Best Gold ETFs with lowest costs to buy

Gold has been one of the go-to asset classes in today’s uncertain environment. With inflation on the rise and the Russia-Ukraine war on the horizon, this has helped gold “regain” back its allure with the asset class now at the highest level over the past 1-year and if this upward continues, it is only a matter of time before it breaches its all-time high level of US2070/ounce set back in 2020.

Besides gold, investors are also moving money into other havens such as government bonds. For example, the short-term 2-year Treasury note fell from 1.6% on Feb 23 to 1.35% of late due to heightened demand for safe-haven assets amid the current economic uncertainties caused by Russia’s invasion of Ukraine.

I have done up a video highlighting 4 investment categories that one should consider to “war-proof” your portfolio. 2 of those investment categories which I proposed are gold and inflation-protected short-term bonds.

Coming back to gold, one of the most convenient methods to buy gold and partake in this precious metal rise is through the purchase of Gold ETFs. This is the preferred method for most retail investors vs. the more direct ownership of physical gold bars.

However, buying Gold ETFs comes with a slight cost. The most direct cost is the expense ratio associated with the purchase of ETFs.

Which are the Best Gold ETFs that have the lowest expense ratio among the lot and should we only take into consideration the associated cost? How about the performances of these Gold ETFs on a YTD basis? Have they all performed equally well?

We will look to explore that in this short article.

Additional Reading: Too late to buy Gold? How to play it with Options for > 100% annualized ROI

How “expensive” are these Gold ETFs?

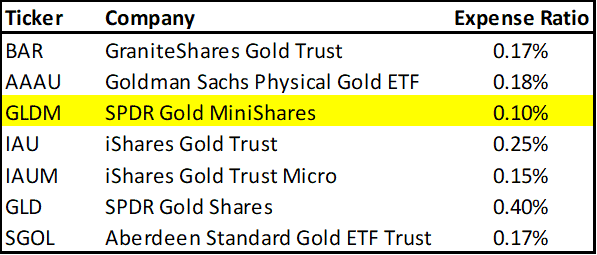

The most popular Gold ETF among the lot is the SPDR Gold Shares (Ticker GLD) which is the biggest ($58bn market cap) and cheapest among the group. However, it is not the cheapest with its expense ratio of 0.40%. This means that every $1000 you invest in this ETF, it cost you $4 in management fees every year.

This is a recurring cost that you have to pay annually.

There are other cheaper options, albeit smaller-sized gold ETFs which are not as well known.

First is the iShares Gold Trust (Ticker: IAU) which has a market cap of about $28bn. It has an expense ratio of 0.25% which is significantly lower than that of GLD.

There are also smaller-sized alternatives such as the Aberdeen Standard Physical Gold Shares ETF (Ticker: SGOL) with a market cap of $2.4bn and an expense ratio of just 0.17%, the $889m GraniteShares Gold Trust (Ticker: BAR) with an expense ratio of 0.17% and the $640m Goldman Sachs Physical Gold ETF (Ticker: AAAU) that has an expense ratio of 0.18%.

Blackrock recently launched the iShares Gold Trust Micro ETF (Ticker: IAUM) with an expense ratio of just 0.15% and already attracted more than $1.2bn in assets.

While you might think that IAUM is now the cheapest of the group, State Street, the sponsor behind the grand-daddy of gold ETFs, the GLD ETF, launched a sister fund, the SPDR Gold MiniShares ETF (Ticker GLDM) back in 2018 with a recently revised expense ratio of just 0.10%.

There are other ways to partake in the rise of gold prices and in my video, I highlighted one particular ETF that investors can consider to take a leveraged bet on gold prices.

Beyond GLD which is perhaps the most well-known Gold ETF out there, but you now know that it is also one of the most expensive ones, there are other cheaper alternatives to consider, the cheapest one being its sister ETF, GLDM.

Additional Reading: Stagflation investing: How to position your portfolio

Performance of Gold ETFs YTD 2022

While one might think that the price performance of Gold ETFs should all be the same, is that true in reality?

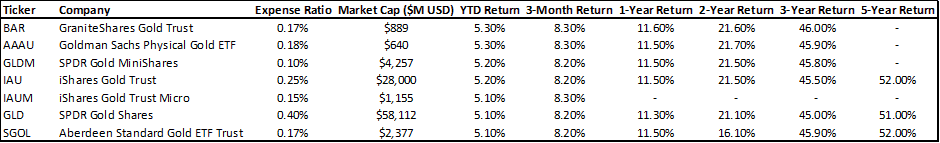

I created a quick watchlist of the above Gold ETFs using the stock rover platform to track the performances of these ETFs over both a short-term and long-term (up to 5-years) basis.

The table below summarizes the key performances of these Gold ETFs where the returns displayed is before taking into consideration the expenses associated with the ETFs.

There is not that much of a difference on a shorter-term basis although the SGOL ETF seems to be a bit of a laggard compared to its peers.

Some of the ETFs do not have a 5-year trading horizon but among those with 5-years of trading history, the performance is typically the same.

Conclusion

Hence for those who are very cost-conscientious, instead of going for the uber-popular GLD ETF which you might be paying the highest amount of annual cost on, you might want to look out for cheaper alternatives, which can also be found in its sister fund, the GLDM ETF which has the lowest expense ratio of just 0.10%

Since all of these Gold ETFs do not have that much of a performance discrepancy, then it might make sense to go for the cheaper alternatives.

For those who are looking to have exposure to these Gold ETFs through options, only the GLD ETF and IAU ETF have tradable options.

One way to generate your synthetic dividends (Gold ETF do not pay dividends) on your Gold ETFs say the IAU ETF, while yet continuing to partake on its upside is to structure a covered call strategy using options.

For those interested in the covered call strategy, I cover this in detail in this article: Covered Call Strategy: Making money when the markets don’t do much.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Too late to buy Gold? How to play it with Options for > 100% annualized ROI

- Copper might be the new gold. How to prtake in this commodity on a new supercycle

- Stagflation investing: How to position your portfolio

- NAOF Portfolio: Still one of the best portfolio allocation strategies in 2022?

- Interest rate hikes are coming in fast and furious. How to preapre your portfolio for it

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only