Best China ETFs based on Performance, Morningstar Rating and Expense Ratios

Investors looking to diversify their portfolios geographically can look to partake in China, the second-largest economy in the world through the purchase of China exchange-traded-funds (ETFs).

Which are the best China ETFs to buy to ride the growth in a nation that is likely to experience one of the fastest GDP growth in 2021 (1Q21 growth was already at a massive 18.3% YoY). For Singaporean investors, I will provide an alternative solution with a brief discussion on the Lion-OCBC Securities Hang Seng Tech ETF.

This is an updated article that was first published back in November 2020. I will look to compare the performances of the ETFs highlighted in November 2020 vs. May 2021 and see where the discrepancies in the respective ETF performances might be.

First thing first, a word of caution. Buying into China stocks is never a walk in the part as seen from recent events.

China tech stocks have been underperforming their US counterparts since late-2020, starting from the dramatic cancellation of Ant IPO, which many believe is due to the direct consequence of Jack Ma “shooting his mouth off” which angered Xi Jinping (China’s president) and that resulted in an abrupt halt in 2020 most anticipated IPO, that is also expected to be the largest-ever.

Consequently, there was a sell-off in China tech stocks such as Alibaba (most obvious candidate), Tencent, JD, etc, all of which were trading at all-time highs before the shocking Ant IPO cancellation.

The announcement that the US is looking to ban tech exports to 89 Chinese firms also fuelled already-heightened tensions between the US and China on fronts ranging from trade and Taiwan to the handling of COVID-19 as President-elect Joe Biden prepares to take over from Donald Trump.

Of late, the Chinese government’s clampdown on heavy-weight tech stocks such as Tencent and Meituan continues to put pressure on the nation’s tech sector.

Might this be a possible long-term buying opportunity?

For those looking at a more diversified exposure, buying China ETFs is preferred over individual counters.

Here are some of the Best China ETFs to consider buying.

Best China ETFs

I look at a few criteria when selecting these China ETFs which are listed in the US.

- Returns (YTD and 5-year returns)

- Morningstar Rating

- Expense Ratio

- Net Asset

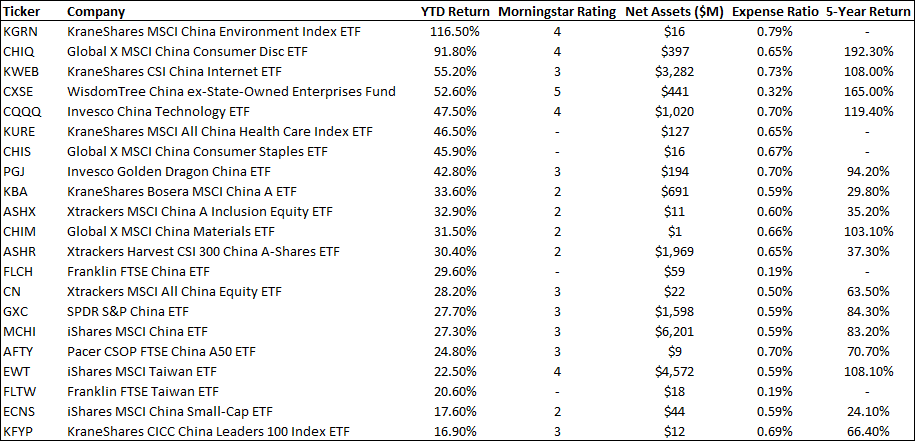

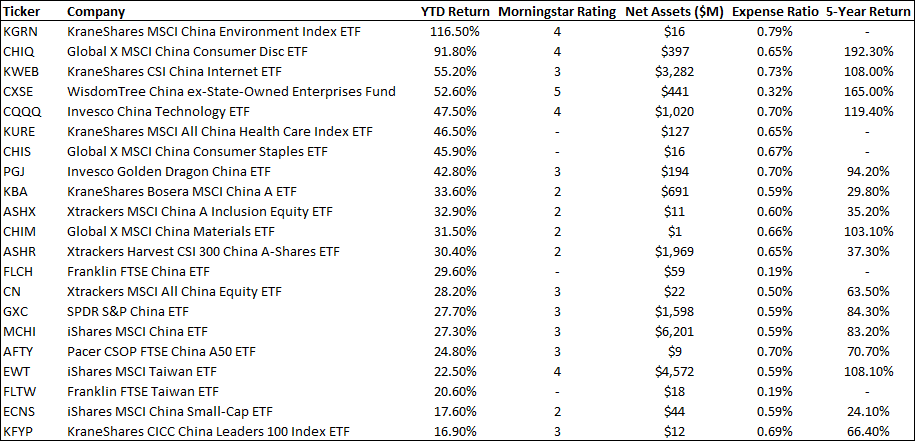

The table below is screened using the Stock Rover platform.

This was the initial list of best-performing China ETFs that was screened back in November 2020. I highlighted which were the best China ETFs at that juncture in terms of YTD 2020 performances, Morningstar Rating, Lowest Expense Ratio, Largest Net Asset, and Best Overall.

Best Performance YTD Nov 2020: KGRN

Highest Morningstar Rated: CXSE

Lowest Expense Ratio: FLCH

Largest Net Asset: MCHI

Best Overall: CXSE

For those who are interested in these ETFs, you can check out the write-up below. If not you can jump to the price performances of these ETFs as of Nov 2020 vs. May 2021.

Best China ETFs: Performance YTD 2020

The best performing China ETF is KranShares MSCI China Environment Index ETF (KGRN), with a YTD return of 116.5%. This ETF seeks to provide investment results that correspond to the price and yield performance of MSCI China IMI Environment 10/40 Index.

The underlying index is a modified, free float-adjusted market capitalization-weighted index designed to track the equity market performance of Chinese companies that derive at least a majority of their revenues from environmentally beneficial products and services, as determined by MSCI Inc.

The Top 5 holdings of this ETF is NIO Inc ADR encompassing approx. 10.6% of the fund followed by BYD Co at 8.9%, China Conch Venture at 8.3%, China Vanke at 7.1%, and Shimao Group at 6.7%.

This ETF is also rated 4 stars by Morningstar which is one of the best among all the China ETFs available.

However, it has one of the highest expense ratios in this list at 0.79%.

Best China ETFs: Highest Morningstar Rated

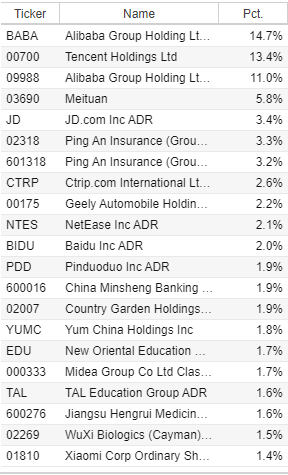

The honor of the highest Morningstar rated China ETF, the only one with 5 stars is WisdomTree China ex-State-owned Enterprise Fund (CXSE) which looks to track the price and yield performance, before fees and expenses, of the WisdomTree China ex-State-Owned Enterprises Index.

Most would probably be very familiar with the names in this fund, with its Top 5 holdings being Alibaba at 14.7%, Tencent at 13.4%, Meituan at 5.8%, JD at 3.4%, and Ping An at 3.3%.

The performance of this top-rated China ETF isn’t too shabby as well, with a YTD return of 53%, which ranks it No. 4 in the list based on YTD performance. Its expense ratio is actually on the low side at just 0.32%.

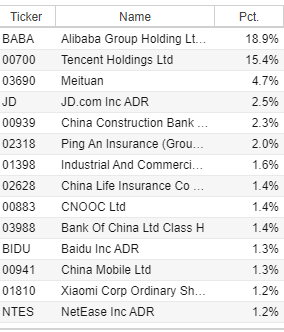

Best China ETFs: Lowest expense ratio (with > 20% YTD returns)

The China ETF fund with the lowest expense ratio but yet generate a decent YTD return of at least more than 20% is the Franklin FTSE China ETF (FLCH). This fund has a relatively low expense ratio of 0.19% and generated YTD returns of 30%.

The fund is benchmarked against the FTSE China Index and is designed to measure the performance of Chinese large- and mid-capitalization stocks, as represented by H-Shares, B-shares, and A-Shares.

This fund is however not rated by Morningstar.

Top 5 Fund holdings include stocks such as Alibaba at 18.9%, Tencent at 15.4%, Meituan at 4.7%, JD at 2.5%, and China Construction Bank at 2.3%.

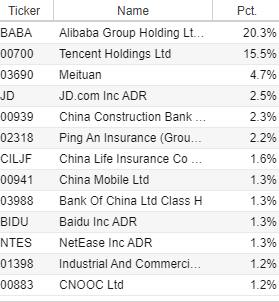

Best China ETFs: Largest net asset

The iShares MSCI China ETF (MCHI) is the largest China ETF by net asset in this list, with a total net asset value of US$6.2bn. Its YTD performance is 27%

The investment seeks to track the investment results of the MSCI China Index. The fund generally will invest at least 90% of its assets in the component securities of the underlying index and in investments that have economic characteristics that are substantially identical to the component securities of the underlying index.

The index is a free float-adjusted market capitalization-weighted index designed to measure the performance of equity securities in the top 85% in market capitalization of the Chinese equity securities markets, as represented by the H-shares and B-shares markets.

This fund has a Morningstar rating of 3 stars with an expense ratio of 0.59% which is around the average level.

The Top 5 holdings of this ETF are Alibaba at 20.3%, Tencent at 15.5%, Meituan at 4.7%, JD at 2.5%, and China Construction Bank at 2.3%.

Best China ETFs: Overall

Among the China ETFs which seek to invest in the largest China corporations, the highly-rated CXSE seems to be a good China ETF to consider, given its strongest YTD performance vs. similar ETFs that also look to invest in the largest China corporations (ex-state owned). Besides, it also has one of the lowest expense ratios at only 0.32%.

While KGRN looks like a good consideration, it is relatively small in terms of its net assets at only US$16m compared to CXSE with US$441m in net assets.

Other notable China ETFs for one’s consideration will include the Global X MSCI China Consumer Discretionary ETF (CHIQ) as well as KraneShares CSI China Internet ETF (KWEB), both of which ranks Top 3 in terms of YTD performance at 92% and 55% respectively. CHIQ is rated 4 stars while KWEB is rated 3 stars by Morningstar rating agency. They do however have relatively high expense ratios > 0.60%.

![Best China ETFs to buy [2021] 1](https://newacademyoffinance.com/wp-content/uploads/2020/11/stock-rover-2-6-1024x570.png)

Stock Rover

An All-in-one Fundamental Stock Screener that EVERY serious investors should have in their investing arsenal.

30% off Premium Plus membership for its Black Friday Sale

2020 vs. 2021 performances

2020

2021

![Best China ETFs to buy [2021] 2](https://newacademyoffinance.com/wp-content/uploads/2021/05/image-24.png)

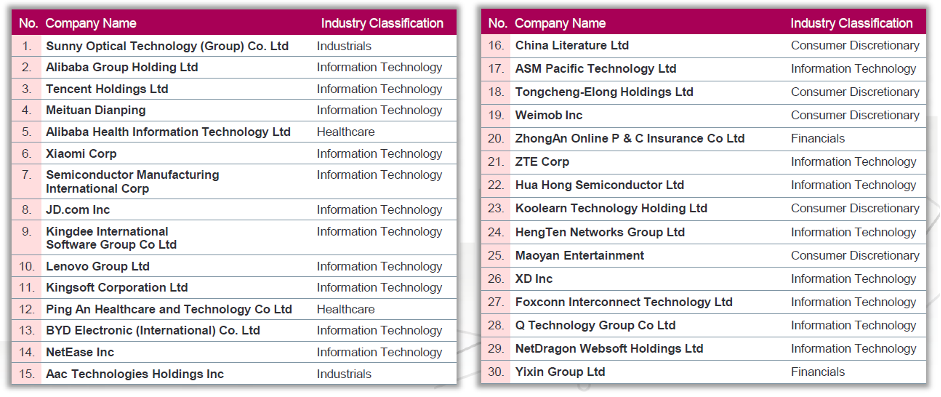

As can be seen from the table above, some of the best performing China ETFs in 2020 have substantially underperformed in 2021 due to the weakness seen in the large-cap tech counters such as Alibaba, Tencent, and Meituan of-late. KGRN, which was the best performing ETF in 2020 with a massive return of c.116.5% over 11 months in 2020, was the worst-performing China ETF in 2021, with a negative return of 9%.

The best performing China ETFs in 2021 thus far are those associated with Taiwan stocks, such as the Franklin FTSE Taiwan ETF (FLTW) and a similar ETF under iShares (EWT). Both these ETFs are also rated highly by Morningstar, with a below-average expense ratio of 0.19% and 0.59% respectively.

Despite the higher expense ratio, EWT has a longer track record vs. FLTW, where its 5-year return is a very decent 176%. The table shows the key stock composition of the EWT ETF.

![Best China ETFs to buy [2021] 3](https://newacademyoffinance.com/wp-content/uploads/2021/05/image-26.png)

I would provide my personal favorites among these list of ETFs in the conclusion. For those who are interested to find out more about investing in these China ETFs, you can check out the next segment.

How to invest in China ETFs

Step 1: Find a China ETF that is suitable for you

I have done the heavy lifting by selecting some of the best China ETFs for your consideration in this list.

I have taken into consideration their YTD performances, ratings by Morningstar as well as expense ratios.

These ETFs are all listed on the US exchanges. Hence if you have got a brokerage account that allows you to purchase US stocks, you can also buy these China ETFs.

Step 2: Analyze the ETF

One can further analyze the performances of the above ETFs using the Stock Rover platform. One should look beyond just the YTD performances but also look at the ETF 5-years historical track record.

Some of these funds focus on the total China market such as CXSE while others focus on particular sectors such as the consumer discretionary (CHIQ) or the tech sector (KWEB).

The expense ratio is the annual fee paid out of your investments in the fund, so the lower the expense ratio the better. The typical expense ratio is in the region of 0.6-0.7%. However, a careful study can also unravel gems such as CXSE which has an expense ratio that is half that of the average China ETFs’ fund expense ratio while yet being in the top quartile of fund performances.

Step 3: Buy the China ETF

You can purchase ETFs just like you buy a company stock. For both, you need a brokerage account to buy and sell shares.

You can check out my comprehensive list of stockbrokers here in Singapore (updated Nov 2020)

![Best China ETFs to buy [2021] 4](https://newacademyoffinance.com/wp-content/uploads/2020/11/tiger-brokers-4.jpg)

Tiger Broker

One of the new fintech brokers that is bringing low-cost commission trading in Singapore to a whole new level.

Trading in SG stocks is now at ZERO min commissions with US min commission at a very competitive US1.99/trade

Step 3(b): Getting an indirect exposure through a Robo-advisor

For those who do not wish to purchase these China ETFs directly through your brokerage firm, you might want to consider doing it through a Robo Advisor such as through Syfe. Syfe’s Equity100 portfolio and Core Portfolio now allow you to have exposure to China stocks through the KWEB and MCHI ETFs.

![Best China ETFs to buy [2021] 5](https://newacademyoffinance.com/wp-content/uploads/2021/05/syfe-5.png)

Syfe

Syfe’s Robo advisory platform now allows you to partake in the China market through their Equity100 and Core Portfolio.

Investors can select to invest passively and regularly into these portfolios to gain exposure into the China market

An alternative for Singaporean investors

For Singaporean investors who do not wish to purchase these US-domiciled China ETFs, one can look closer to home.

I previously wrote about the Hang Seng Tech Index in this article. A Singaporean investor can partake in the Tech Index by purchasing an ETF such as the CSOP HST Index ETF (3033 HK) which looks to track the performance of the Hang Seng Tech Index.

However, for Singapore investors looking to invest in the ETF, that will mean facing foreign currency risk since the ETF is traded in HK Dollar. This is in addition to the high expense ratio of 1.05% per annum.

Lion-OCBC Securities Hang Seng tech ETF

The good news is that Singapore investors are now given another option if they wish to buy into this Tech Index. This ETF is the recently launched Lion-OCBC Securities Hang Seng Tech ETF (Ticker HST for SGD denominated and ticker HSS for USD denominated)

Jointly launched by Lion Global and OCBC Securities, this will be the first ETF that will be invested exclusively in technological companies domiciled in China. Investors who choose to buy this ETF will essentially be investing in a diversified portfolio of the 30 largest China-domiciled technology stocks listed in Hong Kong via the SGX.

This ETF will be listed in both SGD as well as USD. For Singaporean investors who do not wish to have exposure to currency-related risk, he/she can select to invest in the SGD-denominated ETF (HST).

The expense ratio of 0.68% is also substantially lower than that of 3033HK.

Other benefits of buying the SGX-listed ETF

Besides the elimination of foreign currency risk as well as lower expense ratio, the other benefits of purchasing this ETF listed here in SG is that the ETF is traded in board lot size of 10 units which makes the minimum investment a lot lower as well as the fact that these ETFs can be purchased without a custodian account (kept in your CDP) and hence there will not be any custodian fees.

Another benefit is that the ETF can also be purchased using your SRS account.

For those who are interested to find out more about the Lion-OCBC Securities Hang Seng tech ETF, you can read up more from this website.

Conclusion

I have highlighted some of the Best China ETFs to consider buying for the long term. Some of these ETFs have performed well in 2020 but have disappointed in 2021. However, do look at their longer-term track record to ensure that these ETFs are not your “one-trick pony”.

My personal favorite among this list of China ETFs are as follows:

EWT: Taiwan exposure with key holdings in stocks such as TSMC which is a major beneficiary of the current global chip shortage. Many of these Taiwan companies are also major chip manufacturers and designers and are leverage to the development of key themes such as 5G and IoT etc. The EWT ETF is suitable for those looking at stability vs. some of the more volatile China ETFs in this list.

CXSE: While its YTD performance (flat) has been lackluster, this has been achieved on the back of a massive sell-off in many of the China tech companies. The outperformance so far in 2021 vs. some of its peers is due to the counter’s massive stake in Alibaba, with a combined portfolio composition of >22% across both Alibaba’s US and HK-listed entities. If you believe that Alibaba is primed for a rebound after a good 5 months of underperformance, then this 5-star Morningstar-rated ETF might be a good selection for you.

KWEB: While its YTD performance might have been a disappointing -3.2%, this might be the pure-play ETF if you believe in the rebound of the China-tech industry as most of its holdings are China-tech stocks.

Special mention: For Singaporeans who wish to subscribe to a basket of China-tech plays, the Lion-OCBC Securities hang Seng tech ETF (HST) might also be a convenient alternative for you to do so.

All this information can be easily sieved using the Stock Rover platform.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update 2021]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.

9 thoughts on “Best China ETFs to buy [2021]”

HST is not SGD-hedged, so will also have currency risk for a Singapore investor.

But currency risk is a smaller part of the equation. More important is the prospects of the underlying companies/assets.

The iShares version (3067) listed on HKEx is cheaper though (lower expense ratio), and probably more liquid (narrower bid-ask spread, lower frictional costs). Let’s see how liquid HST will be.

Hi Sinkie, thanks for dropping by again. Once again, all very useful information. To me actually currency risk can be a substantial downer, such as how USD weakness might persist which will drag the HKD along with it.

For a Singaporean investing into the underlying companies of the China tech index, the main FX concern is CNY/SGD, seeing as most of their earnings are from the mainland.

Even if priced in SGD, if CNY depreciates then the price in SGD will drop.

If HKD depreciates due to USD depreciation, then the etf units priced in HKD will rise, all things being equal.

Forex due to the listing price is not such a big deal. What’s important is the forex due to the main underlying earnings. In this case it’s CNY.

Noted on your point. I agree that earnings translation risk is something that is not evident but yet should also be taken into consideration. But again this is the same with investing in all foreign companies where their earnings are not in SGD. Will there be a substantial CNY depreciation vs. SGD…. I don’t see why that might be the case.

On the other hand, since the HKD is currently still pegged to the USD and USD has been weakening (more ahead with printing press going brrr), one buying the HKD listed and denominated ETF will face that immediate and more evident risk

Hi Sinkie,

You might also want to note that iShares 3067 / 9067 can use a swap-based replication methodology (ie. potentially synthetic ETF). This makes it potentially riskier than the other 3 HKSE-listed HSTECH ETFs and the upcoming LGI HSTECH ETF, as the others all follow a full-physical replication methodology.

– – –

Hi RT,

Thanks for your article.

Cheers

thanks for the add goondu. my pleasure

I was reading the prospectus for the 3067. The replication method is representative sampling – isn’t that one of the method of physical replication ?

Hi, so glad that I found this complete comparison on the China ETF. I have been searching all over to find a good China ETF to invest in. After reading your article, I am still unable to decide after a few research. Appreciate if anyone can help.

I am planning to hold this China ETF for long term. what exactly do I need to look out for really? I really believe in China to be the next superpower dominant economy in the next 5-10years. do I select specifically on Tech/Consumer discretionary related OR China in overall such as MCHI / CXSE?

I mean consideration on in terms of the underlying company/sector/industry.. having difficulty to pick one. not sure if anyone can assist to narrow down my option again. thanks and appreciate in advance.

Hi Kelvin,

I think it might be more appropriate to start off with an ETF which gives you general exposure to the China market… However, having said that, the largest companies in China are also the Tech related ones. However, you do get a little diversification from insurance and bank holdings as well etc. i Personally like the consumer discretionary exposure.