Master the market cycle to supercharge your returns

There is a famous saying that goes: “It is futile to time the market. It is time in the market that matters.” Or perhaps you have heard the saying: “The only thing that matters in long-term investing is the company’s fundamentals.”

However, while you might not be able to catch the absolute top and bottom, you can know when it is the time to go aggressive or stay defensive in the market if you can identify the correct stage.

In this article, I will share with you the 4 stages of a market cycle, how to identify them, and how to time the market to a certain extent.

Why are there Market Cycles

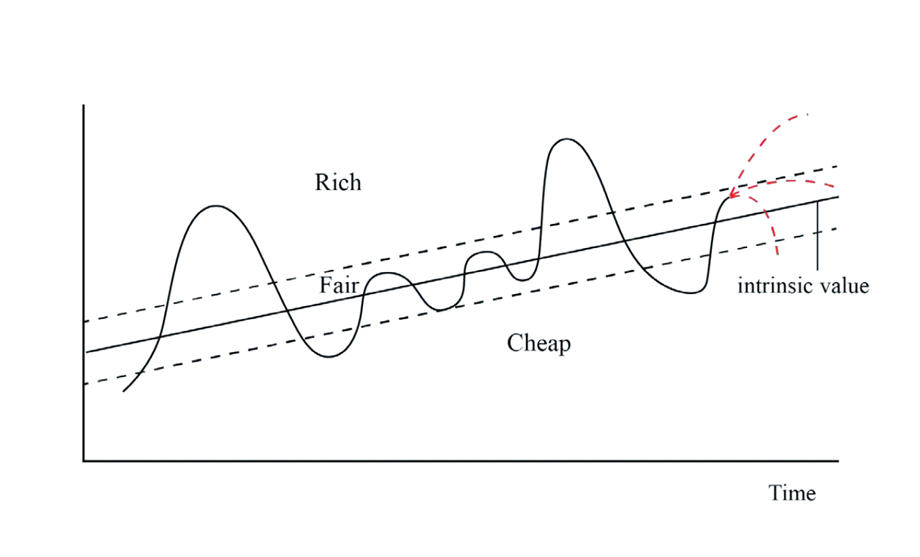

It is generally accepted that the S&P 500 appreciates at an average of 10% a year. However, looking back in history, it is rare that the index goes up by 10% in a year. The market tends to overshoot on both the upside and the downside due to greed and fear. Hence, it is common to see the market being up >15+% for many years while it returns >-33+% for an average bear market. Thus forming those market cycles in the stock market that we call today.

It can feel like a rollercoaster as you experience the highs and lows of the cycle but if you buy the right companies and do nothing, you will compound your wealth over the years.

4 Stages of a Market Cycle

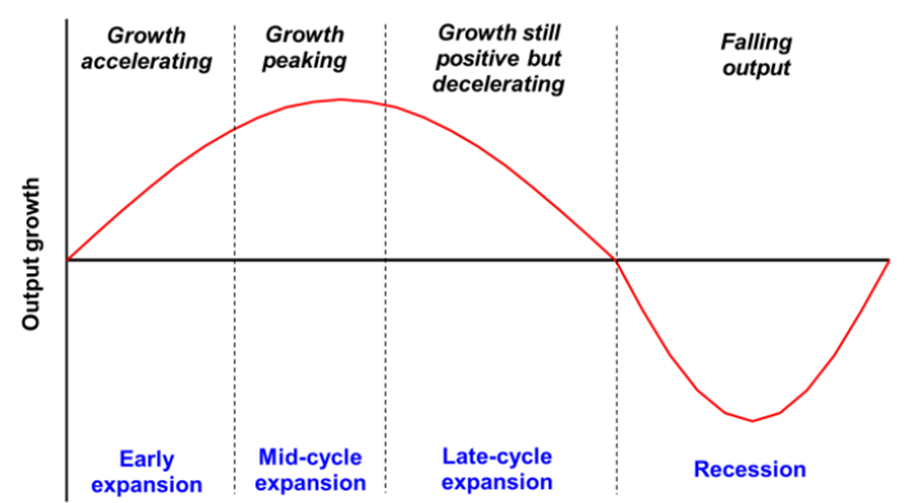

In general, there are 4 main stages of the market cycle. Depending on the stage, different stocks will do better than the rest. The reason is that this market cycle follows the business cycle (albeit 6-9 months ahead as stocks discount the future).

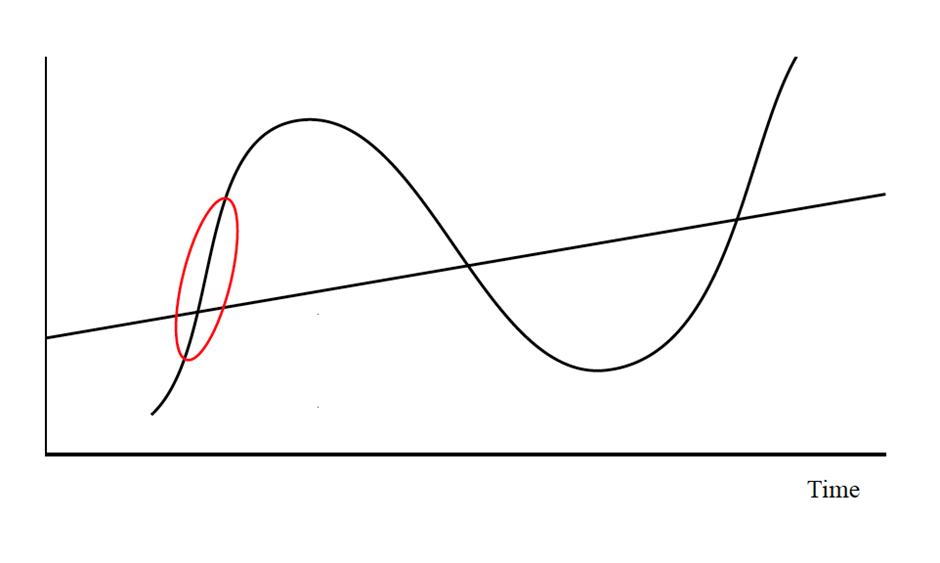

Early Expansion (Rebound):

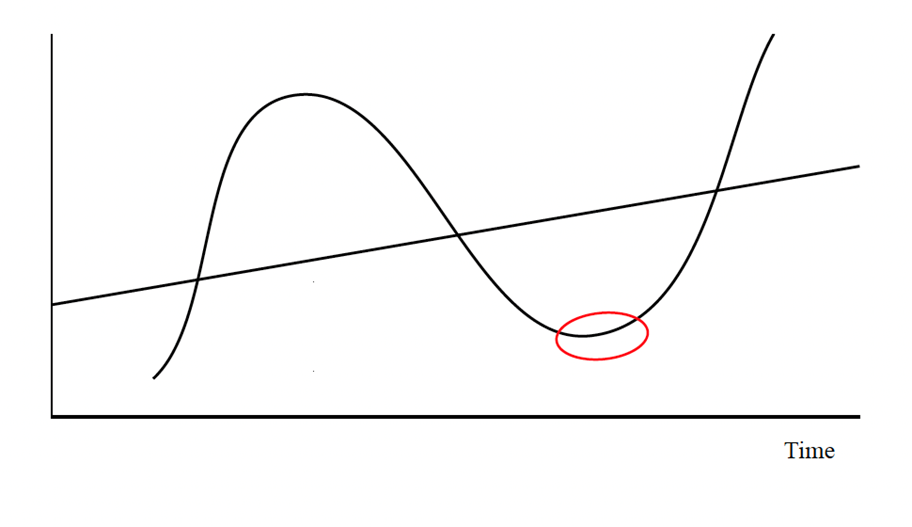

This is when the worst of the recession has been discounted by stocks and a new market cycle of growth is just starting. Here, asset prices are low, the bad news never stops flowing and the mood is cautious and depressed (people are unwilling to commit capital). However, it is only at the bottom when asset prices are now cheap, prospective returns are high and risk is low. It is time to get aggressive.

Economically sensitive sectors such as consumer discretionary (LOW), financials (DBS), industrials, and information technology may outperform while more defensive sectors such as healthcare, utilities (AWK), telecommunication (Singtel), and consumer staples may underperform.

Investors in general are more willing to take on risks by allocating a higher percentage of their portfolio towards industries that outperform when the economic cycle is in a new markup phase. High growth would do well in this stage of market cycles as well.

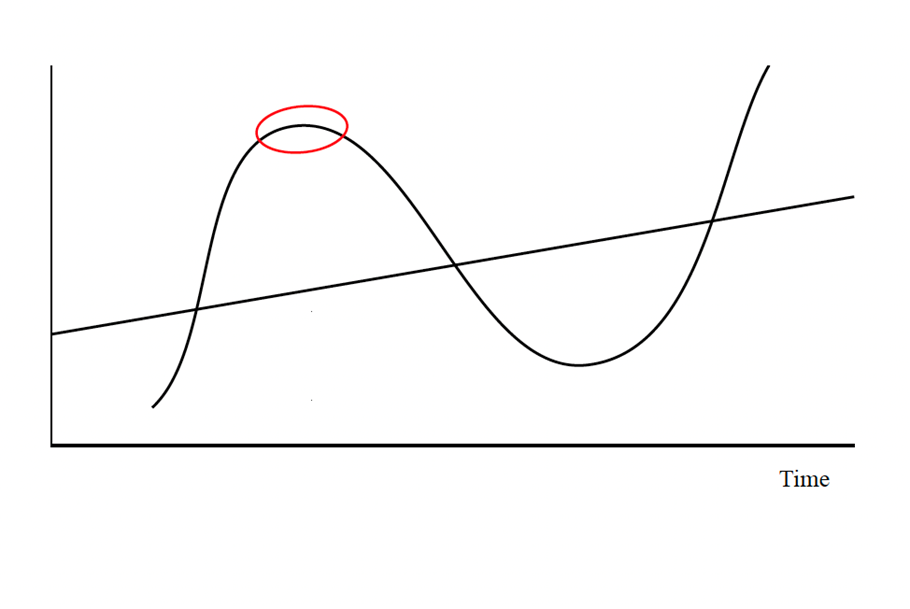

Mid Cycle Expansion (Peaks):

This is the stage of market cycles when economic growth is peaking. While there are not many portfolio allocation changes to be made, it might be time to consider taking profits in economically sensitive sectors while maintaining an overweight position in industrials (ITW) and information technology (tech stocks).

During this stage, there is a palpable sense of FOMO in the air as no one is willing to bear the risk of missing out on further gains. The stock market just seems to go up every day; it is different this time – it never is. Here, asset prices are high, prospective returns are low and risk is high.

When everyone thinks that the market will keep going up forever in a straight line, it is time to be cautious!

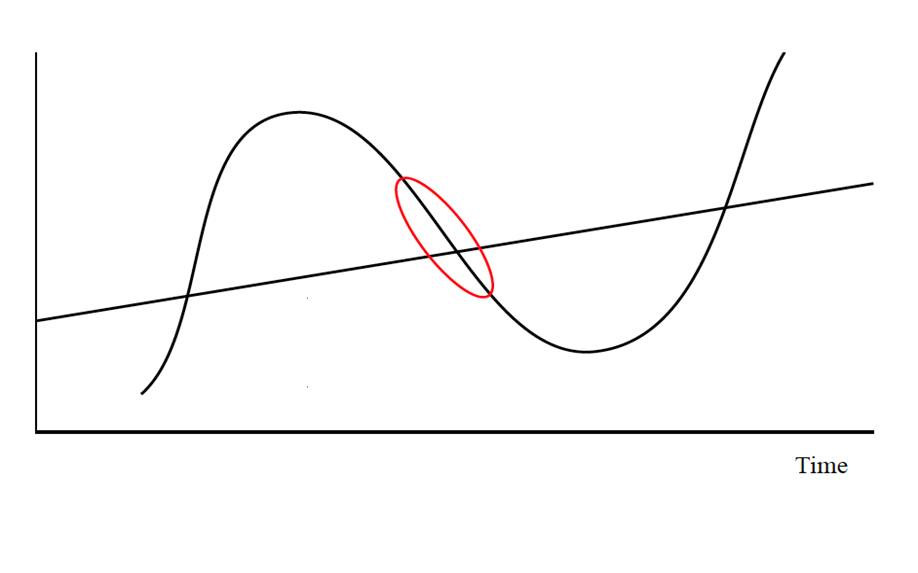

Late Cycle Expansion:

This is the stage where the stock market cycles experience their last hurray before economic growth starts contracting. Defensive and inflation-resistant sectors such as consumer staples, healthcare, energy, and materials may outperform while sectors like consumer discretionary and information technology (except big tech companies) may underperform.

The key here is to focus on companies that have solid secular growth prospects and produce free cash flows (think MSFT, ADBE, NVO, etc). Take profits in highly cyclical names (banks) and focus on being defensive.

Recession:

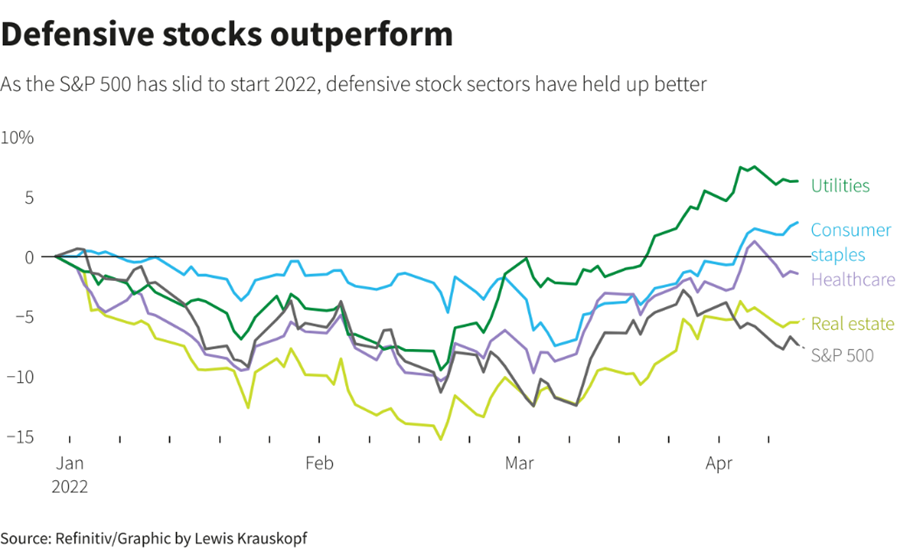

All stocks fall in recessions so the best place to hide for investors during this period is to focus on defensive, stable companies such as consumer staples and healthcare companies that produce daily essentials required in everyday life. Companies such as Pepsi, JnJ, and PG should do well relative to names from other sectors. Alternatively, you can always substantially increase your cash position and/or protect your portfolio by hedging via inverse ETFs / shorting the market. Thus this phase of the market cycle is where investors panic and lose their money.

Which part of the market cycle are we at now?

I believe we are somewhere between the late stage and the recession stage. A recession is all but guaranteed at this point given the Federal Reserve’s actions of tightening financial conditions (raising interest rates and conducting quantitative tightening) to slay the inflation dragon.

The yield curves across many maturities (ex: 2y/10y and 5y/30y) stay inverted, consumers are taking on more debts to stay afloat, housing prices are falling, and consumer spending is weakening. The only question is how deep and how long a recession is going to last. While the valuation of the market is not undemanding, earnings estimates have yet to be revised by analysts.

I believe that we are not out of the woods yet for this bear market and that we are due for another leg down due to the earnings of companies coming down. As such, I remain defensive with a bigger-than-usual cash position while slowly DCA-ing into my favorite quality growth companies that produce huge amounts of free cash flow (Visa / Microsoft).

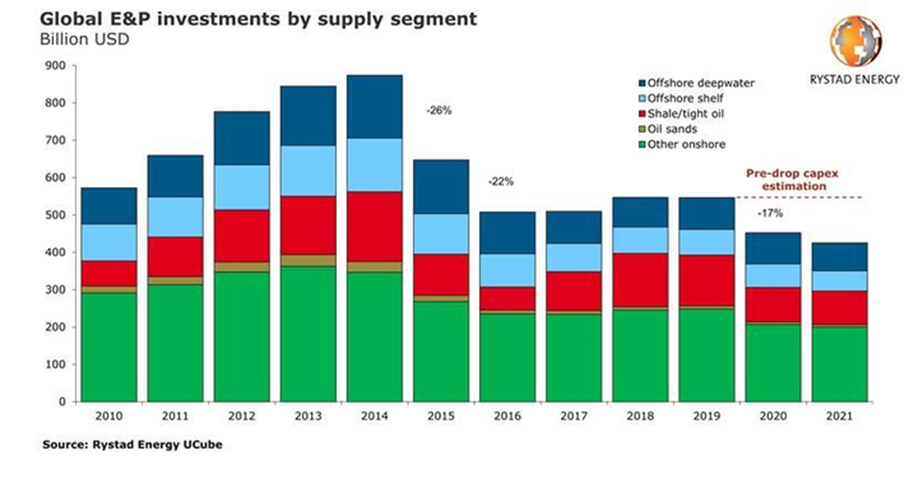

It is not yet the time to get aggressive and take on risks. I think energy is also another compelling sector to consider given the huge mismatch in supply/demand dynamics due to the lack of Capex investment over the past 5 years.

Finding winning stocks to buy in all scenarios

I provided a quick summary of the stock market cycle and the respective sectors to be positioned at each stage of the market cycle.

It can, however, be a daunting task for the man-in-the-street to actively rotate out of stocks based on the market cycle.

A simpler solution to stay ahead of the investing game, in the long run, is to invest “passively” into the market regularly. This can be done through a dollar-cost average approach. Usually, this is one of those business cycles that is crucial for your financial investing journey.

However, by “hugging the index”, one should not expect outsized returns over a mid-long term horizon. The average long-term returns of the market are approx 7-8% annualized, after accounting for inflation.

To generate strong outperformance (15-20% annualized returns), one would need to find stocks that are going to become multi-bagger winners for you. These are stocks that can not just survive an economic recession, but emerge stronger out of it.

Market fear will, however, often result in these stocks being unfairly beaten down in a bearish environment. That should be seen as an opportunity to FIGHT rather than FLIGHT.

For readers who are interested in finding these winning stocks, do check out the Stock Alpha blueprint course. These companies, which I termed Alpha Blueprint Stocks, possess several characteristics that make them high quality in nature.

For example, many of them are market leaders in their respective industries and possess competitive traits that allow them to stay ahead of the competition. Importantly, they are highly profitable companies with a great growth runaway ahead, ensuring that they continue to compound solid returns for shareholders in the long run.

Earnings are well-supported by the immense amount of free cash flow that their operations churn out. This will not just help them to ride out an economic downturn, but also provide them with the necessary “bullets” to capitalize on acquisition opportunities in a recessionary environment.

You can sleep easy knowing that your growth stock will not plunge >70+% during a bear market a la Shopify and Peloton which has no safety net in the form of earnings and cash flow. These hyper-growth companies are also highly dependent on 3rd party financing to sustain their operations.

In a rising interest rate environment, that is going to be a major problem.

For those interested to check out more information on Alpha Blueprint Stocks, do click on the link above.

Conclusion:

In this article, I have shared some information that might give you a better insight into identifying different market stages. While it is not possible to time an absolute top/bottom, one can make reference to where the market cycle might currently be in to go aggressive or defensive.

As usual, none of the stocks mentioned in this article is a recommendation to buy or sell the stock. The market is extremely volatile these days but if you take this opportunity to accumulate shares in fundamentally solid companies that are growing at a decent rate, the future YOU will thank you for your actions today.

If you have been complaining about missing out on the entire bull run from Apr 2020 – Jan 2022, this is the time to start selectively buying shares in your favorite quality companies. Stay safe out there!

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB from time to time that might not be covered here in this website.

Join our Instagram channel for more tidbits on all things finance!

Join our Youtube channel for short and sweet videos on all things finance!

SEE OUR OTHER WRITE-UPS

- Inflation: Don’t ignore this silent retirement killer

- Inflation at 5% in May: Transitory or a structural problem

- Pricing Power: Stocks that can do well amid inflation concerns

- 5 Small-Cap US Stocks with 10 years of consecutive earnings growth

- How to invest in Dividend stocks

- 9 Strong Free Cash Flow Stocks that you need to own

Disclosure: The accuracy of the material found in this article cannot be guaranteed. Past performance is not an assurance of future results. This article is not to be construed as a recommendation to Buy or Sell any shares or derivative products and is solely for reference only