A good opportunity or a structural trap?

Arista Network’s stock plunged by c.24% after it announced its 3Q19 results. We took the opportunity to enter a small position in the counter. The counter has been on our radar since it was first recommended by Motley Fools US back in Sep 2017. We detailed why we are small buyers in the stock below.

Despite being on our radar for a while, there has not been an opportune time to take a stake in this technology innovator that has been steadily taking market share away from the 800-pound gorilla in the room by the name of Cisco Systems due to its cloud-native architecture. Other key competitors include Juniper Networks and Extreme Networks.

For those who are unfamiliar with Arista Network, the company is a manufacturer of networking hardware, one that designs and sells multilayer network switches for large data centres and cloud computing companies (think Microsoft and Facebook).

Horrendous forward guidance

After reporting 3Q19 that beat the market’s estimates, the company threw a bombshell when it guided extremely weak 4Q19E revenue of USD$540-560m which is down 8% YoY vs. 4Q18 revenue of USD$595m. This is the first time that the company announced a quarterly YoY decline in revenue, with potential for more revenue weakness into 2020. Stock plunged 24%!

Key reason for revenue weakness was that Arista warned of a spending pause in one of its largest customers, widely believed to be Facebook. Arista noted that the company has risen to more than 10% of Arista’s overall revenues.

Here’s what CEO Jayshree Ullal had to say on the spending pause:

“I would like to offer some further color on Q4 2019 guidance, given our significant drop. After we experience the pause of a specific cloud titan’s orders in Q2 2019, we were expecting a recovery in second half 2019 for cloud titan spend. In fact, Q3 2019 is a good evidence of that. However, we were recently informed of a shift in procurement strategy with a material reduction in demand from a second cloud titan, reducing their forecasts dramatically from original projections for both Q4 2019 and for calendar 2020.

Naturally, this type of volatility brings a sudden and severe impact to our Q4 guidance. Given this tepid forecast and volatility of this cloud segment, we believe the cloud titan forecast should be modelled as flat to down in calendar 2020.

I do want to take an opportunity to reiterate that our market share for both 100-gig and overall high-performance switching remains solid and strong. We are proud of our strength in the enterprise and financial segment with growing success in our very first quarter of shipping Cognitive Campus portfolio products, which is now on track for $100 million in the first full year of shipments.”

Is the weakness going to be a one-off issue?

One of the key risks of Arista has been that the company is highly dependant on a few customers, predominantly Microsoft and now Facebook, both in totality accounting for more than 30% of the company’s revenue. A significant spending decline by either Microsoft (which happened in 1Q19) or Facebook will naturally have a large impact on Arista’s top-line.

However, it is also useful to note that Arista’s products are not discretionary purchases. A company like Facebook might defer capital expenses due to short-term business growth concerns (such as impact from US-China trade war). But as long as Facebook’s data continues to grow, so will its need for networking software.

Hence, we will like to lean to the “notion” that this weakness seen by Arista is temporary. Management highlighted that the loss of revenue was not due to market share loss, but due to lower product demand for that particular client based on the latter’s view of their forward business requirement.

It may take several quarters or even years for Facebook to resume normal spending levels. This has prompted the street to drastically cut their earnings forecast for the company and downgraded the counter from a Positive call to a generally Neutral one.

Personally, I see no red flags at the moment to be worried about a structural change in Arista’s product demand that warrant long-term concerns. While 2020 will be viewed as a transition year, we believe that most of the bearishness has already been priced into the counter at its current stock price.

Key financials

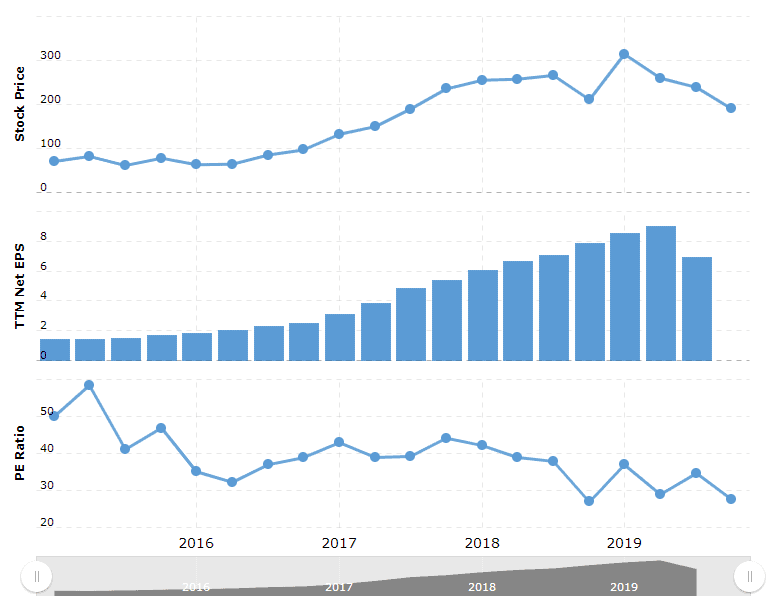

Prior to this forward guidance hiccup, the company has been a very consistent grower of both top and bottom-line. Particularly impressive has been the fact that operating margin has been on a consistent uptrend as the company benefitted from operating leverage.

This is one of the key metrics that we like to see, a consistent growth in operating margins profile which highlight a certain level of operational moat in its business.

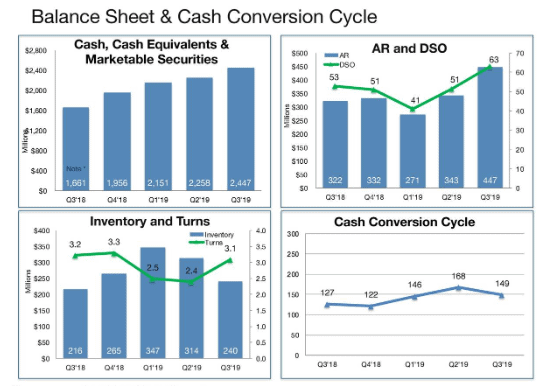

The company also spots a very health cash balance with minimal debt in its balance sheet, which goes to demonstrate its credit strength.

Valuation

The counter is now trading at a forward 2020 PER multiple of 24x based on consensus estimate that the share will be generating USD7.76/share in earnings for 2020, down from USD8.54/share seen in 2019. This compares favourably against the 40x average PER multiple that the counter has been trading at over the past 4 years.

While still early days, expectations are for earnings to rebound relatively strongly in 2021 to USD8.84/share.

Why we are small buyers of Arista

We decide to take a small position in Arista Network. Below are our key reasons for doing so:

- We view the decline in revenue forecast for 4Q19 and 2020 as a temporary hiccup and not a structural decline in product demand. Large cloud titans like Microsoft and Facebook will eventually need to ramp up their capex to meet the underlying growth in data and users.

- The company remains a market leader in its field, with no apparent loss of market share, according to management (we will give them the benefit of the doubt at present)

- Valuations are now more palatable at 24x 2020E PER and 21x 2021E PER vs. historical average of 40x.

- We continue to like PROFITABLE companies with exposure to cloud networking

Key risks:

- Loss in demand turns structural. This could happen if cloud titans decide to develop their own networking hardware. While the possibility is low, if such a scenario is to materialise, it will have an extremely detrimental impact on Arista’s business model

- Loss in demand not confined to just one client. Management believes that the loss in demand for 4Q19/2020 is pertaining to just a single major client. However, if demand weakness spreads beyond a single client, that will be a major risk that will portend further loss in revenue.

- Reliance on two major clients. Arista’s product demand remain heavily dependant on product demand from Microsoft and Facebook. While macro fundamentals remain strong, the over-reliance on these two cloud behemoths could result in elevated price volatility

Conclusion

We see Arista’s share price weakness post its 3Q19 results as a potential buying opportunity but not an extremely convincing one, hence we are only restricting ourselves to a small stake, approx. 2% of our allocated US portfolio (size of USD100k for a start).

We are prepared to be long-term holders of the stock as we like the company’s business model and market leading position. However, we will also to re-evaluate the company based on future earnings performance and its strategy to mitigate revenue volatility.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our whatsapp broadcast: txt hello to https://api.whatsapp.com/send?phone=6587407951&text=&source=&data=

SEE OUR OTHER STOCKS WRITE-UP

- SINGAPORE AIRLINES 2QFY20 PREVIEW. HERE IS WHAT TO EXPECT.

- RIVERSTONE 3Q19 PREVIEW: POTENTIAL TO SURPRISE?

- SHENG SIONG 3Q19. 4 KEY AREAS TO LOOK OUT.

- VALUEMAX: A RECESSION PROOF BUSINESS BUT WE SEE 1 MAJOR RISK

- 10 “MUST-HAVE” STOCKS FAVORED BY MOTLEY FOOLS US

- HOW TO PLAY THE PARTIAL OFFER FOR KEPPEL?

Disclosure: The accuracy of material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.