Motley Fool has a list of 10 starter stocks which new investors looking to build up a long-term portfolio should seriously consider.

You should feel comfortable holding these stocks for the long haul and not be spook by market volatility. These stocks not only have the financial strength to ride out economic downturns but also have powerful growth characteristics embed in its business model to ensure operational longevity.

8 traits of a Starter Stock

- Green Circle: Like a beginner’s ski slope; easy to grasp

- So David or So Tom: At the heart and soul of the Gardners’ philosophies

- Room to Grow: Opportunities to expand worldwide

- High Confidence: Has strong potential to beat the market

- Track Record: Bold, proven history of success

- Community- Happy: Generates discussion among Fools

- Innovative Culture: marches to the beat of its own drummer

- Great People: talented partners; exemplary corporate ethos

Motley Fools 10 starter stocks

Without further ado, let’s look at David’s and Tom’s list of 10 starter stocks for your consideration:

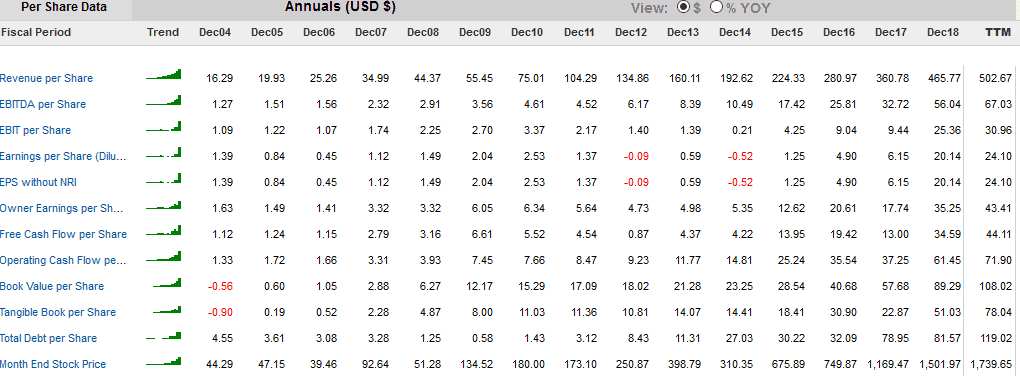

Amazon.com

This has been a stock that was first recommended to Motley Fools’ members back in 2002 and has been a big winner since then. There might not be a company that embodies the Starter spirit better than Amazon.com (NASDAQ: AMZN).

The company has become a behemoth of the online world, so big that politicians are beginning to question if they should be broken up.

CEO, Jeff Bezos has fostered an entrepreneurial culture and a customer first mindset that have produced a growth runway best measured not in years but in decades. From cloud computing (Amazon Web Services or AWS for short) to consumer service (Amazon Prime) to potential expansion into healthcare, cashier-less stores and more, this is one mega innovator that does not seem to run out of ideas anytime soon.

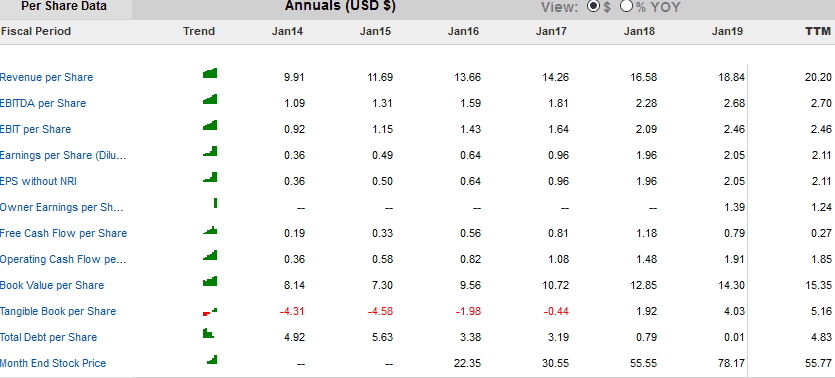

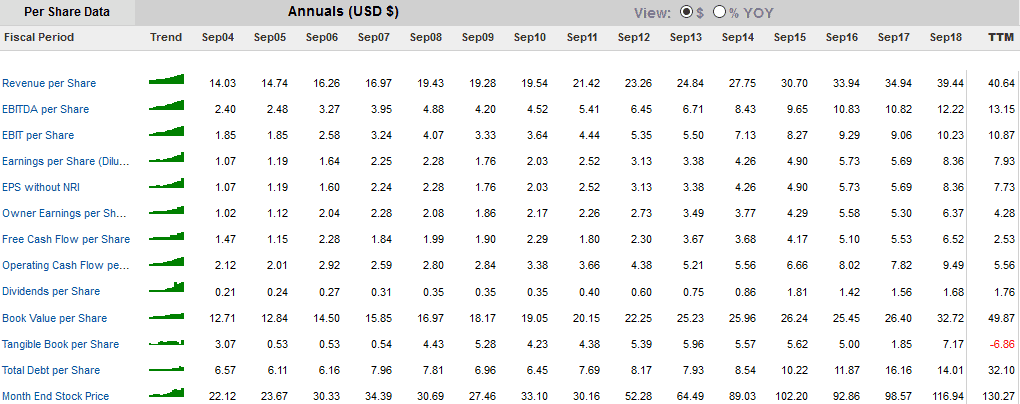

Amazon key financials snapshot

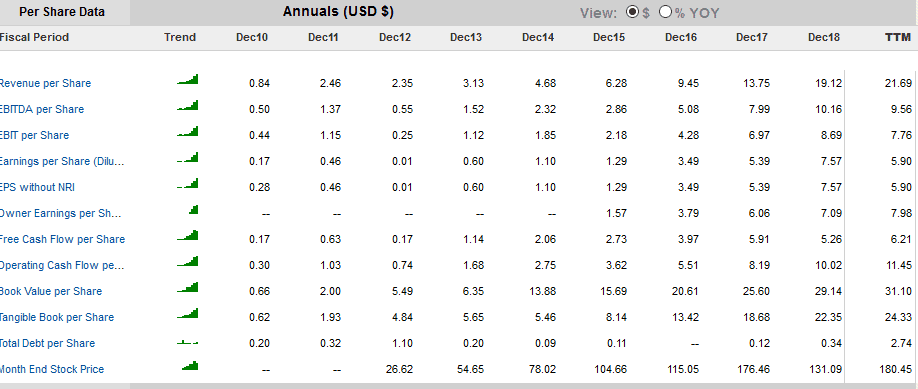

Facebook (NASDAQ: FB) has been one of the better tech out-performers in 2019 despite the numerous macro and micro, external and internal, public and private challenges it has faced over the past year.

The world’s largest social media platform owns and operates Facebook, Instagram, WhatsApp and Messenger which together draw some 3 billion users across the globe each month and that figure continues to be on an uptrend.

The strength in growing its user base illustrates the platform’s unique value proposition, which despite concerns over privacy and sharing, has been a haven in drawing advertisers to pay up to reach up to those billions of users.

Facebook’s innovation for growth is not just in constantly refining its social media platform to enhance users’ experience but potentially in its cryptocurrency which could be massive. That is assuming it gains the relevant authorities’ approval.

While there are undoubtedly growing risks of more regulation coming from governments, advocacy groups, clients and even former co-founders, Facebook’s social media platforms remain the go-to places for normal day folks to connect, share, laugh and cry

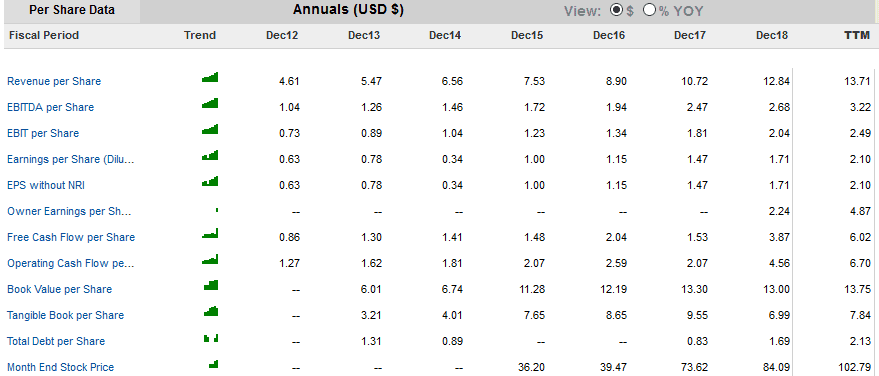

Facebook key financial snapshot

Idexx Laboratories

Idexx laboratories (NASDAQ: IDXX) makes our furry friends’ lives better by providing veterinarians with state-of-the-art diagnostic instruments right in their own clinics. This is a company that might you might not be familiar but it is a company that has been listed since 1991.

The company benefits from a classic razor-and-blades business model: First sell the instruments, then sell the consumables needed to run those instruments (repeatedly).

Management has been making the right moves consistently to grow the company, including winning new business overseas as well as growing its market share pie.

Pet owners love their pets and spending on pet care tends to grow in good and bad times. This is a recession-resistant company that makes a great addition to a long-term portfolio.

Idexx key financial snapshot

Illumina

Illumina’s (NASDAQ: ILMN) DNA sequencing instruments are showing up in more and more places around the world. The growing popularity of sequencing via companies like 23andMe and Ancestry.com continues to push demand for the instruments.

While Illumina does its part to drive down the cost of sequencing an entire genome – now at about $1,000 for a human’s DNA with the aim to push that figure down to $100, it is benefiting from selling the instruments and the consumable reagents used to run them.

The company has a strong track record and likely to market-beating counter over the long run despite current near-term price weakness.

ILMN key financial snapshot

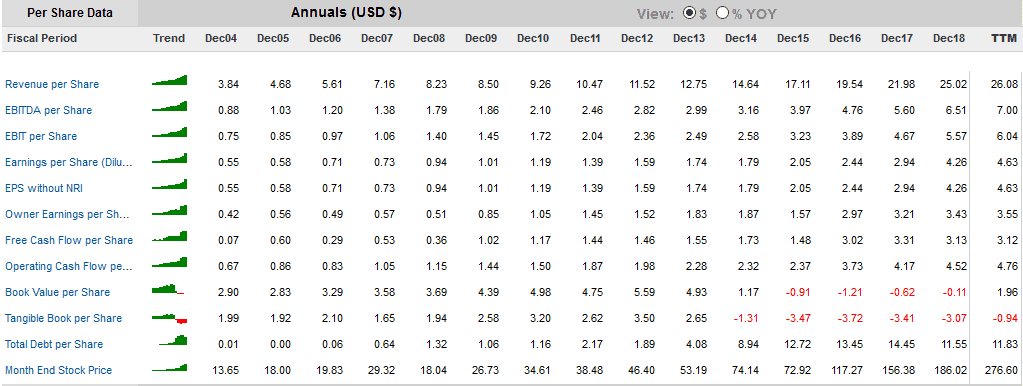

Mastercard

Mastercard (NYSE: MA) has mastered payment processing in a world whose reliance on it is only growing. This is also one of Warren Buffett’s top 20 stock holding.

In 2018, the company generated $15 billion in revenue by taking a cut of the $5.9 trillion worth of payments that it handled. This number will continue to grow exponentially as we transition towards a world of cash-less payment.

Led by Ajay Banga, Mastercard has remained relevant throughout the e-commerce revolution by staying abreast of payment technology and seeking new markets to dominate globally.

With a solid profit margin and an oligopolistic position in the world of online payment, this is a stock that forms the foundation of Motley Fools Starter Stock portfolio.

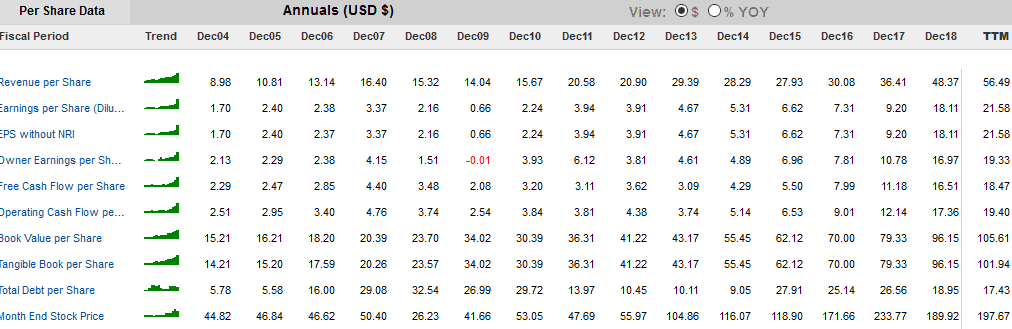

MA key financial snapshot

Ollie’s bargain Outlet Holdings

(NASDAQ: OLLI) Through more than 300 stores, Ollie’s sells close-out, overstock, and excess inventory products which it purchased at bargain prices from suppliers going out of business.

Let by CEO Mark Butler, the company’s largest shareholder, Ollie’s team is exceptional at sourcing products, treating suppliers well and creating an engaging in-store atmosphere for its customers.

Many of those customers are members of the Ollie’s Army shopping loyalty program which drives more than two-thirds of company-wide sales.

While not a common stock that investors outside of the US will be familiar with, it is useful to note that the financial performance of Ollie has been very stable over the course of the last 5 years.

OLLI key financial snapshot

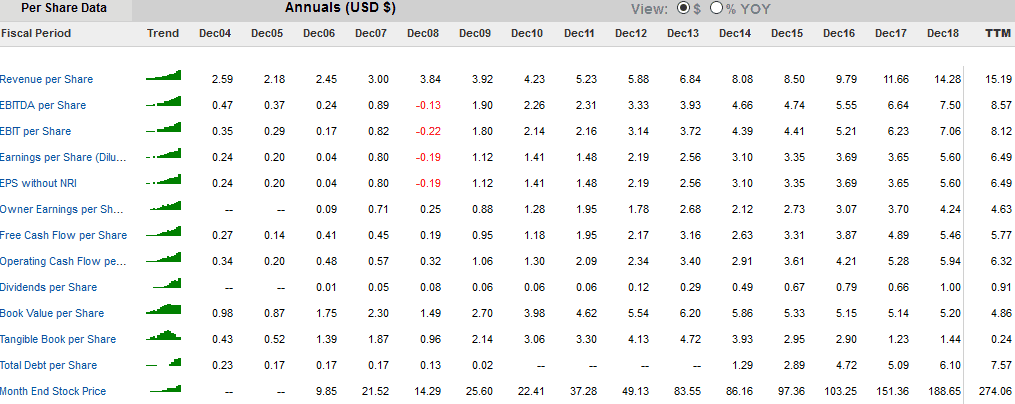

PayPal Holdings

PayPal (NASDAQ: PYPL) continues to exert its e-commerce dominance. Through a series of crafty acquisitions such as iZettle, Brainstree/Venmo, and Xoom, PayPal has expanded its presence and relevance both internationally and with millennials.

The company currently has close to 300 million active accounts across its payment platform and digital wallet and facilitate 10 billion transactions annually.

Its strong network effect gives provides the confidence to the Motley Fool team that they can continue to beat the market while shifting trends towards digital payments from cash ensure that the company’s growth runway remains long and bright.

PayPal key financial snapshot

Shopify

Shopify (NYSE: SHOP) is a big winner serving a growing and competitive market space. Founder and CEO, Tobi Lutke has nurtured an engineering-first culture dedicated to giving clients the best e-commerce tools available to manage their own business, help their customers and drive sales.

Shopify caters to small entrepreneurs to large enterprises alike, offering them multiple tiers of service to best fir their needs.

By providing a valuable service that’s in high demand, Shopify has demonstrated impressive sales growth and the Foolish team believes a market cap of $100 billion over the next few years is not out of the question.

However, do note that this stock is a richly valued one which has not yet generated any meaningful earnings at present. Stock prices tend to swing wildly as well.

But for forward-thinking investors who have a 5-10 years holding period horizon, this is a good counter to start.

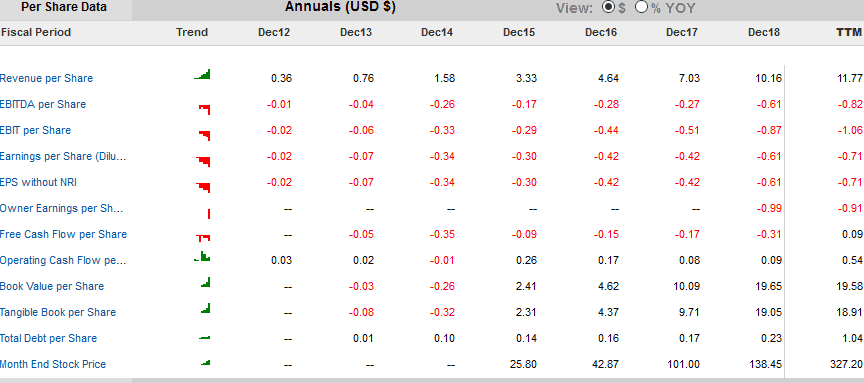

Shopify key financial snapshot

SVB Financial Group

SVB Financial Group (NASDAQ: SIVB) provides funding for entrepreneurs and it has been in the business of doing so for the last 35 years.

This is a company that knows all about turning innovation into results. Around two-third of US businesses backed by venture capital that went public in 2018 used SVB’s services at some point. The company even publishes its own annual Startup outlook Report.

The bank operates SVB Capital, a $4. Billion venture capital funds that invests on behalf of clients. While 2019 has been an exciting year for IPOs, demand for SVB’s expertise can still continue to grow, making the company a great one to invest in for something we all want a piece of…. The future.

SVB key financial snapshot

Walt Disney

Walt Disney (NYSE: DIS) was one of the first companies most of us were introduced to as children. Here at New Academy of Finance, we have also written a Buffett series on it. Disneyland and Disney World are well-loved vacation destinations and its movies draw audience of all ages.

The company has expanded beyond basic entertainments through time to include international theme parks, resorts, cruise lines, books and live stage plays to its vast array of media-related assets.

Its streaming service Disney+ which is about to be launched in late 2019 is expected to reach 60-90 million customers by 2024.

Disney key financial snapshot

Conclusion

The Motley Fools Starter Stocks are ideal considerations for beginner investors to take a look at.

Here at New Academy of Finance, we have already done a financial analysis of Walt Disney, with a conclusion that the stock is a fantastic company with a strong-moat in place but now is just not the right time to be purchasing the counter. Read our article here for our target entry price.

While some stocks such as Shopify as recommended here tend to be a little “speculative” in nature, given that it has not been profitable since inception, one can choose household counters such as Mastercard, PayPal, Facebook, Amazon etc for consideration.

We will be doing more Buffett-like analysis on these names in due time, starting off with Idexx laboratories which has caught out attention with its extremely stable-like financial profile.

Take a look at our other investing articles

- BUFFETT SERIES: DISNEY

- 46 STOCKS IN BUFFETT PORTFOLIO

- BUFFETT SERIES: MCDONALD

- STRACO: IS IT A GOOD BUY NOW?

Do Like Me on Facebook if you enjoy reading the various investment and personal finance articles at New Academy of Finance. I do post interesting articles on FB often which might not be covered here in this website.

1 thought on “10 “Must-have” Stocks favored by Motley Fools US”

beckoning , https://cabelas.cc