How to find Winning Stocks Fast

- In Under 10 Minutes

Without Doing 5 Hours of research each week!

- This method crushes both growth & value investing

Dear Investor,

I’m not one to make assumptions… But the fact you’re on this page suggests you’re different to most people.

You know you want to make a change.

You’re ready to try and take better control of your finances.

And you know the sooner you do this effectively, the faster you get to your end goal: The Coveted Financial Freedom.

Here's

The Problem

You Face:

Most people think that stock investing is so hard and only professionals can do it. They cannot imagine themselves becoming a good investor!

Which means that they will never ever get started, and in the process find out how sweet it is to make your money work HARD for you, all while you are sleeping.

Value Investing - Finding “Undervalued” Stocks That

- Takes Forever

to be Fairly Valued

You wish to become the next Warren Buffett. I had that same wish too, when I first started my investing journey more than 15 years ago as a junior fund manager (more on that later) in a family office.

My bubble got pricked soon after. I invested according to the concepts and teachings of Value Investing. I bought only CHEAP stocks.

I filled the family office’s portfolio with “value” stocks. What could possibly go wrong when you buy cheap stuff, ya?

But you know what happened?

These cheap (I would like to convince myself that a more appropriate term to use is “undervalued”) stocks keep getting cheaper!

Take Intel as a recent example.

- A classic example of a cheap stock that remains cheap (aka A Value Trap).

Needless to say, my career in the family office wasn’t very long-lasting.

A HARD realization, indeed.

Growth Investing -

It is All About Conviction!

I remembered a good buddy, let’s call him Mr JH, who asked me out for coffee one fine day. It was mid-2021.

This was the gist of the conversation I had with him:

JH: “Hey buddy, my stock portfolio is doing very well these days. If this trend continues, my retirement is in sight!”

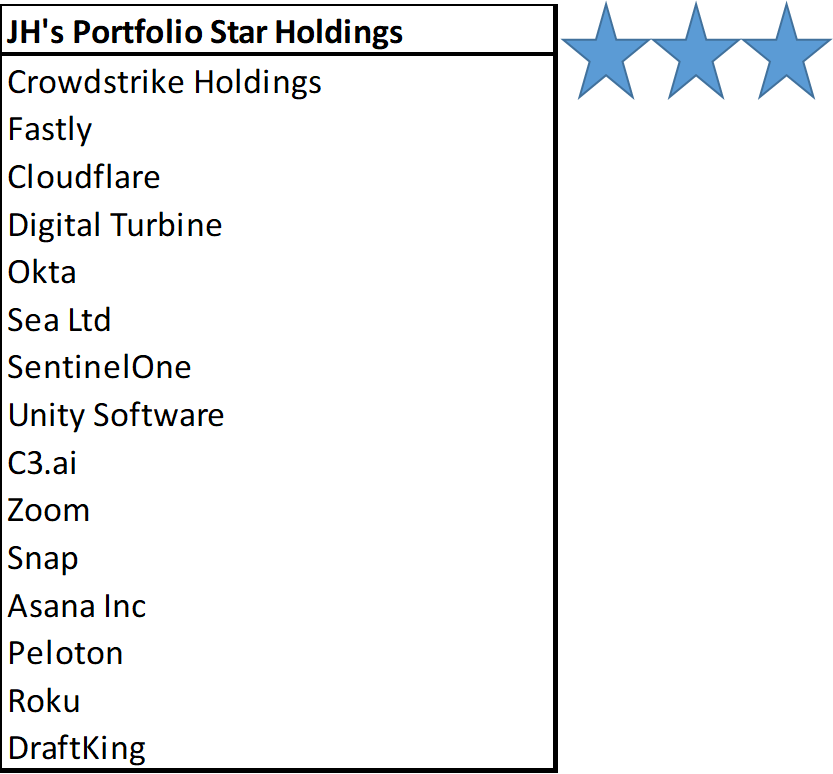

He showed me his portfolio and the stock holdings looked something like this.

JH: “Well, I know Sea Ltd, they own Shopee right? And Zoom too. Have been using it for online meetings. Yup, other than that, the rest are all pretty much foreign to me.”

Well, I did try to convince him that he is investing in all the WRONG stocks, stocks that are “hyped-up” by the market, compelling him to crowd-seek or FOMO (fear of missing out) and enter alongside thousands of other investors.

But alas, JH was too caught up in the moment to “get out of the game”.

Then this happens.

That was Sea Ltd. If you are in JH’s shoes, what would you have done when the price of your favorite growth stock collapsed by 70-80%?

1. Buy more since it’s so cheap, or

2. Get out now before it is too late?

Most new investors I know will select the second route. Why so? Because they don’t know the stock that they are vested in.

They are just following the hype. And when everyone rushes for the exit, they follow suit

Do You Have

What It Takes?

The conviction to believe that your stocks will weather the storm ahead and emerge, not just unscathed, but in a stronger position.

Alas, it is easy to hold a high conviction level when it is blue skies ahead, but self-doubt typically creeps in when the bear takes control.

You don’t know if it is the correct decision to buy more into the counter when it is trading at a huge discount.

Can it turn out to be a dud? Sure thing.

So, should you be selling for pennies on the dollar?

Now, I suspect that you, like the rest, will be frozen like a deer in headlamps, not knowing how to react.

FOMO + Self-doubt.

Not a good one-two combination.

You will be telling yourself:

- "Investing is just too hard."

- "Investing is keeping me awake at night."

- "I better leave investing to the professionals."

- "I think it is best to stick to a passive investing approach."

- "There is no easy solution to find great stocks to invest in."

I am not saying that everyone can become an investing legend like Warren Buffett.

Let’s admit it.

It is close to impossible to achieve what Warren Buffett has achieved without spending hours upon hours to do research work.

Hours that you and I don’t have, with all our other commitments in life. Does that mean that retail investors should give up achieving “ALPHA” for their portfolio?

I know I almost did.

For the longest of time, I did not have much success with both value and growth investing. As an ex-stock market analyst, I knew that real value investing is not as easy as it is being made out to be.

However, Of course not! For the longest of time, I did not have much success with both value and growth investing. As an ex-stock market analyst, I knew that real value investing is not as easy as it is being made out to be.

It involves the input of assumptions and we all know what happens when that input is “Garbage”!

Then I tried my hands on growth investing, lured by these sexy stocks that “promises to bring me to the moon”. Alas, that promise did not last and before long, I was sitting on substantial losses, not knowing if I should bite the bullet and move on, or pray for a miracle rebound to happen.

That is why when my buddy JH sought to follow in my footsteps, I had to warn him of the consequences.

I know that something is missing from these 2 investment styles and after countless hours of research + trial and error on my part, I believe that I have finally “crack the code” with a systematic investing approach that finally works!

That missing puzzle is not for you to find cheap nor sexy stocks, but stocks of a

- High Quality

nature

No emotions involved here. Just the RIGHT execution using the RIGHT approach. An approach that ANY retail investors can execute.

Luckily for you, there is now a solution.

Introducing:

The Stock Alpha Blueprint Course,

This is THE masterclass in using a systematic approach to find high quality winning stocks in just 10 minutes each week (once you have set up the system), so you can #havemorefamilytime and #sleepwellatnight.

In just 3-4 hours (I believe in going straight to the point), you’ll learn the systematic approach top fund managers used to identify high quality winning US stocks – while others struggle for days on ends “researching” on the internet.

This is my winning formula for finding and executing stocks.

Focus on Quality Investing: Remember I mentioned about an investing style that crushes both value and growth investing that is rarely talked about?

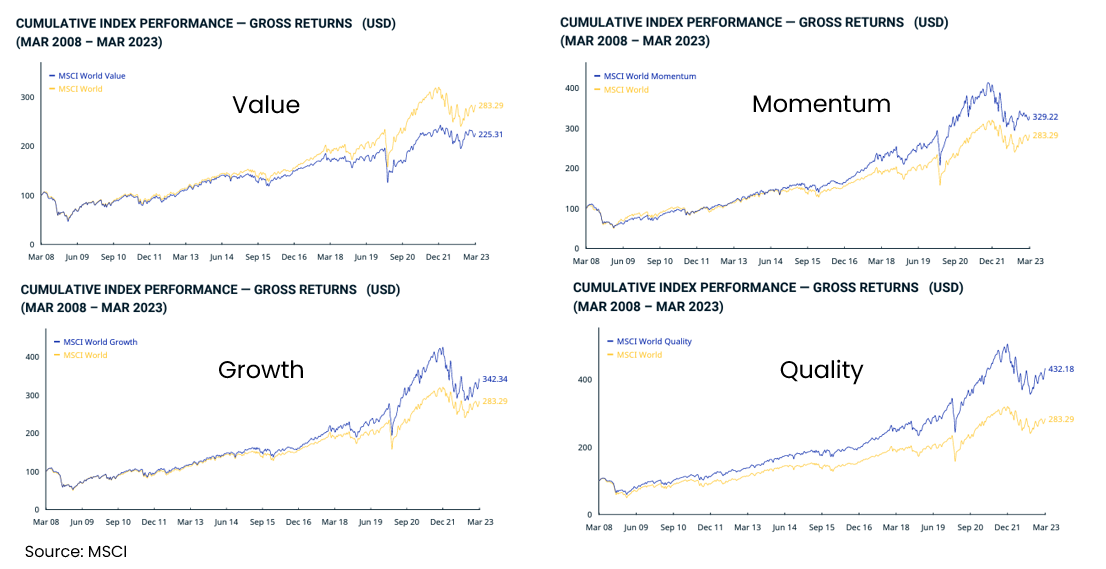

That is Quality Investing – the art of finding quality stocks that have proven to outperform all other factor investing style.

According to data tracked by MSCI, Quality Investing has outshone popular factor investing methods such as Value, Momentum and even Growth over the past 15 years.

Take Intel as a recent example.

Using a quality-style investing approach greatly enhances your chance of generating “alpha” for your portfolio in all market scenarios, which means:

Incorporating

The Power Of 5 Metrics:

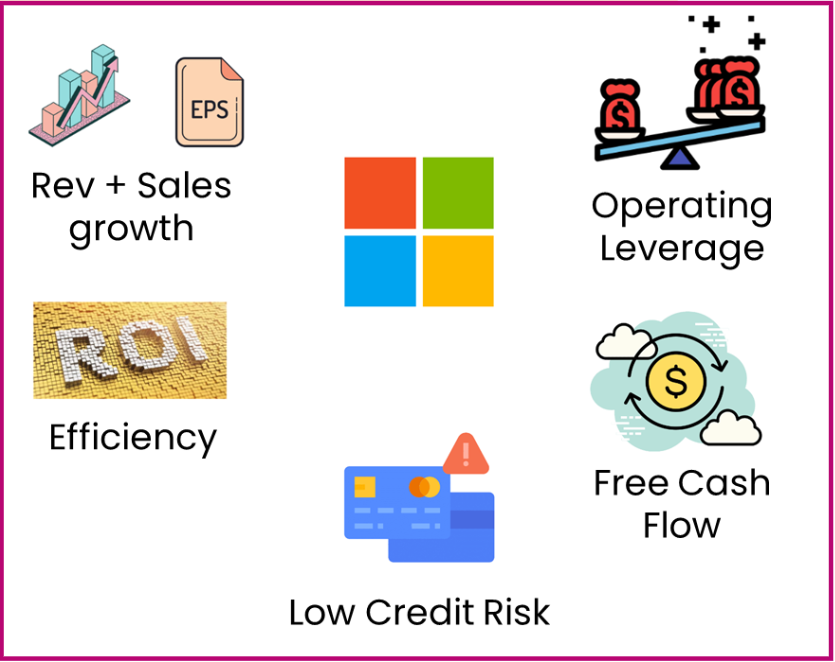

After more than a decade of being in the finance industry, looking at 1000s of financial statements and metrics, I have narrowed down the Top 5 financial metrics that top investment gurus use all the time to find winning stocks.

These are the metrics that REALLY matters. There is no need to beat around the bush with financial jargons like “Oscillation”, “Acid-Test”, “Absolute Liquidity”, etc.

These are all “noises” that serve to confuse more than educate.

There are just 5 metrics that matters. I termed these as my Power of 5.

Stocks that fulfil the Power of 5 metrics possess these common characteristics:

- Dominant Market Position,

- Track Record Of Profitability And Growth,

- Operational Efficiency,

- Ability To Capitalise On Market Downturn To Grow Market Sales

- High Survivability With Low Credit Risks and

- Forefront Of A Market Rebound.

Buying stocks that fulfill the Power of 5 metrics

Means you will never be left holding a “fly-by-night”, loss-making hyper-growth stocks that could come crashing down, literally overnight.

Using A Data-Driven Process:

The execution (Buy/Sell) of stocks is a data-driven process so there is no human emotion involved which means you make better investing decisions for the long-term success of your portfolio.

Enhancing the timing factor using the Smart Impulse Factor:

The final cherry on the cake is using our unique timing factor called Smart Impulse.

Smart Impulse allows you to better time the entry/exit of your high-quality stocks so that you enter and exit at the most opportune time, which means you significantly enhance the winning probability of your trade. I will explore more of our unique Smart Impulse factor later.

Winning Formula = Quality Style + Power of 5 + Data-Driven Process + Smart Impulse

The stocks that fulfil this winning formula are termed as my Alpha Blueprint Stocks, the crème of the crop that represents the Top 0.5% of the US Stock Universe.

Now some of you might be wondering at this juncture, what exactly are the Power of 5 metrics that have consistently proven to sieve out winning stocks that can withstand the test of time.

I can assure you they are not rocket science stuff over here.

In fact, I am going to DISCLOSE right here, right now, the identity of the Power of 5 metrics.

Are You Ready For It?

They Are…

- Dominant Market Position,

- Track Record Of Profitability And Growth,

- Operational Efficiency,

- Ability To Capitalise On Market Downturn To Grow Market Sales

- High Survivability With Low Credit Risks and

- Forefront Of A Market Rebound.

As I have alluded previously, these metrics are nothing revolutionary. Cash flow? Earnings Growth? These are all well-known metrics.

While at first glance, the financial metrics on this list aren’t revolutionary in and of themselves, it’s the combination of all these factors together that makes it a real breakthrough.

Essentially, we are pinpointing the world’s strongest, healthiest companies….. The undisputed champions of their sectors. The best of the best.

Even though these 5 factors might seem common. But finding a stock with the Power of 5 metrics all aligned is what “makes it tick”. There are just 20 odd companies in the entire universe of 5000+ stocks that fit these criteria!

Now, it is not good enough for these companies to have metrics that describe them as “strong” or “high”. They need to be accompanied by an assigned value.

Take for example, the second factor in our Power of 5 is Earnings Growth. It is not sufficient for a company to just display earnings growth.

An Alpha Blueprint Stock will require to generate forward earnings growth of at least 10% and that growth has got to be faster than what the company is generating on its top-line.

This Is

Quality Growth

Through Operational Efficiency

When all 5 metrics meet their pre-determined values – at a single point in time – THIS is the time where you can be assured you have found a “gem” a stock with a proven track record of operational excellence that typically leads to strong price appreciation.

That is the signal that gives you the confidence to BUY.

Microsoft is one of those companies that fit the description of a Quality Growth Stock.

Now, when one or more of those metrics falls off – it’s time to SELL and collect your profits.

Simple as that.

The Power of 5 metrics, which combines the essence of Quality, Growth and Value Investing is all you need to find high quality stocks with a safe and resilient business model.

Think About It:

In the process, they build up their cash reserves and strengthen their balance sheet which gives them the “bullets” necessary to not just withstand an economic crisis, but to emerge stronger when their competitors falter. And these are all things the “Power of 5” metrics signal about a company as it scans the market. Let me state again: We are pinpointing the world’s strongest, heathiest companies…… The best of the best.

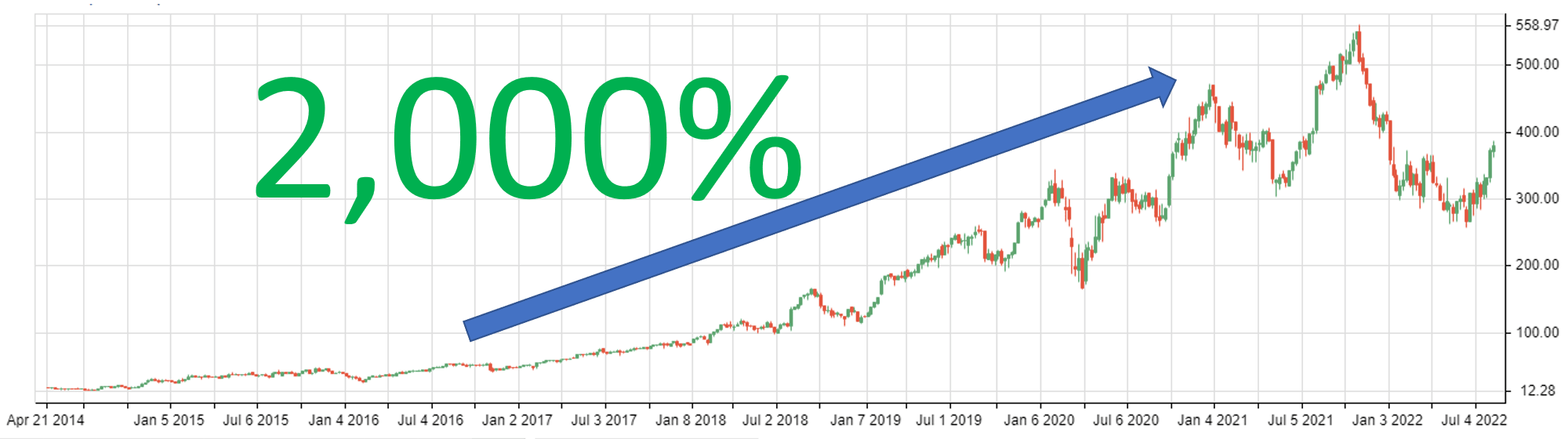

Here let me give you another example….

What if I told you I was researching a payroll processing company started by a “farm boy” from Oklahoma. Now, payroll is a necessity for all companies, large or small, but a real challenge especially for the latter. It’s a huge hassle for these small mid-sized companies as they made mistakes all the time, causing their employees to get paid late and in the wrong amounts.

And one fine day, that Oklahoma “farm boy” had the idea to revolutionize the industry by making the entire payroll process completely digital…. Making it easier for companies to pay their employees accurately and on time.

And soon his company’s software became so popular it was used by thousands of businesses all over the globe… and went on to make billions.

As a result, its stock climbed more than 2,000% in seven years….

That payroll service company is an Alpha Blueprint Stock by the name of Paycom (ticker: PAYC). And its CEO – a farm boy from Oklahoma – is now one of the highest paid CEO in the S&P 500.

My point is…. These businesses screened out by the Power of 5 metrics aren’t some “flash in the pan”. They are as stable as it gets. They are the best of the best. These are solid, cash-rich companies…. the strongest in the world.

And if they continue to fulfil the Power of 5 metrics, they will likely remain as the market leaders in their respective industry decades from now. And rest assured that investors in their companies will also be amply rewarded by a strong appreciating share price.

Sounds good!

But wait, there is more….

Incorporating SMART IMPULSE FACTOR

Smart Impulse tells you WHEN TO BUY these high-quality stocks and WHEN TO SELL them based on a back-tested set of proprietary TIMING indicators. Now, how exactly does that enhances the Power of 5 metrics?

Timing The Buy

Take a look at 2 well-known blue-chip stocks operating in the Credit Services industry that most will concur, are of a high-quality nature: Visa and American Express.

Both stocks fulfil the Power of 5 metrics. However, only one of them is a BUY while the other is not based on the Smart Impulse Factor.

The Smart Impulse Factor has identified that one of those 2 stocks have fallen into value territory while the other has not.

Can you guess which might be the better BUY of the 2?

Answer: Visa

Timing The Sell

It is not just knowing when to BUY that makes the Smart Impulse Factor so powerful. It is knowing exactly when to SELL that makes this feature stand out.

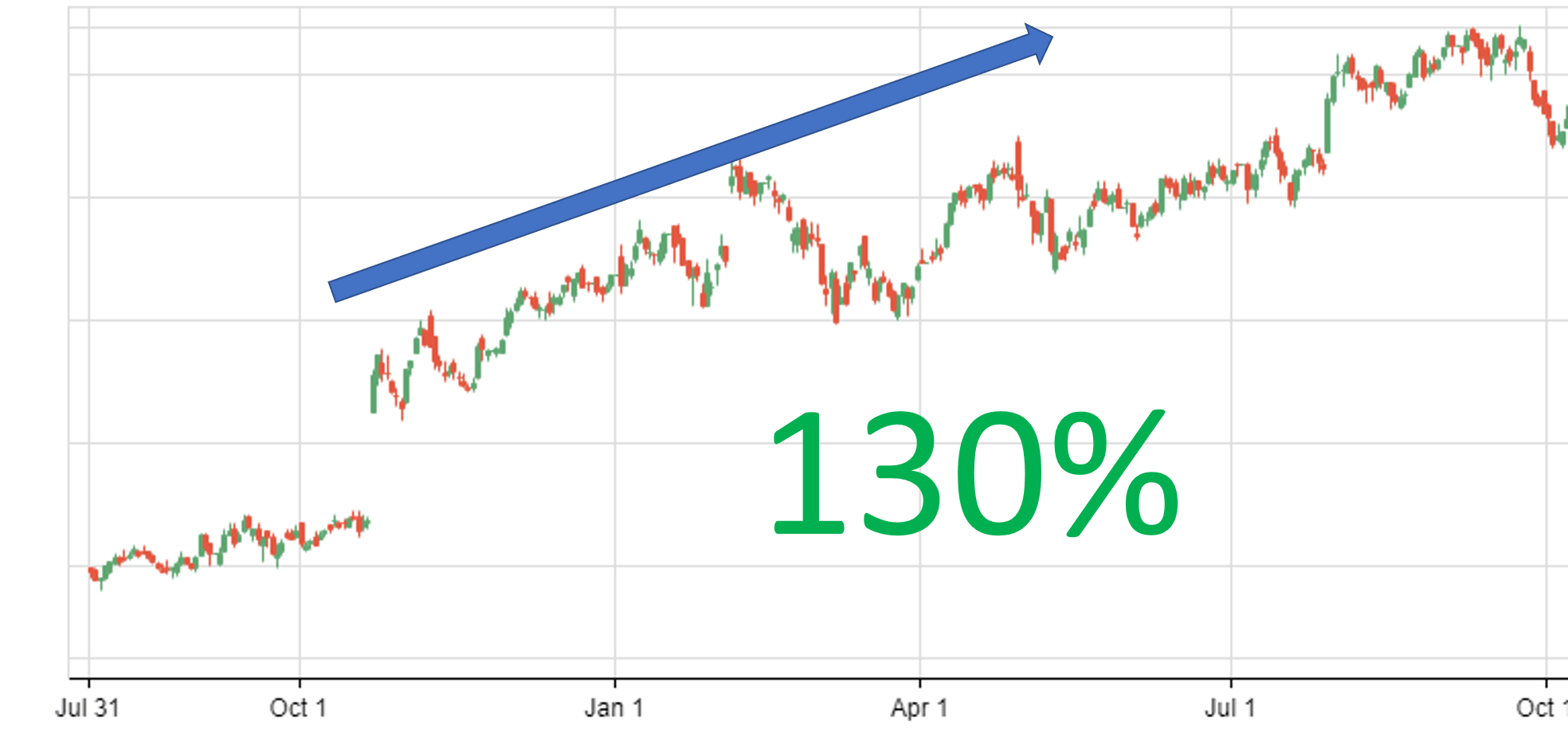

Take for example, Back to Align Technology, a stock which I highlighted earlier that fits the Power of 5 metrics 2 years ago, one that has rewarded its shareholders’ tremendously, up 130% over the course of 14 months.

This is still a great company that fulfills all 5 of the power metrics. There is just ONE big problem.

The stock lost its MOMENTUM. The timing is no longer RIGHT.

This is what happens next.

If you have held onto Align Technology amid the current bear market, you have given up all of your gains and perhaps more.

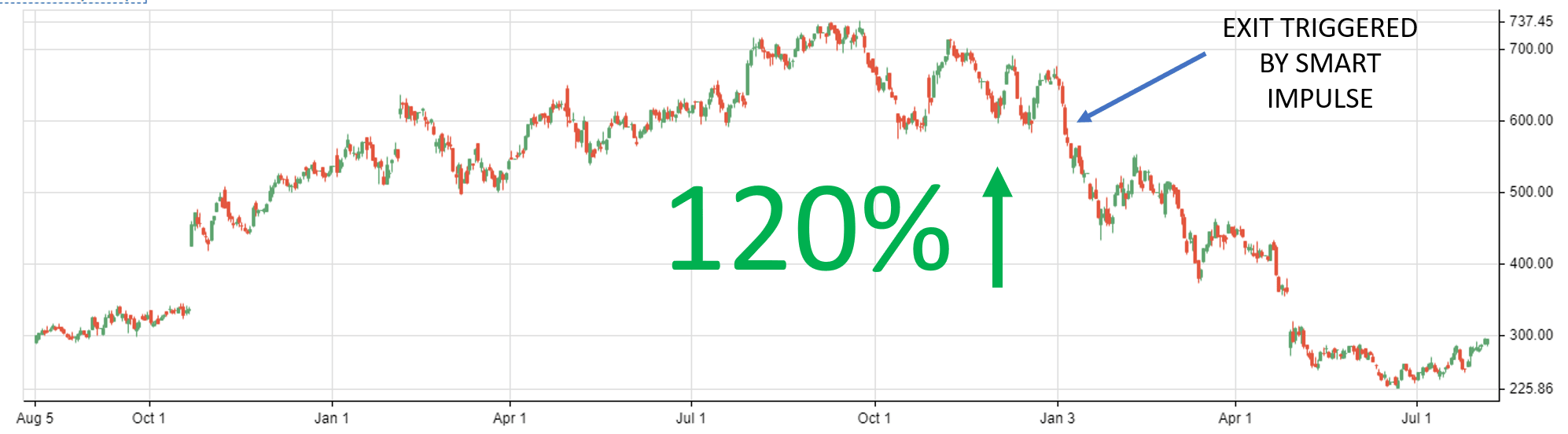

This is where the beauty of Smart Impulse comes in. It would have triggered an exit, based on the counter losing its momentum.

Now, instead of losing 10% of your initial capital if you have engaged a simple “Buy and Hold” strategy…

You would have generated a REALIZED return of 120% when the Smart Impulse signal kicks in to get you to exit in early Jan 2022, just before the major sell-off happens.

Smart Impulse gave the early signal to exit most of these stocks in Jan/Feb 2022, before the market sell-off worsen in April and booking the BULK OF THE PROFITS for most of these counters.

Investors would be HOLDING ONTO CASH, awaiting the right time to redeploy them.

And when might this “right time” be?

Two Scenarios:

Stock Price regains back its momentum. Continue to fulfill Power of 5 Metrics

Scenario #2:

Stock Price hits VALUE territory. Continue to fulfill Power of 5 Metrics.

- Screen for Alpha Blueprint Stocks using the Power of 5 metrics

- Timing the purchase of Porsche-Like stocks by incorporating Smart Impulse

- Implement stock position using SAB Portfolio Template. Ensure right Position Sizing to avoid over-leveraging

- Monitor for any changes in Alpha Blueprint List

- Execute Hold, Buy More, or Sell based on the data-driven rules set in place

The goal of Stock Alpha Blueprint is not to overwhelm investors with a complicated and detailed Investing Course.

I am not training you guys to become a stock market analyst.

The goal here is to have a simple system that allows even the man-in-the-street to identify high quality stocks. The market leaders in their respective industries, the best of the best, have the conviction to buy into these potential multi-baggers and most importantly, be able to SWAN (Sleep Well At Night).

Now, if I GUARANTEE you that buying into multi-baggers is a “piece of cake” with Stock Alpha Blueprint, would you believe me? Some of my existing students would, but many of you will be extremely sceptical and rightfully so, I would say. Why? I am not disclosing the full picture.

You see, anyone (or almost anyone) can “guarantee” a multi-bagger if the time horizon is long enough. 10 years, 50 years or 100 years? Sure, that can be done. But you guys will be cursing and swearing if that turns out to be my HOT recommendation here. Most of you would not want to be realizing your multi-bagger returns in your grave, I suppose.

You would want to enjoy the fruits of your labor as early as possible, to envision achieving financial freedom ASAP.

That is what Stock Alpha Blueprint aims to do.

Meet Your Trainer

Hi I’m Royston.

I have been an award-winning stock market analyst (Top 3 Stock Picker in the Industry) for more than a decade, and in the process, have reviewed 1000s of stocks. Through my day-to-day conversations with many top fund managers, I see a common pattern developing when it comes to the brightest of the investing minds, picking stocks that “tick all the right boxes”.

This sets the foundation for the Power of 5 metrics.

Since leaving the finance industry in 2019, I set up New Academy of Finance, a personalized financial site with a strong focus on imparting my investing knowledge that I have accumulated through the years and helping the “man-in-the-street” get started on their investing journey.

Many friends regularly “consult” me on their portfolio holdings. The #1 mistake I see most of them make is FOMO Investing. Buying stocks that have been hyped up by the media/ friends/acquaintances and “freezing up” when things go south.

I wanted to help them with a simple solution that doesn’t take endless hours of their time to learn and master.

That led to the creation of the Stock Alpha Blueprint Course.

And that solution has got to be simple and easily executed.

Even with ZERO investing background, you can now get the system for finding the RIGHT high-quality stocks and executing them at the RIGHT time.

Don’t believe the results? Hear from our satisfied customers:

THERE’S NO MORE SECOND-GUESSING ABOUT WHAT TO DO NEXT

Before Stock Alpha Blueprint, I was just like any newbie investor, not exactly knowing what am I getting myself into.

I bought into stocks that seem to have huge potential. That is what the papers, online media, and well-known bloggers are all saying. But before I know it, these stocks are down 50-60% and I am like a deer frozen in headlights.

With SAB, I now have much greater clarity as to when to buy and when to sell a stock. There is no more second guessing on what to do next.

– Alan Tang

MANAGING MY RISK THROUGH PROPER POSITION SIZING

Before Stock Alpha Blueprint, I was just like any newbie investor, not exactly knowing what am I getting myself into.

I bought into stocks that seem to have huge potential. That is what the papers, online media, and well-known bloggers are all saying. But before I know it, these stocks are down 50-60% and I am like a deer frozen in headlights.

With SAB, I now have much greater clarity as to when to buy and when to sell a stock. There is no more second guessing on what to do next.

– Chris Teo

DOUBLE THUMBS UP FOR YOUR COURSE

I would like to share with you that your course is so good. I just want to continue and ended up sleeping very late for a few nights to complete it.

I have attended a few fundamental analysis courses, and this is by far the easiest to understand and follow.

Besides the Power of 5, I love the way you taught the position sizing topic which is different from the other trainers.

– Giselle Kwok

I MADE MY FIRST DOUBLE-BAGGER IN 6 MONTHS

One of the stocks that were highlighted by Royston in Stock Alpha Blueprint back in late 2022 was ASML. I knew about this company from my previous research into the semiconductor industry and I know that it is a market leader in the semiconductor equipment segment.

I was just uncertain when to get my feet wet on this counter, particularly when it was “unloved” and sold off strongly in the 2nd half of 2022.

Stock Alpha Blueprint reaffirms my confidence in this quality counter now trading at a value price and I took a position in the counter at $370+/share. With the counter now trading over $720+/share, I have made my first double-bagger in less than 6 months.

– CY

HUGE VALUE FROM ALL THE WEBINAR SESSIONS

I will like to show my appreciation to Royston who continues to impart his financial knowledge to us through the periodic webinar sessions that he conducts at least once a month.

So far, he has already conducted more than 10 webinar sessions, on topics ranging from big-picture market outlook to valuation strategies such as intrinsic value and DCF models.

These sessions are all FREE and I have gained many insights, well beyond stock selections.

Thank you very much Royston for your commitment and all the value you continue to give beyond the online course.

– Nick Teo

With The Stock Alpha Blueprint Course is, you’ll finally be able to…

- Know when to SELL and book your profits (or cut losses) at the most appropriate time

- Avoid newbie investing mistakes (such as buying into hyped up stocks) that can be extremely COSTLY

- Execute the proven 5-steps (STIME) process in just 5-10 mins each week

- Discover a STRESS-FREE investing process that can help you achieve your retirement goals earlier rather than later.

- Spend more TIME doing what really matters most in your life (ie time with family and friends)

- Engage in ACTIVE QUALITY-STYLE Investing that has historically proven to outperform all other traditional investing methods

- Focus first on the financial metrics that truly matters in finding high-quality WINNING stocks

- Learn the CRITICAL numbers associated with each of the power of 5 metrics to effectively screen for Alpha Blueprint stocks

- Nail the exact timing for BUYING your Alpha Blueprint stocks

- Have the CONFIDENCE to buy more into a quality counter when there is “blood all over the street”

See How You’ll Master The Art Of High-Quality Investing In 4 Hrs Or Less: The Segment-By-Segment Breakdown

- Segment One

Introduction: The importance of securing our financial future

First and foremost, let’s tackle the elephant in the room (or should I say, the piggy bank). Why on earth should you start investing early?

Well, for starters, time is your greatest ally when it comes to growing your wealth. Thanks to the magical powers of compound interest, your money multiplies exponentially over time, which means your hard-earned dollars can work harder for you.

So, investing early can mean the difference between sipping piña coladas on a beachfront property in your golden years or living off instant noodles in a cramped studio apartment.

You’ll get there with:

- “The #1 Reason why you need to Start Investing IMMEDIATELY”:

- “The Formula for Investing Success":

There are just two things you need to do well to achieve investing success. By focusing on what matters, you can succeed easily where most other fail

- “Setting up a Plan for Investing Success”:

Don’t start investing without first setting up your Emergency Fund. This is the safety net required to provide you with a peace of mind. Your next plan would be to “pay-yourself-first” before everyone else.

TIME COMMITMENT: ~27 MINUTES

- Segment Two

Investing Strategies: The Best Investing Style. Hint: (It is neither Value nor Growth Investing)

Ah, the elusive search for the “best investing style” – because, you know, there’s a one-size-fits-all approach to making boatloads of money in the stock market.

Let’s just throw value and growth investing out the window because they’re so passé, am I right?

Instead, our witty journey leads us to a lesser known, but incredibly effective approach that incorporates the essence (but not the drawback) of both value and growth investing.

You’ll get there with:

- “The Flaws of Value and Growth Investing”:

I will show you how to get started on Value and Growth Investing immediately. It is not hard to get started but a challenge to master these styles.

Why are these methods of investing just NOT suitable for the “man-in-the-street”.

- “A Superior Investing Strategy”:

This investing strategy is proven to work in both a bull and bear market environment. Historical data compiled by MSCI has shown that this style of investing trumps your traditional Value, Growth and Momentum-style.

TIME COMMITMENT: ~45 MINUTES

- Segment Three

Power of 5 Metrics: The 5 Champions to Uncover “Gems”

In the unpredictable world of investing, finding safe businesses that can withstand the test of time is no easy feat. One way to do it is to become well-versed in the art of financial metrics.

These numerical wizards have the power to reveal the most secure and stable businesses, by casting their analytical spells on balance sheets and income statements.

You’ll get there with:

- “The Magical Elixirs” that Separates the Safe Businesses From the Risky Gambles:

When you dive into the mystical realm of ratios and percentages, you’ll find yourself swimming in a sea of data that can help you identify companies with strong fundamentals and solid growth prospects.

Seek out businesses with a history of profitability, low debt, high efficiency, and robust cash flow. These are the shining beacons that guide you toward the land of long-lasting success.

TIME COMMITMENT: ~69 MINUTES

- Segment Four

Power of 5 Metrics: The 5 Champions to Uncover “Gems”

Are you ready to discover the secret to unlocking the ultimate investment strategy? The answer lies in finding the top 1% of stocks, also known as Alpha Stocks, that are set to skyrocket your portfolio to unimaginable heights!

These elusive and highly sought-after stocks have the power to outperform the market, leaving all other investments in the dust.

But fear not, for we’re about to share the exclusive step-by-step method on how to screen for and uncover these hidden gems, elevating your financial success like never before!

You’ll get there with:

- “When the Powers Combine”:

“By your powers combined, I am Captain Planet!” For those old enough, you might remember how this cartoon inspire a generation of millennials to save the world!

See the magic happens when we combine the Power of 5 metrics and their associated “magical” numbers to screen for the “best of the best” stocks.

By mastering the art of uncovering Alpha Stocks, you’ll be investing in only the best of the best, ensuring that your hard-earned money is working tirelessly to generate the highest possible returns.

TIME COMMITMENT: ~34 MINUTES

- Segment Five

Smart Impulse Factor: Right Stock + Right Time

When you invest in strong stocks at the perfect moment, you’re not just dipping your toes into the stock market – you’re making a splash that can lead to substantial returns and financial success.

Whether it’s due to temporary market downturns or undervaluations, knowing when to buy is just as important as knowing what to buy.

You’ll get there with:

- “No excuse of buying for the long-term”:

How many times have you experienced a short-term stock trade turning into a long-term investment. Yes, that is the most common excuse to justify holding a loss-making stock. We don’t need that justification with Smart Impulse.

You see, even the best stocks can witness a prolonged period of price weakness. Why not Sell into weakness and Buy them back when the price momentum resumes?

This is where the Smart Impulse Factor comes into the picture. See how incorporating this unique proprietary timing factor can help enhance your portfolio returns substantially.

TIME COMMITMENT: ~16 MINUTES

- Segment Six

Portfolio Management: The Unsung Hero of the Investment World

You see, while everyone else is busy chasing shiny new stocks and obsessing over profit margins, portfolio management is working tirelessly behind the scenes to ensure that your financial future remains as bright as possible.

Without it, you might as well be playing the stock market equivalent of Russian roulette.

You’ll get there with:

- “Don’t put all your Eggs in the Same Basket”

Portfolio management plays a crucial role in keeping you from falling into the dreaded trap of over-leveraging. You see, leverage can be a double-edged sword – while it can potentially magnify your gains, it can also amplify your losses.

Learn how to position size your Alpha Blueprint Stocks so that you are not at risk of over-leveraging on any single one counter.

The Result: You get to SWAN (Sleep Well at Night)

TIME COMMITMENT: ~17 MINUTES

Total time to learn a systematic stock selection process to 10x your retirement portfolio? ~ 3.5 hours

Total time thereafter to maintain your Alpha Blueprint Portfolio? ~ 5-10 mins (each week)

(If there is a faster way to learn a systematic stock selection process that is also easy to maintain and execute, let us know)

Join Stock Alpha Blueprint Course TODAY!

Once you have completed the Stock Alpha Blueprint Course (in < 4 hours), you will be able to learn the exact methodology top investing managers use to screen and seek out high-quality winning stocks.

No more making costly mistakes such as buying into “value-traps” or “hyper-growth, loss-making” stocks that have a high probability of failure.

No more spending countless of hours on the net, researching aimlessly for the “Next Big Thing”.

The truth is: We don’t need to invest in the next FAANG stocks to achieve investing success.

We just need quality stocks that adhere to the essence of Quality Investing, stocks that can afford us peaceful rests at night.

What do you think such a solution is worth?

Yes, That Is Less Than

$1.40 Per Day

Signing up to the Stock Alpha Blueprint Course today is an INVESTMENT IN YOURSELF that will pay the highest ROI.

To further sweeten this deal, I would also like to offer you 5 bonuses TODAY, that by themselves, are worth more than $1,500.

These bonuses are ALL FREE if you sign up for the Stock Alpha Blueprint Course TODAY! There is no guarantee that they will still be made available FREE once the launch period is over.

Instant Saver

- One-Time

Get immediate access to the complete Stock Alpha Blueprint Course training

A Single Payment Today Of

$497

- Bonus One

4 Options Primer Videos:

Understand what options are and how you can use them to supercharge your portfolio of Alpha Blueprint Stocks

- Learn how to win in the world of options by using simple (but effective) strategies that work

- Find ways to supercharge returns on your Alpha Blueprint Stocks through simple options strategies such as my “Landlord Strategy”

Value: $199

- Bonus Two

Weekly Updates of Stock Alpha Blueprint List:

Get the latest Alpha Blueprint Stocks

- Get the latest list of Alpha Blueprint Stocks all “serve up to you on a platter”

- We don’t just teach you the Art of Fishing. We provide the Fish for you as well.

Value: $597/year

- Bonus Three

“Live” Stock Alpha Blueprint Model Portfolio:

Get access to our model Stock Alpha Blueprint Portfolio

- We have created a model portfolio using Alpha Blueprint Stocks. See how it compares against the rest of the competition

- Learn how to position size your trades according to avoid over-leveraging on any one single counter

- Bonus Four

Monthly SAB Webinar Sessions:

Get access to monthly webinar sessions

- Your learning journey does not end with the completion of the online course.

- Join the monthly SAB Webinar session and gain exposure to various macro and thematic topics that will further enhance your investing knowledge

Value: $497/year

- Bonus Five

Stock Rover User Guide

How to use the BEST fundamental stock screener to execute various stock strategies

- Learn how to navigate and benefit from the best fundamental stock screener for US stocks

- Tips on how to screen for the right stocks based on various stock strategies (Earnings stocks, Most shorted stocks, Strong stocks in strong industries, etc)

Value: $397/year

- Step-by-step Video Tutorials hosted on Teachable with 24/7 access forever (Worth $797)

- 4 Options Primer Videos + Complementary access to options webinars (Worth $199)

- Weekly updates of Stock Alpha Blueprint List pre-screened for you (Worth $597)

- “Live” Stock Alpha Blueprint Portfolio (Worth $597)

- Monthly SAB Webinars (Worth $497)

- Stock Roverr User Guide (Worth $397)

Total Value: $2,984

- Check Out With Confidence - All payment are processed securely via Stripe

- 30 Day Guarantee - Experience a dramatic improvement in your portfolio or your money back

That is 30 days for you to go through the online course curriculum at your own pace, following the 5-steps systematic process to execute on Alpha Blueprint Stocks at the RIGHT time.

If you don’t think that the stocks identified by the Alpha Blueprint Method is your cup of tea, or the training you get out of all the FREE webinar sessions is worth your time, that is fine.

No buyer’s regret necessary.

Just send an email to contact@newacademyoffinance.com within 30 days. We’ll send back every dollar. No Questions Asked.

Try It No-Risk Free Today. Decide within 30 days.

Don’t believe the results? Hear from our satisfied customers:

THERE’S NO MORE SECOND-GUESSING ABOUT WHAT TO DO NEXT

Before Stock Alpha Blueprint, I was just like any newbie investor, not exactly knowing what am I getting myself into.

I bought into stocks that seem to have huge potential. That is what the papers, online media, and well-known bloggers are all saying. But before I know it, these stocks are down 50-60% and I am like a deer frozen in headlights.

With SAB, I now have much greater clarity as to when to buy and when to sell a stock. There is no more second guessing on what to do next.

– Alan Tang

MANAGING MY RISK THROUGH PROPER POSITION SIZING

Before Stock Alpha Blueprint, I was just like any newbie investor, not exactly knowing what am I getting myself into.

I bought into stocks that seem to have huge potential. That is what the papers, online media, and well-known bloggers are all saying. But before I know it, these stocks are down 50-60% and I am like a deer frozen in headlights.

With SAB, I now have much greater clarity as to when to buy and when to sell a stock. There is no more second guessing on what to do next.

– Chris Teo

DOUBLE THUMBS UP FOR YOUR COURSE

I would like to share with you that your course is so good. I just want to continue and ended up sleeping very late for a few nights to complete it.

I have attended a few fundamental analysis courses, and this is by far the easiest to understand and follow.

Besides the Power of 5, I love the way you taught the position sizing topic which is different from the other trainers.

– Giselle Kwok

I MADE MY FIRST DOUBLE-BAGGER IN 6 MONTHS

One of the stocks that were highlighted by Royston in Stock Alpha Blueprint back in late 2022 was ASML. I knew about this company from my previous research into the semiconductor industry and I know that it is a market leader in the semiconductor equipment segment.

I was just uncertain when to get my feet wet on this counter, particularly when it was “unloved” and sold off strongly in the 2nd half of 2022.

Stock Alpha Blueprint reaffirms my confidence in this quality counter now trading at a value price and I took a position in the counter at $370+/share. With the counter now trading over $720+/share, I have made my first double-bagger in less than 6 months.

– CY

HUGE VALUE FROM ALL THE WEBINAR SESSIONS

I will like to show my appreciation to Royston who continues to impart his financial knowledge to us through the periodic webinar sessions that he conducts at least once a month.

So far, he has already conducted more than 10 webinar sessions, on topics ranging from big-picture market outlook to valuation strategies such as intrinsic value and DCF models.

These sessions are all FREE and I have gained many insights, well beyond stock selections.

Thank you very much Royston for your commitment and all the value you continue to give beyond the online course.

– Nick Teo

The Stock Alpha Blueprint (SAB) approach is based on the premise of Quality Investing, a strategy that has outperformed more popular forms of investing styles such as Value, Growth, Momentum, etc over the long run.

While the definition of Quality might be subjective, stocks selected for the Alpha Blueprint Portfolio are typically the market leaders in their respective industries and passes stringent financial criteria to make them the Top 0.5% of all stocks in the US universe.

With Alpha Blueprint Stocks, you would have the peace of mind that you are investing in high-quality companies that will not “disappear” over night.

This course was created for an investor who is willing to venture into buying individual stock vs. taking a diversified approach through index investing.

We believe that the era of Passive Investing to generate strong returns for your portfolio is over.

To generate further “Alpha”, an investor will need to take an “Active” approach through individual stock selection.

Having said that, the actual activity or time taken each week to maintain your Alpha Blueprint Portfolio is limited to just 5-10 minutes.

Being an existing stock investor is an advantage, for sure. You would have “seen” and perhaps experience the perils of stock investing, first hand.

This course was created with the existing stock investor in mind, as mentioned in my previous point.

You would have a better appreciation of the financial metrics highlighted in the course.

When you have the proven system for high-quality stock selection layered on top of what you already know, you know you will be an investing force to be reckoned with.

Coffee shop patrons, beware (~_^)

Yes, you can.

The prospect of investing in stocks can send our reptile brains into overdrive, cranking out fears that it’s just too hard, something reserved for the Pros.

But if you’re ready to fall back on a proven method…. If you are ready to take it step-by-clearly-set-out-step…. If you are ready to rely on what’s been proven to work time and again in the investing world, then yes, you can do this.

It really isn’t rocket science. You don’t need to be Warren Buffett reincarnate to do well in stock investing. You just need to work the system.

Three hours. Just three hours to learn the 5-Steps Stock Alpha Blueprint systematic process to identify high-quality stocks.

Thereafter, you will need just 5-10 minutes each week to maintain your portfolio.

We believe in going “straight-to-the-point” instead of “beating around the bushes”.

That is why, instead of rehashing basic investing information, we will immediately highlight what matters the most to you – focusing on the Power of 5 metrics.

And trust me, that three hours spent learning will be nothing compared to the time you’ll save from scouring the web for information.

And that three hours will also generate the highest Return on Investment (ROI) for you!

As a Stock Alpha Blueprint (SAB) student, you get access to…

- The tested and proven framework for selecting high-quality stocks using our 5-steps (STIME) process

- Step-by-step video tutorials

- Access to past webinar sessions

- Invitation to join monthly live webinar sessions through Zoom (currently FREE)

- Access to Private Telegram Group

- Weekly update of Alpha Blueprint Stock List in Excel (currently FREE)

Instant Saver

- One-Time

Get immediate access to the complete Stock Alpha Blueprint Course training now!

A Single Payment Today Of