Table of Contents

Bear Market Bounce at the Start of 2023?

2022 has been a rather forgettable year when it comes to the stock market and investors are hoping that 2023 will usher in the start of a new bull market.

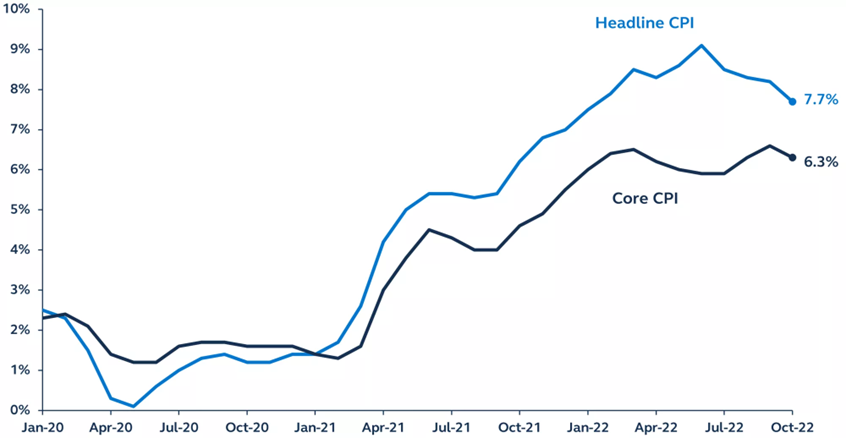

So far so good, with the stock market starting 2023 on a positive note (I won’t term it as a bang) as recently announced data might imply that the worst of our inflation fears are finally behind us.

All eyes will be on this coming Thursday’s CPI figures.

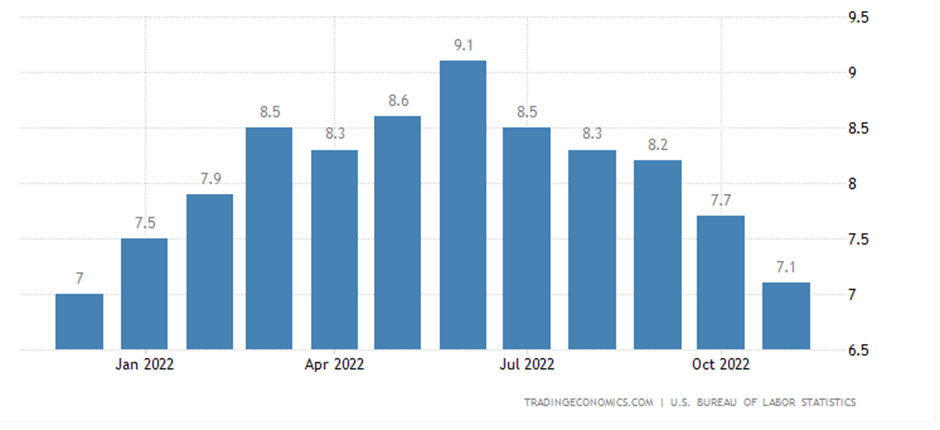

However, there are reasons to believe that the market rally, where the S&P500 recovered from a recent low of 3,491 to its current level of 3,892, is just a bear market bounce, and not a prelude to a sustained bull market. I will state 4 reasons why we might still be in a midst of a bear market bounce, which started in Oct 2022, largely due to a better-than-expected October Inflation/CPI number.

This is followed by an even lower CPI growth figure in November, coming in at 7.1% YoY.

This gave the market the impression that inflation is within the Fed’s control, and they will start to taper down the rise in interest rates in 2023, possibly even initiating the first interest rate cut this year.

That is bullish for the stock market, right? Is the bear market over? Should I start buying stocks now hands over fist?

Valid questions that are swirling in the minds of investors.

Personally, I think we are still caught in a bear market bounce. While inflation and interest rates (projected) may have peaked, they are still at pretty much “sky-high” levels that remain a cause for concern, both to the stock market and the broader economy.

In this article, I will share four reasons why I think this bear market bounce is not a reason to get overly optimistic and how you can prepare yourself and your portfolio for a possible market sell-off in the coming weeks/months.

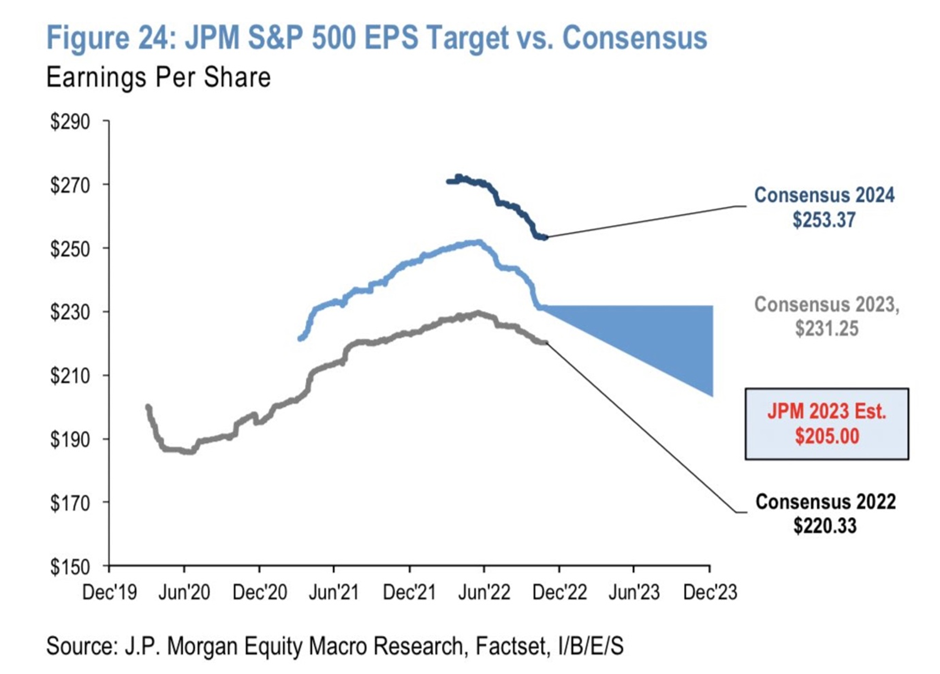

Reason 1: Decline in earnings

Market analysts have recently started to downgrade the earnings of companies for 2023 onwards. This is due to multiple factors such as high inflation resulting in higher costs/lower margins for companies, reduction in consumer spending power, and a higher interest rate environment for a longer period of time, etc.

Lower corporate earnings typically result in lower stock prices (unless there is an expansion in valuation multiples).

Applying an average multiple (17x forward earnings) on 2023 SPX earnings ($205), I get a rough value of 3485 which is ~$348.5 in SPY.

While this -11% decline in estimated earnings (2023) is in the right direction, this might prove overly optimistic as previous recessions usually result in 20-25% decline in earnings.

If so, this would put the fair value of the SPY at ~$314.50 (based on the same forward valuation multiple of 17x), which represents a further ~19% decline from the current level.

Might this recession be any different?

Reason 2: Increase in consumer debt + decline in savings

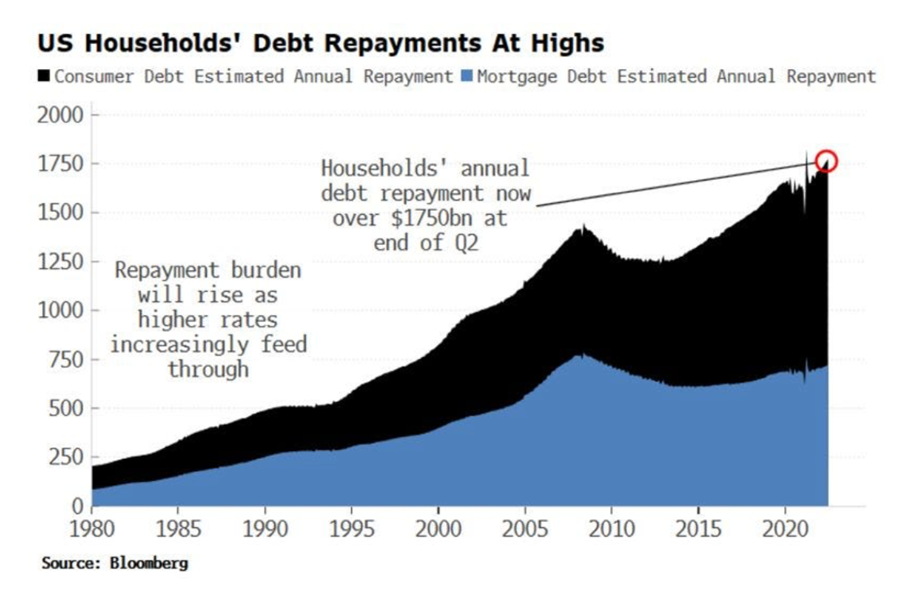

Consumers have continued spending vast sums of money even during this period of high inflation due to excess wealth/savings built up during Covid and borrowing (incurring credit card debt) to fund their purchases.

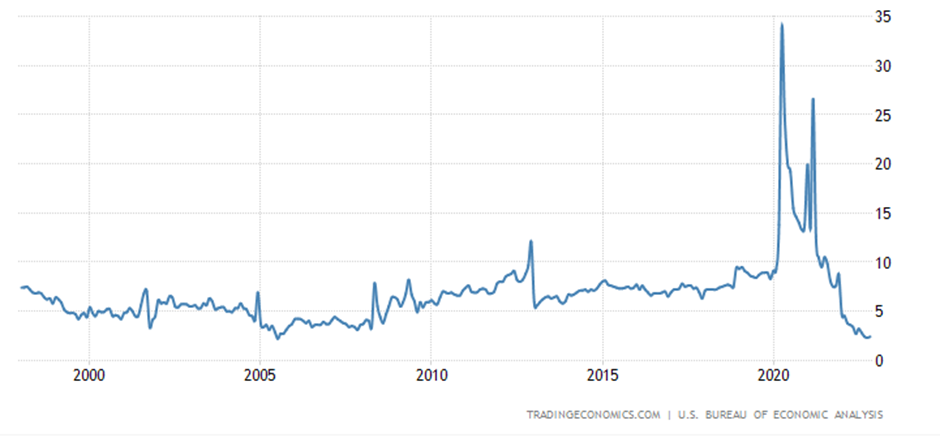

However, this purchasing power is extremely likely to weaken in the near future due to a severe drawdown in savings (thanks inflation) where it is at the lowest point since 2008 (see diagram above) and the excessive indulgence in borrowing (which is almost back to pre-COVID high).

Plus, the fact that these borrowings are getting increasingly expensive and “Houston, we might have a problem!”

Weaker consumer spending leads to lower revenues and profits for companies which ultimately results in lower stock prices.

Reason 3: Unemployment is starting to increase

While some job reports have shown a very strong labor market, unemployment is a lagging indicator of the health of the economy. The stock market bottoms long before unemployment peaks.

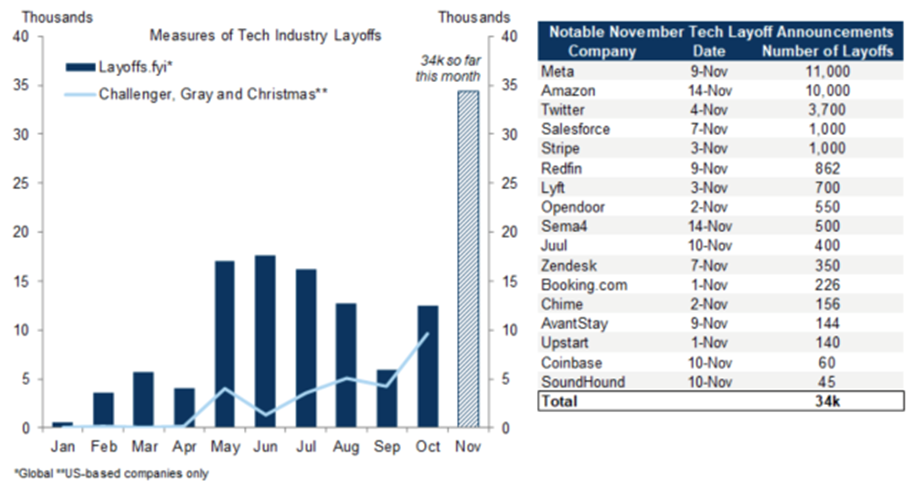

Unfortunately, unemployment is starting to increase, evident from the huge layoffs starting in the tech industry.

Even huge companies such as Microsoft, Nvidia, Netflix, and Apple have paused hiring or started to trim their workforce. This figure would get worse in 2023.

While the labor market in the US is holding up, the quality of jobs available has declined, with well-paying industries such as technology, finance, and manufacturing firms laying off workers, while lower-paying industries like leisure and hospitality continue to add jobs.

Any sign of a rising unemployment rate could be the next trigger point for a sell-off.

Reason 4: Persistent Inverted Yield Curve

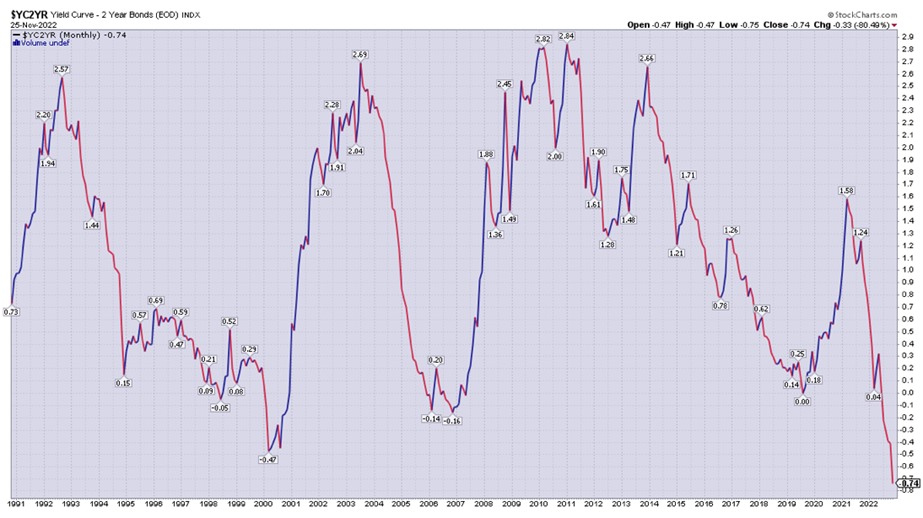

Normal yield curves (short-term interest rates being lower than longer-term ones) are normal in a healthy economy. This indicates economic growth.

However, when yield curves invert (short-term interest rates higher than longer-term ones), it means investors are not confident in the future health and prospects of the economy.

This is what is happening now.

When yield curves such as the 2-year and 10-year bonds stay inverted for a persistent amount of time, a recession in the next 6-18 months is virtually guaranteed. This is especially so if other yield curves (3 months and 30 years) invert as well.

As seen in the above picture, when the 2–10-year curve inverts (<0) for a period, the economy always enters a recession.

This coincides with the multiple bear markets of the past 20 years: 2000-2002, 2008-2009, 2020). Given the severity of the current inversion (-0.74) lasting for 100+ days, I am not particularly optimistic that the US economy will be able to skirt a recession and achieve the ideal “soft landing” scenario.

Given my seemingly bearish outlook, you might think: Should I just sell everything and hold cash? Is Cash King right now?

Well, it is always smart to have a cash buffer, ready for deployment. However, the problem for most investors is that after going into cash, they will NOT deploy their excess capital when there is “blood everywhere in the street”

They will hold on to their capital until AFTER the market rebounds strongly and lament that they have “missed the boat”.

Another problem with holding cash unique to the current environment is the high inflation situation we are currently facing.

As inflation is still at decade highs (7+%), you would lose purchasing power by staying in cash.

So, what should one do instead?

Time to Explore High-Quality Companies

Now is THE time to slowly accumulate selected individual high-quality companies that are now ON DISCOUNT, a situation that only happens once in a blue moon, when the bear takes control.

Buying these inflation-resistant companies will also preserve your purchasing power and substantially increase your wealth, helping you take a step closer to achieving your coveted financial independence when the bull market eventually returns.

What is a high-quality company? Simply put, we want to purchase companies that sell essential products and services that have shown to be able to be resilient enough to survive past recessions/bear markets and come out even stronger afterward.

Example of a High-Quality Company

An example of a high-quality company is United Health Group (UNH). UNH is one of the biggest players in the healthcare industry in the US. It helps people live healthier lives and make the health system work better via two business segments: Optum and UnitedHealthcare.

Optum delivers care aided by technology and data to allow people, partners, and providers the appropriate tools to achieve better health.

UnitedHealthcare offers health benefits such as affordable healthcare coverage, simplifying the healthcare experience, and delivering access to high-quality medical care.

As a company that provides mission-critical services (Health care), UNH is likely to weather the upcoming recession relatively better than other companies. People are not simply going to stop paying for healthcare no matter the economic circumstances.

Other than its proven ability to survive recessions and thrive afterward, UNH has certain key traits that allow it to far outperform the returns of simply passively investing in SPY.

Does this mean you should go out and buy UNH right now at current prices?

Maybe, maybe not. After all, valuation and timing (entry and exit timings) play a huge role in earning superior returns. If you entered UNH at the wrong time and it suffers a huge drawdown (say -30+%) due to market conditions, would you have the fortitude to continue buying this high-quality company and reap the subsequent returns?

For those who are interested to learn a simple method to find these high-quality winning stocks with a good track record of consistently outperforming the market + knowing the RIGHT time to enter these stocks, do check out the link below:

Through this course, you will also learn how to better time your entries and exits to further improve your returns. This is NOT just going to be a simple “identify good companies and adopt a Buy and Hold approach”.

Engage in some hedging

Personally, I would continue accumulating high-quality companies even if we do get a further selloff in stocks (as I foresee in 2023). However, to complement this strategy, I would also look to add some protection to my portfolio by hedging (a more advanced strategy).

I would be adding shares of “SH” to my portfolio. SH is an inverse ETF of SPY; if SPY goes down -1%, SH goes up 1%. The correlation is usually 1:1. This can be helpful to make some money while the market goes down.

However, do be aware that inverse ETFs carry their own risks: higher expense ratio, volatility, and smaller assets under management. This might cause a slight difference in the 1:1 correlation as seen below.

As such, this might not be suitable for everyone. This is not a recommendation to purchase SH but rather what I plan to do personally.

Conclusion:

In conclusion, while the recent bear market bounce in stocks is nice, don’t take it for granted that we have seen the last of the bears.

I do not believe we have reached an ultimate bottom due to the following 4 reasons: 1) decline in earnings, 2) high consumer debt and low savings (lower consumer spending), 3) unemployment rising, and 4) persistent yield curve inversion.

Instead of staying out of the market, this is a good opportunity to slowly buy into high-quality companies (which are now trading at a discount) to preserve your purchasing power and outperform the market when the market turns into a true bull market. An example provided is UNH.

Finally, I have also shared how I plan to hedge my portfolio (buying SH) while slowly buying into high-quality companies like UNH.

Check out my FREE 3-Parts Video on How to engage in High-Quality Investing to secure your Financial Freedom Early by clicking on the diagram below.

If you are also interested in learning a simple 5 steps process to acquire the RIGHT companies (high-quality blue-chip companies) at the RIGHT time, then do also check out the simple solution that I have for you by clicking on the button below.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- GUIDE TO SYFE AND HOW TO OPEN AN ACCOUNT IN LESS THAN 10 MINUTES

- SYFE GUIDE: DID SYFE’S ARI ALGORITHM OUTPERFORM IN TODAY’S MARKET VOLATILITY?

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only