Investor Education Series: Stock market bubble

According to famed value investor, Jeremy Grantham of GMO fund, the long long bull market since 2009 has finally matured into a full-fledged epic bubble, one in which he believes this particular bubble, when it finally burst, will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929 and the Tech bubble of 2000.

These great bubbles are where fortunes are made and lost – and where investors truly prove their mettle.

So are we in a bubble that is about to be pricked?

Are we waiting for the last dance?

In his article: Waiting for the Last Dance, Mr Grantham believes that it is highly probably that we are in a major bubble event in the US market, the type that typically occurs once every several decades, with the last one being the tech bubble which started in late -1990.

While he currently making a bear market call, Mr Grantham admitted that it is almost impossible to call a top in the market.

“The market can stay irrational longer than the investor can stay solvent”

Maynard Keynes

His fund GMO has typically been early in calling a market top. Back in the late 1980s, GMO got entirely out of Japan when the index was over 40% of the EAFE benchmark and selling at over 40x earnings vs. a previous high of 25x. The Japanese market continued to stay “irrational” for the next 3 years, appreciating to 65x earnings before capitulating. In these 3-years, GMO substantially underperformed the Japanese market.

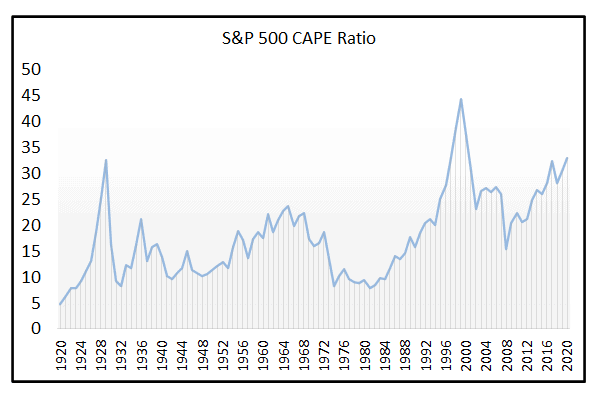

In late 1997, GMO sold down their discretionary US equity positions, then watched in horror as the market appreciated from the then “pricey” 21x earnings to an unheard-of 35x earnings (we are currently at 38x). As a result of their underperformance, they lost half of their asset under management but in the ensuing decline, they much more than made up their losses.

So where exactly are we in the current market cycle? Is GMO getting their timing right this time round?

5 Stages of a Bubble

According to Economist Hyman P.Minsky, he identified five stages in a typical market cycle. These stages also outline the basic pattern of a bubble.

Stage 1: Displacement

In Stage 1, a displacement occurs when investors get enamored by a new paradigm such as a new technology.

Stage 2: Boom

Prices rise slowly at first but then gain momentum as more and more participants enter the market, setting the stage for the boom phase

Stage 3: Euphoria

During this phase, caution is thrown to the wind as asset prices sky rocket. Valuations reach extreme levels during this phase.

Stage 4: Profit-taking

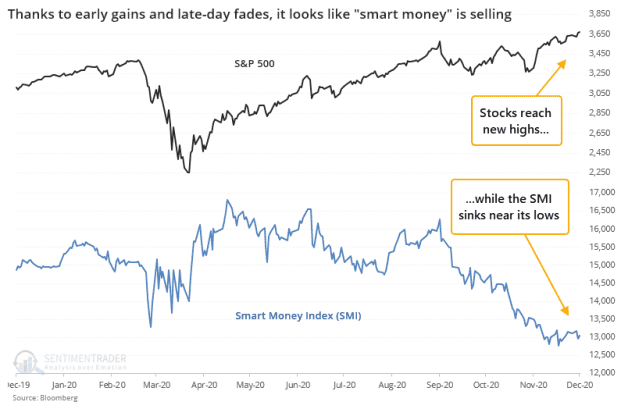

The smart money starts selling positions and taking profits. But this is also the trickiest part where estimating the exact time when a bubble is due to collapse can be a difficult exercise.

Stage 5: Panic

Once a bubble is pricked, the bubble cannot inflate again. In the panic stage, asset prices reverse course and descend as rapidly as they had ascended.

Why now might be the time the bubble finally burst?

According to Grantham, the single most dependable feature of the late stages of great bubbles of history has been crazy investor behavior, buying at any price, especially on the part of individuals. Smart investors on the other hand are looking to pare down their stakes. This seems to be what is happening at the moment (Stage 4)

For the first 10 years of the bull market starting from 2010, we lack such wild speculation. While the market has generally been up-trending in the past decade, huge volatility in stock prices weren’t a common sign.

But now we have it in record amounts. Look at stocks like Kodak, Nikola, Tesla. Stocks that have been wildly speculated, not by the “savvy” institutional investors, but by the retail masses as they FOMO (fear of missing out).

The “Buffett indicator” which measures the total stock market capitalization to GDP, broke through its all-time-high 2000 record. Based on the current level of approx 180+%, the implied market return using the standard Buffett Indicator is -2.3%/annum over the next 8-years, assuming a reversion to the 20-year mean market valuation level.

A new modified Buffett Indicator, according to GuruFocus, which takes into account the Fed’s expansionary monetary policy, will result in a value of 135.6%, which still indicates an over-valuation of the stock market, but the implied market return improves to -0.5%/annum based on a reversion to the 20-year mean market level.

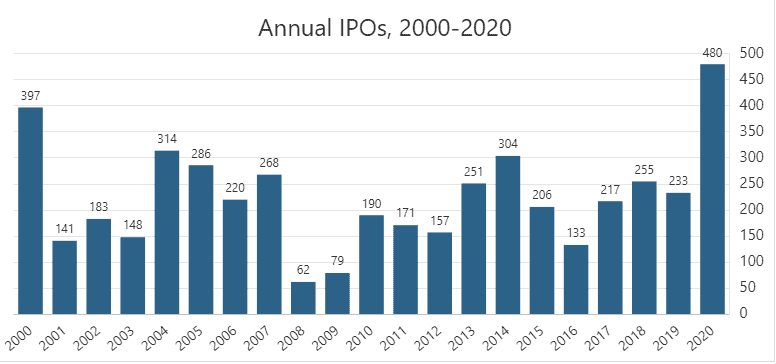

Besides the Buffett Indicator “flashing red”, the “gold rush” into IPOs is also probably a warning sign that should not be ignored.

In 2020, there were a record 480 IPOs (including 248 SPACs) – more new listings than the 406 IPOs in 2000.

Additional Reading: How to invest in SPAC (SPECIAL PURPOSE ACQUISITION COMPANIES) like a Venture Capitalist

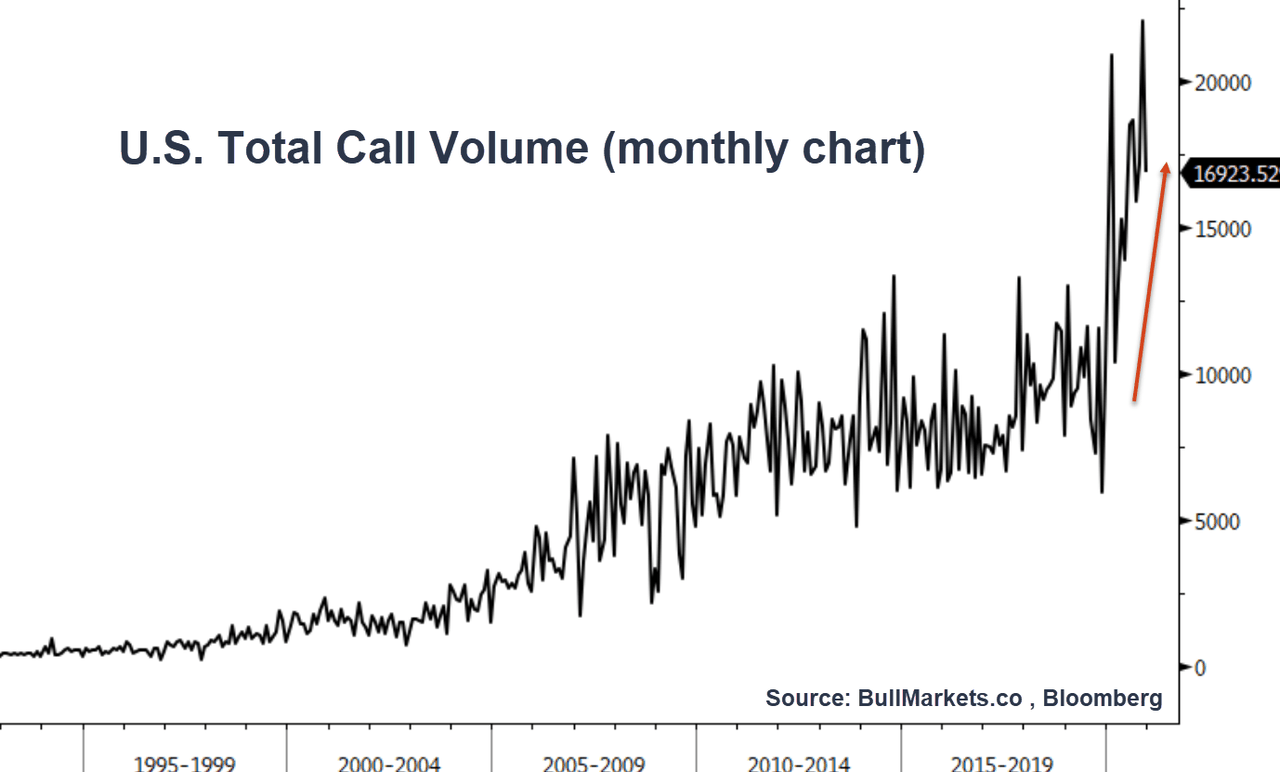

The volume of small retail OPTION purchases, of less than 10 contracts, of call options on US equities, has increased 8-fold compared to 2019, with 2019 already well above the long-run average.

Robert Shiller, a Nobel Laureate and long-time bear, makes the point that his legendary CAPE asset pricing indicator shows less impressive overvaluation when compared to bonds.

This is exactly what you should be expecting from a late-stage bubble: an accelerating, nearly vertical stage of unknowable length. This stage at the end of a bubble is shockingly painful and full of career risk for bears.

The one key exception

Previous bubbles have combined accommodative monetary conditions with economic conditions that are perceived at that time as near perfect for the bull-run to continue.

That of course did not happen, on hindsight.

This time around, the global economy has only partly recovered, possibly facing a double-dip, probably facing a slowdown, and certainly facing a high degree of uncertainty. Yet amid such economic uncertainty, the market is at a record level, higher than pre-COVID-19 levels when the economy looked fine and unemployment was at a historic low.

Today, the P/E ratio of the market is in the top few percent of the historical average range and the economy is in the worst few percent. This is completely without precedent.

More so than ever, investors are relying on accommodative monetary conditions and zero real rates continuing indefinitely. Is that realistic? Can we be permanently in a scenario with perfect economic conditions and perfect financial conditions?

Some believe that in a world of extremely accommodative monetary stance and zero interest rate, asset prices can be kept high forever. Who is to stop the Fed from printing more money and dishing out thousands of dollars to the man-in-the-street as stimulus measures? Who is to stop the Fed from keeping interest rates artificially low at zero % indefinitely, spurring demand for housing due to low mortgage payments?

Mr Grantham believes that this fallacy of artificially low rates and non-step money printing cannot be permanently sustained and it will ultimately lead to a full-blown decline in prices. In his words, we are “waiting for the last dance, and eventually for the music to stop“.

Is now the time to stay out of the market?

Mr. Grantham, as bearish as he is on the stock market outlook, believes that this market can soar upwards for a few more weeks or even months. While it is entitled to break any day, having checked all the boxes of an epic bubble, but could still soar upwards for a few months longer or perhaps a few years longer (if GMO’s historical track record of being 2-3 years early in calling a market top remains valid).

His best guess is that when the COVID-19 vaccine is rolled out en-masse, that is when market participants will finally come to the realization that the economy will continue to remain in poor shape for a sufficiently long period of time, that stimulus will end and that valuations are absurd.

“Buy the rumor, sell the news” will be the mantra of the day at that point.

Nonetheless, he concurs that timing the bursting of bubbles has a long history of disappointment.

The great bull markets typically turn down when the market conditions are very favorable and that is why they are always missed.

So yes, while valuations look extremely demanding at present, it is not YET a clear indicator to stay out of the market.

It is only when things are finally turning up should we be really fearful of complacency setting in and for the unexpected to happen: the BEAR finally appearing.

Personally, I will be on the look-out for a recovery in economic demand driving core asset prices higher, particularly in areas such as Food and Housing. That could stoke inflationary fears, a topic which I have written on numerous occasions such as in this article: Inflation: Don’t ignore this silent retirement killer

I still believe that INFLATION, while seemingly benign at the moment, will be the key “unexpected” catalyst that result in a drastic turn of event for the stock market (if it has not already turn by then)

With higher inflationary pressure, it will be hard to justify a persistently accommodative stance by the Fed and if interest-rates are forced to rise “pre-maturely”, that could trigger a massive sell-off in both the stock as well as the bond market.

The only safe haven then might be GOLD or its digital alternative, Bitcoin.

What to do now?

Today’s market features extreme disparities in value by asset class, sector and company. Those at the very cheap end include traditional value stocks all over the world, relative to growth stocks.

Compared to Growth stocks, Value stocks have had their worst-ever relative decade ending Dec-2019, followed by the worst-ever relative year in 2020.

Concurrently, compared to US stocks, Emerging market equities are at the lower-band vs. their US counterparts.

GMO believes it is in the overlap of these two ideas, Value and Emerging, that one bets should be placed on.

Evaluating on what are the emerging + value stocks to purchase will be an article for another day.

Conclusion

Everyone looks to be an investing genius in a bull market but it is really during a bear market where the tide recedes will we know who is actually “swimming naked”.

If making money was this easy, everyone will be generating boatloads of profits from their portfolio every year. And if getting rich was that easy, wouldn’t everyone in the world becomes a millionaire already?

Common sense would dictate that reality doesn’t often gel with fantasy.

While the market might continue to be irrational over the coming months, don’t bet on it generating 2020-type returns in 2021.

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time which might not be covered here in this website.

Join our Telegram broadcast: https://t.me/gemcomm

SEE OUR OTHER WRITE-UPS

- Motley Fool review: Getting multi-bagger ideas the easy way

- Hang Seng Tech Index: A deep dive into the hottest tech stocks of Asia

- Best Stock Brokerage in Singapore [Update November 2020]

- Syfe Equity100 review: Does this portfolio make sense to you?

- Tiger Brokers review: Possibly the cheapest brokerage in town. Is it right for you?

- FSMOne Singapore: Step-by-step guide to open your FSMOne account and start trading

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only.