Domino’s: Generating a return of $16,700

When it comes to fast-food restaurants, McDonald’s takes the top spot as being the largest and most widely recognized fast-food restaurant brand in the world. However, a $1,000 investment in McDonald’s a decade ago would have translated into an investment value of just $3,490 today, underperforming the broader S&P 500 index value of $4,391 and the Nasdaq index value of $7,115.

On the other hand, if that investment $1,000 investment was allocated to one of America’s best fast-food restaurant chains 10 years ago, that $1,000 investment would return $16,700 today. This fast-food restaurant is none other than Domino’s, a pizza chain that most of us can associate with.

Back in 2011, one share of Domino’s cost less than $30, enough to get you a few pizzas plus a 2-liter bottle of coke. The company was struggling with its product and had to toss out its old recipe and publicly admit to its customers that it had failed when it comes to delivering on its promise of ensuring quality food.

However, over the past 10 years, Domino’s underwent one of the biggest corporate transformations, turning this once struggling fast-food restaurant into one of the best and well-managed fast-food chains that have pleased both its customers and shareholders.

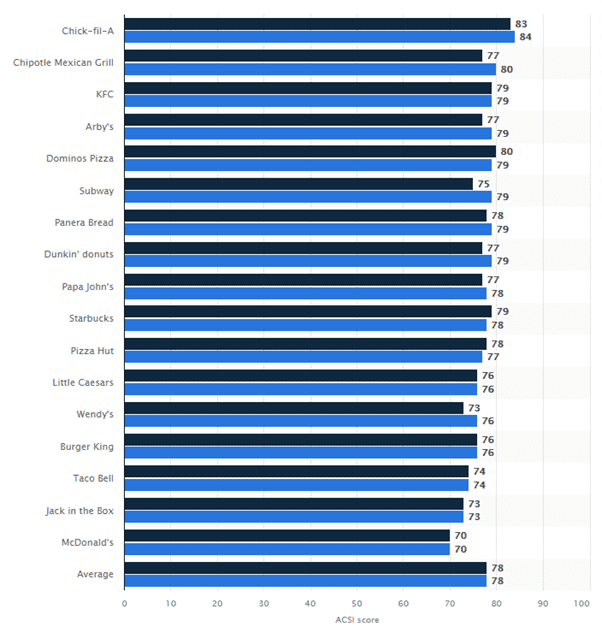

According to the American Customer Satisfaction Index Scores for leading quick-service restaurant chains in the US in 2021, Domino’s ranked as the 2nd best fast food restaurant chain in terms of customer satisfaction, behind Chick-fil-A which has won this accolade for the seventh straight year.

The worst was good old McDonald’s, which garnered a score of just 70 in 2021.

Chick-fil-A is not a listed entity but if it is, this is likely one restaurant stock that will be highly loved by the street.

Domino’s transformation

Domino’s turnaround started when it brought in new CEO Patrick Doyle back in 2009 and publicly admitted that its old recipe was a major failure, with a controversial marketing ad that “honestly” showed how bad its pizza was, in the eyes of consumers.

Those controversial marketing campaigns got the street’s attention as they successfully launched their new recipe with much fanfare. For the first time in a long time, consumers are associating Domino’s with pizzas again and giving their pizzas a “bite”.

That was the start of a very successful turnaround story. The company also started digitalizing its operation and built out its website and app to encourage customers to stop placing orders through phone and instead to do it through the company’s online platforms.

This helped the stores to run more efficiently in terms of order processing. Another area in which the company invested in is data analytics, ensuring the efficiency of its pizza delivery routes which allowed store owners to maximize revenue for their stores.

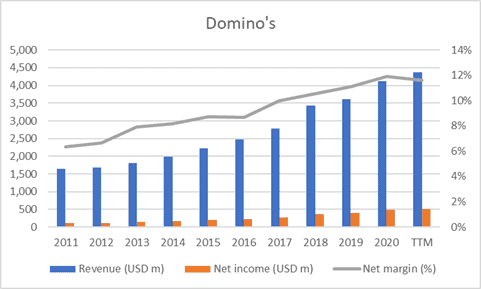

As can be seen from the chart below, Domino’s is one of those rare restaurant chains that have managed to grow its revenue and profits consistently over the past 10 years.

The company has also been successful in raising its net margin consistently over the past decade, one which is a rare feat for a restaurant stock that is often subject to inflationary costs associated with raw materials and labor.

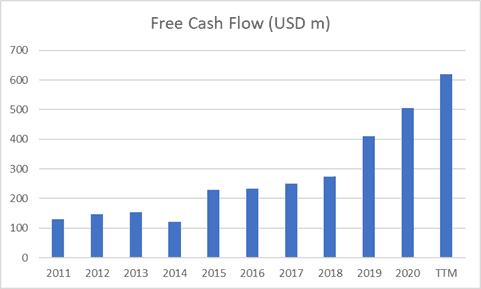

It is not just the company’s ability to grow its revenue and earnings that is impressive, but also for a fact that the company’s free cash flow has been increasing along with earnings growth, with a projected free cash flow of $USD600m in 2021.

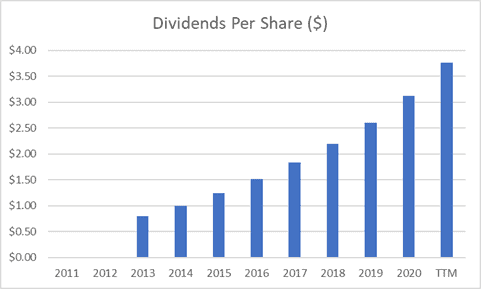

Its free cash flow generation ability and allowed the company to aggressively return excess capital to shareholders in the form of share buybacks and dividend payments.

Is there more upside for Domino’s?

Domino’s have undoubtedly recovered from its failure in the early to late 2000s, witnessing a major turnaround, operationally (as evident from its consistent financial performance) and on the stock side, with the market re-rating the counter massively over the past few years.

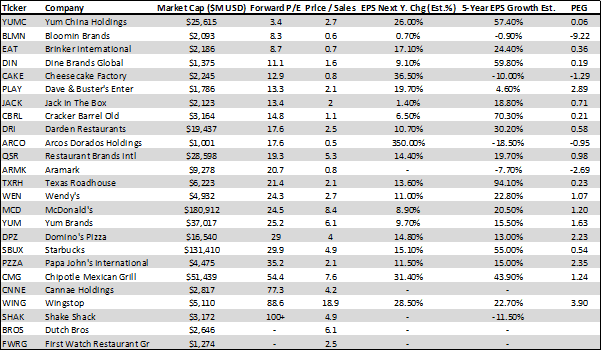

The counter is projected to generate $507m in profit in 2021. At its current market valuation of $16.5bn, Domino’s is valued at 29x forward Price/earnings (P/E) vs. the 21x P/E multiple a decade ago. Compared to McDonald’s which is currently valued at 26-27x forward P/E and the stock might seem a tad expensive but considering its stronger growth potential, valuation is not exactly demanding, in my view.

The counter’s recent price decline is a result of posting its first drop in same-store sales in more than a decade. While US stores are facing a slower growth outlook, their international growth is rosier with same-store sales climbing 8.8% in the quarter.

What investors will need to be wary of is associated labor issues, with lack of staffing a key problem highlighted by the company for the latest financial quarter.

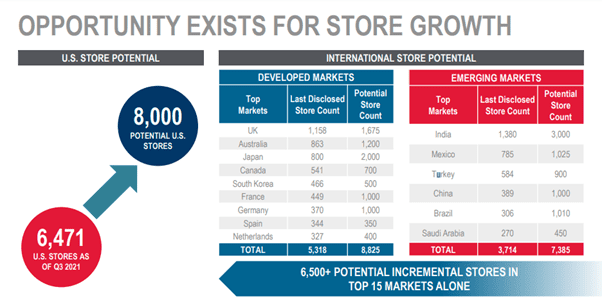

Domino’s is still a growth company, with lots of potential to expand, not just within the US, but also internationally where the company target 6,500+ in-store expansion count for its Top 15 markets alone.

If the company can execute its expansion plan “flawlessly” as it has done over the past decade, then it is not unreasonable to expect Domino’s to enjoy further price appreciation upside over the coming years.

Top competitors to Domino’s

Domino’s share price has been the best performing of all listed US restaurant stocks over the past 10 years

However, 2 other restaurant stocks are worth a mention here. They are Chipotle Mexican Grill and Wingstop.

Both stocks have performed extremely well in terms of their share price performances over the past 5-years and are on track to beat or match Domino’s impressive 10-years track record in the coming years ahead.

While Domino’s pizza is already a well-known international brand since 10-years ago, both Wingstop and CMG are just beginning to expand internationally.

CMG has yet to hit our local shores here in sunny Singapore. The company shouldn’t even be considered an “international” company, with just 40 international outlets (mostly in Canada) as of the end of Dec 2020.

While the growth potential for CMG is evident, particularly in terms of global expansion, the company is also trading at a hefty forward P/E multiple of 54x, approx. 2x as expensive as that of Domino’s.

A similar situation is seen for Wingstop (which already has a presence in Singapore, and a very popular one I must say), which is trading at an even more mind-boggling multiple of 89x forward P/E, with the company valued at $5bn in market value despite forward earnings forecast of just $56m.

Investors have to be mindful about overpaying for growth.

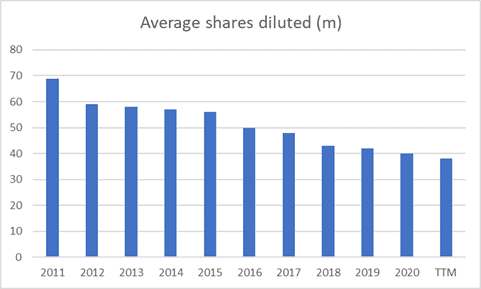

10 years ago, Domino’s was trading at a P/E multiple of 21x. Its strong share price performance was a combination of 1) P/E multiple expansion (from 21x to the current 29x), 2) consistent revenue growth, 3) margins expansion, 4) share buyback and 5) strong growth in EPS.

The difference between buying into a Wingstop share (at 89x forward P/E) and buying a Domino’s share 10-years ago (at 21x P/E) is the high “growth” valuation that one is paying for the former at this current juncture.

One will need to query if such high double-digit P/E multiples can be sustained in the coming years ahead.

Other restaurant peers

In terms of forward P/E, Yum China looks to be a value BUY at 3.4x forward P/E, with the street also expecting its EPS growth over the coming 5 years to be a massive 57%/annum, translating to a price-earnings growth (PEG) multiple (forward P/E divide by 5-years EPS growth forecast) of just 0.06x (a lower multiple represents more value).

Domino’s, CMG and Wingstop are all trading at above-average forward P/E multiples (vs. their peers).

In terms of PEG, CMG does look like a better buy vs. Domino’s due to the former stronger growth potential.

Conclusion

While Domino’s trades at a “premium” relative to well-known fast-food brand chains such as McDonald’s, that premium becomes a “discount” when compared to faster growth companies such as CMG and Wingstop.

Despite the Domino’s brand already a well-known one, synonymous with pizza hut (under Yum Brands) when it comes to the purchase of pizzas, it remains a restaurant brand that has good growth potential over the coming decade, in my view.

A key catalyst for the company has been the successful digitalization of its business where purchases and delivery are mainly all fulfilled online, without the need for too many physical pizza outlets.

Brick-and-mortar stores are now facing the “heat” as a result of COVID-19, with many well-known restaurant brands “closing shop” during this period.

Restaurants such as Domino’s that have successfully pivoted and embrace digitalization will likely continue to strive amid uncertainties associated with re-opening efforts faltering due to a resurgence in COVID-19.

Will investors continue to generate strong returns by investing in Domino’s stock today or is there a new (and smaller) contender in the form of Wingstop that is still in the early innings of their global expansion?

In which fast food chain brand will you look to invest your next $1,000 in?

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Best Dividend Growth Stocks: How to become a millionaire by investing in these 6 dividend growth stocks

- Top 5 Undervalued Small-Cap Singapore Dividend Stocks (>4% yield) (2021)

- Best Blue Chip Growth Stocks: 5 Blue Chip Companies with 10 years of earnings growth and consistently outperform the S&P 500

- 6 Blue-Chip Dividend Growth Stocks with High Dividend Growth Rate

- How to invest in Dividend stocks

- Dividend Investing Strategy: Combining key ratios with economic moats

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only

1 thought on “How much will $1,000 be worth if you invested in one of America’s best fast-food restaurants 10 years ago?”

Hi is the PE ratio for Yum China correct? It seems different on Yahoo Finance.

By the way, would you do an article for Yum China also since it looks appealing based on the table.