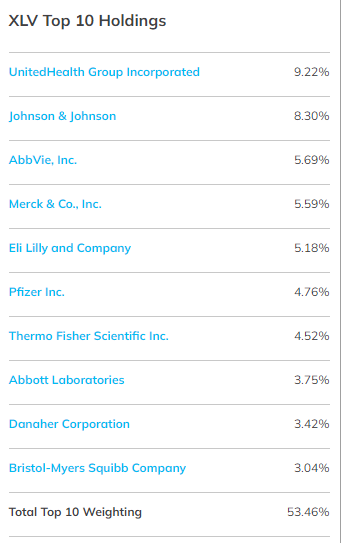

Healthcare Select Sector SPDR ETF (XLV)

The XLV ETF has outperformed the S&P 500 across almost all of the time horizons stated above, with the exception on a YTD 2023 basis, where healthcare-related stocks have underperformed rather significantly.

Nonetheless, healthcare remains a very defensive sector and will likely outperform all the sectors even in a recessionary environment. Hence it might make sense to be positioning XLV on its current price weakness.

The fund provides exposure to companies in pharmaceuticals, healthcare equipment, and supplies, healthcare providers and services, biotechnology, life sciences tools and services, and healthcare technology industries.

Top 10 Holdings of XLV

There are other interesting ETFs not featured in this list due to their smaller market cap nature that I will cover in a separate article in the future. This will include industry ETFs such as the iShares Semiconductor ETF (SOXX), an ETF that I am positive about in the long term and has been engaging a dollar cost average approach using the Syfe Robo Advisor.

For those who are interested to find out more about ETFs and which are my preferred ones to be positioned in, do download the FREE ETF Video Guide where I will highlight the salient differences between SG, US and UCITS ETFs and how you can structure your own ETF portfolio based on your investing strategies.

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

1 thought on “Best Performing ETFs [2023 update]”

What about OGIG? It is recommended on Investopedia website.